Evgenii Mitroshin

Why Oil Company Profits Will Rise Over the Coming Winter

The price of fuel relaxed over summer in the US as people chose to stay home and save their money in lieu of shopping trips and restaurant excursions. However, unprecedented heatwaves sent the price of fuel soaring in Europe, and the upward price curve is likely to get worse over the winter when the EU’s liquified natural gas (LNG) consumption typically rises 250%.

The pinch will also likely be felt in the US insofar as natural gas makes up 40% of our nation’s power consumption. All in all, it appears prices could soar over the impending winter.

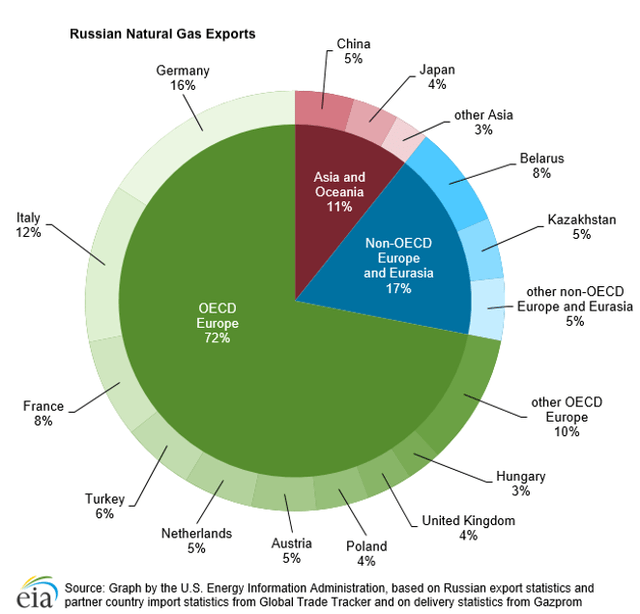

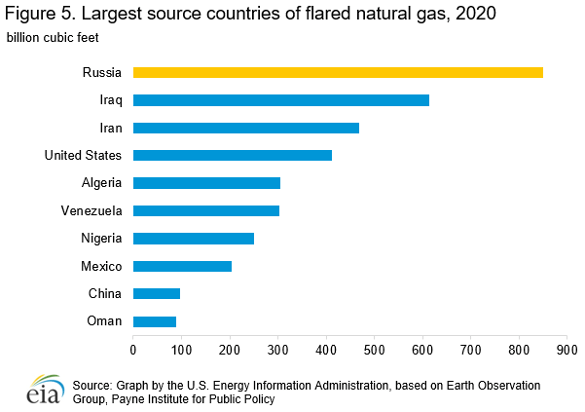

Taken together, the two charts below are a snapshot of how a ban on Russian gas will play out in Europe over the coming winter.

Fig. 1 Pie Chart of Russia’s Natural Gas Exports

U.S. Energy Information Administration

Fig. 2 Largest Natural Gas Producers by Country

U.S. Energy Information Administration

Since Russia has been sidelined as a provider, the EU must choose new vendors from a motley crew including Iraq, Iran, US, Algeria, Venezuela, Nigeria, Mexico, China, and Oman, all of whom know that Europe is in a weakened bargaining position due to the sanctions. Of the nine top LNG exporting nations, the US may appear to be Europe’s best bargaining partner at first glance, but cheap gas from America could be a mirage. Earlier this year, senators on Capitol Hill were urging the Secretary of Energy to limit exports of LNG in order to keep prices bearable. While this movement lost some steam over the summer as priced came down a bit, it’s sure to become an urgent issue if prices soar once again.

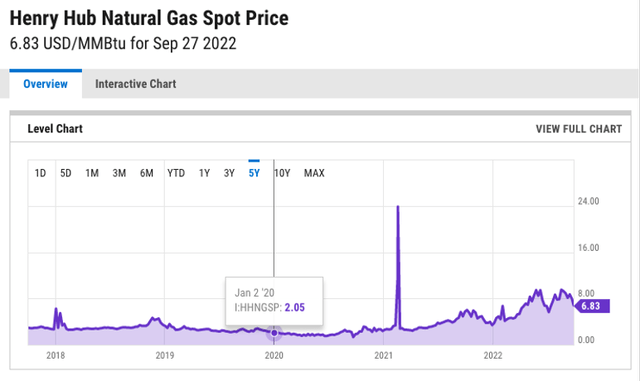

The EU ban on Russian imports was certain to roil markets, but it just added fuel to the flames as LNG has been rising dramatically for the last two years. Despite a midsummer downturn, LNG is still up a stunning 535% since June 2020.

Fig. 3 Spot Price of Natural Gas

Henry Hub Natural Gas Spot Price

The reason gas prices are less flexible than oil prices is because unsold oil can be rerouted, whereas Russian LNG must be piped, so if the customers on the receiving end cancel the sale, the LNG stays where it is. This scenario creates a global shortage that is keeping LNG prices higher than oil prices, which means Europe is likely to import a lot more oil to make up for the shortfall in gas this winter.

Why Occidental is Poised for Upward Momentum

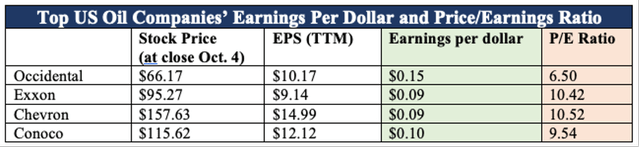

Let’s take a look at Occidental’s (NYSE:OXY) financial fundamentals. The following table shows that Occidental has better P/E ratio than any of its competitors. While all of the oil companies mentioned below have excellent price-to-earnings ratios, Occidental’s stands out at a stunningly low 6.08. For the sake of comparison, Tesla’s (TSLA) P/E ratio is over 100.

Another advantage Occidental has over its competitors is earnings. Earnings per share (EPS) is a useful indicator in terms of getting a quick snapshot of a company’s performance. But when it comes to comparing one company to another, the information provided by the EPS figure is incomplete. You can’t get an apples-to-apples comparison until you divide the EPS by the current stock price. Once that’s done you know how much a company is earning per dollar invested. At 15 cents per dollar, Occidental has the advantage in this category as well.

Fig. 4 Top US Oil Company EPS and P/E Ratios

Author Created Table (Stats drawn from SeekingAlpha)

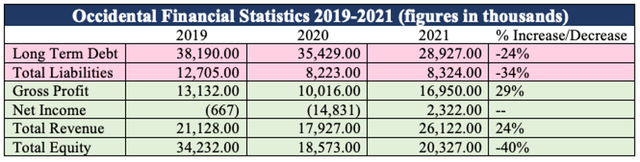

The table below shows that Occidental has excellent momentum in regard to increasing profits and decreasing liabilities. While Occidental has suffered a 46% loss in equity from 2019 to 2020, due to dramatically reduced fuel consumption during the COVID-19 shut-down, the company’s equity recovered 10% in 2021, which was still a COVID year. Also, the company has a higher free cash flow than earnings before tax and interest, which indicates paying off debts as they come due shouldn’t pose a problem. Moreover, the debt to net worth ratio comes in at a healthy 0.41 (= $8,324 mil/$20,327 mil). Insofar as an ideal ratio in this category is between 0.3 and 0.6, Occidental is well in the safe zone in regard to its overall debt.

Fig. 5 Occidental Petroleum’s Debt and Profit Profile

Author Created Table (Statistics gathered from Reuters.com)

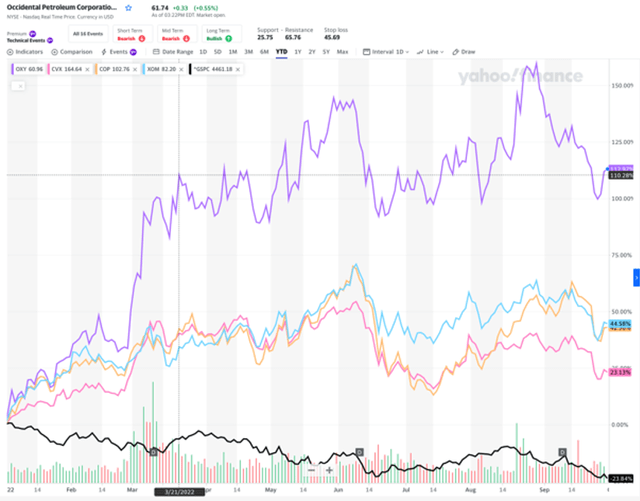

The best example of Occidental’s momentum is demonstrated in the comparative chart below. Even as the S&P 500 (shown in black) has plummeted 24% since the beginning of the year, Occidental (purple line) has defied the laws of market gravity, rocketing up 113% over the same period, leaving its competitors far behind.

Fig. 6 Price Chart Showing OXY versus Competitors

Petroleum’s Long-Term Horizon

While Petroleum’s short to mid-term horizon shines brightly, that light will soon dim. After a few more profitable years (if that), investors need to reassess all oil companies in terms of black swans and industry disruptors. I’ve listed the current ones below, but there are likely to be more in the years to come.

Europe Will Switch To Alternative Fuel Sources ASAP

The Ukraine war has jolted Europe into a hyper awareness of their dependence on foreign fuel. While Russia is currently the most painful thorn in the EU’s side, if you look at the world’s largest LNG producers (Fig. 2), one can plainly see how global politics could interfere with gas supplies at any given time. The only wise move the EU can make to ensure reliable fuel resources moving forward is sourcing power closer to home. Having virtually no fossil fuel of their own, Europe will turn to alternative fuel sources such as solar, wind, hydro-electric, and nuclear power. While Europe will play the outrider in this regard, the US and the rest of the world is already following suit.

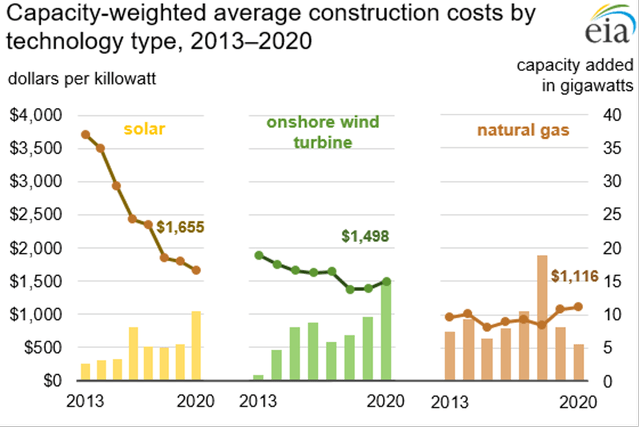

Solar Power Is Now the Least Expensive Fuel

Thanks to a decrease in the price of solar panels, combined with an increase in the price of carbon-based fuels, solar power is now the “cheapest electricity in history” according to the U.S. Energy Information Administration.

The chart below tells the story. The dollar figures on the left axis are the construction cost of solar, wind power, and natural gas in the US, while the right axis represents the amount of power generated from those energy resources. Notice that whereas the price of solar energy has dropped dramatically since 2013 as the rate of implementation has risen, the price of producing natural gas has ticked up, and the amount of natural gas used in the US is down considerably.

Fig. 7 Chart-Average Construction Costs Of Solar/Wind/Natural Gas Technology

U.S. Energy Information Administration

Electric Vehicles Widening Their Market Share

The reliability of fossil fuel supplies is getting shakier with each passing year, leading to prices that soar and fall so unexpectedly it’s hard for companies and private consumers alike to plan ahead for fuel costs. An individual can buy a gas guzzler when prices at the pump are fairly low, only to discover months later that it costs over $100 to fill up their tank. This is leading an increasing number of people to turn to electric vehicles.

According to Kelly Blue Book, the average cost of charging an electric car is roughly $59 per month, whereas the cost of fueling a gas-powered car is about $182 per month—208% more than the EV. While EVs are still more expensive than gas cars, the increasing amount of savings that the EV owners enjoy will ensure more electric cars on the road in years to come.

HFC Vehicles On Track To Replace Gas-powered Delivery Trucks

Gas cars will still be ubiquitous on the highways for years to come, due to the disadvantages of EVs. Most EVs are still range bound and take hours to charge. While rapid charging stations are available along popular interstate routes, they shorten the extremely expensive lithium-ion battery’s life and still take roughly 20-30 minutes for an 80% charge, which gives the driver just 60 to 100 miles of extended range. In other words, EVs are not viable for travel outside of the city.

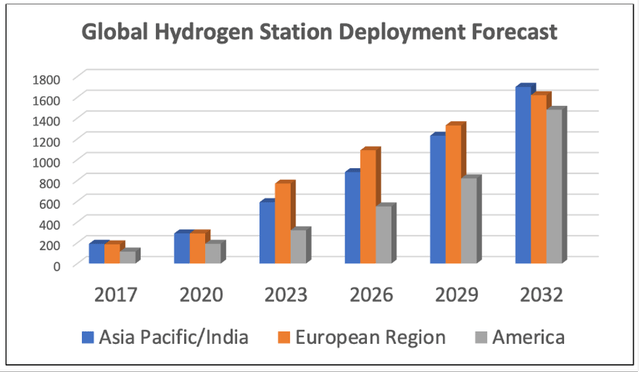

But that doesn’t mean gas-powered vehicles are safe from competition on the open highways. There is a movement in both the US and the EU to switch to delivery and transportation vehicles powered by hydrogen fuel cells.

The Hydrogen Council of California claims that hydrogen fuel could be price competitive with gasoline if they could achieve economies of scale. The US and EU are already financing subsidies for hydrogen fuel cell energy.

The chart below projects the deployment of hydrogen fueling infrastructure around the world over the next decade.

Fig. 8 Global Hydrogen Station Deployment Forecast

Author Created Chart (Stats gathered from Researchgate)

Once governments step in to build out hydrogen fuel pump infrastructure, and the price of green hydrogen becomes cost-competitive as a result of economies of scale, it is possible that HFC cars and trucks could outsell their gas-powered competitors within the decade.

Risks of Investing In Occidental Petroleum

The biggest risk in going long on any equities at this time is that the Fed is going full steam ahead with quantitative tightening and has given no signal that it will ease up any time soon. This new policy is pulling the entire market down, and even companies with strong tailwinds could be affected.

That being said, the other risk that shows up in the spreadsheet is Occidental’s drop in equity from 2020 and 2021. But that didn’t deter Warren Buffett who has recently doubled down on his investment in Occidental Petroleum, lifting his stake from 20% to 27%.

Recapping The Outlook for Occidental Petroleum

Whereas the fossil fuel industry will succumb to sustainable and alternative energy resources over the coming decade, this winter will be marred by a global fuel shortage that is bound to drive up fuel prices around the world as the US and EU sanction Russian LNG exports. Since most Russian LNG is piped to Western Europe, that means it will likely stay in Russia, and this could raise the price of natural gas above that of petroleum. This will probably prompt European countries to buy more petroleum, and US oil companies stand to benefit. Occidental has demonstrated the best momentum of its competitors, which makes it the best investment prospect in this sector in my opinion.

Be the first to comment