Justin Sullivan

NVIDIA (NASDAQ:NVDA) has reported a very poor quarter and its outlook was not much better, while its shares still trade at a very high valuation. Long-term investors should wait for a pullback, as a lower share price is justifiable in the short term.

Background

As I’ve covered in previous articles, I’m bullish on NVIDIA over the long term due to its business profile that is highly exposed to several secular growth trends, making it a great play for long-term investors in the semiconductor industry.

However, the short-term outlook has turned much more negative in recent months as the semiconductor sector is facing a slowdown, of which NVIDIA is obviously not immune. The company had already warned investors a couple of weeks ago that revenues in the most recent quarter were below expectations, thus a weak report was already expected related to Q2 of fiscal year 2023.

As I’ve not covered NVIDIA since last November, I think now is a good time to revisit its investment case and look at its most recent earnings, to see if NVIDIA is still a good long-term investment in the semiconductor investment theme, or if the global economic slowdown is affecting the company’s fundamentals.

Q2 FY 2023 Earnings Analysis

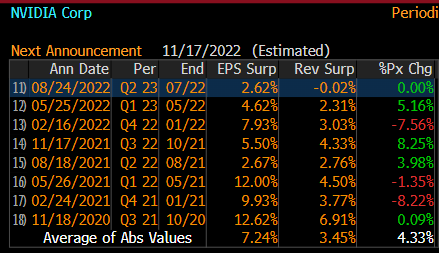

NVIDIA reported yesterday its earnings related to Q2 of fiscal year (FY) 2023, reporting revenues in line with expectations, while its EPS was able to beat by a slight margin as shown in the next graph. NVIDIA has a great history of beating market estimates, but this quarter was particularly weak, showing that the semiconductor industry continues to be exposed to economic cycles, and weakness in consumer electronics and PC sales is also hurting NVIDIA’s growth.

Earnings surprise (Bloomberg)

NVIDIA’s revenues amounted to $6.7 billion in the last quarter, representing an increase of only 3% YoY and a decline of 19% compared to the previous quarter, being a severe growth slowdown in a relatively short period of time. Indeed, in Q1 FY 2023, NVIDIA reported revenue growth of 46% YoY, showing that revenue growth has collapsed very fast in the last three months to 31 July 2022.

Even more severe than its revenue plunge in the quarter, was the decline in its earnings given that GAAP EPS was $0.26, a decline of 72% YoY and 59% QoQ. This clearly shows that this was a weak quarter for the company, which to a large extent was unexpected as operating trends remained resilient in the previous quarter and the company’s outlook was for revenues of about $8.1 billion in Q2. This means that NVIDIA was not predicting a slowdown to occur so rapidly, and has missed its own outlook by a considerable margin.

Beyond weak revenue growth, another factor that affected its profits significantly was the decline in gross margin, which was only 43.5% in Q2, down by 22 percentage points compared to the previous quarter. This is justified by an inventory impairment of $1.22 billion, a temporary setback due to changing market conditions, while NVIDIA expects its long-term profitability to remain the same.

The segment that justified this weak performance was mainly gaming, which reported revenues of $2.04 billion (down by 44% QoQ and 33% YoY), due to weak market conditions. Investors should note that both Intel (INTC) and Advanced Micro Devices (AMD) were also affected by weak PC sales and gaming-related revenues, but NVIDIA is clearly the chip company most affected here. This weakness is, most likely, also related to the crypto winter and lower demand for GPUs from crypto mining companies, but as NVIDIA does not disclose how much revenue it derives from crypto mining it isn’t possible to quantify how much revenue the company has lost this quarter due to this effect.

Another segment that reported weak numbers was professional visualization, which reported revenue of $496 million in Q2, a decline of 4% YoY and 20% QoQ, due to lower demand from enterprise customers.

While gaming and professional visualization reported a weak quarter, on the other hand, NVIDIA’s automotive segment and the data center continued to show positive momentum. Automotive reported revenue of $220 million, presenting an increase of 45% YoY and 59% QoQ, and data center was another positive segment reporting revenue of $3.81 billion (up by 61% YoY and 1% QoQ), even though data center was somewhat below the company’s expectations due to supply chain issues.

Regarding expenses, they were up by 36% YoY to $2.4 billion, due to higher salaries and R&D. Considering the backdrop of lower revenues and higher expenses, it is no surprise that NVIDIA’s net income plunged by 72% YoY to $652 million. Despite these lower earnings, NVIDIA maintained its strategy of returning excess capital to shareholders, which amounted to some $3.4 billion in the quarter through share repurchases and dividends.

If recent trends were quite poor, operating prospects aren’t much better considering that NVIDIA’s guidance for Q3 FY 2023 was not particularly bullish. The company expects to report revenue of around $5.9 billion, a decline of 12% QoQ, with weakness coming again from the same segments (gaming and professional visualization) that should not be offset from strength in automotive and data center. Gross margin will recover to a more ‘normal’ range of 62-65%, and capital expenditures should be between $550-$600 million.

I see these earnings and outlook as very poor, as revenue is being heavily hit on its gaming division, which doesn’t seem to be only related to high inventories ahead of new releases. While it is true that NVIDIA will launch new chips in coming months and some demand may be temporarily pushed back, the extent of revenue decline is too harsh and may be a sign of a harder impact from the economic slowdown than NVIDIA, and the market, was expecting just one month ago.

As can be seen in the next graph, consensus estimates were for revenue to be about $8.5 billion in Q3, while this has been rapidly revised downwards to $5.9 billion (red line). This is a drop of about 30% in a very short period of time, which may be more than just a seasonal effect and may take some time to recover as new products enter the marketplace and inventories get more balanced.

Revenue revisions (Bloomberg)

Going forward, NVIDIA is expected to maintain a strong operating momentum in data center and automotive, two segments that are less exposed to economic cycles, but gaming is key to a turnaround of recent weakness. Nevertheless, the street expects FY 2023 revenue of only $27.1 billion, while in my last article I was expecting revenue above $31 billion. This clearly shows that NVIDIA’s growth prospects have dampened, at least in the short term.

Estimates & Valuation

While NVIDIA reported a strong operating momentum in recent years, this profile has completely changed in the most recent quarter due to weakness in its gaming segment. This also happened in 2018 when crypto prices collapsed, showing that NVIDIA is still quite exposed to this market, even though it is not possible to quantify this as the company does not disclose revenue related to crypto mining.

Nevertheless, the company’s long-term prospects remain good considering that its business is gradually shifting away from gaming to other segments that have good secular growth prospects, such as artificial intelligence or autonomous driving.

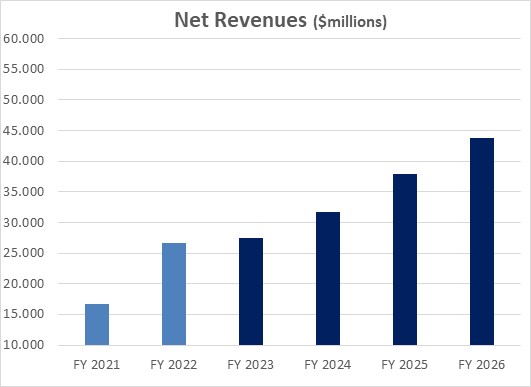

Indeed, regarding medium-term estimates, NVIDIA’s revenues are still expected to grow at about 13% per year, over the next four years. This is still a strong growth rate, but much lower than 20% per year that was expected at the end of 2021. NVIDIA is now expected to grow its revenue to more than $43 billion by FY 2026, while back in November the street was forecasting $56 billion in revenue. Its bottom line is now expected to reach close to $16 billion, also lower than the $20 billion expected some months ago.

Revenue estimates (Bloomberg)

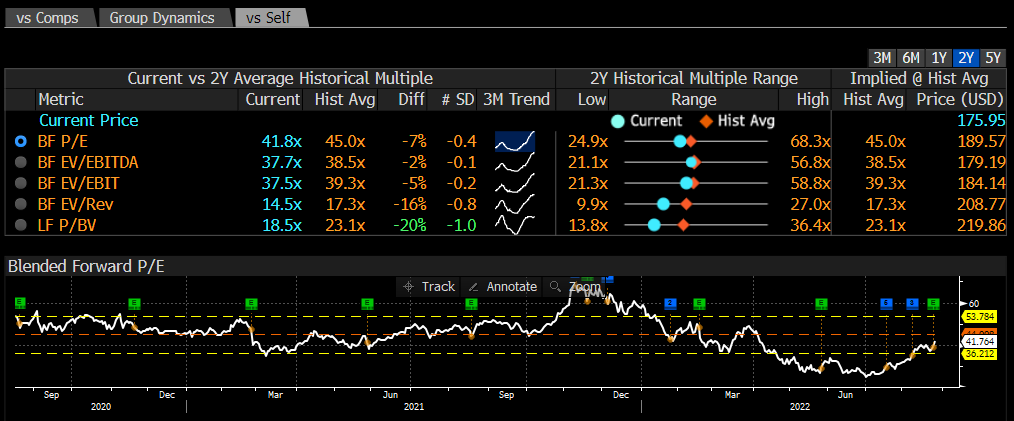

Not surprisingly, lower revenue and earnings estimates have led to a lower share price, but its valuation has also de-rated in recent months, as happened to most growth stocks. As can be seen in the next graph, NVIDIA’s forward earnings ratio has been quite volatile over the past year, with a peak valuation of more than 60x back in November, and a bottom of 25x back in June. Currently, NVIDIA is trading at close to 42x forward earnings, a slight discount to its historical two-year average.

Valuation (Bloomberg)

This seems to be a somewhat high valuation for a company that is reporting weak trends and provided a very bleak outlook, thus the risk-return proposition of its shares appears to be more skewed to the downside.

Conclusion

NVIDIA is a great company and long-term growth prospects are supported by several secular growth trends, including data center, AI, and autonomous vehicles. Despite that, its business is still significantly exposed to gaming, which is showing weakness and is not likely to turn around soon.

For long-term investors, I still see NVIDIA as a great play in the semiconductor industry, but I’m not a buyer at current prices. Its valuation is quite high, and this doesn’t seem to be justified by the company’s current earnings. Therefore, I think it is better to wait and buy more shares during pullbacks, as a lower share price may be warranted in the short term to reflect NVIDIA’s lower growth prospects.

Be the first to comment