Luis Alvarez/DigitalVision via Getty Images

REIT Rankings: Office

Hoya Capital

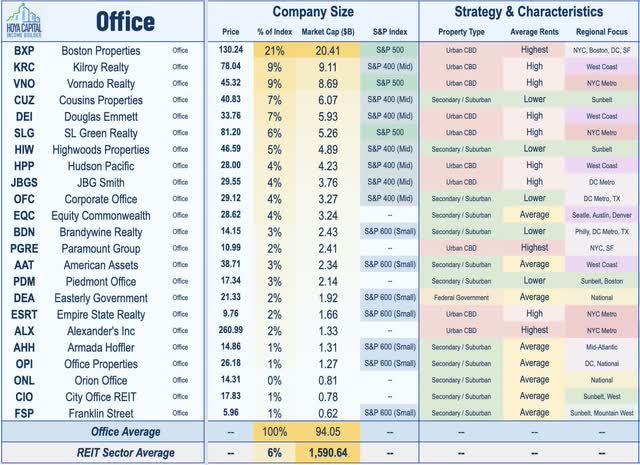

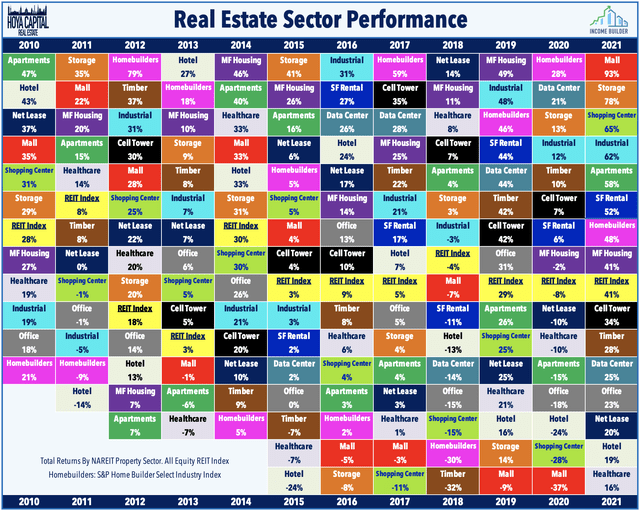

Back To The Office, Finally? Office REITs – which lagged over the prior two years from persistent pandemic-related headwinds – have been the best-performing major property sector in early 2022. A “new normal” on several levels, office REITs – which historically traded at persistent premiums to their REIT peers – have become relative “value plays” in the post-pandemic era while dividend yields have swelled. Within the Hoya Capital Office REIT Index, we track the 23 office REITs, which account for roughly $95 billion in market value and comprise 6-8% of the market-cap-weighted REIT Indexes.

Hoya Capital

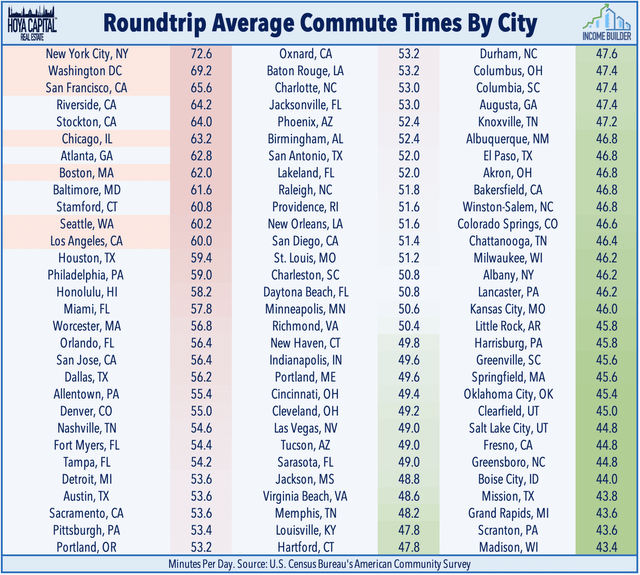

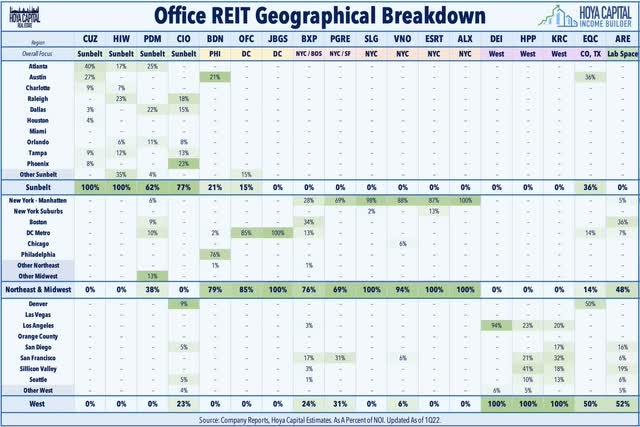

Early in the pandemic, we theorized that “Work From Home” would be more permanent than many suspected, and that the recovery in office demand would be quite uneven across metros. Our theory was that the patterns wouldn’t necessarily follow the clear-cut regional dynamic. Instead, one overlooked factor determining how fast – and to what extent – employees returned was employee commute times. Stanford University researchers found that office workers saved an average of 70 minutes per day from the lack of a commute, of which about 40% goes into extra work – explaining all of the “gained” productivity reported by WFH employees. Per the American Community Survey, the cities with the longest average commutes are New York City, Washington DC, and San Francisco.

Hoya Capital

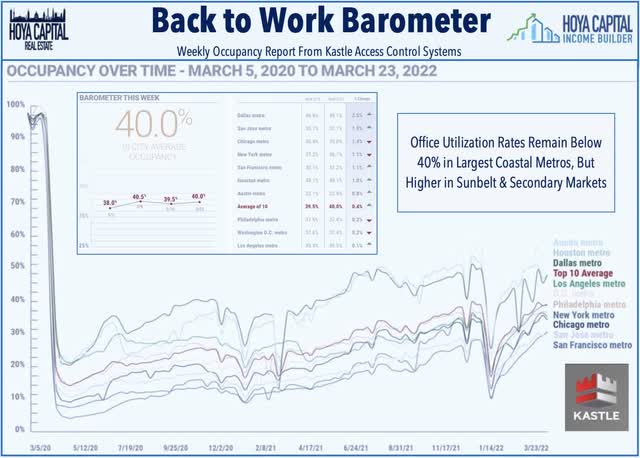

As expected, two years into the pandemic, office utilization rates have recovered only a fraction of pre-COVID levels, particularly in these largest coastal transit-heavy markets. According to recent data from Kastle Systems, office utilization levels remain at 40% or less in seven of the largest office markets including New York, Chicago, San Francisco, and Los Angeles, but have shown notable improvement to 50% or higher in major Sunbelt markets including Austin, Houston, and Dallas and closer to 75% in Raleigh, Charlotte, Atlanta, and Phoenix. For many, WFH will transition to “hybrid” work environments over the next quarter, setting up a “now or never” dynamic for utilization rates that corporate decision-makers will be monitoring closely.

Hoya Capital

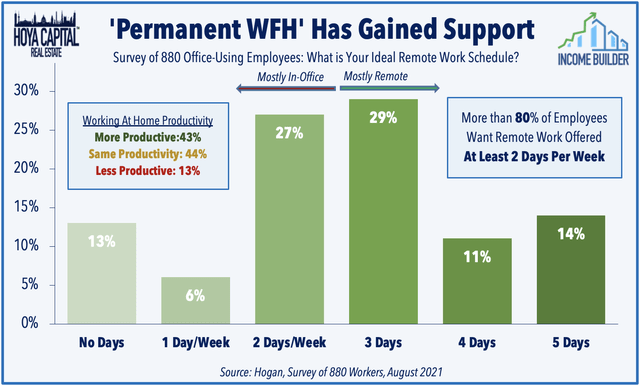

For many employees, there’s no going back to the long transit-heavy commutes – at least not to the pre-COVID norms of a traditional 5-day in-person workweek and evidence suggests that it’s market forces rather than discrete decisions driving the shift. Recent data from Hogan Assessments found that more than 80% of employees look for employers to offer remote work at least two days per week while nearly 90% reported that they are at least as productive at home as they are in a traditional office setting. A survey published by Stanford University economists showed that employees value hybrid WFH the same as a 10% pay rise, but most don’t want to be fully remote either. With an increasingly tight labor market, we believe that employees – not employers – will chart the future of the workplace.

Hoya Capital

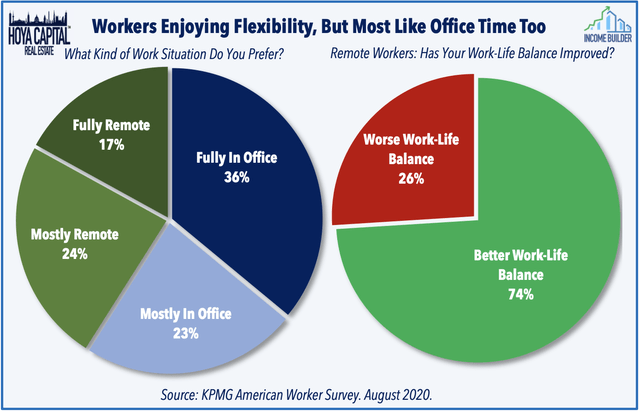

The finding that two-thirds of employees place significant value in working-from-home is remarkably consistent across many similar surveys including from KPMG, which found that only a third of workers wanted to see a return to the five-day in-person work week. However, perhaps equally as important as it relates to the long-term outlook for office REITs, a consistently small share of employees want to do away with the office entirely – averaging 10-20% across most surveys. In the recent Hogan survey, employees cited challenges with collaboration (36%), distractions at home (25%), and difficulty with motivation (16%) as the top challenges of the fully-remote environment.

Hoya Capital

Office Demand Has Been Surprisingly Resilient

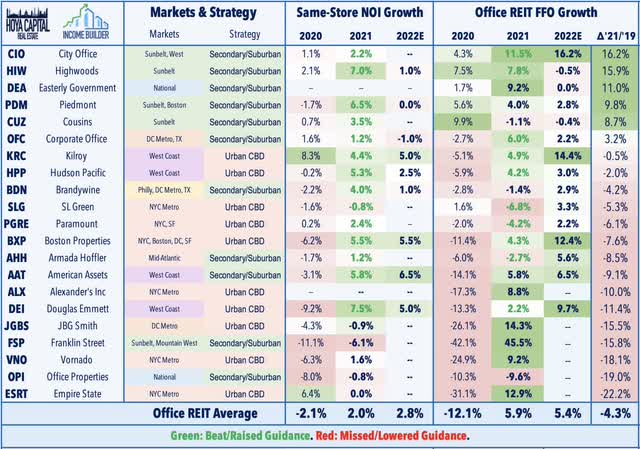

While we see Work-From-Home headwinds persisting in this “New Normal,” office leasing demand – and earnings results from these office REITs – have been surprisingly resilient, particularly for REITs focused on business-friendly Sunbelt regions and specialty lab space. As discussed in our REIT Earnings Recap, office REITs reported 5.9% FFO growth in 2021, on average, which was roughly 4% below their pre-pandemic levels in 2022. Ten office REITs eclipsed their prior full-year outlook led by solid results from sunbelt-focused REITs Highwoods (HIW) and Piedmont (PDM) and signs of resilience from several coastal-focused REITs Boston Properties (BXP) and Hudson Pacific (HPP) on strength in lab space demand.

Hoya Capital

Consistent with office REIT leasing trends which have exhibited solid resilience over the past three quarters, Jones Lang LaSalle (JLL) noted in their recent Office Outlook that the U.S. office market registered positive net absorption for the first time since the onset of COVID-19 during the fourth quarter. Citing robust job growth over the past twelve months – particularly in office-using professional jobs, leasing velocity increased by 9.2% in Q4, lifting full-year leasing volume 14.6% above 2020 levels, while vacancy rates plateaued. Lower-cost secondary markets in the Sunbelt and the West continued to lead the way in Q4, with many of these markets approaching pre-pandemic levels of leasing volume, while larger coastal “gateway” cities continued to lag.

Hoya Capital

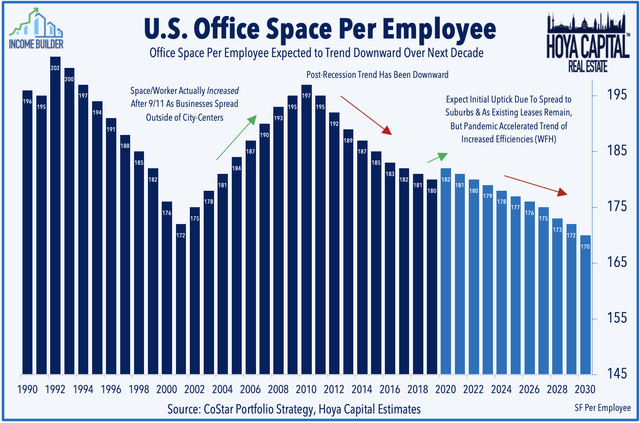

So while the office isn’t going away entirely, hybrid work environments – which will typically result in less office space per employee – are increasingly standard and we continue to believe that COVID-19 has simply accelerated – rather than temporarily altered – the pre-existing trends of increased workplace efficiency and technological disruption powered by Zoom (ZM), Slack (WORK), Alphabet (GOOG), Microsoft (MSFT), and Amazon (AMZN). As WFH becomes the norm in many of the largest ‘gateway’ cities, the office sector’s loss will continue to be the housing market’s gain as households look for more living space to adapt and thrive in the new normal. We expect a 15-20% decline in office space per employee by the end of 2030 as a reduction in traditional desk space is partially offset by more workplace amenities.

Hoya Capital

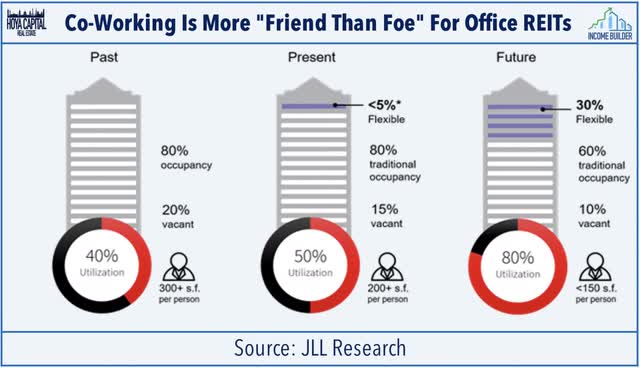

Some of the drag from reduced footprints will be offset by shared office space models. We were skeptical of the much-hyped WeWork (WE) spectacle before the pandemic, ironically we see a far more appealing use case for co-working in the “new normal.” Co-working firms have always been far more “friend than foe” for office REITs, serving as an intermediary to facilitate shorter-term space rentals and create incremental demand that would not otherwise be tenants of these office REITs. We believe that companies with hybrid workforces – and smaller office footprint – will increasingly provide allowances for co-working memberships and that employers will find that providing remote employees with local office space will be beneficial to productivity and retention – two of the most significant employer “costs” of remote work.

Hoya Capital

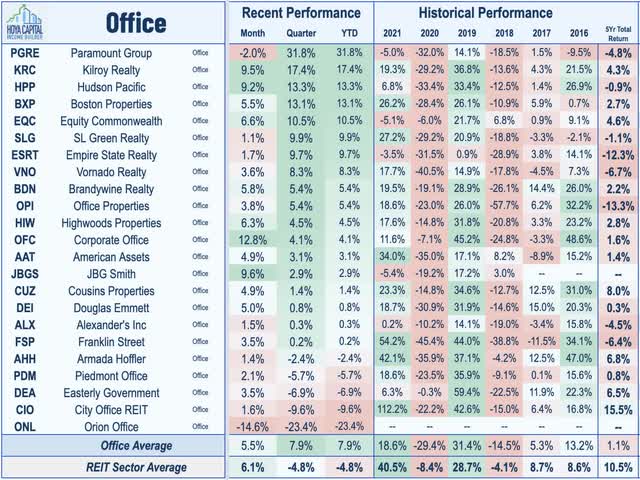

Office REITs Stock Price Performance

Office REITs lagged over the prior two years from persistent pandemic-related headwinds. After riding the vaccine-driven ‘reopening rotation’ to strong gains in early 2021, the fourth and fifth waves of the coronavirus pandemic resulting from the Delta and Omicron variants resulted in a second-straight year of significant underperformance for office REITs. Office REITs ended 2021 with total returns of 23.3%, significantly lagging the 41.3% total returns from the All Equity REIT Index. Interestingly, four of the six REIT sectors that underperformed in 2020 were ‘repeat offenders’ in 2021 as office REITs joined hotels, healthcare, and net lease REITs as underperformers in both years.

Hoya Capital

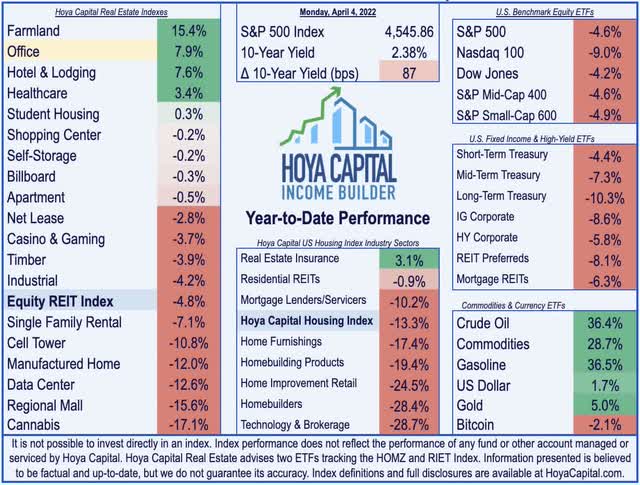

Office REITs have rebounded in early 2022, however, following resilient fourth-quarter earnings results, better-than-expected job growth, and a broader rotation from growth into value. As noted above, office REITs are some of the most pro-cyclical sectors and as a result, provide some of the better inflation-hedging properties of any REIT sector despite their rather healthy dividend yields. The Hoya Capital Office REIT Index is higher by nearly 8% so far in 2022 – the best-performing major property sector – and significantly outperforming the -4.8% decline from the market-cap-weighted Vanguard Real Estate ETF (VNQ) and the -4.6% decline from the S&P 500 ETF (SPY).

Hoya Capital

Diving deeper into the performance of these individual REITs, we note that all but five office REITs finished in positive territory for 2021 while seven office REITs delivered total returns of over 20% for the year. Small-cap City Office (CIO) doubled last year after a large asset sale of its entire Sorrento Mesa portfolio which suggested that CIO – along with the majority of office REITs – were (and still are) trading at meaningful discounts to their private-market-implied Net Asset Value. Most secondary/Suburban REITs – particularly those focused on the Sunbelt region – have delivered positive total returns since the end of 2019 while the majority of Coastal-focused REITs remain underwater by 10-30% from pre-pandemic levels on a total return basis.

Hoya Capital

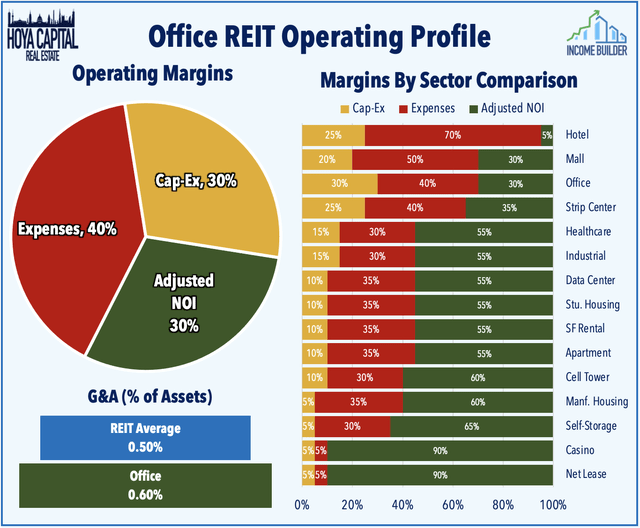

Deeper Dive: Office REIT Fundamentals

Even in the best of times, office ownership is a tough, capital-intensive business with relatively low operating margins and high capital expenditure needs, as tenants tend to have quite a bit of negotiating power relative to landlords. This is particularly true given the ample available supply – a supply overhang that will linger for much of the next decade. Given the high degree of fixed costs incurred in managing an office property – whether fully occupied or mostly vacant – operating leverage is quite high. Thus, small changes in occupancy and market fundamentals can have significant negative impacts.

Hoya Capital

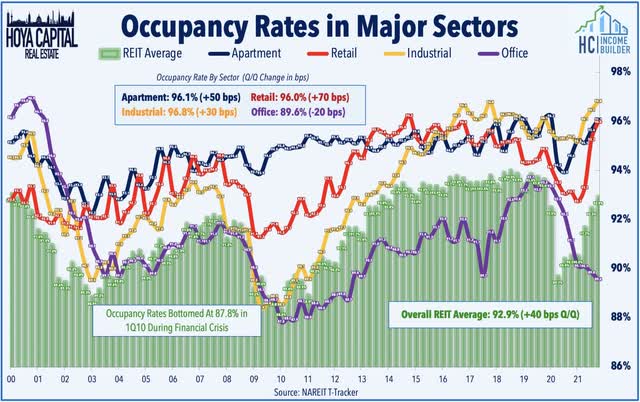

Power to the tenants. More than other REIT sectors, office REITs have a relatively small roster of tenants, and given the ongoing supply overhang from the combination of weak demand and continued supply growth, we project that most landlords will have soft pricing power for the foreseeable future. Occupancy rates across the office sector have declined more sharply than any other major property sector since the pandemic began, but have stabilized in recent quarters. In CBRE’s 2022 U.S. Real Estate Market Outlook report, the real estate brokerage firm forecast that the national office vacancy rate will reach its highest level since 1993 in 2022 due to elevated levels of new supply, which will keep market conditions decidedly in favor of tenants.

Hoya Capital

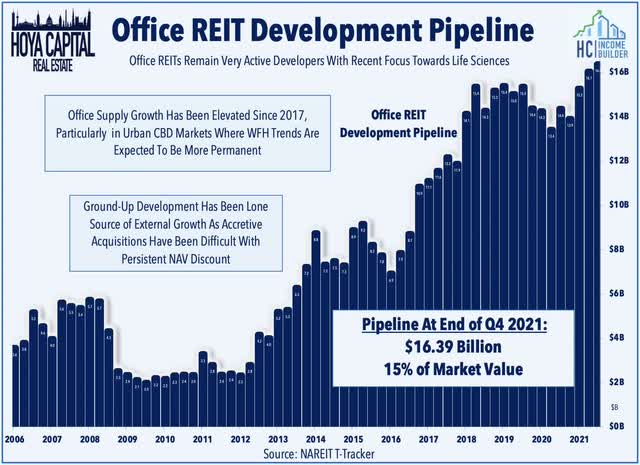

On that note, the supply dynamic certainly hasn’t helped, either, as construction spending on office development ramped up after the 2016 elections, spurred by the passage of corporate tax reform and strong job growth of key office-using sectors. The office pipeline increased to a new cycle-high in late 2019 right before the start of the pandemic, and after a slight pullback during the pandemic, the office REIT pipeline is yet again at fresh record highs. According to NAREIT T-Tracker data, the office development pipeline stands at $16.39 billion, up sharply from the 2012 level of $2 billion, representing 15% of office REIT market value which is by far the highest relative pipeline in the REIT sector.

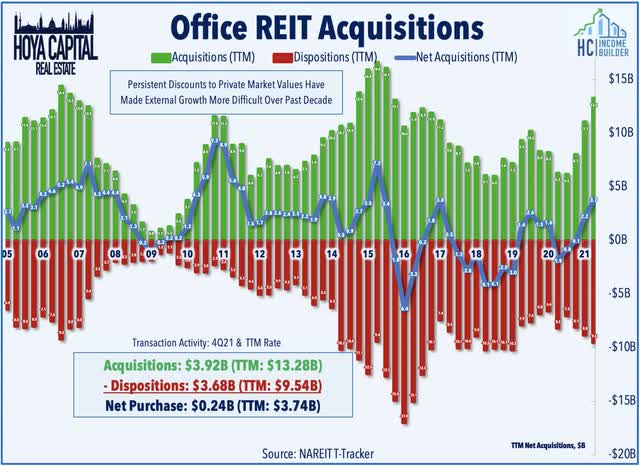

Hoya Capital

Ground-up development has been the lone source of external growth for office REITs over the past half-decade as accretive acquisitions have been made quite difficult by the persistent valuation discounts relative to private market valuations. As noted above, private market pricing has remained notably firm in recent quarters, underscored by several major transactions including Google’s $2.1 billion deal to buy a Manhattan office building, consistent with recent data from CBRE (CBRE) which showed that cap rates have “remained stable or compressed across most of the top 25 markets” since the start of the pandemic. Office REITs have shown signs of life on the acquisition front in recent quarters, particularly the Sunbelt-focused REITs with a more attractive cost of capital, recording $13.3 in acquisitions in 2021, the highest since 2017.

Hoya Capital

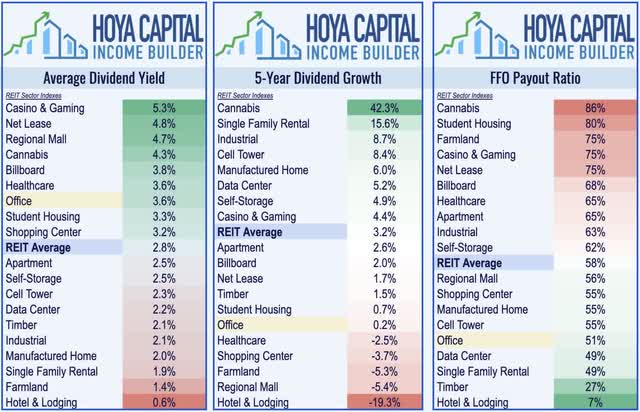

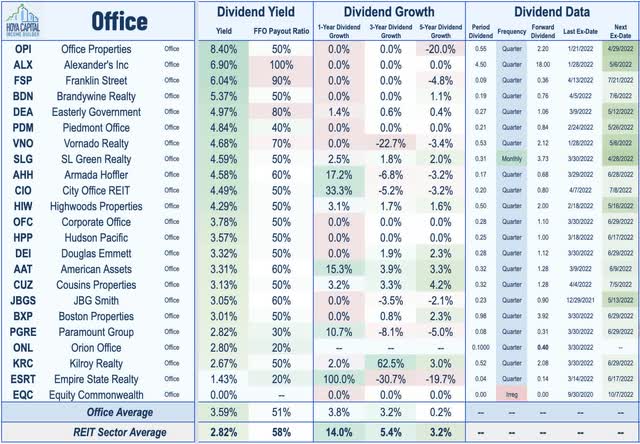

Office REITs Dividend Yields

While the growth outlook remains muted, office REIT dividend yields have swelled over the past year amid this post-pandemic pullback, and as eleven office REITs boosted their payouts in 2021, part of a historic wave of more than 130 dividend hikes across the REIT sector in 2021. Current payout ratios suggest that these distribution levels are quite sustainable, as a whole. Office REITs now rank toward the top of the REIT sector, paying an average yield of 3.60% compared to the market-cap-weighted REIT sector average of 2.8%, despite paying out just 50% of their available Funds from Operations.

Hoya Capital

A pair of office REITs – Cousins and Paramount – have hiked their dividends so far this year. A handful of office REITs also declared special distributions in late 2021 including SL Green (SLG) and Franklin Street (FSP). There is a wide range of dividend distribution strategies employed by the 23 REITs within the sector, with yields ranging from 8.40% from Office Properties (OPI) and 6.90% from Alexander’s (ALX) to a low of 0% from Equity Commonwealth (EQC). Also notable – Orion Office (ONL) – the newest office REIT that was spun out from Realty Income (O) as part of its merger with VEREIT – has been under pressure since reporting its first inaugural earnings results as investors were disappointed by its lower-than-expected quarterly dividend of $0.10/share – representing a yield of 2.6%.

Hoya Capital

Key Takeaways: A New Normal

We remain downbeat on the office recovery in New York City, in particular, which has the longest average commute time for office workers. Similar themes apply to the Washington DC region, San Francisco, and Chicago. While the highest-quality “trophy” buildings will continue to see demand from top-tier tenants, we forecast higher levels of capital expenditure needed to compete for tenants in these markets while Class B and C properties will face persistently elevated vacancy rates. Office REITs tend to be more region-specific than other REIT sectors, and with our view that coastal transit-heavy cities will continue to underperform in the “new normal” for office utilization, we’ve been particularly selective in our Income Builder portfolios with recent allocations towards attractively-valued Sunbelt-focused office REITs.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Prisons, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Be the first to comment