Justin Sullivan/Getty Images News

Price Action Thesis

Healthcare leader Johnson & Johnson (NYSE:JNJ) is a retail investor favorite, given its well-known branding and diversified portfolio. Furthermore, it has a solidly profitable business model that generates attractive free cash flow (FCF) margins.

However, despite its recent retracement, we don’t consider JNJ stock as attractively valued now. Moreover, given its anemic forward revenue growth, we find it challenging to justify an entry point at the current levels.

Furthermore, our detailed price action analysis suggests an ominous double top bull trap formed in April, which could set the stage for a deeper retracement. The stock is currently testing its 50-week moving average but has no bear trap price action to support it.

Therefore, we believe it’s apt to revise our rating from Buy to Hold. We encourage investors to wait for a better entry point at a more attractive valuation before adding exposure.

Johnson & Johnson Stock – Double Top Bull Trap Warrants Caution

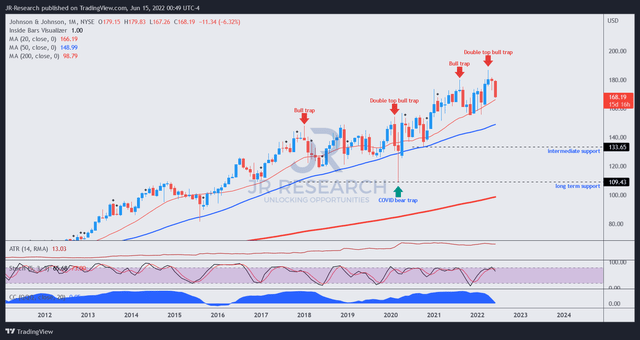

JNJ price chart (monthly) (TradingView)

JNJ stock has a well-supported secular uptrend, despite underperforming the market in the past five years.

Notably, JNJ has had a couple of double top bull traps over the past two years. The first occurred in early February 2020, as the market drew in the final round of buyers before forcing the COVID bear trap bottom. The steep sell-off (29% to the COVID bottom) and the subsequent bear trap resolved the double top threat.

As a result, it helped JNJ stock stage its subsequent uptrend reversal to the current levels. However, we observed another double top bull trap at its recent April top. As a result, JNJ stock has retraced about 10% from its April highs, but we believe a deeper retracement could follow.

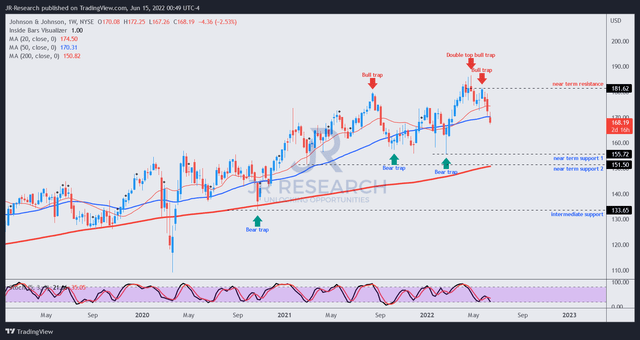

JNJ price chart (weekly) (TradingView)

Zooming into its weekly chart, we can observe its April double top bull trap, which represents significant caution. In addition, another bull trap occurred from its May recovery and set up its near-term resistance.

Given the recency of its double top, coupled with the slight retracement, we don’t think the sell-off has ended. Notwithstanding, JNJ stock could find some reprieve at its 50-week moving average. However, we don’t think it could hold.

Therefore, we are looking for a deeper retracement towards its near-term support 1 before it could find a more sustainable bottom. But, our valuation analysis suggests that the stock could underperform unless investors enter near its intermediate support.

JNJ Stock Could Underperform At The Current Levels

| Stock | JNJ |

| Current market cap | $442.58B |

| Hurdle rate (CAGR) | 10% |

| Projection through | FQ2’26 |

| Required FCF yield in FQ2’26 | 5% |

| Assumed FCF margins in FQ2’26 | 24.7% |

| Implied TTM revenue by FQ2’26 | $131.17B |

JNJ stock reverse cash flow valuation model A. Data source: S&P Cap IQ, author

A simple reverse cash flow valuation analysis with reasonable parameters suggests that JNJ stock could underperform at the current levels. We use a hurdle rate of 10%, as a lower hurdle rate is unattractive. However, our model suggests that JNJ needs to register a TTM revenue of $131.17B by FQ2’26. It represents a revenue CAGR of 9.18% from FY22-FQ2’26, an improbable scenario.

| Stock | JNJ |

| Entry price | $133.65 |

| Hurdle rate (CAGR) | 10% |

| Projection through | FQ2’26 |

| Required FCF yield in FQ2’26 | 5% |

| Assumed FCF margins in FQ2’26 | 24.7% |

| Implied TTM revenue by FQ2’26 | $104.22B |

JNJ stock reverse cash flow valuation model B. Data source: S&P Cap IQ, author

In model B, we used an entry level equivalent to its intermediate support level. Coupled with identical parameters from model A, we think it gives JNJ stock a much-improved probability to achieve our required TTM revenue of $104.22B by FQ2’26.

Therefore, we believe investors should be patient with JNJ stock and let it come down to you. Otherwise, another five years of underperformance could await investors at the current price.

Is JNJ Stock A Buy, Sell, Or Hold?

We revise our rating on JNJ stock from Buy to Hold. We don’t think the stock is attractively valued at the current price for it to outperform the market.

Furthermore, our price action analysis suggests that a deeper retracement could follow, given the menacing double top bull trap and subsequent bull trap seen in April, and May, respectively.

Therefore, we exhort investors to bide their time with JNJ stock.

Be the first to comment