dusanpetkovic/iStock via Getty Images

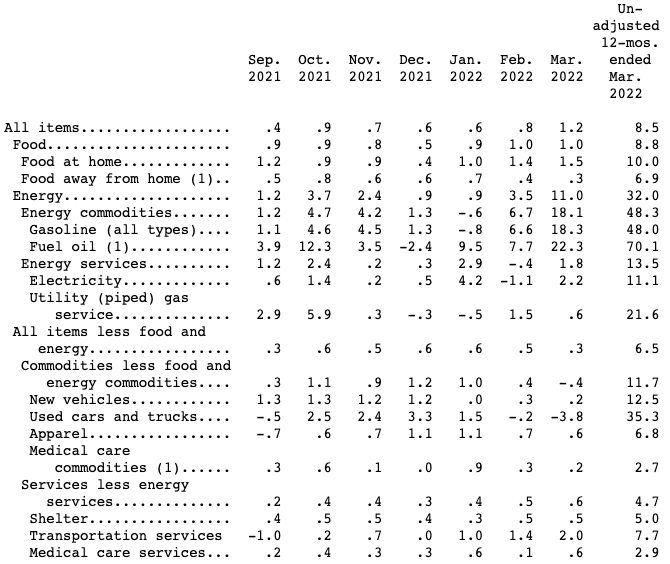

Inflation is riding high in 2022, and few companies are better positioned to profit from it than Occidental Petroleum (NYSE:OXY). As an oil producer that profits by selling oil & gas, it makes more money the higher the price of oil goes. Oil is without a doubt the top contributor to inflation this year. In the most recent reported period, CPI inflation came in at 8.5%, and energy rose the most of all goods, with a stunning 32% rise.

Energy leads inflation in March (Bureau of Labor Statistics )

Most integrated energy companies make money when oil rises, but not all of them are as cheap as OXY. The stock trades at a mere 5.5 times free cash flow (“FCF”), even after its 142% 12-month rally. Additionally, it is one of the largest producers in the Permian Basin, an oil rich region that many think will produce new discoveries in the future. So, future growth is possible. In this article I will develop a bullish thesis on OXY, arguing that its cheap valuation combined with high oil prices make it a great stock to own in this high-inflation environment.

A Financial Model for Occidental Petroleum

We can construct a financial model for Occidental Petroleum by making some basic assumptions about revenues, operating costs, interest expenses and taxes. This model will yield forecasts of both EBIT and net income.

In the interests of being conservative, I’ll assume that:

-

Revenue grows at 10% per year over the next five years.

-

Cost of revenue plus operating expenses grow at 10% combined.

-

Interest expenses grow at 10%.

-

The tax rate doesn’t change.

Before going any further, I should explain why these estimates are conservative.

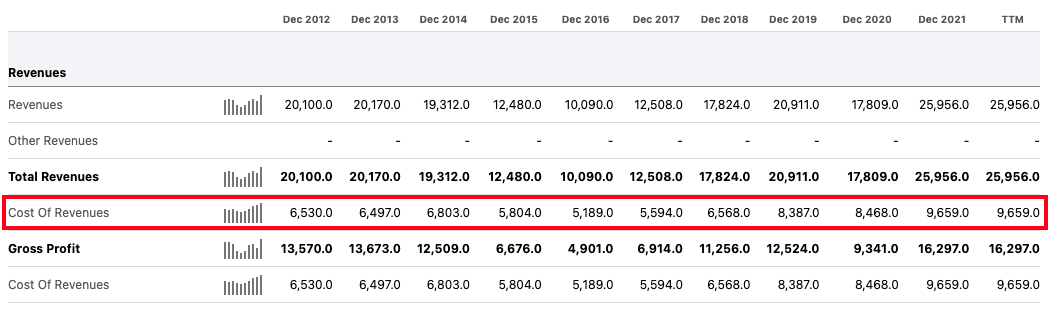

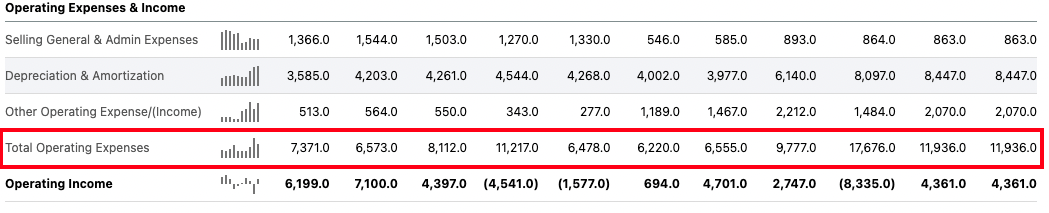

First, my projected revenue growth rate is a tiny fraction of 2021’s revenue growth rate. It’s also about 25% lower than the three-year CAGR revenue growth rate. Second, my projected growth in expenses is ahead of historical norms. Using 10 years of COGS and operating expense data from Seeking Alpha Quant, I calculated 3.99% CAGR growth in COGS. There is no clear upward trend in operating expenses, which have peaked and fallen many times.

OXY’s cost of revenue (Seeking Alpha)

OXY’s operating expenses (Seeking Alpha)

Having explained my assumptions, here is the model (all figures in US$ millions):

|

2021 (actual) |

2022 |

2023 |

2024 |

2025 |

2026 |

|

|

Revenue |

25,956 |

28,561 |

31,418 |

34,559 |

38,015 |

41,816 |

|

COGS + operating costs |

21,595 |

23754 |

26129 |

28743 |

31617 |

34778 |

|

EBIT |

4361 |

4807 |

5289 |

5816 |

6398 |

7038 |

|

Interest + other non-operating |

656 |

722 |

793 |

872 |

960 |

1055 |

|

EBT |

3705 |

4085 |

4496 |

4944 |

5438 |

5983 |

|

Tax |

915 |

1021 |

1124 |

1235 |

1360 |

1496 |

|

Net income |

2322 |

3064 |

3372 |

3709 |

4078 |

4487 |

|

EBIT CAGR: |

10% |

|||||

|

NET INCOME CAGR |

14% |

A few things to note about this model before interpreting it:

-

The net income I arrive at includes preferred dividends ($810 million). The company excludes this, resulting in reported net income of $1,522. I chose to keep these in for the sake of an analysis that reflects total shareholder value, including preferred shareholders.

-

The tax burden rising does not violate my assumption of a fixed tax rate. I applied the same tax rate (25%) to a gradually rising EBIT, which produces incrementally higher total taxes.

With these caveats out of the way, it’s time to interpret the results of the model.

First, the earnings implications. As the model shows, even with revenue and costs rising at the same rate, we still get moderately strong (10%) CAGR growth in EBIT. The CAGR growth rate in net income is even higher at 14%.

Second, the valuation implications. The earnings figure for the last forecast year is $4487 million. This forecast will come into play heavily when we look at OXY’s valuation. While OXI is not “dirt cheap” going by trailing GAAP earnings, it is cheap compared to future earnings, as I will demonstrate in the next section.

Valuation

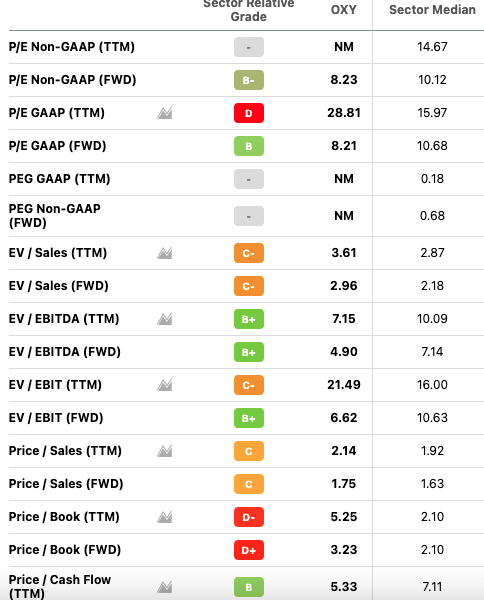

Occidental Petroleum is in many respects a cheap stock. The GAAP P/E ratio is a little high, but is low going by forecast earnings for the next year. We can get a feel for the stock’s valuation by looking at the multiples Seeking Alpha Quant has on file for it:

Occidental Petroleum Valuation (Seeking Alpha)

As we can see, OXY is cheaper than the average energy stock on the following metrics:

-

Forward P/E.

-

Price/operating cash flow.

-

EV/EBITDA.

On the other hand, there are some metrics by which OXY is more expensive than the average oil stock, such as the price/book ratio. However, note the results of the model I calculated: it takes us to $4.844 billion in earnings in only five years. At that earnings level, OXY would be trading at 11.86 times earnings.

Another way we can value OXY is with a discounted cash flow analysis. Using the five years’ earnings estimate above plus a terminal value estimate, we can arrive at an approximation of the stock’s present value. For this analysis, I will use the following estimates.

-

The best approximation of OXY’s cost of capital is the 10 year treasury yield.

-

The 10 year will yield about 4% on average over the next 5 years. I base this on the fact that its yield is already nearly 3%, and more interest rate hikes are coming this year.

I’ll start by discounting my five year earnings estimates to the present. The calculations are shown below:

|

2022 |

2023 |

2024 |

2025 |

2026 |

TOTAL |

|

|

Earnings |

3.064B |

3.372B |

3.709B |

4.078B |

4.487B |

N/A |

|

(1+r)^n |

1.04 |

1.0816 |

1.125 |

1.169 |

1.217 |

N/A |

|

Discounted earnings |

2.95B |

3.12B |

3.29B |

3.488B |

3.68B |

$16.57B |

|

Per share |

$3.43 |

$3.63 |

$3.83 |

$4.065 |

$4.28 |

$19.24 |

So, we get $19.24 per share in present value just from five years’ discounted cash flows.

Now, for terminal value. I will use the exit multiple approach here, multiplying terminal earnings by the current earnings multiple.

I estimated OXY’s 2026 earnings per share at $4.28. OXY’s earnings multiple is about 28.5. If you multiply these two numbers together you get a terminal value of $121.98. Add to that the $19.24 in EPS for the next five years, and you get to $141.38 in present value. That is a gain of 139% over today’s price (which was $59 at the time of this writing).

Risks

As I have shown in this article, Occidental Petroleum is a solid pick for today’s economic conditions. Not only does its business benefit from inflation, but its stock could very easily deliver inflation-beating returns. So far, it looks like a great stock for a high inflation environment. However, there are many risks and challenges to this thesis. Three of the most pressing include:

-

A major decline in the price of oil. Occidental Petroleum could probably withstand a small downswing in the price of oil, as it achieved its massive 2021 growth in a period when oil was only $70 on average. Therefore, if oil fell to $80, OXY would probably be OK. That is less the case if oil drops far lower than that. By the second half of 2021, the COVID-19 oil collapse was far in the rearview mirror, and prices were healthy. If prices were to drop below late 2021 levels, then the earnings growth I forecast wouldn’t materialize.

-

Regulatory risk. Regulatory risk is always big for energy companies. Climate change is one of the biggest political concerns of our time, and many countries are regulating energy companies. Canada’s government passed a carbon tax in 2018. Taiwan recently set a zero-net emissions target. The U.S. government cancelled the Keystone XL pipeline project just last year. Measures like these can cost oil producers real money. Carbon taxes result in higher costs, while pipeline cancellations make it more costly to move oil. Any one of these risks could materialize in the future, so be on the lookout.

-

ESG concerns. Related to regulatory risk is ESG. Occidental Petroleum is an oil company, and such companies are not exactly loved by ESG funds. While not all ESG funds exclude oil stocks, a good few of them do. If these funds become big enough as a percentage of all money in the markets, then oil stocks may never rise to fair value, because many funds will ignore them out of principle.

The Bottom Line

The bottom line on Occidental Petroleum is this:

It is a robust, well-positioned energy company that could thrive in a high-inflation environment. Oil and gas are driving much of the inflation we’re seeing this year, and OXY is right where it needs to be, as a supplier of these economically vital commodities. The stock has already seen major gains this year, yet it still trades at just 5.5 times free cash flow. It is a rare energy stock that remains dirt cheap even after the oil sector’s blistering 2022 rally. Definitely one worth looking at.

Be the first to comment