yodiyim

Investment summary

As we continue our quest to separate long-term cash compounders in the healthcare and medical technology space, more and more opportunities present before us. To help understand our global investment strategy team’s systematic process, be sure to check out a few of our recent long ideas:

We are neutral on Oak Street Health, Inc. (NYSE:OSH) shares and reiterate the stock is a hold after a thorough examination of its Q2 FY22 earnings. The company and stock display a loose affinity to the equity premia investors are paying a premium for in FY22, in particular, return on capital and profitability. Covid-19 continues to be a key risk, and management alluded to this in its latest earnings call. Without certainty on the predictability of OSH’s future cash flows, we rate it neutral.

Exhibit 1. OSH 6-month price action has turned bullish in H2

Shares now trade above moving averages potentially signally buyer support, however, we demonstrate there’s lack of fundamental premia readily available in OSH’s investment debate, and thus chart studies aren’t showing the full picture.

Q2 earnings: rebound to the upside

Second quarter earnings came in strong, with upsides at the topline relative to the Street and to previous guidance. OSH printed a 48% YoY gain in turnover to $523.7 million in Q2 FY22. Capitated revenue from managed care organizations lead the way with a 49% growth to $516 million. Growth in capitated revenue was underlined by a 51% growth in the at-risk patient base to 134,000. Management reported it cared for 120,000 at-risk patients in Q1 FY22, and so it was nice to see some movement there.

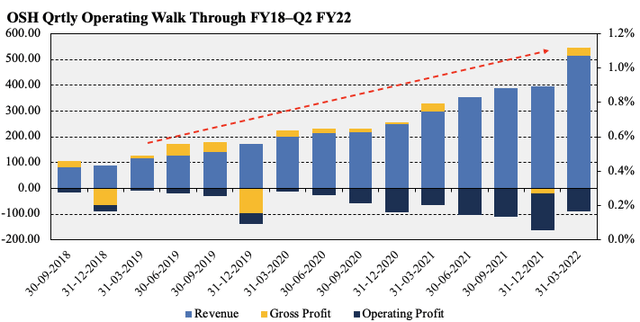

Exhibit 2. Topline metrics widening substantially on a sequential basis, headwinds at the operating level

There’s still a lack of affinity to the kind of premia we are seeking, however. Profitability is a differentiating factor in health care, especially in terms of FCF and earnings quality. We see evidence of neither in OSH over a period of several quarters now, plus, Covid-19 continues to pose a threat to topline growth, leaving OSH [and the sector] little room to hide if cases pick up again.

Data: HB Insights, OSH SEC Filings

Other highlights include another 49 operating centers on the books, and a ~40% YoY gain in medical claims expense. At the YoY gain of 49 stores, each store added ~97bps of margin or ~$3.5 million at the topline on average. OSH now operates 144 centers, up from 95 in Q2 FY21 and 140 in Q1 FY22. Meanwhile, the medical claims expense came in to $391.6 million. However, the company recorded non-GAAP medical claims expense growth of 53% – a 300bps step ahead of the capitated revenue run rate. Management estimate ~4.6% of this to be related to Covid-19 tailwinds. Moreover, it saw a 91% gain to $124 million ($0.51/share) in patient contribution margin, defined as capitated revenue less medical claims expense.

Offsetting the upside at the topline, cost of care also widened by 48% YoY to $98.9 million. This was driven by the growth in new centers. With 49 centers added YoY, each center represents ~97bps in additional cost margin. It also saw a 28% YoY headwind at the SG&A line. Although, G&A expenses formed the bulk of this due to an increased headcount, but also: “excluding stock-based compensation, which is partially inflated due to the treatment of our pre-IPO management equity plan,” per CFO Tim Cook on the earnings call.

Overall, results were in line with expectations, but not enough to get OSH over the hurdle, in our estimation. It continues to print a loss on its invested capital whilst it has a WACC of 8.17%, a key risk investors must consider and monitor heading forwards. Moreover, our investment strategy team believes that the asymmetry in unprofitable to cash flow positive, profitable assets will continue to widen in H2, therefore, OSH displays a loose affinity to the premia we are chasing. Now that’s something for investors to think about.

Key catalyst: FY22 earnings upgrade

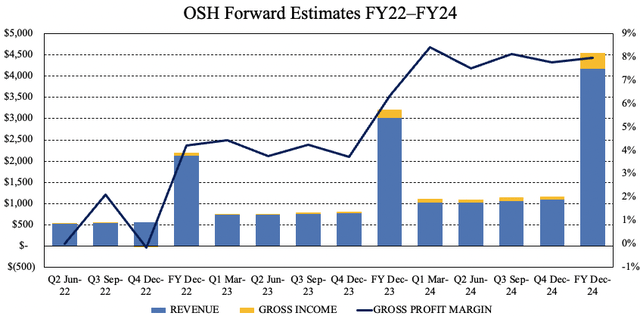

In lock-step with other large caps in the sector, OSH increased FY22 full year guidance at the top. It also forecasts growth in care for at-risk patients of ~18% YoY to 158,000. Overall turnover is forecasted at $2.15 billion at the upper end. Q3 FY22 revenue is forecasted at $535 million to $540 million and an adjusted EBITDA loss of $90-$95 million. It estimates to run ~159 centers by the end of the third quarter. Our forward estimates into FY24 are plotted below. We expect the company to print annual total revenue of $2.13 billion in FY22, stretching up to $4.2 billion by FY24, a 40% CAGR.

Exhibit 3. A pragmatic view believes that it’s not an unreasonable expectation to see Covid-19 numbers diminish into FY24, forming a solid bedrock for OSH’s revenue growth.

However, much of the upside hinges on where cases head next, not in the least another outbreak, or similar health risk. The question is, has the market fully priced this uncertainty in? Or will further downsides hurt the OSH share price further? At this point, we don’t have the confident answers without concrete evidence “Covid-19 sensitivity” isn’t a factor anymore.

Valuation

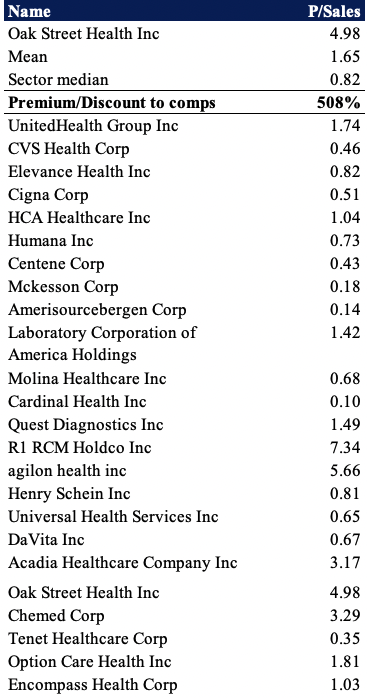

Valuations are unsupportive, and the company’s lack of profitability and sensitivity to Covid-19 reduces the predictability of its future cash flows by estimation. As such we are neutral on these grounds alone. With respect to topline multiples, shares are priced at ~5x sales, a substantial premium to both the GICS Industry peer group mean and median. At 5x sales, this assumes OSH can pay 100% of its revenues out as dividends (cost and tax free) over the next 5 years for an investor to realize their money back.

Exhibit 3. Multiples and comps

Image: HB Insights

In short

Whilst there were key highlights from OSH’s Q2 FY22 performance, investors need more flesh to put on the skeleton in this instance. Without the profitability factors, OSH lacks the resiliency data we are seeking exposure to, despite its defensible industry. There’s just not the palpable value to extract from the OSH investment debate, and therefore, we advocate investors to factor in the points raised in this report if considering to enter a position in OSH. Valuations are unsupportive, and estimating a concrete future value of the company comes with too many uncertainties at this point. We rate OSH neutral but look forward to providing additional coverage.

Be the first to comment