CasarsaGuru/E+ via Getty Images

Oil-Dri (NYSE:ODC) is an archetype of a small company with erratic earnings and an array of businesses that are a little bit difficult to comprehend. However, the company has a decent track record of sales and earnings growth, strong balance sheet and a solid dividend.

Oil-Dri has also three major megatrends behind it. The demand of Oil-Dri’s products benefit from an upsurge in the amount of pets, increasing use of biofuels and rising attention towards the health of livestock. Being a small cap stock and a company operating toneless businesses, these tailwinds have mostly gone unnoticed.

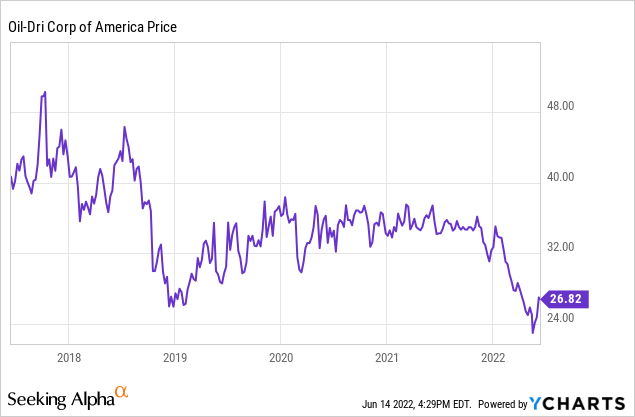

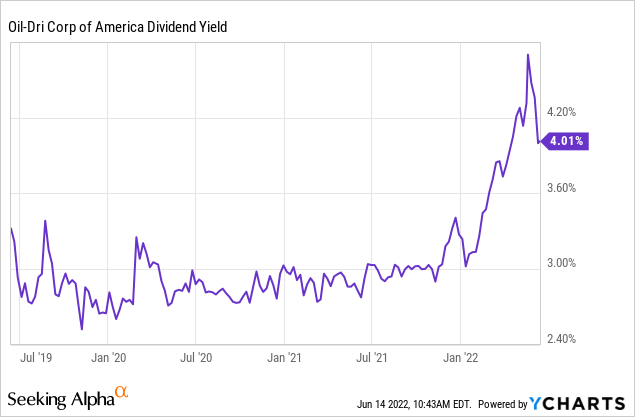

Oil-Dri has an impressive track record of paying a healthy and growing dividend. During the past decade, the dividend has been growing at 4.5% CAGR with an average payout ratio of 53%. Currently, the stock offers a relatively safe dividend yield of 4.2%. The stock recently bounced off from a low of $23 after a significant decline. For a dividend investor looking for a decent margin of safety, the stock is a buy at a price below $25.

Understanding the company

Despite its name, Oil-Dri is not involved with the oil business. Oil-Dri is a consumer goods and industrial products company, which mines its own raw material. Oil-Dri owns or leases the land, where the company mines different minerals, mainly bentonite clay. After getting the minerals out of the ground, Oil-Dri processes the minerals into different kinds of products. There are various applications and end markets for its products.

In 1941, the company originated around Nick Jaffee’s idea of using calcium-based clay to absorb oil from the floors of factories and garages. First, the product was called Floor-Dri, but soon the name was changed to Oil-Dri.

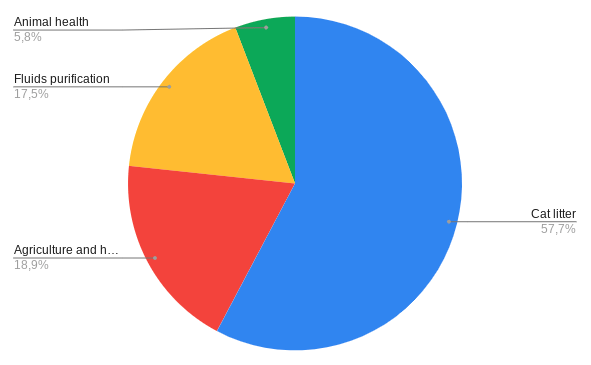

Six years after Oil-Dri was established, the company sold its first bags of cat litter. Its most popular brand, Cat’s Pride, was introduced in 1961. Today, Oil-Dri holds the second largest market position in the lightweight litter in the United States. The market leader is Purina, which is owned by the consumer goods giant Nestle (OTCPK:NSRGY). Another CPG giant, Clorox (CLX), is one of the private label customers of Oil-Dri. Cat litter is the largest product group of Oil-Dri, representing 57% of total sales.

In the 1970s, Oil-Dri developed several new products for agriculture and lawn care, aimed especially for golf courses. In 1991, the company introduced its first product for animal health. Today, a subsidiary by the name Amlan International offers feed additives for poultry and livestock. The purpose of the additives is to improve the health of hens, pigs and cows. Animal health products represent approximately 6% out of total sales and agricultural and horticultural products represent 19% of total sales.

In the following decade, 1986, the company introduced the first products for purification of fluids. Different brands are used for removal of soaps, metals and lipids out of edible oils and biodiesel. These products represent approximately 18% out of total sales.

The split of sales by product group (10-K, Author’s own calculations)

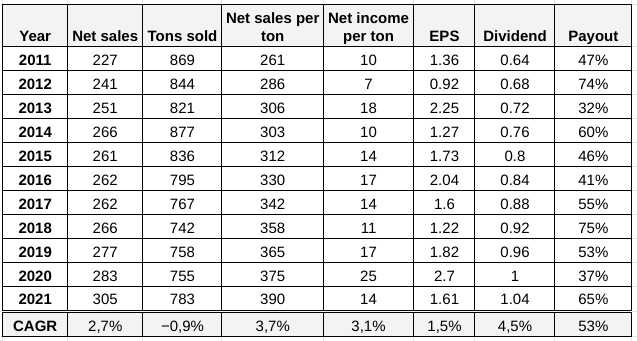

The history of Oil-Dri is characterized by new product innovations. In spite of it, most of the existing products face intense competition. Although the company has been able to grow the sales without increasing the amount of minerals used (see table below), most of the products have characteristics of bulk. As we will see in the next sections, there’s potential that the company could be building up new success stories next to the cat litter business.

Starting from 1960s, the company has amassed a portfolio of land assets. The purpose of the land assets is to ensure the company has enough raw material available for production. Today, Oil-Dri owns a little over 8,000 acres of land and leases 3,400 acres. It has proven reserves of 102,953 thousand tons and consumed 781 thousand tons last year. In other words, Oil-Dri is in the business of utilizing its mineral assets in various different applications.

Being vertically integrated and controlling your own raw material supply could turn out as an advantage in today’s market environment. Oil-Dri also has opportunities for acquisitions in a relatively fragmented market. The company has made several acquisitions during its long history and it has expressed to pursue new opportunities for acquisition.

Oil-Dri is a family-owned and led company. The descendants own a little less than 30% of the outstanding stock. The grandson of the company’s founder Daniel Jaffee serves as a chairman, president and chief executive officer. He has worked with the company since 1987 in several different roles.

In 2021, the total turnover of the company was $305 million and the year before $283 million. Only 5% of the sales was international. Oil-Dri has subsidiaries in Canada, Great Britain, Switzerland, China, Indonesia and Mexico. In the developing markets, the company mainly sells agricultural and animal health products.

Financial development 2011-2021, sales and income in millions $ (Company’ material, author’s own calculations)

Three supporting tailwinds

Total addressable market for cat litter has grown significantly

According to Statista, in 2021, there were 45.3 million (36%) households owning a cat in the United States. In 2017, there were 32 million households owning a cat according to the American Veterinary Medical Association. On average, each household had 1.8 cats. A domestic cat can live up to 10-15 years, meaning the market for cat litter should have grown tremendously.

When it comes to cat litter, there’s another ongoing trend supporting Oil-Dri’s business. The company expects that the cat litter market in the United States shifts into a so-called lightweight type of litter, which was introduced in 2011. The shift to the lightweight has happened already in Canada, where 50% of litter sales comes from the lightweight category. The share of lightweight litter is growing fast in the United States but yet only represents 14% out of the total consumption. The lightweight litter weighs half that of a traditional one, which translates to significantly reduced freight costs.

Oil-Dri cat litter sales have grown at 9% CAGR and stood at $176 million at the end of 2021, and grew at the historical rate of compounded annual growth. In the latest fiscal quarter, the total cat litter sales grew 8%, while lightweight litter sales grew 13%. Based on these numbers, it appears that Oil-Dri is capturing the growth in the pet industry.

Legislation drives sales of animal health products

The opportunity for animal health products arises from the direction of legislation in several regions around the world. The European Union and many Asian countries have prohibited the use of antibiotics in animal feed additives. The products of Amlan International are helping farmers to replace antibiotics with natural alternatives.

The animal health business is in the growth stage. Amlan International has been hiring key personnel to its international operations. Particularly in China, Amlan has been able to increase sales to its existing customers, establish new customer accounts and add new distributors to its network. Susan Kreh commented on the status in the latest quarterly call:

I’m particularly optimistic about the quarterly growth in our animal health products that was 23% and growing. This is a business, which we — is strategic, and we’re making strategic investments in both, capital as well as in SG&A to build out sales and leadership to drive the growth opportunities there. – Susan Kreh, CFO & CIO

In 2021, the international operations of the company were still loss making. However, the loss was more than halved from $1.3 million to $0.6 million. Further increase of volumes and prices could lead to positive results in the near future, and that’s where the numbers seem to be heading.

In the fiscal Q2 2022, Amlan International reached all-time high sales. In the latest quarter, fiscal Q3 2022, the sales increased further by 23% compared to the year before. In China, the sales grew 40% despite the continuing COVID-19 restrictions and African swine fever which is impacting pork consumption. Just recently, the company started to build its presence in the U.S., where its presence has been non-existent. On this basis, the company is about to budget 100% higher sales for the following fiscal year.

The amount of biodiesel produced will double

Oil-Dri’s products are used for purifying biodiesel and jet fuel. Purification of crude biodiesel is mandatory for the fuel to meet the strict international standard specifications for biodiesel (Atadashi, 2015). According to the U.S. Energy Information Administration, the production of renewable diesel is going to increase two to three times in the couple of following years.

It’s worth noting that there are several different ways to purify biodiesel and for an investor it’s relatively difficult to judge whether the products of Oil-Dri possess any competitive advantage. Therefore, it’s safer to assume the products are bulky and will provide only an opportunity to grow along with the market. Nevertheless, together with the return of air travel and the growth of biodiesel production, there’s a lot of runway for growth.

The sales of purification products increased 16% in the latest fiscal quarter by increased prices and volume in North America.

Renewable diesel production capacity (U.S. Energy Information Administration)

Evaluating the headwinds

In the latest fiscal quarter of Q3 2022, the company booked a large $5.6 million, $0.65 per common share, goodwill impairment. The impairment was related to an acquisition that took place eight years ago. Due to the impairment, the company faced a $4 million operating loss for the quarter. Excluding this non-cash line item, the quarterly result would have been positive but significantly below the results of the quarter a year before. There’s only $3.6 million of goodwill left on the balance sheet, so no surprises should be left on the books.

The company is also suffering from cost pressures. The products of Oil-Dri require lots of space and weight in transport. The rising freight costs were a major headwind for the financials in 2021. They increased 13% compared to fiscal year 2020. As a comparison, in 2020 its freight costs decreased 18% compared to 2019. Currently, there are signs that the freight costs are again heading lower. This would help to increase profits and the increasing sales would show up also on the bottom line.

Natural gas and packaging materials are both other significant cost components. In fiscal year 2021, the packaging expenses were 19% higher and the cost of natural gas was 15% higher. The cost pressures and the goodwill impairment have led to a recent sharp decline in the stock price.

It is difficult for a company to quickly accommodate such increases to the pricing of its products. The challenge is visible in the current financials and the news feed of the company is filled with announcements of price increases. In the latest quarterly call, the company reported the second consecutive increase in gross margins, which was a result of price increases starting to kick in.

Volatile cost components make Oil-Dri’s results erratic, but fortunately there’s a strong balance sheet to rely on.

Strong balance sheet as a protection

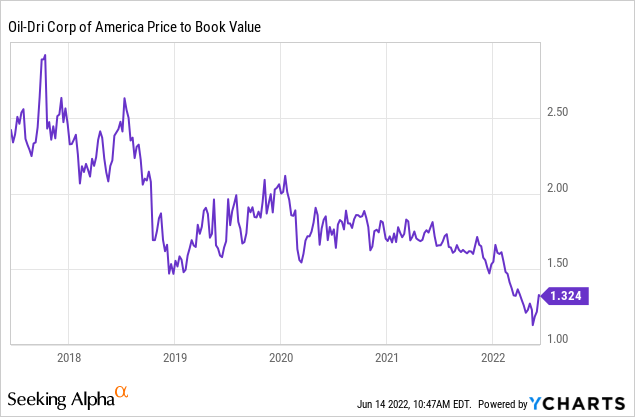

Oil-Dri has a very conservative balance sheet. Its book value per share stood at $20.9 at the end of the latest fiscal quarter, down from $21.63. The price to book value multiple is 1.3, which is historically very low for the company. Normally, the shares have been trading between 1.5 and 2.5 during the past three years.

In addition, the land assets of the company are valued by depreciated historic values as Dan Jaffee states:

As I look at our balance sheet, we’ve got $200 million of assets. And the question is, does that mean that could we replace all five of our major U.S. locations, Georgia, two in Mississippi, one in Mounds in Illinois, one in Taft, California for $240 million. And the answer is not even close. These are historic values, they’re depreciated values and so forth. – Dan Jaffee, President & CEO

Until recently Oil-Dri carried a very little amount of debt, $8 million. In the last fiscal quarter, the company issued $25 million of debt at an interest rate of 3.25%. The issuance brought the debt level back where it has typically been. Oil-Dri intends to use the debt for building up inventory in response to the logistic and shipping challenges that the company is experiencing. At the end of the latest fiscal quarter, the company carried $23 million of cash compared to $30 million the year before. The newly issued debt does not need to worry investors.

19 years of dividend growth

Oil-Dri has paid cash dividends since 1971. The current dividend yield stands at 4.2% and the five-year average yield is 2.9%. From 2011 to 2021, the dividend has grown at a 4.5% CAGR (see the table above). On 9th of June, Oil-Dri announced a dividend increase of 3.7%, which was the 19th consecutive dividend increase.

The pay-out ratio has been rising in line with the dividend increases. At the moment, the pay-out ratio remains under 65%. The dividend has been growing more linearly than the earnings per share. The average EPS for the past decade stands at $1.68 which indicates that paying an annual dividend of $1.12 would become a burden for the company.

Oil-Dri is boosting the returns by buying back its own stock. The number of outstanding stock has been decreasing since 2020 from approximately 7.3 million to 7 million. During the last quarter, the company bought back 151,913 units of common stock, around 2% of total shares outstanding.

We also have opportunistically repurchased shares of stock as we believe they are currently at a very good value. – Susan Kreh, CFO & CIO

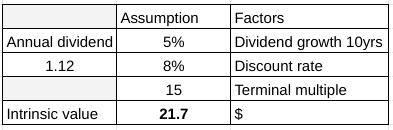

Intrinsic value based on the dividend (Author)

Valuing the stock based on the current annual dividend and 5% growth rate for the next 10 years and applying 8% discount rate and terminal multiple of 15, gives us an intrinsic value of $21.7 per stock. Considering the potential tailwinds, conservatively valued and strong balance sheet and buybacks, it’s safe to assume the stock is a buy below $25 for income seeking investors.

Conclusion

The revenue of Oil-Dri increased 12% in the latest fiscal quarter. The three growth areas of the company delivered even higher growth figures. When the cost pressures settle down and when the price increases come fully into force, the increased turnover can nicely descend down to the bottom line.

The company has a strong balance sheet and an impressive dividend growth record. While the cost pressures settle down and the company builds its emerging businesses, an investor with tolerance for earnings volatility can harvest the dividends. Historically high starting yield of 4.2% is a good spot to step in.

Be the first to comment