Aleksandr Zubkov/Moment via Getty Images

Making the Most of Ongoing Volatility

Market Overview

Equities ended a tumultuous year on a positive note, grinding higher in the fourth quarter on better than expected corporate earnings and signs that inflation may have peaked. The S&P 500 Index rose 7.56% for the quarter but finished down 18.11% in a year marked by a historic tightening of financial conditions. With the Federal Reserve raising interest rates by 425 basis points, its most aggressive campaign since the 1980s, long-duration growth stocks felt the most pain. The benchmark Russell 3000 Growth Index gained 2.31% for the quarter but underperformed the Russell 3000 Value Index (+12.18%), extending a streak that saw growth stocks fall 28.97% for the year, trailing value by 2,100 basis points.

From a sector perspective, defensive and cyclical sectors delivered the best performance in the benchmark, led by industrials, health care, energy and consumer staples. Materials, financials, utilities and real estate also outperformed the benchmark. The longer-duration, higher-beta information technology (IT) sector performed in line with the index while consumer discretionary and communication services sectors underperformed meaningfully.

Markets remained volatile during the fourth quarter, with sentiment dictated by expectations around the future direction of monetary policy. The ClearBridge Multi Cap Growth Strategy kept pace during a double-digit rally in October and November and held up better than the benchmark in December as the Fed signaled it would keep rates higher for longer to ward off structural inflation. The ability to perform well on a relative basis through such differing conditions speaks to the balance we have sought to achieve since embarking on a portfolio repositioning in early 2021.

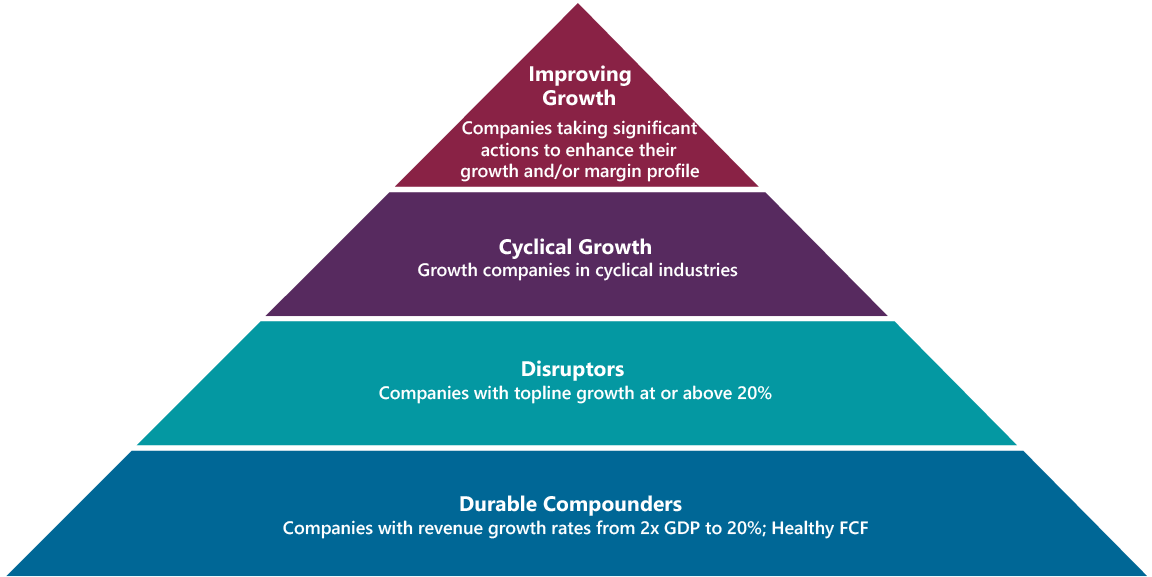

As we’ve detailed over the last two years, our intent with the repositioning was to expand the types of growth companies we target and broaden our sector exposures, resulting in a portfolio that could outperform over a variety of market environments. Over the last seven quarters, we have added 13 new positions, the majority being higher-growth disruptors early in the development of their market opportunity, while reducing cyclical exposure and sizeable overweights in certain industries or subsectors of the market. The additions of Etsy, an online marketplace for craft and smaller retailers, Airbnb, an online platform for alternative lodging, and global spirits marketer Diageo expanded our relatively low exposure to consumer discretionary and consumer staples within the portfolio with industry leaders in their respective businesses.

Exhibit 1: A Balanced Approach to Growth

Source: ClearBridge Investments.

The additions have improved the Strategy’s overall growth profile while maintaining high active share with a low correlation to the mega cap heavy Russell 3000 Growth Index. An ongoing focus on valuation as well as cash flow positive businesses and those with a visible path to profitability have also supported downside capture through a volatile period of normalization from the COVID-19 pandemic.

That balance served the Strategy well throughout the year, enabling outperformance against the benchmark in all four quarters. Results in the last three months were driven by a long-time media position in Comcast (CMCSA), which we consider a durable compounder due to its consistent revenue growth and free cash flow generation. Comcast shares saw a snapback after a difficult first half of the year caused by cord cutting in its cable business and slowing subscriber growth in its broadband business. A flexible balance sheet and strong cash generation enabled the company to repurchase shares during the selloff earlier in the year.

Performance was also supported by communications chipmaker Broadcom (AVGO), which has managed inventory better than peers and continues to generate healthy levels of free cash. Broadcom should benefit from a more balanced revenue mix between semiconductors and software upon the expected closing of its acquisition of VMware (VMW) in 2023. HVAC and building services provider Johnson Controls (JCI), meanwhile, saw a normalization of supply chain and semiconductor shortages lead to better operating results and subsequent strong performance.

More restrictive financial conditions weighed on several disruptors and companies that are not yet profitable. Wolfspeed (WOLF), a leader in the emerging market for chips from silicon carbide (SiC) for power management applications, was a primary detractor in the fourth quarter after strong performance earlier in the year. The company has suffered from short-term execution issues at its Durham, N.C. plant as it ramps up capacity in its newer fab to meet the significant long-term demands for SiC technology. The company raised $1.5 billion in a convertible offering that improves its cash position, but it will have ongoing financing needs in the years ahead.

Guardant Health (GH), a disruptor within health care that is developing blood tests for cancer screening, announced a mixed readout for its Eclipse screening test that raised concerns about how much market share the product will eventually garner. The company will likely need to raise capital over the next couple of years, which has also weighed on the stock. We believe the issues facing both Wolfspeed and Guardant are temporary and we continue to maintain our weightings in both.

Portfolio Positioning

During the quarter we exited a position in ImmunoGen (IMGN), a biotechnology company developing antibody-drug conjugate therapies to treat cancer. ImmunoGen received FDA approval for Elahere for ovarian cancer, however it is a relatively modest opportunity and the company still faces a long road to reach meaningful profitability. The sale is also part of our effort to consolidate the portfolio in our highest conviction ideas.

Beyond the sale of ImmunoGen, our transactions were relatively limited in the fourth quarter. We cut our cyclical technology exposure with a trim to hard disk drive maker Western Digital (WDC), which has higher than average financial leverage for our portfolio and is facing a challenging demand environment.

With volatility expected to remain elevated going forward, we are actively looking at a number of new names, opportunistically waiting for good entry points. Two areas of focus are the consumer discretionary sector, where we remain significantly underweight versus the benchmark, and steady compounders in IT, consumer staples and potentially alternative energy that can improve the earnings variability of the portfolio while maintaining an attractive growth profile. As long-term business owners, we will look to use short-term trading volatility to initiate and scale these positions over time.

Outlook

Names like Airbnb (ABNB) and data warehouse software provider Snowflake (SNOW), which we added to during the quarter, offer better than average growth exposure with strong margins and cash generation that should allow the Strategy to capture better upside in markets with greater price momentum. We partner these higher-growth names with the stability, predictability and economic insensitivity provided by our large cap health care positions. We are striving to strike a balance in the portfolio across varying growth rates, consumer and enterprise as well as international and domestic equity markets.

We are clearly in a volatile macro environment with low visibility and predictability to near-term economic direction. This type of backdrop places a premium on industry leaders with strong growth and profit margins and low financial leverage. Additionally, experienced and seasoned management teams that can navigate macro headwinds while continuing to invest in growth are essential. Such characteristics should enable these companies to gain share and emerge in a better position than before the correction. As long-term investors, we are exercising patience and care in vetting both companies on our watch list, as well as existing holdings, to ensure we maintain a portfolio that can perform strongly through this period of uncertainty.

Portfolio Highlights

The ClearBridge Multi Cap Growth Strategy outperformed its Russell 3000 Growth Index benchmark in the fourth quarter. On an absolute basis, the Strategy had gains in six of the seven sectors in which it was invested (out of 11 sectors total). The primary contributors were in the health care, industrials and communication services sectors while the sole detractor was the IT sector.

Relative to the benchmark, overall sector allocation contributed to performance. In particular, an underweight to the consumer discretionary sector, an overweight to the health care sector and stock selection in the communication services, consumer discretionary and materials sectors drove results. Conversely, stock selection in the health care and IT sectors weighed on performance.

On an individual stock basis, positions in Broadcom (AVGO), Johnson Controls (JCI), Comcast (CMCSA), AbbVie (ABBV) and Freeport-McMoRan (FCX) were the leading contributors to absolute returns during the period. The primary detractors were CrowdStrike (CRWD), Wolfspeed (WOLF), Guardant Health (GH), Airbnb (ABNB) and Snowflake (SNOW).

In addition to the transactions mentioned above, we sold our position in Twitter in the communication services sector.

Evan Bauman, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Be the first to comment