Justin Sullivan

Thesis

Nvidia (NASDAQ:NVDA) stock is up by more than 45% from intra year lows. But year to date, shares are still down by approximately 60%. For further guidance about the company’s prospects, investors are now awaiting Q3 earnings, which are expected to be released on the 16th November post-market.

Although I think revenue and earnings estimates are reasonable for Nvidia’s Q3, I am worried the stock might fall on disappointing management commentary and FY 2024 guidance – whereby Qualcomm’s (QCOM) share price reaction post Q3 might serve as a reference.

Nvidia’s Q3 Preview

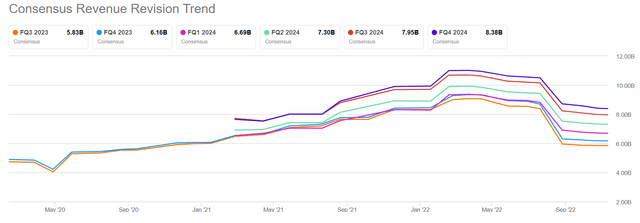

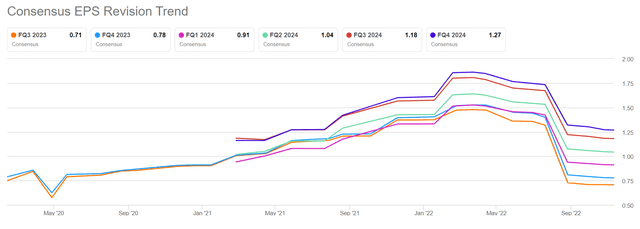

According to data compiled by Seeking Alpha, as of November 13th, 37 analysts have submitted their estimates for Nvidia’s Q3 results. Total sales are expected to be between $5.5 billion and $6.9 billion, with the average estimate being $5.8 billion (versus Nvidia’s guidance of $5.9 billion, plus or minus 2%). If an investor would assume the average as the anchor, Nvidia’s Q3 sales are estimated to contract by about 17.9% as compared to the same quarter in 2021.

EPS estimates are between $0.59 and $0.89. The average is $0.71, which would imply a year-over-year growth of negative 40%.

Personally, I believe expectations for Nvidia’s September quarter are reasonable, as they have come down significantly since early 2022 – revenue has been cut by about one-third and EPS by almost half. Moreover, I would like to point out that estimates are very closely in line with management guidance. And given that there was no profit warning, I do not expect a strong deviation from what is expected.

However, investors should consider however that the risk to expectations might be in management commentary, or in other words as softer than expected outlook for late 2022/early 2023.

Will Guidance Disappoint?

Looking beyond Nvidia’s Q3 reporting, analysts expect that the chipmaker’s business prospects will gradually improve – with quarter-over-quarter growth expected for both Q4 FY 2023 and Q1 FY 2024. But in my opinion, estimates might be too optimistic and provoke an aggressive market disappointment if management commentary does not support these expectations.

Qualcomm’s recent earnings announcement might serve as a reference. Although Qualcomm delivered a strong Q3, and beat analyst consensus estimates, the company’s stock fell sharply (as much as -10%) on softer-than-expected management commentary. Qualcomm said that the outlook for the next couple of quarters remains clouded, given that the global economy is still pressured by weak consumer sentiment, a prolonged Russia-Ukraine war, inflation, and COVID-19 restrictions in China. Qualcomm also pointed out that abnormally high channel inventories will likely reduce chip demand until the second half of 2023.

The rapid deterioration in demand and easing of supply constraints across the semiconductor industry have resulted in elevated channel inventory. Due to these elevated levels, our largest customers are now drawing down on their inventory …

And if Qualcomm sees a weak Q4 2022/ Q1 2023, then it is likely that also Nvidia will continue to struggle. Investors should consider that Nvidia’s business – which is strongly levered to gaming and crypto – is more negatively affected to the current downturn in the semi-industry than Qualcomm’s – which is exposed to a more diversified portfolio including smartphones, IoT, and automotive.

Valuation Still Excessive

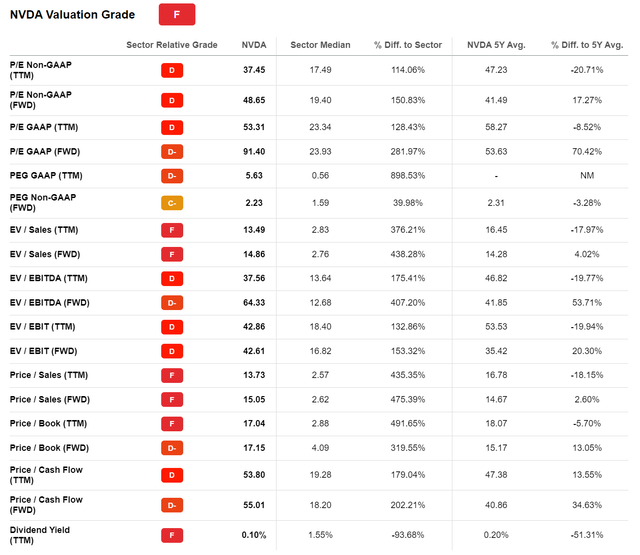

Another argument to be cautious on Nvidia is anchored on the company’s excessive valuation versus peers.

According to data compiled by Seeking Alpha, Nvidia is valued at a one-year forward P/E of x49, which represents a more than 150% valuation premium versus the information technology sector. Nvidia’s P/B is x17 and P/S is x15, valuation premia of 320% and 475%, respectively.

Conclusion

Although I think Q3 analyst estimates for Nvidia’s key financial metrics are reasonable, I am worried that the tech giant might disappoint against still relatively optimistic Q4 FY 2023 and Q1 FY 2024 estimates through a worse-than-expected guidance. In such a case, I would argue that it is not unreasonable to expect a sharp drop for NVDA shares – given the disappointing outlook would surely be judged relative to the company’s rich valuation. For reference, QCOM which trades at about 25% of NVDA’s valuation dropped 10% after the company flagged a softer-than-expected outlook.

Trade Idea

Going into earnings, buying time-sensitive Put spreads might be an interesting trade opportunity. Personally, I like the risk/reward of the 95/85%-moneyness Put spreads with November 18 expiration. If Nvidia stock would close at the 80%-moneyness strike (approximately $140/share), traders may enjoy a more than 5:1 payoff.

Be the first to comment