Roman Babakin/iStock via Getty Images

Office Properties Income Trust (NASDAQ:OPI) is an externally managed real estate investment trust (“REIT”) that owns a portfolio of high-quality office buildings that are leased to high-credit tenants, one of which is the U.S. Government, their largest single tenant by annualized base rents (“ABR”).

For income investors, the stock offers a sizeable quarterly dividend payout of $0.55/share, which represents an annualized yield of 15% at current pricing, which is just above new 52-week lows. Even at their highs, however, the yield was still elevated, at over 7%.

While the threat of a cut is always on the mind of dividend-focused investors, especially on the high yielders, the dividend has been maintained at current levels for the past two years, even through the worst months of the COVID-19 pandemic.

At present, shares are down over 40% YTD and trade at just 3x forward funds from operations (“FFO”). This multiple is among the lowest in the office sector. Interestingly, short interest is lower than on some other office-centric names. SL Green (SLG) and Vornado Realty Trust (VNO), for example, are each 10% shorted. In addition, Easterly Government Properties (DEA), whose top tenant is also the U.S. Government, has short interest of over 7%.

Seeking Alpha – Summary Of OPI’s Current Trading Metrics

While the current yield and pricing levels may seem inviting to yield-starved investors, it’s best to proceed with caution. The company has an elevated debt load and significant lease expirations over the next two years. They also require significant funds for ongoing redevelopment projects. The combination of these three considerations could constrain cash flows in the coming periods, especially if OPI falls short on their leasing and disposition goals. While these risks do have some counterbalancing strengths, they still warrant a pause from investors, at least through the next earnings release.

A Portfolio With A Significant Percentage Of Highly Rated Tenants

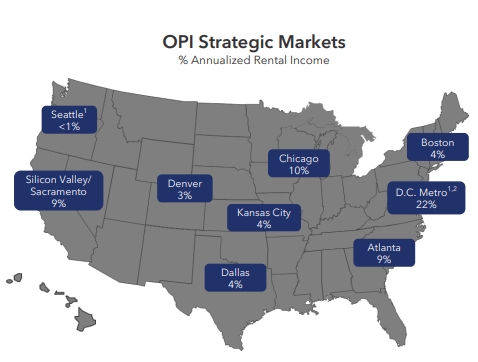

OPI’s portfolio includes 172 total office properties that are spatially diversified across the U.S., with an elevated concentration of properties in the D.C. Metro and Chicago, Illinois. Together, the two regions accounted for a third of the company’s total ABR.

Q2FY22 Investor Presentation – Map Of Geographic Concentration

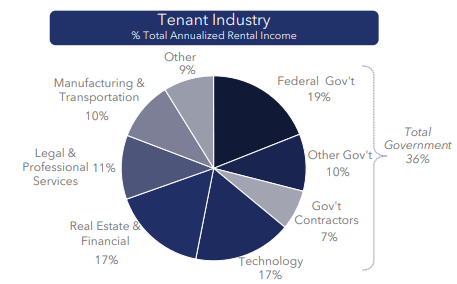

Greater exposure to the D.C. Metro region is driven primarily by the company’s relationship with the U.S. Government, which is their largest tenant, representing almost 20% of total ABR. When including contractors and other government-related bodies, the exposure level is 36%. Aside from the federal government, no other tenant accounted for over 5% of total revenues.

Q2FY22 Investor Presentation – Breakout Of The Industries Served By OPI

Uncertainties Surrounding The Government’s Leases

Having the U.S. Government as a top tenant does provide several competitive advantages. For one, the government has never defaulted on its obligations. This provides predictability and stability to continuing cash flows. Additionally, many governmental agencies, such as the Department of Homeland Security, perform highly sensitive work that is incompatible with remote or hybrid working arrangements. This provides some downside protection against non-renewal risk.

That being said, the U.S. Government Accountability Office (“GAO”) recently released a study that showed that in the next three years, most agencies reported that they expect to reduce the number of leases in their real estate portfolio. If these findings are accurate, it could have material implications on OPI’s portfolio and results of operations.

Significant non-renewals by any of their governmental tenants could result in significant costs in repurposing and backfilling the vacant space. This would place even greater strain on liquidity and could force a going-concern disclosure.

Granted, this is unlikely to materialize, given the government’s past propensity to renew their leases due to the extraneous costs of moving elsewhere and the costs associated with a large build-to-suit project that effectively puts them right back where they were before vacating OPI’s properties. Nevertheless, the GAO study is one that should not be discounted by any means.

Elevated Non-Renewal Risks

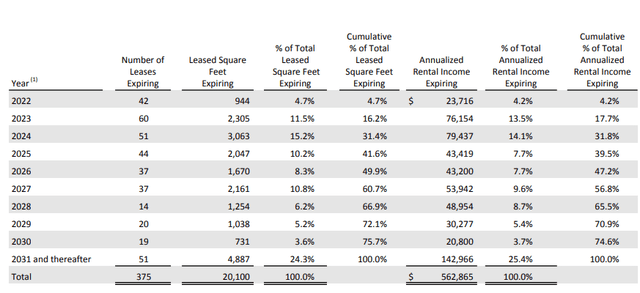

Renewal risk is especially relevant at this time because of the significant expirations within the next two years. In total, about 30% of contractual rent is set to expire. While this does provide a mark-to-market opportunity, the operating landscape is highly uncertain.

Q2FY22 Investor Supplement – Lease Expiration Schedule

On the earnings call, it was noted that subsequent to quarter end, the company signed about 345K square feet (“SF”) of space, representing 2% of the expirations for the remainder of the year. Furthermore, management also stated that the leasing team is in advanced conversations with many of the expirations in the back half of the year and the early part of 2023.

In addition, they also intend on marketing several of the buildings on the expiration list. All considered, the team has about 7% of annualized revenue to work through in 2023. Despite their progress, that is still a sizeable quantity.

And regarding the disposition plans, those deals are at heightened risk of falling through due to widening bid/ask spreads that is resulting in uncertain price discovery between buyers and sellers. In some cases, for example, buyers are asking for a 10% discount on pricing on some of the assets being shopped.

Potential Strain On Liquidity In Periods Ahead

An inability to address their upcoming expirations through leasing or disposition efforts could constrain their current liquidity position. At present, total liquidity stood at nearly +$550M, comprised primarily of the +$520M available on their revolving credit facility. In addition, they typically generate between +$200-$220M in operating cash flows per year.

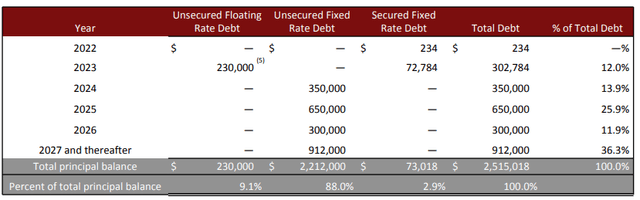

Looking ahead to the end of 2023, the company needs approximately +$685M in funds to address upcoming debt maturities, their estimated dividend payouts, and their remaining redevelopment spend. Together, these three commitments approximate to +$300M, +$155M, and +$230M, respectively.

For a more conservative estimate, this could be rounded up to +$700M. While expected liquidity is adequate to meet these obligations, even under a stressed scenario where operating cash is reduced by 15%, funds would still get tight.

Q2FY22 Investor Supplement – Debt Maturity Schedule

Furthermore, any drawdown on the revolver would result in variable rates that would expose them to heightened interest rate risk. While current coverage ratios are adequate, at about 3.3x, it would be pressured under a stressed scenario. With net debt already on the high end, at above 7x, OPI could be at risk of a credit downgrade or a potential covenant violation, though the latter is less likely.

Counterbalancing Strengths

Despite the uncertainties in the market, OPI is still reporting healthy operating metrics. In the current quarter, they signed about 680K SF of space at a weighted average roll-up of 5%. Overall, volume was up 18% sequentially and 23% on a YOY basis, with government agencies representing approximately 30% of their total leasing volume.

Additionally, these leases were signed with average terms of nearly 10 years. And at period end, overall occupancy stood at nearly 90%, with some properties at 94.3%. The strength in leasing and occupancy does seem to contradict much of the more bearish concerns regarding renewal risk.

Also, while the high-yielding dividend does invite concerns regarding a cut, current coverage levels seem adequate. Presently, the normalized FFO payout ratio stood at 45%, while the CAD payout stood at 65%. This level of coverage is quite reasonable, especially for a stock with a double-digit yield. Sure, the payout hasn’t been increased, but it has been maintained at elevated levels for several years, providing many investors a steady source of continuing income.

An Interesting High-Yielder That Is Worth Further Consideration Following Their Q3 Release

OPI is a high-yielding office REIT that offers prospective investors a dividend yield in excess of 15% at current pricing levels. Even at their 52-week highs, the payout still offered a sizeable yield of over 7%. At its current rate, it would take an investor just under seven years to recover their principal from just the reoccurring dividend payments, assuming the payout is maintained over the holding duration.

For yield-starved income investors, the stock certainly appears attractive. It even has some fundamental strengths, such as a high percentage of investment-grade tenants, one of which includes their largest single tenant, the U.S. Federal Government. In addition, their overall portfolio is approximately 90% leased, with same properties even better at 94.3%. Continued strength in leasing is also producing weighted average roll-ups of 5% and lease terms of nearly 10 years.

These positives, however, must be measured against the near-term concerns, which include significant lease expirations over the next two years and an uncertain market outlook that could impede their disposition goals. Inadequate progress on either of these near-term priorities could strain their current resources.

While the company has adequate liquidity at present, OPI may need to tap further into their revolver to address upcoming maturities and redevelopment spending. This would increase their variable-rate exposure as well as their leverage ratio, which is already high.

OPI is also externally managed by the RMR Group (RMR). This company is also the manager of Diversified Healthcare Trust (DHC), Service Properties Trust (SVC), and other many other funds and operators. Often, external structures are cited as a key credit concern due to conflicts of interest between investors and management. While this has yet to be an issue, one should not rule out negative ramifications in later periods.

With shares down over 40% YTD and valuation multiples at just 3x, the stock is more likely to bounce higher in the periods ahead as opposed to experiencing even further and more significant declines. This would provide some reprieve to existing shareholders who are likely sitting on significant losses.

For new investors, on the other hand, it may be best to wait for the release of the Q3 earnings report before initiating any position in the stock. For those looking to buy in for the dividend, a stop-loss on the position would be well-warranted, given current uncertainties.

Be the first to comment