imaginima/E+ via Getty Images

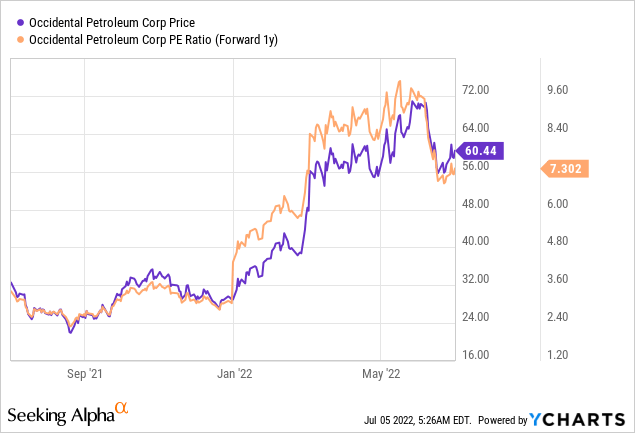

Soaring market prices for petroleum products have led to an incredible windfall in profits for the industry as a whole. Occidental Petroleum Corporation (NYSE:OXY) is a huge beneficiary of these changes in market conditions and it has seen a surge in free cash flow recently. I believe the producer could see between $12-13B in free cash flow in FY 2022 and will likely see a fundamental improvement in balance sheet strength as it repays more of its debt. Since Occidental Petroleum is selling at a P/E ratio of only 7.3 X, based off of next year’s expected profits, the risk profile is still heavily skewed to the upside!

Pricing strength in energy market likely to stay

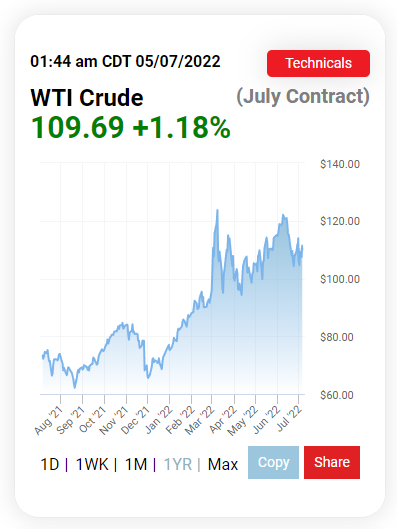

In 2022, a sharp upwards revaluation of energy products has taken place, chiefly because of Russia’s invasion of Ukraine. Because the war in Eastern Europe is now in its fifth month and dragging on for far longer than initially expected, petroleum prices have not retreated in a material way after the initial price increases at the end of February. Petroleum prices have remained rather high in the last three months, creating a favorable setup for producers like Occidental Petroleum. I believe there is even the possibility that crude oil prices, which are currently at around $110, may even go into a new leg up if Russia decides to further limit energy exports into Europe.

Oilprice.com

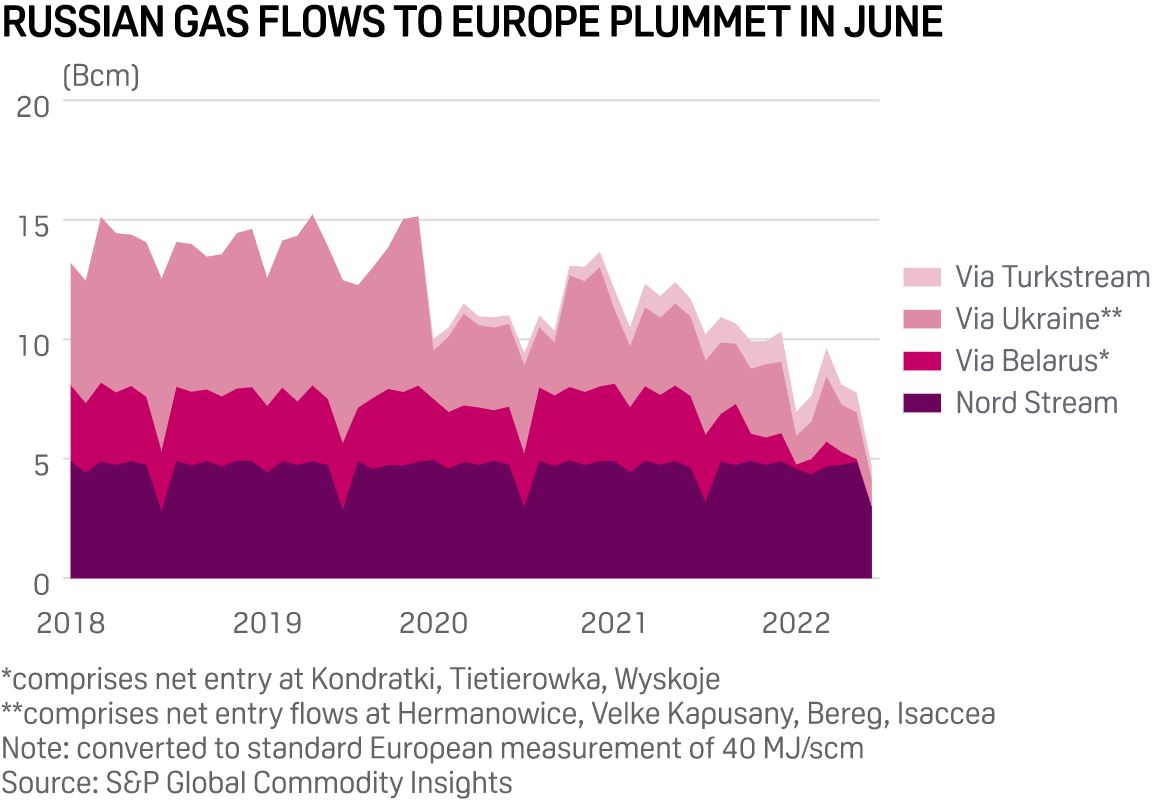

Before the war, Russia supplied about two-fifths of Europe’s gas, and the country has recently moved to limit energy exports to major clients in Europe. Russia’s energy flows to Europe (based on pipeline volumes) plunged about 40% between May and June, and the head of the International Energy Agency (“IEA”) recently cautioned against the possibility of a complete shutdown of Russian energy supplies this winter. A partial or complete shutdown of current-level energy exports from Russia into Europe would likely send crude and natural gas prices soaring.

SPG Global

The surge in pricing has led to a windfall in profits for Occidental Petroleum in the first quarter which produced $3.32B in free cash flow, showing 113% year-over-year growth in the most important metric for petroleum producers. In the year-earlier period, the company just achieved $1.56B in free cash flow. Occidental Petroleum’s free cash flow margins soared from 29.4% last year to 39.8%, and they could go even higher if the supply situation in Europe deteriorates in the second half of the year.

|

$millions |

Q1’21 |

Q2’21 |

Q3’21 |

Q4’21 |

Q1’22 |

|

Product Net Sales |

$5,293 |

$5,958 |

$6,792 |

$7,913 |

$8,349 |

|

Net Cash Provided by Operating Activities |

$788 |

$3,324 |

$2,910 |

$3,231 |

$3,239 |

|

Plus: Working Capital/Other |

$1,347 |

($614) |

$57 |

$636 |

$939 |

|

Less: Purchases of Property and Equipment |

($579) |

($698) |

($656) |

($937) |

($858) |

|

Free Cash Flow |

$1,556 |

$2,012 |

$2,311 |

$2,930 |

$3,320 |

|

Free Cash Flow Margin |

29.4% |

33.8% |

34.0% |

37.0% |

39.8% |

(Source: Author)

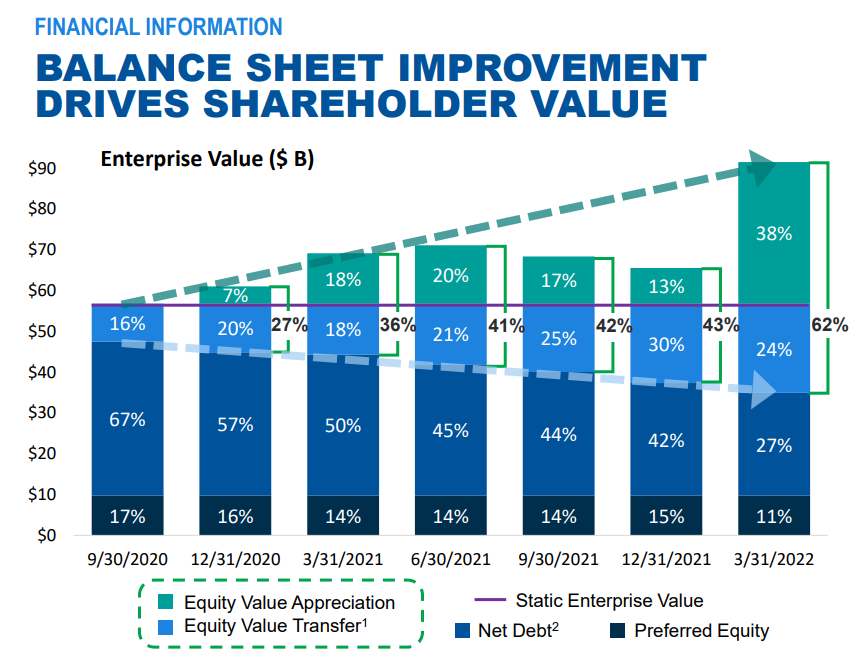

Occidental Petroleum generated $8.81B in free cash flow in FY 2021 and FCF started to really surge in Q4’21. If pricing remains strong in the second half of FY 2022, I believe Occidental Petroleum could achieve between $12-13B in free cash flow, the majority of which is likely going to be used to lower the firm’s debt. Occidental Petroleum fully used its $3.3B in free cash in the last quarter to repay debt which at the time represented 12% of the company’s outstanding principal. Occidental Petroleum had about $25.8B in long-term debt in the last quarter, and management would likely want to throw as much FCF at its debt as possible in FY 2022. Debt repayments and improved free cash flow already made a big impact on the firm’s balance sheet: Occidental Petroleum’s net debt represented just 27% of the company’s total enterprise value in Q1’22, which was down from 50% just a year earlier.

Occidental Petroleum

Possibility of a share buyback

Occidental Petroleum’s significantly improved free cash flow position could result in a share buyback, although the repayment of debt is likely going to be a short-term priority for management. Occidental Petroleum also pays a dividend, but I believe management wants to avoid creating a permanent liability by committing to a higher distribution.

Occidental Petroleum is cheap

Occidental Petroleum is expected to generate EPS of $10.74 in FY 2022 and EPS of $8.28 in FY 2023. Based off of FY 2023 projections, shares of Occidental Petroleum currently have a price-to-earnings ratio of 7.3 X. The P/E ratio is low chiefly due to expectations of above-average earnings growth for Occidental Petroleum this year. A decrease in EPS predictions would result in a higher P/E ratio for the producer.

Making accurate EPS projections in the petroleum industry is extremely challenging due to the volatile nature of the market itself, so I apply a 25% discount to FY 2023 EPS predictions. The risk-adjusted EPS for FY 2023 would then be $6.21 which implies a price-to-earnings ratio of 9.7 X… but even then shares of Occidental Petroleum would be reasonably valued.

Risks with Occidental Petroleum

The biggest risk for the producer is possibly the reliance on volatile and unpredictable market prices for its energy products. A material decline in the pricing of petroleum products is likely to result in a serious contraction of Occidental Petroleum’s free cash flow as well as a valuation factor. Valuations in the petroleum industry are as cyclical as market prices and free cash flows. Should the petroleum market drop back into a bear market, Occidental Petroleum may still generate profits, but likely not as much as the current valuation implies.

Final thoughts

Occidental Petroleum is a bet on continual strength in pricing for energy products, and I believe the market still underestimates the potential for a protracted conflict in Ukraine and the impact it could have on energy markets. A further limitation of Russian energy supplies into Europe could drive a significant upwards revaluation of crude and natural gas prices. Additionally, the windfall in profits and free cash flow could lead to a stronger balance sheet for Occidental Petroleum and may even result in a share buyback going forward. To top things off, Occidental Petroleum’s earnings are only valued at a valuation multiplier factor of 7.3 X (9.7 X risk-adjusted), indicating an attractive risk profile!

Be the first to comment