Editor’s note: Seeking Alpha is proud to welcome Varun Vithalani as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

imaginima/E+ via Getty Images

Nvidia (NASDAQ:NVDA) is on a clear path to be the AI engine for Earth. With accelerated computing being the backbone for AI, Nvidia is primed to capture the exponentially growing AI market with its three key advantages:

- Omniverse: A digital twin of the real world that obeys the laws of physics and allows simulation of real world challenges in a virtual environment before building the physical.

- CUDA: A programming language platform allowing developers to build their own AI apps.

- GPUs for data centers: The powerful chips which enable high performance computing needs for AI and deep learning.

More than 25,000 companies are already using Nvidia’s hardware and software to solve complex real world problems such as drug discovery, autonomous driving, climate prediction, building car factories of the future, hospital fall detection, translating languages in video conferences, preventing financial fraud, building a virtual city to simulate 5G setup, and many more. My thesis assumes that, in the future, Nvidia will be able to charge recurring software revenue or developer fees for third parties using their CUDA programming platform and their 150+ software libraries. Nvidia has ambitions to democratize AI.

This article takes a look at Nvidia’s AI adoption, upcoming catalysts, new company announcements, and why I believe Nvidia is a must-own for long-term investors. With shares trading at $260 at the time this was written, I feel the stock has at least 15% in upside potential.

Nvidia ‘I Am AI’ presentation GTC Keynote 2021 & 2022 (Nvidia YouTube Official)

Nvidia’s accelerating AI adoption in numbers

Nvidia’s Data Center and Automotive businesses are primarily responsible for its AI growth. Let’s look at some key numbers that show how Nvidia’s AI adoption is accelerating:

- Data Center growth up 11% QoQ and 71% YoY, by end of Q4FY22

- Automotive growth down 7% QoQ and 14% YoY, by end of Q4FY22

- Data Center and Automotive segments are 42% of Nvidia’s total revenue in FY22

- CUDA adoption: number of developers for CUDA is 3 million users (six times over past five years)

- Omniverse adoption: downloaded 30 million times over last 15 years, 7 million in last year alone

- Over 25,000 companies use Nvidia AI

- Eight out of 10 supercomputers use Nvidia

Nvidia is innovating at scale and bringing new products to market at speed. Increasing adoption is clearly visible in revenue as well as other internal metrics.

Catalyst: Recurring software subscription revenue might not be priced in for Nvidia

As I mentioned earlier, I believe Nvidia will soon be in a position to charge recurring software subscription revenue or developer fees for their platforms. Nvidia starts with high performance chips, but for each field of science, industry, and applications, they create a full stack. They have over 150 SDKs (software development kits), which serve industries from Gaming and Design to Life and Earth Sciences, Quantum computing, AI, Cybersecurity, 5G, and Robotics.

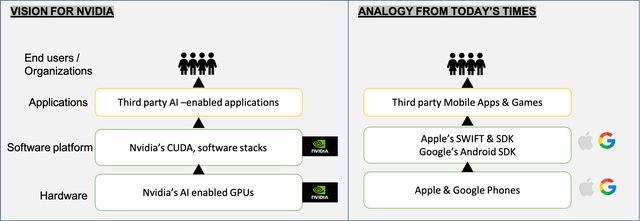

Let me paint a picture of how I see Nvidia’s future:

Vision for Nvidia AI and an Apple, Google Analogy (Created by Varun Vithalani)

Today, Apple (AAPL) and Google (GOOG) have achieved great success by being the hardware and software platforms for apps and games that run on iOS and Android. Nvidia’s vision of democratizing AI will enable them to collect software revenue from third parties who wish to use Nvidia’s CUDA and software stacks to build their own AI-enabled applications on Nvidia’s GPUs. Someday, every company will be a data company, and every server will be an accelerated computer.

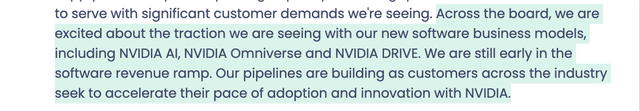

We can already see clues from management about this. During the Q4 2022 earnings call in February 2022, Nvidia CFO Colette Kress explained how the company is still early in its software revenue ramp:

Nvidia Q4 FY2022 Earnings transcript (Fincredible.ai)

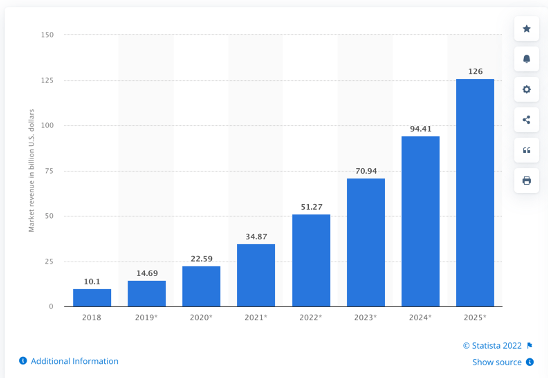

For the entire AI software industry, revenues are expected to more than double by 2025 from where they stand today:

Artificial Intelligence Total Addressable Market (Statista)

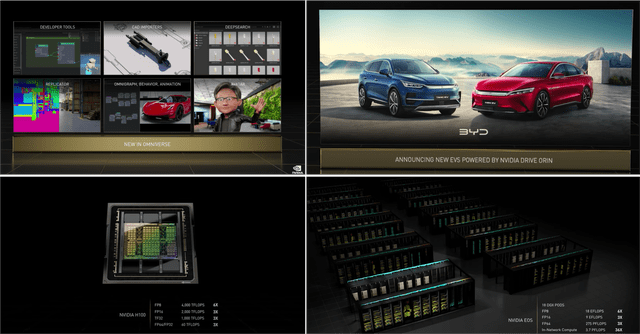

Groundbreaking announcements at Nvidia’s GTC 2022 Keynote Event

Twenty years ago, all of this was science fiction. 10 years ago, this was a dream. Today, we are living it. – Jensen Huang

Nvidia made some groundbreaking announcements on March 23, 2022, during their GTC 2022 Keynote event. While there were numerous new initiatives mentioned by Nvidia, I wanted to call out the top few that piqued my interest:

- Autonomous driving partnership with BYD and Lucid (LCID)

- Omniverse Kit and Omniverse Cloud collaboration platform to democratize creation and collaboration on Omniverse

- A new powerful H100 GPU; for comparison, 20 H100 GPU can sustain the equivalent of the entire world’s internet traffic

-

EOS, an AI factory; for comparison, EOS has four times the processing power of the world’s largest supercomputer in Fugaku, Japan

Nvidia’s key new announcements at GTC Keynote 2022 (Nvidia Official YouTube Channel)

Such speed of innovation and scale of vision is impressive.

Nvidia is a buy at these levels with asymmetrical upside

Nvidia has five business segments: 1) Gaming, 2) Professional Visualisation, 3) Data Center, 4) Automotive, and 5) OEM and Others. Although the products of Nvidia might be across segments, it is safe to assume that AI-, Omniverse-, and Software-enabled growth will come from the Data Center and Automotive businesses. I will lay out my valuations in three cases (bull, base, and bear), with varying assumptions. You can decide what you believe in the most. Personally, I believe there is asymmetrical upside on the bull case with a potential recurring software revenue stream not priced in.

For Nvidia, I prefer to use a 10-year discounted cash flow model instead of relative valuation. This is because Nvidia has consistent and growing cash flows. I am willing to make some educated assumptions about future growth rates based on where I believe the world is heading. My source for the discount rate is finbox, while my source for Wall Street consensus estimates in the Base case is simplywallstreet.

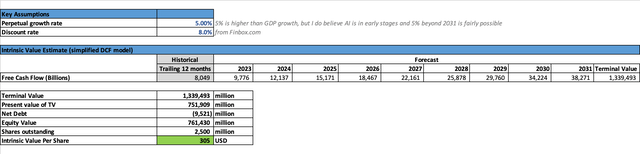

Bull Case*: Sustained growth in AI adoption until 2031 and in Gaming; supply constraints ease

Here are my assumptions:

- Revenue growth 30%-10% from 2023-31

- Free cash flow margin in 2031: 29%

- Perpetuity growth: 5%

- Discount rate: 8%

Intrinsic value: $305

Nvidia Bull case Intrinsic Value (Finbox and Varun Vithalani)

*An upside surprise that’s possible but not included in my valuation is Software recurring revenue.

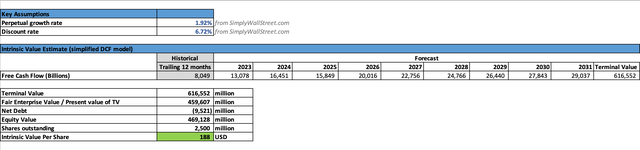

Base Case: Wall Street consensus free cash flow expectations

Assumptions:

- Free cash flow in 2031: $29B

- Free cash flow margin in 2031: 29% (until 2027 I’m using Wall Street consensus estimates, beyond 2027 to 2031 is my self input)

- Perpetuity growth: 1.92%

- Discount rate: 6.72%

Intrinsic value: $188

Nvidia Base case Intrinsic Value (SimplyWallStreet and Varun Vithalani)

I performed the base case valuation just to get a sense of what Wall Street is thinking.

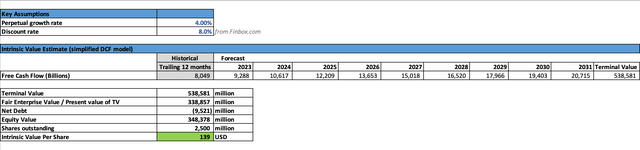

Bear Case: Declining growth, cyclical business with stable cash flows

Assumptions:

- Revenue growth 20% to 6% from 2023-31

- Free cash flow margin in 2031: 29%

- Perpetuity growth: 4%

- Discount rate: 8%

Intrinsic value: $139

Nvidia Bear case Intrinsic Value (Finbox and Varun Vithalani)

This bear case is unlikely in my opinion, as it would mean Nvidia stops innovating and becomes a chip commodity business.

Risks for Nvidia

My Nvidia thesis is at risk if the AI industry is unable to advance at the expected speed. Of course, it remains to be seen how this translates to the top and bottom lines. Early signs are promising. A lot of real-world AI adoption use cases have come forth, and their Data Center business has shown hypergrowth.

For an asymmetrical upside, the recurring software revenue and achieving L4/L5 autonomy with autonomous cars is critical. Without those, Nvidia might struggle to give outsized gains.

What to look for next

For a quantifiable crosscheck on my thesis, look out for two key things from Nvidia:

- Nvidia’s Data Center and Automotive segments revenue should reach >60% of Nvidia’s revenue pie by 2025 (currently at 42%).

- Will Nvidia be able to lift up their software revenue by late 2023/early 2024? The likelihood is high, as the CFO provided positive comments during the Q42022 earnings call.

If Nvidia does achieve recurring software revenue, valuations will have to be readjusted by Wall Street to project the recurring revenue in the future. In that case, I expect an asymmetrically higher upside than my bull case of $305.

My thesis will get violated if Nvidia is unable to generate software revenue by 2024. It will then have to be valued purely based on its ability to sell GPUs, still closer to my bull case of $305.

Final thoughts

In this article, I intentionally focused on the opportunities that lie ahead for Nvidia rather than its status quo. Nvidia continues to do great in its dGPU market and is the market and product leader. The Gaming and Professional Visualization segments have seen remarkable growth in the last year. But the asymmetric upside is not based on the business today – it’s probably on the whole new AI-enabled world of tomorrow.

Be the first to comment