All_About_Najmi

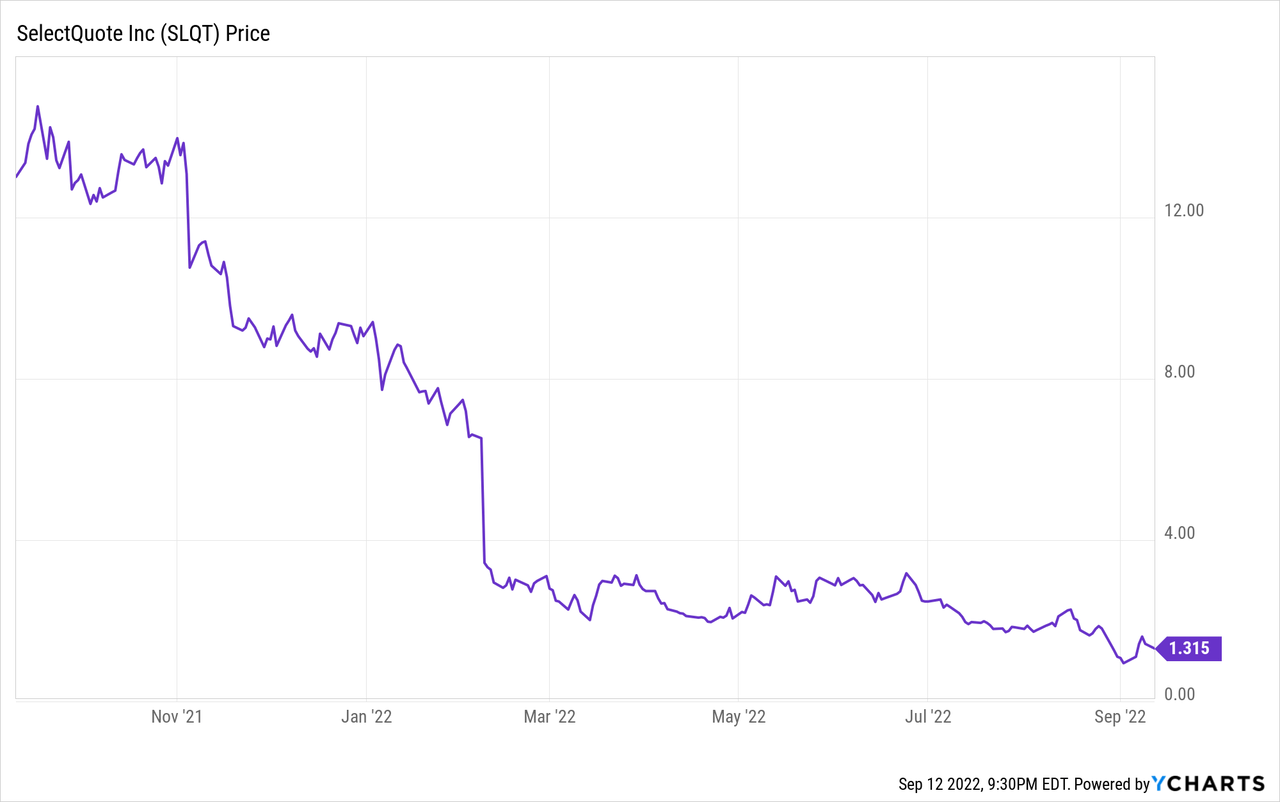

While I’m ordinarily a big proponent of “buy the dip” strategies during these market conditions, I think some of the year’s biggest losers have also been accompanied by major swings in fundamental trajectory – and SelectQuote (NYSE:NYSE:SLQT) is a great example of this. This insurance lead-gen company, which specializes in Medicare and Medicaid insurance sales to seniors, has seen a dramatic turn in its growth prospects this year, and profitability has bled as well.

The markets have lost patience with SelectQuote. Year to date, the stock has lost 85% of its value, and now trading barely above $1, it’s at a near-term risk of being delisted. In my view, there is little value to be salvaged here, and SelectQuote is looking at further pain up the road.

After reviewing the company’s latest guidance and turnaround plan for FY23, I remain incredibly skeptical about SelectQuote’s prospects, and am very bearish on this stock.

Resist the temptation to buy the dip here: I think SelectQuote is painting a much rosier outlook for FY23 than is realistically achievable.

FY23 Guidance: the pitfalls

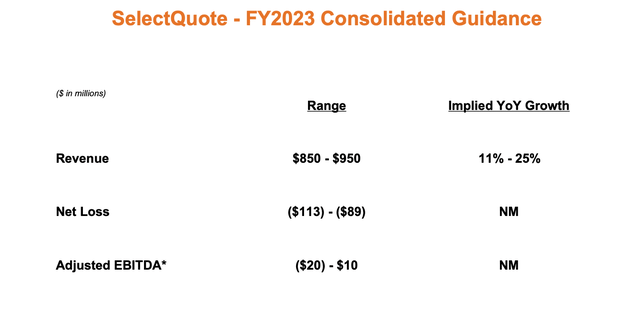

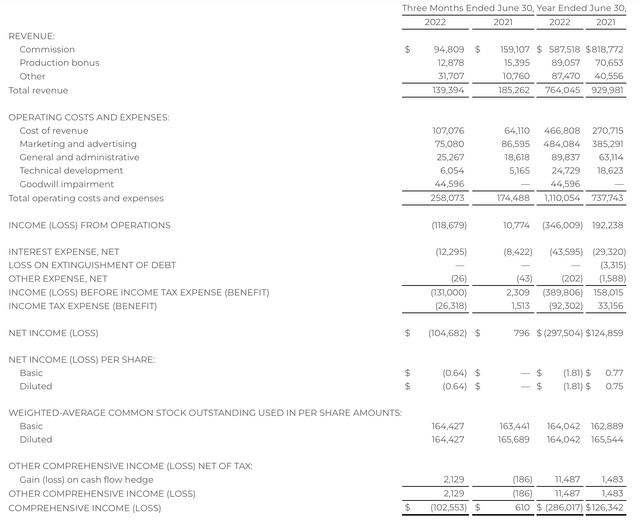

Let’s first discuss the company’s financial targets for next year (the year ending June 2023), and then its plans for how it intends to get there. The numbers are shown below:

SelectQuote FY23 outlook (SelectQuote Q2 earnings deck)

As shown above, SelectQuote is aiming for 11-25% y/y revenue growth, as well as adjusted EBITDA of -$20 to $10 million, or essentially breakeven. This compares to adjusted EBITDA losses of -$260.5 million in FY22.

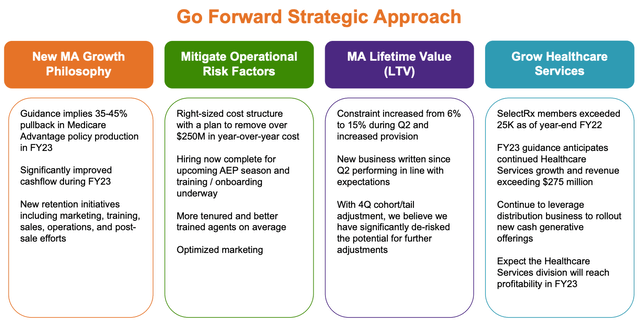

SelectQuote FY23 strategy (SelectQuote Q2 earnings deck)

The slide above showcases the company’s main strategic pillars to get there. The key takeaways from this strategy are:

- SelectQuote intends to reduce operating expenses by $250 million year over year, driven primarily by pulling back on agent hiring and marketing. This compares to $644 million in GAAP opex costs in FY22 (excluding cost of revenue).

- The company is banking on longer average agent tenures and strong employee retention to improve its sales results.

Let’s discuss and put a big question mark over the revenue item first. How exactly does SelectQuote intend to grow revenue at a double-digit pace, when it is cutting its discretionary growth spending?

Recent trends don’t give us much confidence that a turnaround is in the works for SelectQuote. As shown in the Q4 results summary below, SelectQuote exited Q4 at a -25% y/y revenue decay clip:

SelectQuote Q2 results (SelectQuote Q2 earnings deck)

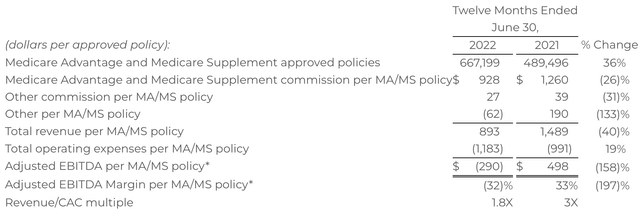

SelectQuote’s sales and marketing efficiency metrics are also on the wane. In FY22, a typical policy approved generated only 1.8x in revenue compared to the customer acquisition cost, versus 3.0x in the year-ago quarter. Adjusted EBITDA per policy dropped to a loss of $290, versus a gain of $498 in the year-ago quarter.

SelectQuote marketing efficiency (SelectQuote Q2 earnings deck)

In essence, SelectQuote’s forecast of revenue re-accelerating to double-digit growth in FY23 is banking on higher sales efficiency. Here’s commentary from CEO Tim Danker’s remarks on the Q4 earnings call, highlighting the company’s hope that sales retention continues to be high:

We’re also doing a good job retaining our highly productive tenured agents, evidenced by an improved year-over-year retention rate. As you recall from our comments in previous quarters, we’ve historically seen higher levels of productivity and policy retention for tenured core agents, compared to newly hired flex agents.

We have conservative expectations, but we believe the combination of a more tenured agent sales force and more targeted marketing on smaller cohort of policies positions us well demonstrate better policyholder retention and overall returns.

Lastly, as we’ve noted, a lower cost base and continued work to optimize profitability and cash flow should benefit 2023 and the years ahead, while simultaneously reducing volatility in our operating results.”

Company employees are not blind, however. They can see what is happening to the company’s share price and how revenue trends are currently down. To me, SelectQuote’s hope that it will be able to produce revenue growth while also slashing hiring – banking almost entirely on improved productivity within the current tenured sales base – is “pie in the sky” and wishful thinking.

We also should express some skepticism over SelectQuote’s planned cost cuts. The company wants to take adjusted EBITDA from -$260 million this year to virtually breakeven next year, by implementing $250 million in cost reductions. Aside from these reductions potentially impacting expected growth as we just mentioned, I think there are several other concerns to flag:

- $250 million represents ~39% of FY22 operating expenses. Is this a realistic target? Note as well that these are expected run-rate savings, and that the company may not realize a full $250 million cost-down in FY23. The expectation for breakeven adjusted EBITDA (especially when policy growth can’t be counted on to support bottom-line growth if current policies are bringing in negative adjusted EBITDA) looks fairly unrealistic.

- Most other companies are experiencing wage inflation and other drivers pushing cost higher, not lower. SelectQuote can’t have its apple and eat it, too: it can either pinch pennies and risk losing tenured sales agents (which is a key pillar for its revenue growth projection) or bite the bullet and increase salaries. The company’s guidance implies both objectives are achievable, which I think to be too rosy.

Key takeaways

Judging by the relentless fall in SelectQuote’s share price after its earnings release and outlook update, the stock market is seemingly also quite suspicious of SelectQuote’s FY23 plan. We note as well that SelectQuote has only $141.0 million of cash left on its balance sheet, and that’s against a huge $705.4 million debt pile. Free cash flow burn in FY22, meanwhile, was a staggering -$363.2 million.

Any way you slice it, SelectQuote’s prospects look fairly dim. Steer clear here.

Be the first to comment