The VanEck Vectors Oil Services ETF (OIH), which is the benchmark fund for the oilfield services industry, was already looking at a mixed outlook entering into 2020, and it has gotten much worse now. The historic drop in oil prices may force oil and gas producers around the world to cut capital investments by more than $100 billion this year, which will hurt the future revenues of oilfield service providers. The ETF will likely remain subdued as the earnings of its underlying holdings come under pressure.

Image courtesy of Pixabay

The oilfield service providers struggled with weak levels of earnings and cash flows in 2019 as their customers – the exploration and production companies – kept a tight lid on their capital expenditures. The US oil and rig count fell from 1,075 units at the start of 2019 to 805 rigs by the end of the year, data from Baker Hughes (BKR) shows, as drilling activity remained weak. The VanEck Vectors Oil Services ETF, the industry’s largest fund in terms of assets under management, fell by ~15% in this period as shares of most oilfield service providers came under pressure. In early-2020, the industry’s outlook was looking largely mixed, as I discussed previously. The North American market was expected to remain weak, but we were beginning to see signs of life in the international markets. But now, following the unprecedented drop in oil prices, the oilfield services industry is looking at a grim future.

With more than $340 million of assets under management and daily trading volumes of almost 700,000 shares ($69.8Mn), the VanEck Vectors Oil Services ETF is the largest and most liquid fund focusing on the oilfield services industry. By comparison, its closest peers SPDR S&P Oil & Gas Equipment & Services ETF (XES), iShares U.S. Oil Equipment & Services ETF (IEZ), and Invesco Dynamic Oil & Gas Services ETF (PXJ) have $67.79 million, $42.43 million, and $5.33 million of net assets respectively. The VanEck Vectors Oil Services ETF, or OIH, also charges a reasonable fee. Its expense ratio is 0.35%, which means that the fund charges $35 each year on every $10,000 of investment. XES also has a similar expense ratio but IEZ and PXJ are more expensive with ratios of 0.42% and 0.63% respectively.

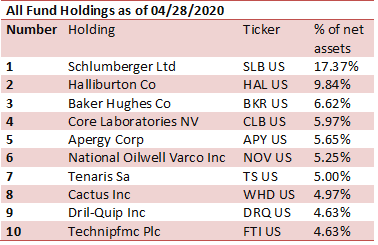

OIH gives investors exposure to 25 of the biggest and most well-established oilfield services companies that provide equipment, drilling, and other services to the upstream oil and gas sector. It is a top-heavy fund that ranks stocks on the basis of market cap (as adjusted). The biggest oilfield services companies sit at the top of OIH’s holdings table and get the largest share of the capital while the relatively smaller operators sit at the bottom of the holdings table and get a small percentage of assets. Its top-3 holdings are Schlumberger (SLB), Halliburton (HAL), and Baker Hughes – three of the world’s largest service providers. Schlumberger, Halliburton, and Baker Hughes get 17.4%, 9.8%, and 6.6% of the ETF’s net assets respectively. Together, the three OFS companies account for more than a third of OIH’s assets. The ETF’s top-10 holdings represent almost 70% of its assets while its bottom-15 companies account for the remaining 30%.

Image: Author

OIH’s underlying holdings are now facing a grim future, thanks to the plunge in oil prices which has triggered a drop in E&P CapEx and drilling activity. The oil prices have been highly volatile and weak, with WTI crude recently falling into the negative territory for the first time from more than $60 a barrel at the start of the year and then recovering to $17 at the time of this writing. Nearly all shale oil producers, such as Pioneer Natural Resources (PXD) and EOG Resources (EOG), have announced major spending cuts in response to the weakness in oil prices. Even the biggest and the most well-established energy companies in the US – Exxon Mobil (XOM), Chevron (CVX), and ConocoPhillips (COP) – have made wholesale budget cuts of more than 20%.

A vast majority of the above-mentioned cuts, however, were announced before oil price futures fell below zero per barrel in April. Although prices have recovered, I believe we are still a long way from recovery. A combination of weak demand, excess production, and shortage of storage capacity pushed oil prices to historic lows. I think as long as these factors persist, the threat of another decline in oil prices to low single digits or even less than zero will remain, particularly as we get closer to the June expiration of WTI futures. In this backdrop, the oil producers might become even more cautious. As the earnings season gets underway, the exploration and production companies could announce even larger CapEx cuts and take drilling activity even lower. The drilling activity has already fallen substantially in the US where oil producers have now removed almost 50% of the rigs since January, as per data from Baker Hughes. The rig count will likely continue its downward trajectory.

The recovery in the drilling activity in the international market seen in the past few quarters has been a bright spot but that is also fading quickly. In its latest quarter results, Schlumberger, which holds a dominating position in the international markets, has confirmed it is experiencing weakness in several key regions such as China, Malaysia, Iraq, Nigeria, and Mozambique. The crash in oil prices has forced even some of the largest and most well-established national oil companies to curtail upstream capital expenditures. Saudi Arabia’s state-owned energy behemoth and the world’s largest oil producer Saudi Aramco (ARMCO) has also announced $25 billion to $30 billion of capital for 2020 citing tough market conditions, depicting a drop of 16% from $32.8 billion spent in 2019.

The global oil and gas producing firms spent $546 billion of upstream capital last year, as per data from Rystad Energy. But we will likely witness a double-digit decline in 2020. Even some of the biggest energy companies have already made more than 15% budget cuts, as indicated earlier. The relatively smaller oil producers, particularly the high-cost operators or those with weak financial health such as Oasis Petroleum (OAS), will cut CapEx more aggressively. If, for instance, we see a 20% to 40% drop in global oil and gas capital investments in 2020, then we are looking at a $109 billion to $218 billion cut in spending. This reduction in global upstream CapEx represents a significant income hit to the oilfield services companies.

OIH’s holdings are now entering what could turn out to be the most severe downturn they’ve ever witnessed. The oilfield service providers are now focusing on cutting costs to the bone, conserving cash flows, and protecting the balance sheet. Schlumberger and Halliburton, the industry’s titans and OIH’s top holdings, have already announced significant cuts. These companies, and others, are closing or consolidating facilities, furloughing or laying off thousands of workers, slashing executive pays, and implementing structural changes as part of the belt-tightening measures. The dividends are also on the line, with Schlumberger and Core Laboratories (CLB) announcing big cuts.

In a nutshell, the oilfield services industry’s fundamentals are looking bleak, with virtually all companies now focusing on surviving this period. The revenues, earnings, and cash flows, of OIH’s holdings will decline substantially in the coming quarters. The ETF also offers 30-day SEC yield of 5.8% but this isn’t safe anymore considering even the blue-chip companies have been forced to cut payouts.

The oilfield services industry will eventually recover in the long-run once the global energy market rebalances. The massive reduction in capital investments from the oilfield service companies and oil producers and the resulting dip in supplies of both oilfield equipment and services and hydrocarbons can help rebalance the market sooner rather than later. But we might still be in the early phase of the downturn. As a result, things will get worse before they get better. The VanEck Vectors Oil Services ETF has tumbled by 59% this year, and I think the fund could remain subdued as we head deeper into the downturn and the earnings of its underlying holdings come under pressure. I suggest investors should stay on the sidelines for now.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment