go-un lee

The semiconductor market has become a tough place to operate in the last few months, but NXP Semiconductors (NASDAQ:NXPI) benefits from a focus on the Automotive segment. The company reported another solid quarter as the auto sector remains below target production levels, even heading into a global recession. My investment thesis remains Bullish on the stock trading down with the market over the last year.

Another Strong Quarter

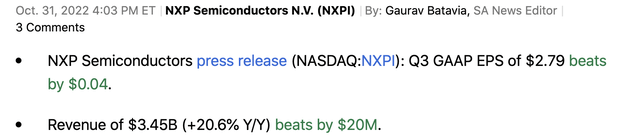

Despite NXP Semi facing impacts from the weakening macro environment, the company reported 21% revenue growth in the quarter. NXP Semi even generated a solid $0.04 EPS beat during Q3 as follows:

Source: Seeking Alpha

The headwinds in the consumer IoT business didn’t stop NXP Semi from actually facing supply constraints in the quarter. As highlighted before, Automotive manufacturing still remains far below pre-Covid levels.

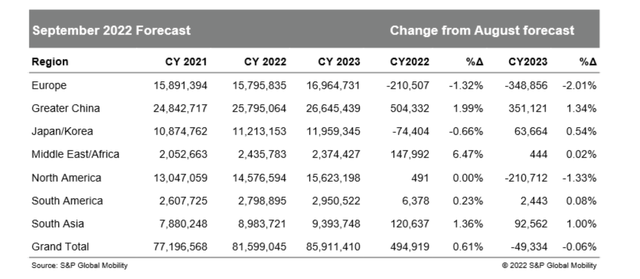

While global auto production is targeted at 86 million vehicles this year, up from 82 million last year, production levels are still far below pre-Covid levels. Global light vehicle sales were around 95 million back in 2017/18.

Source: S&P Global

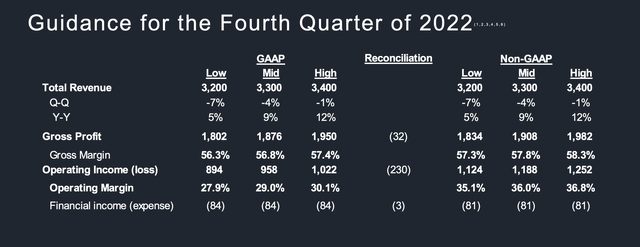

The Q4 guidance highlighted some weakness now showing up in the quarterly results. NXP Semi only guided to a mid-point revenue target of $3.3 billion for 9% growth. The consensus estimates were closer to $3.4 billion.

Source: NXP Semi Q3’22 presentation

The company does appear cautious on these numbers, but too many semiconductor companies have blown up recently to think NXP Semi will completely avoid any major hiccup in business.

The major opportunity to avoid a big disruption to growth is the Automotive segment where revenues grew 24% YoY to $1.8 billion. NXP Semi grew revenues 5% sequentially and auto manufacturers are still struggling to match demand.

As the company discussed on the Q3’22 earnings call, revenues were held back by both NXP Semi holding more inventory and a lack of ability to meet demand due to constraints in Automotive:

But as I mentioned, given the whole macroeconomic uncertainty, we just feel it is a much more prudent approach to actually limit this channel inventory at this very low level of 1.6 months and mind you that the delta to 2.5 months in terms of revenue would be about $500 million. And that’s the level of open orders, which we would easily have, which we could serve.

One area I think we need to understand a little bit better is that our internal utilizations remain in the high 90s as we are still well constrained specifically in our auto. And if you think about internally, more than two-thirds of our capacity is just pinpointed to our IP proprietary mixed-signal, auto-centric capacity internally. And we are constrained. As you heard Kurt mention, we are sold out, and we expect this to be well-utilized all throughout 2023.

Of course, the big benefit to being invested in the stock here is the valuation. NXP Semi will generate up to $14 in EPS this year and the stock only trades at $150. The company might struggle to maintain massive growth in Q4, but the semiconductor business is forecast to produce $1.2 billion in operating income in the quarter with a 36% operating margin.

Play The Long Term

NXP Semi can use these massive profits to repurchase shares and pay down debt. The company spent $400 million to repurchase 2.5 million shares in the last quarter and another 1.77 million shares in October for $260 million.

With a $40 billion market cap, NXP Semi has repurchased 1.5% of the outstanding shares over the last 4 months alone. Along with a 2.2% dividend yield, the company rewards shareholders at these cheap stock prices waiting for the long term to play out.

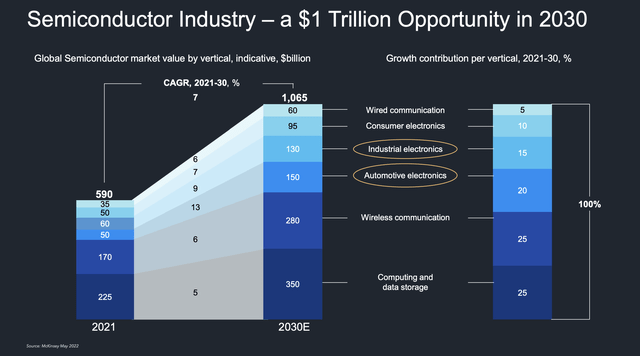

The Automotive sector tech content growth is the bread and butter of NXP Semi. The sector is expected to see the TAM surge from $50 billion last year to $150 billion in 2030.

Source: NXP Semi Q3’22 presentation

The industrial and wireless communications markets where NXP Semi plays will continue to grow as well. The business opportunities of the semiconductor company provide a lot for shareholders to like.

NXP Semi should be able to boost EPS about 5% annually via share buybacks alone while the above growth drivers play out. If the company can achieve anywhere close to the 10% annualized growth rates forecast at the Analyst Day last year, the company can achieve 15% EPS growth. The stock remains insanely cheap for the opportunity to both grow net income and boost the bottom line via share buybacks.

Takeaway

The key investor takeaway is that NXP Semi is still generating strong growth despite supply constraints and holding inventory reducing sales by $500 million. The stock is exceptionally cheap with an easy path to growth while the macro environment impacts investor confidence.

Be the first to comment