Nigel Stripe/iStock via Getty Images

From the experience I have generated over time, the most ‘boring’ companies are often the most attractive and, over the long run, they tend to outperform other opportunities on the market. One really great example of this that played out over the past couple of months can be seen by looking at Oil-Dri Corporation of America (NYSE:ODC), a producer of sorbent products that can be used in agriculture, horticulture, animal health, and more. Perhaps the easiest product to point to in order to illustrate what the company does is cat litter. But some of the company’s offerings also are involved in much more exciting things like jet fuel. Even though we are dealing with rather questionable economic conditions, the company’s financial performance as of late has been rather robust. Given this performance and factoring in how cheap shares still are despite rising materially since I last wrote about the enterprise, I do think it still deserves a solid ‘buy’ rating at this time to reflect my view that shares should continue to outperform the broader market moving forward.

Solid results

The last time I wrote an article about Oil-Dri was back in August of this year. In that article, I talked about the company’s operating history, even pointing out that some of the more recent financial data had been somewhat discouraging. This largely centered around a decline in profitability that the company had experienced. Even with that decline, shares of the business were looking rather affordable. But in the event that financial performance was to revert back to what it had been in prior years, I felt as though upside could be meaningful. Since then, things have gone quite well. On the back of robust sales and profit performance, shares of the company have generated a return for investors of 21.8%. That compares to the 3% decline experienced by the S&P 500 over the same window of time.

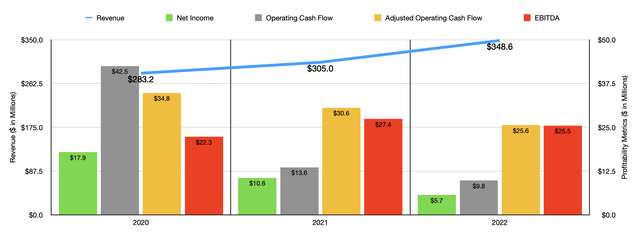

To start with, we should touch on how the company ended its 2022 fiscal year. After all, in my prior article, we only had data extending through the final quarter. For 2022 as a whole, revenue came in at $348.6 million. That compares favorably to the $305 million the company reported the same time one year earlier. But despite this rise in sales, the company saw its profitability worsen. Net income went from Point $6 million to $5.7 million. Operating cash flow declined from $13.6 million to $9.8 million. Even if we adjust for changes in working capital, it would have fallen from $30.6 million to $25.6 million, while EBITDA for the company declined from $27.4 million to $25.5 million.

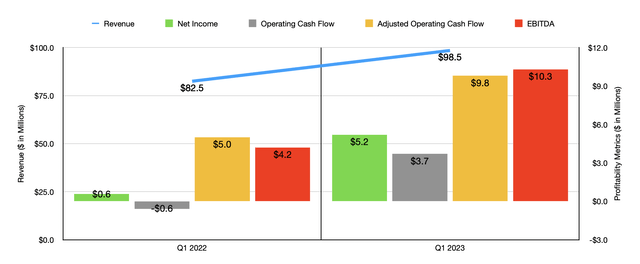

Earlier in this article, I promised you that the picture for the company was showing nice signs of improvement. And I was not lying. While the 2022 fiscal year in its entirety was disappointing, 2023 is already looking up. In the first quarter of 2023, sales for the business came in at $98.5 million. This 19% increase was driven by strength across both the Retail and Wholesale Products Group, and the Business-to-Business Products Group of the firm. Under the Business-to-Business Products Group portion of the enterprise, revenue jumped 36% thanks to a 61% rise in agricultural and horticultural chemical carrier products. Strong demand from its customers, combined with price increases, was instrumental in this regard. Meanwhile, under the Retail and Wholesale Products Group side of the enterprise, sales rose a more modest but still impressive 12%. According to management, higher net sales of cat litter, industrial and sports products, and other related offerings, were helpful in pushing this revenue higher. This, in turn, was driven primarily by price increases.

With the rise in revenue, we also saw profitability surge. The company went from generating a net profit of only $0.6 million in the first quarter of 2022 to generating a profit of $5.2 million the first quarter of this year. Operating cash flow turned from negative $0.6 million to a positive of $3.7 million. And if we adjust for changes in working capital, then the metric would have nearly doubled from $5 million to $9.8 million. An even larger increase can be seen by looking at EBITDA, which jumped from $4.2 million to $10.3 million over the course of a year.

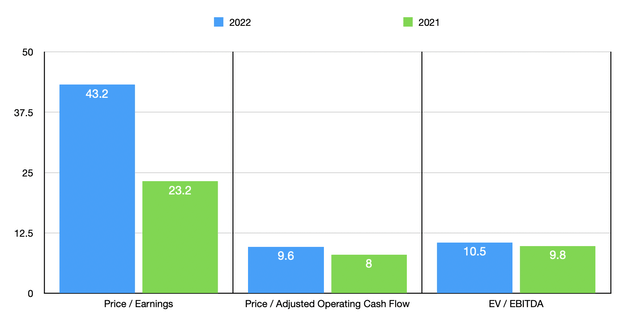

In the absence of guidance, we don’t really know what to expect for the rest of the current fiscal year. It is tempting to project out results experienced so far. But given the historical volatility of the company’s financial data and the uncertainty plaguing the market this year, I think a better approach is to value the company based on its 2021 and 2022 results. Using data from 2022, shares look remarkably pricey on a price-to-earnings basis, with a trading multiple of 43.2. That compares to the 23.2 reading that we get using data from 2021. But even earnings may not be the most reasonable way to value the firm. Using, instead, the price to adjusted operating cash flow multiple, we get a reading of 9.6. That compares to the 8 we get using data from last year. Meanwhile, the EV to EBITDA multiple for the company should be around 10.5 compared to the 9.8 reading that we would get using data from 2021.

As part of my analysis, I did compare the company to five similar firms. And a price-to-earnings basis, these companies ranged from a low of 8.5 to a high of 33.9. In this case, Oil-Dri was the most expensive of the group. Using the price to operating cash flow approach, though, we get a range of between 11.6 and 2,411.1. In this case, our prospect is the cheapest of the group. And finally, using the EV to EBITDA approach, the range was between 9.3 and 49.5. In this scenario, only one of the companies was cheaper, while another was tied with it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Oil-Dri Corporation of America | |||

| Energizer Holdings (ENR) | 8.5 | 2,411.1 | 10.5 |

| Central Garden & Pet Company (CENT) | 14.1 | 22.9 | 9.3 |

| Spectrum Brands Holdings (SPB) | 33.4 | 11.6 | 49.5 |

| WD-40 Company (WDFC) | 33.9 | 874.2 | 25.1 |

| Reynolds Consumer Products (REYN) | 25.5 | 21.5 | 17.0 |

Takeaway

In my opinion, Oil-Dri is not exactly the most stable and attractive company on the market. Having said that, recent financial performance achieved by the firm has been impressive and shares are trading at very attractive levels from a cash flow perspective. This is true on both an absolute basis and relative to similar firms. Already, the stock has risen nicely since I last wrote about it. Certainly, the easy money has already been made. But absent some material change in business, I do think that some additional upside could be warranted. As such, I still think that the company makes for a ‘buy’ prospect, even if upside potential might not be as great as it was before.

Be the first to comment