Brandon Bell/Getty Images News

Timeline: 5-10 Years

Price Target: $150 / share

Estimated Annual Returns: 12-15%

Risk Level: Very Low

The government has consistently critiqued oil profits in the current up cycle. Unfortunately, when oil prices are going up due to factors outside of your control (Russia’s invasion of Ukraine, long-term declines due to dropping renewable costs, etc.), the only avenue left is to critique the companies’ profits. Of course it’s not successful, but it gives the appearance of caring.

Regardless of the political opinions here, we see this as an apt time to discuss the future of a large oil company in the markets, using Exxon Mobil (NYSE: NYSE:XOM) to highlight the opportunity.

Market Environment – Short-Term

In the short term, the market environment is expected to remain strong.

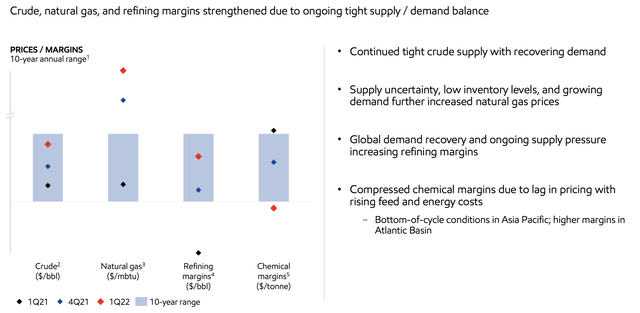

Exxon Mobil Margins – Exxon Mobil Investor Presentation

Exxon Mobil has seen incredibly strong margins across its portfolio. The company’s natural gas margins are well above the 10-year range and the company’s refining and crude margins are approaching the upper end of the 10-year range. The company’s chemical margins are on the lower end of the range, due to rising input; however, we expect a recovery here.

Across the board, margins for 2Q 2022 remain incredibly strong, and we continue to see the potential for increased recovery here. In the short term, with companies continuing to focus on improving their balance sheet versus increasing production, we see no reason for this to change. However, there is a potential caveat here.

Inflation is running high and energy prices are a large source of that. Over the short-to-medium term, we expect strong government pressure for prices to continue going down, combined with the potential for a recession to push down demand and prices as well.

Market Environment – Long-Term

In the long term, the market is much more interesting.

Let’s start with the simple. Climate change is real. That doesn’t mean it’s necessarily worth spending trillions to solve it or anything of the sort, but that doesn’t mean it won’t have impacts. At the same time, investment has continued into alternative fuels. Those alternatives might not be more economical now, but technology is always quick to advance.

We expect that 100 years from now, oil and natural gas will be dramatically less relevant in our economy. However, we expect natural gas especially to continue to dominate for the next 50+ years, given that it’s much cleaner than coal. Oil will always have some demand as engine oil for example, or in sources where density is essential, such as shipping or fighter jets.

However, it’s also worth noting that the decline rates for assets is much faster than expected demand decline rates. That means companies won’t necessarily lose money; they’ll just be investing dramatically less.

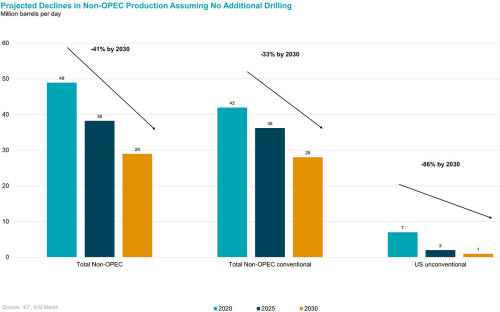

Oil Industry Investment – Green Car Congress

It’s already clear above that oil companies are calibrating their investment for expected future demand in the markets. That means that the companies will be able to maximize profits and cash flow even taking advantage of the expected decline in the markets.

Exxon Mobil Financial Performance

Financially, Exxon Mobil has continued to outperform as a result of short-term strength in the market.

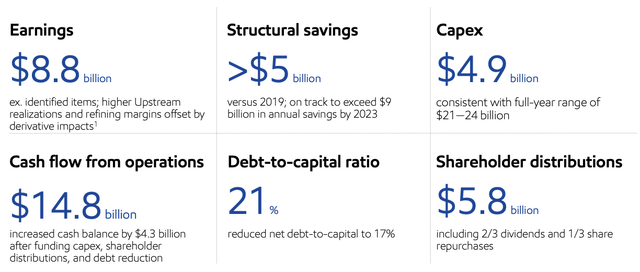

Exxon Mobil Financials – Exxon Mobil Investor Presentation

Exxon Mobil had annualized earnings from the quarter of more than $35 billion. Versus a market capitalization of more than $420 billion, that would imply a more than 8% earnings yield (or a P/E of ~12). The company has continued to achieve strong structure savings and annualized capital expenditures of roughly $20 billion.

The company is continuing to invest in growth, and its FCF yield is closer to 10%. The company has continued to invest in growth with a 3.5% dividend yield and roughly half that in share repurchases. We expect the company to continue investing in modest growth and asset replacement while maintaining strong FCF.

Exxon Mobil Upstream Asset Portfolio

Exxon Mobil has one of the strongest upstream asset portfolios in the world.

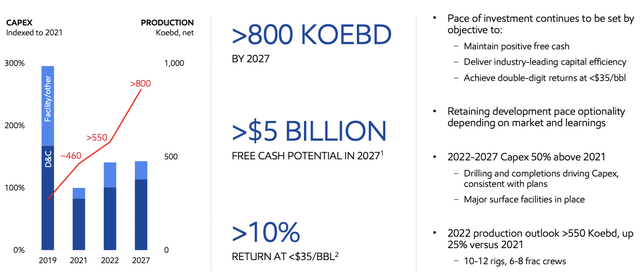

Exxon Mobil Upstream Asset Portfolio – Exxon Mobil Investor Presentation

In our view, the three largest segments of the company’s upstream portfolio are Guyana, the Permian Basin, and Liquefied Natural Gas (or LNG). In the Permian Basin, the company is expecting >800 thousand barrels / day in production by 2027, an almost doubling from 2022. The company expects a double-digit return at <$35 / barrel or >$5 billion in 2027 FCF.

The company is operating 10-12 rigs with 6-8 frac crews, which could go up with a 50% capital expenditure increase. The company has massive acreage in the area which it has selectively added to and the company has built this into a massive low-cost operation. We expect FCF to remain high if not increase from current levels.

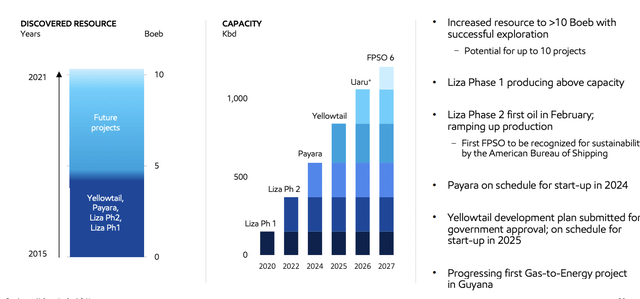

Exxon Mobil Guyana – Exxon Mobil Investor Presentation

Exxon Mobil has a 45% ownership in this massive asset that will likely become one of the largest producing oil fields. The company has already committed to projects that will take production towards roughly 800 thousand barrels / day of production using 4.5 billion barrels of assets. That’ll give these assets a 15-year reserve life.

The true assets are more than 10 billion barrels and continuing to increase by several billion barrels per year. We see this field as hitting 2 million barrels / day of production in the early-2030s and then, tentatively, given current exploration trends and available sites, hitting a steady state of 3-4 million barrels / day in production.

That could see the field responsible for a third of Exxon Mobil’s production.

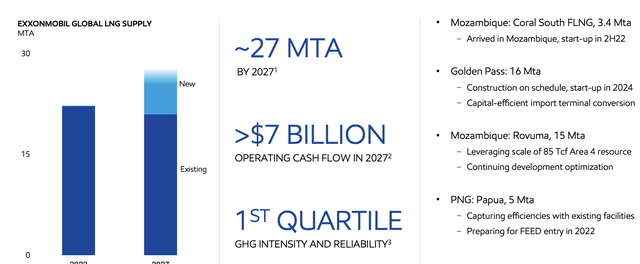

Exxon Mobil LNG – Exxon Mobil investor Presentation

Lastly is LNG, another major aspect of growth, and in our view, an important transition fuel as long as it’s built with a focus on GHG reliability. The company sees more than $7 billion in operating cash flow by 2027, supported by rapidly expanding volumes. The company is also looking at potential new developments such as in Mozambique.

Given the multi-billion dollar cost of LNG projects, we expect it to continue to support the ability of major oil companies to maintain their strong market positions.

Exxon Mobil Integrated Assets

Exxon Mobil also has substantial integrated assets as it continues to focus on upgrading the portfolio.

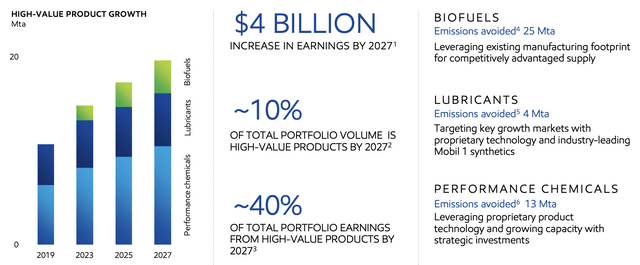

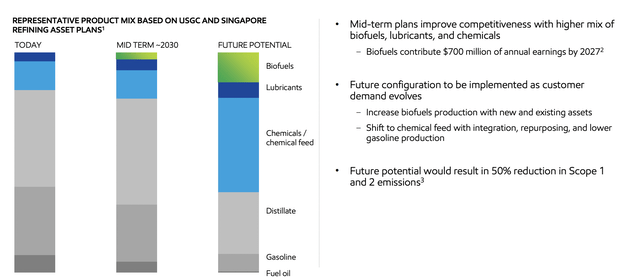

Exxon Mobil Portfolio Change – Exxon Mobil Investor Presentation

Exxon Mobil is looking to rapidly increase the quality of its assets, with 40% of 2027 earnings from high-value products, adding $4 billion in additional earnings. The company will be drastically reducing its gasoline and fuel oil production, not only lowering its carbon footprint, but also removing its exposure to markets in decline.

More so the company’s new fields are fields that will be essential even in an oil free world. For example, lubricants will always be a necessary part of the industrial process not easily replaced by other fuels. As the company continues to improve its upstream portfolio as well, it’ll be able to maximize extracted value from each barrel.

These integrated assets help make Exxon Mobil a valuable investment.

Exxon Mobil Shareholder Returns

Exxon Mobil’s unique portfolio of assets will enable the company to generate massive shareholder returns.

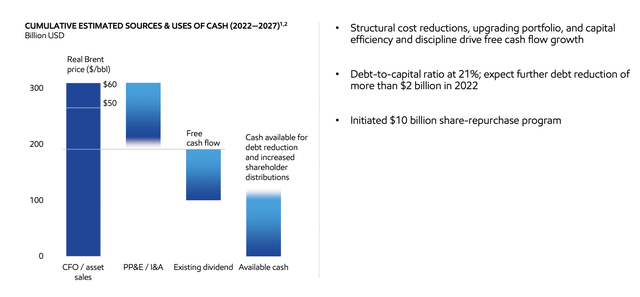

Exxon Mobil Shareholder Returns – Exxon Mobil Investor Presentation

Exxon Mobil expects to generate $300 billion in cash flow from operations and asset sales through 2027 for the 6-year period. At current prices of $120 / barrel, that number is closer to $550 billion in cash flow. The company plans to spend $100 billion on capital spending and its existing dividend of almost 4% will use up another $100 billion.

That means that the company has another $100 billion available.

Exxon Mobil Thesis Risk

The largest and most obvious risk to Exxon Mobil is crude oil prices. Crude oil prices are more than $120 / barrel; however, that’s the highest prices have been in a substantial amount of time. There’s substantial risk that prices will drop back down, especially if a recession hurts demand, hurting the company’s ability to drive future returns.

Conclusion

Exxon Mobil has a unique portfolio of assets. We firmly believe that in the coming decades oil and natural gas (oil first) will be primarily replaced in the market; however, that doesn’t make the company a bad investment. That’s despite the company’s continued investment in growth and the ability to drive shareholder returns.

The company has the ability to generate double-digit yields in an incredibly weak overall market. The company is investing in growth but its volume is expected to go down faster than the overall market demand, enabling the company to generate strong shareholder returns.

At current prices, we believe Exxon Mobil is a strong buy, unless the market changes significantly, i.e. OPEC+ announces a change in policies and an effort to dramatically ramp up production over the short term.

Be the first to comment