Justin Sullivan

Last week, I detailed how chipmaker Nvidia (NASDAQ:NVDA) could potentially warn investors again when it reports results this afternoon. History suggested that current quarter analyst estimates were a bit too high after the company’s early August warning, but expectations and the stock have come down since. As we get ready for the company to update investors, one recent supporter of the company has done a quick U-turn.

Back in late May, Cathie Wood and Ark Invest started building a small position in the chipmaker. The ETF firm bought positions in three of its actively managed funds – the Ark Innovation ETF (ARKK), Ark Next Generation Internet ETF (ARKW), and Ark Fintech Innovation ETF (ARKF). When the firm bought more shares in early August after the chipmaker’s warning, the total position was just under a million shares between these three ETFs.

Since then, the number of shares held by Ark Invest is down about 6%, but this is completely due to redemptions, the majority of which were in the flagship fund. As of Monday, Ark Invest held over 940,000 shares of Nvidia. While the chipmaker wasn’t a top holding in any of the funds, it was still was a roughly $160 million overall position, which isn’t exactly peanuts. That changed in a big way on Tuesday, however, as the graphic below details.

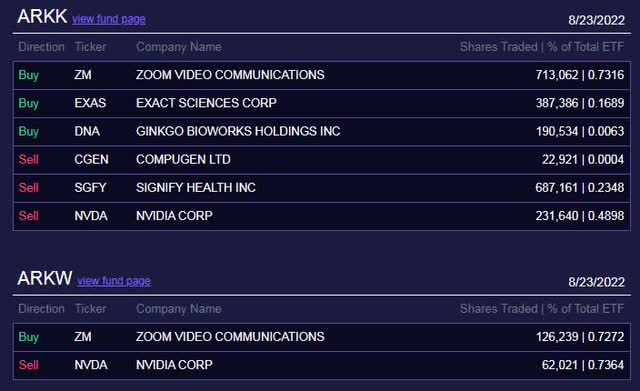

August 23rd Trades (Ark Invest Daily E-mail)

In the ARKW ETF, the sale was almost a one to one trade for shares of Zoom Video Communications (ZM), which fell after another disappointing earnings report. In the flagship fund, Zoom was again bought, but there were other sales beyond Nvidia and other purchases as well. In total, more than 293,000 shares of the chipmaker were sold on Tuesday. That represented more than 31% of Ark Invest’s entire position, but it was more than 34% if we only focus on the two ETFs that sold and exclude the ARKF holding for now.

The timing of the Nvidia sale is very curious on a couple of fronts. First of all, earnings come out, so making a big trade like this is a gamble there. Second, Ark Invest apparently felt confident in the name less than three weeks ago when it bought almost 367,000 shares on the day that Nvidia warned about Q2 revenues. Also, these major sales come less than three months after the initial purchases, which is one of the quickest turnarounds that I’ve seen (especially in the flagship fund) over the past couple of years for Ark Invest.

One of the key points of my article last week was that analyst estimates seemed to be high for the current quarter. This was based on how Nvidia revenues trended last time we saw a major downturn in the company’s top line. Since then, however, the street has become a bit more bearish. Currently, the average street estimate for the October period is $6.92 billion, or a decline of nearly 2.6%. Last week, the average was $7.08 billion, or a decline of just 0.3%. The historical trends show that there’s still a chance for disappointing guidance on Wednesday, but that probability dropped a bit with the $160 million decline in the average estimate. The street has also cut estimates for the following couple of quarters as well.

The other thing that’s changed here a bit in the past week is that Nvidia shares have dropped due to some overall market weakness. Analysts still see plenty of upside, with the average price target remaining around $225, but those valuation figures could change a bit after Wednesday’s report. The stock has fallen $11 since I last covered it, putting shares just above their 50-day moving average (purple line) as shown in the chart below. The short-term direction of this key technical trend line will depend heavily on which way the stock moves after earnings.

Nvidia Last 12 Months (Yahoo! Finance)

As we prepare for Nvidia earnings, Cathie Wood and the Ark Invest team sold a good chunk of their position. The major sale comes less than three weeks after a large buy following the chipmaker’s revenue warning, and less than three months after the initial positions were started in these active ETFs. With analyst estimates and the stock having dipped a bit since last week, the bear camp’s hope for another disappointment this week have dropped a bit, so it’s very interesting to see this kind of sale from a very prominent investor like this right before earnings.

Be the first to comment