Jamie McCarthy/Getty Images Entertainment

Thesis

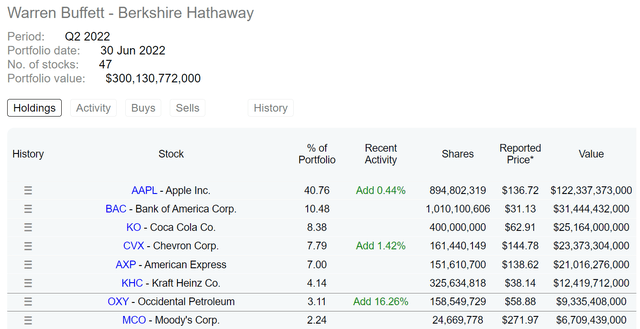

Warren Buffett’s Berkshire Hathaway (BRK.B) (BRK.A) kept adding Occidental Petroleum (NYSE:OXY) shares since its August filing. BRK already owned 158.5 M shares as disclosed in its August filing as you can see from the following chart. These shares already make OXY the 7th largest position in the BRK equity portfolio with a total worth of more than $9.3B. And it now owns more than 20% (20.9% to be precise) of all OXY outstanding shares as detailed in the following SA news:

Warren Buffett’s Berkshire Hathaway scooped up almost 6M more shares of Occidental Petroleum, bringing the investment company’s holdings to 194.5M shares, or ~20.9% of the petroleum company’s outstanding common stock, according to a filing submitted late Wednesday, September 28.

Furthermore, there is a chance that BRK could purchase the entire company outright. For example, a report provided by Truist mentioned, “We continue to believe an outright total purchase of OXY in the near-term could make logical sense for Berkshire Hathaway.”

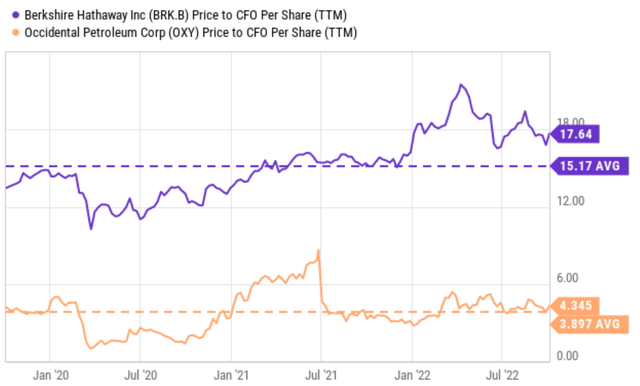

So potential OXY investors face an interesting opportunity here. To start, there is an arbitrage opportunity here if BRK does pursue an acquisition. Then OXY is not a bad business at all in itself. Its debt has declined substantially and there is a strong forecast for its cash flow. And its current valuation is attractive, although not THAT attractive as you can see from the chart below. As seen, it’s currently priced at a P/CFO of 4.34x, quite attractive in absolute terms. But when compared to its average P/CFO of 3.897x in the past few years, it is currently trading at a small premium.

And in the remainder of this article, I will show a backdoor for investors to buy OXY shares through BRK. You will see that instead of buying OXY from the open market, you could buy it through Berkshire at larger discounts or even for free (depending on how you value Berkshire’s operating segments).

And note that in the remainder of this article, all numbers will be based on per BRK B shares.

A closer look at BRK’s finances and valuation

Buying BRK seems to be a non-starter on the surface. Its nominal valuation is not attractive either in absolute or relative terms. As seen from the chart above, it’s currently priced at a P/CFO of 17.6x, quite expensive in absolute terms. And when compared to its average P/CFO of 15.17x in the past few years, it is trading at a sizable premium of 16%.

However, the above nominal P/CFO ratio (or equivalently the PE ratios too) distorts BRK’s valuation significantly because the GAAP numbers do not reflect its true economics. For example, in GAAP terms, according to its recent shareholder letter:

Berkshire earned $42.5 billion in 2020, which includes 4 main components a) the ~$22 billion operating earnings already mentioned, b) a $4.9 billion of realized capital gains, c) a $26.7 billion gain from an increase in the amount of net unrealized capital gains that exist in the stocks, and d) an $11 billion loss from a write-down.

Thus, at least for the last year, operating earnings are not even the largest item by the GAAP standards. Yet, with today’s BRK, operating earnings should be the most important recurring income. With this background, the table below shows my analysis to correct such distortion.

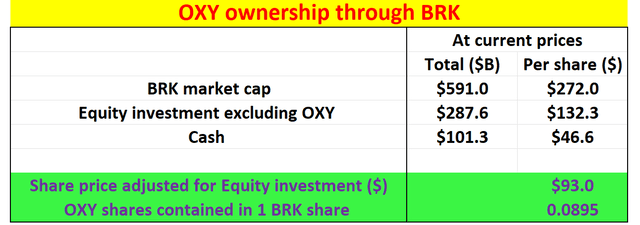

This table is based on A) BRK’s finances in its 10Q filed on June 30, 2022, and B) BRK’s current market cap of $591 B (or $272 share prices) as of this writing. Out of the $591B market cap, $300 billion is invested in its equity portfolio if you recall from the first chart. And $101.3 billion is in cash according to its most recent 10Q (translating to $46.6 per share). And out of the $300B equity investment, OXY’s current total market value is about $12.4 billion. So now if we take all the other equity investments except OXY and the cash position out of the share price, BRK’s adjusted share price would be $93 only.

So if we pay today’s market price of $272 to buy 1 BRK share and immediately liquidate the cash and all other equity investments except OXY (risks in this assumption are discussed toward the end), the end results are that we are essentially paying $93 for A) all the BRK operating business segments, and B) also the OXY share contained in each BRK.B share (which turns about to be 0.0895 shares).

Based on this, we will reexamine their valuations next.

Source: Author based on Seeking Alpha data.

OXY and BRK valuation reexamined

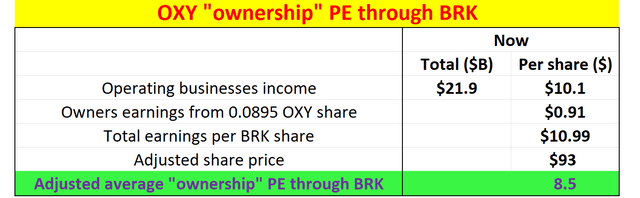

The next table shows the “ownership” valuations for OXY and BRK based on the dissection of their finances above. In this table, I assumed $21.9 billion of operating earnings for BRK, or $10.1 per share. And remember that for each BRK share, we are also getting 0.0895 OXY shares. With an EPS forecast of $10.17, these shares contribute a total of $0.91 owners earnings to each BRK share. Hence, the total earnings per BRK share are $10.99.

Now to recap, if we pay today’s market price of $272 and immediately liquidate the cash and all other equity investments except OXY,

- we are essentially paying $93 to buy 0.0895 shares of OXY and all the BRK operating business segments.

- and from the OXY share and BRK operating segment, we are getting a total of $10.99 of owners’ earnings per share.

Of course, how you go from here is a matter of your personal judgment now. If you take the aggregated average as I did in the following table, the “ownership” PE for the BRK+OXY combo is on average 8.5x only. And if you value BRK’s operating earnings at 10x PE – a very reasonable valuation in my view, then these operating businesses would be worth $100 per share already, which means you are (theoretically) getting the OXY shares for free!

Source: Author based on Seeking Alpha data.

Risks and final thoughts

Finally, risks. The risks associated with both BRK and OXY themselves have been thoroughly detailed by other SA authors already and won’t be repeated here. Here, I will just mention risks specific to the idea specific to this particular approach of analyses. These risks have been detailed in my other articles and are briefly summarized here:

- Uncertainties in BRK’s equity portfolio. The value of BRK’s sizable equity portfolio fluctuates together with the overall market. And the latest data available are those reported as of June 30, which could be different from the market value today.

- This analysis assumes BRK’s cash position and equity investment are worth exactly the market price. However, no one really knows what would actually happen when you try to liquidate ~$300 billion worth of stocks.

- BRK’s cash position and its insurance float. This analysis also assumed that all the cash positions are truly cash can. However, in reality, this is not entirely true because part of the cash is insurance float and cannot be entirely liquidated as assumed in my thought experiment above. Buffett mentioned that he will at least maintain a cash position of about $30B. So I am guessing we could use $30B as a minimum for estimating the float. Taking $30B out of the cash will change the valuation analysis a bit but not by too much.

Finally, I want to close by emphasizing my above analysis is more valid for the long-term than the short term. For example, investors who directly own OXY shares could enjoy an arbitrage opportunity if BRK does pursue an acquisition in the near term (assuming the acquisition happens at a premium to OXY’s market price). However, if you own OXY shares through BRK, you would not be able to benefit from that acquisition premium. The premium is paid by BRK (i.e., it comes out of your pocket).

Be the first to comment