vzphotos/iStock Editorial via Getty Images

Recent reports have claimed that most of Nvidia’s (NASDAQ:NVDA) revenue from the RTX 30 series of graphics cards is due to crypto. In this article, I demonstrate why that cannot be true and present a more reasonable estimate of Nvidia’s revenue due to crypto and its exposure to a potential crash in crypto mining demand.

Media Reports Imply An Imminent Crash In Graphics Card Demand

A couple of recent Bloomberg articles have painted a rather dire picture of the potential effect of the crypto crash on the desktop graphics card market. A June 30 article titled Nvidia Game Card Prices Fall Along With Crypto Mining Demand claimed:

By one estimate, more than a third of the consumer graphics-card market could vanish as crypto enthusiasts abandon the technology. And the products are piling up on eBay’s site and other marketplaces. Though Nvidia’s suggested retail price for the cards hasn’t changed, they’re selling for 50% less on secondary markets than they did in recent months.

Another article went even further, implying that most of the demand for graphics cards has been due to crypto:

Ethereum miners have spent approximately $15 billion on graphics processing units (GPUs), according to Bitpro Consulting, and that doesn’t include ancillary costs like wiring and transformers.

The article doesn’t define the time frame in which the $15 billion was supposedly spent. Is it for all time? The past year? I looked at the Bitpro Consulting web site for clues. The most applicable information I found was a blog piece that stated:

Rough calculations based on total hashpower suggest roughly 10-15 million GPUs are mining.

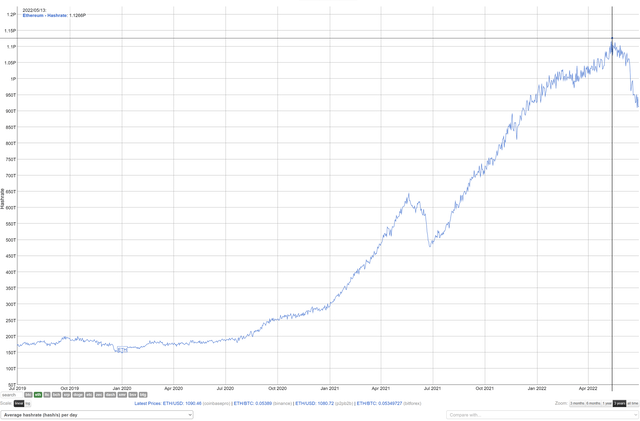

Probably the author was looking at a source of data that I often use, a chart of Ethereum mining pool hash rate vs. time from BitInfoCharts:

Source: BitInfoCharts.

Hash rate is a performance metric for mining graphics cards usually measured in millions of hash per second. A hash is a particular encryption method which is used to secure the block chain. Mining Ethereum involves finding the unique hash that will secure a particular block, a time and energy consuming task, even for a GPU that can create 100 MHash/s.

The rough estimate that Bitpro gives is consistent with the global mining pool hash rate at its peak, which on May 13 was 1.266 petaHash/sec or 1.266e15 Hash/sec.

Assuming an average GPU hash rate of 100e6 (100 MHash/sec) then that works out to 12.66 million GPUs in the mining pool. Assuming a lower hash rate would give a larger number.

Where the $15 billion comes from isn’t mentioned in the blog piece, but if miners spent about $1000 per card, that would give the $15 billion figure. So, in a rough estimate kind of way, the numbers hold up.

What’s Wrong With This Picture?

Up to this point, the rough estimates are fine as far as they go, but the way that they’re applied to Nvidia is not. For instance, an article in WCCFtech claimed that the $15 billion estimate meant that crypto-miners, not gamers, bought most of the desktop gaming graphics cards since the start of 2021.

This ignores the fact that the $15 billion estimate is for all time, not just since the beginning of 2021. I’ve also seen it represented in comments that this $15 billion all went to Nvidia. If it had, that would constitute about 75% of Nvidia’s total revenue in the Gaming segment since the launch of the RTX 30 series in September-October 2020.

In this view, Nvidia’s gaming segment revenue is largely dependent on crypto, and will collapse if Ethereum mining ceases. And there is every expectation that Ethereum mining will cease in the near future when it goes to a completely different method of securing the Ethereum block chain.

There are a couple of things wrong with this view. First, it ignores the division of the crypto mining GPU market with AMD (AMD). AMD’s Radeon RX 6000 series cards were released at about the same time as the RTX 30 series and are perfectly respectable Ethereum mining cards.

It can be argued that the AMD cards don’t perform as well as the RTX 30 series, but they also cost less than the RTX 30 series. Given the shortages that existed in 2021, miners probably bought any suitable GPU they could get their hands on, AMD or Nvidia.

The other big factor that is often ignored is that neither AMD nor Nvidia make the retail price on graphics cards sold by third party graphics card builders such as EVGA or Gigabyte. AMD and Nvidia just sell the raw GPU. The pricing for the graphics chips themselves has to be much lower than the retail price of the cards in order to allow the card makers a reasonable profit, especially if they’re selling wholesale to retail distributors.

How things worked last year in the context of the GPU shortage isn’t exactly clear. Nvidia’s Founders Edition cards (for which it did get the full retail price) sold out instantaneously, and there’s no indication that Nvidia made any effort to replenish them. I believe that this was because the board partners were so desperate for chips that they demanded everything Nvidia could supply.

So for all practical purposes, Nvidia and AMD were on the same level, selling chips to board partners. Did Nvidia and AMD take advantage of the shortages to charge extra for their chips?

They may have, but I doubt they could get away with much of a surcharge without the board partners throwing a fit. The board partners have a lot of clout because they’re the ones selling most of the graphics cards. If anyone (besides scalpers) was reaping a windfall profit from the shortages last year, it was probably the board partners.

A Detailed Calculation Of Crypto Revenue On A Quarterly Basis

There are so many moving parts to the crypto mining puzzle that even a detailed analysis has to make some simplifying assumptions. So let me state mine up front.

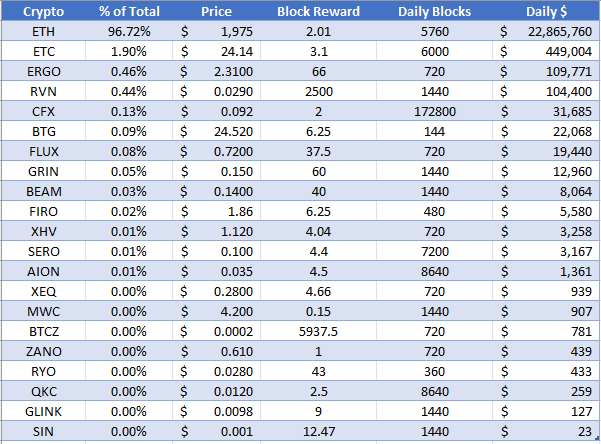

Ethereum: there are over 20 GPU mineable crypto currencies, but only one really matters, Ethereum. Ethereum accounted for more than 96% of all the revenue derived from GPU-based mining according to this table published in the Bitpro Consulting blog:

BitPro Consulting

Source: Bitpro Consulting.

It can be assumed that an increase in the global mining pool hash rate is due to the addition of new mining graphics cards. Likewise, a decline in the global hash rate must be due to mining cards being removed from the pool.

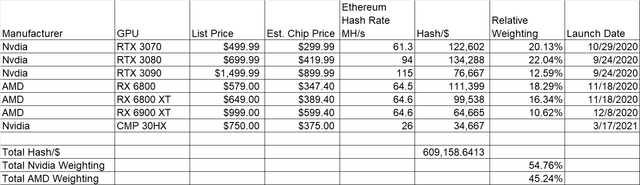

What remains is to estimate the mix of cards being purchased by miners. Starting at the launch of the RTX 30 series, I assume that only the RTX 30 series and the RX 6000 series cards were added during the period of Nvidia’s fiscal 2021 Q3 (ending 10/25/20) to Nvidia’s fiscal 2023 Q1 (ending 5/1/22).

I estimate the mix of GPU models based on calculating the card hash rate divided by the list price. This just assumes that cards that offer more “bang for the buck” would be preferred by miners and have a higher market share. I give the approximate market share in the relative weighting factors given in the table below:

The estimated chip price is pegged at 60% of the list price. The hash rates are somewhat algorithm dependent and are drawn from multiple sources, such as Minerstat. The Nvidia CMP 30HX was a special purpose mining GPU for which Nvidia reported income separately. Since this reporting provided the best way to estimate CMP 30HX unit sales, it isn’t included in the weighting calculations.

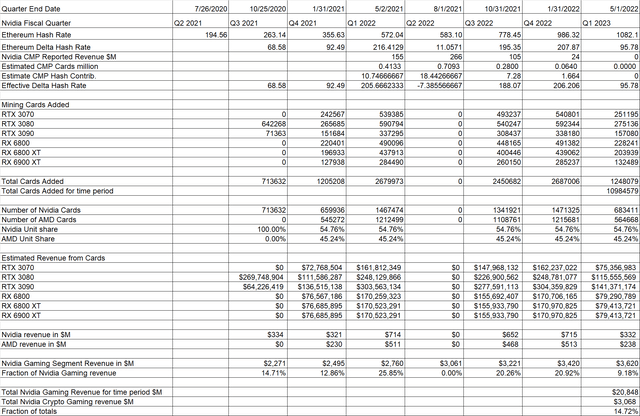

The change in hash rate from quarter to quarter scales the total number of cards added, while the weighting factors provide a means to calculate total sales of each model. The table below summarizes the calculations of the numbers of cards added per quarter and the estimated revenue from those cards:

Over the time period shown above, I estimate that about 11 million graphics cards were added to the mining pool, not counting the CMP cards, which are tallied separately. In fiscal 2022 Q2, so many CMP cards were added, that I calculated there was actually a reduction in conventional GPUs in the mining pool. Thus, no gaming GPUs are estimated to have been added for the quarter.

The contribution of crypto to the Nvidia Gaming segment revenue is estimated to have never been higher than about 26%, and averages over the period to be 14.72%.

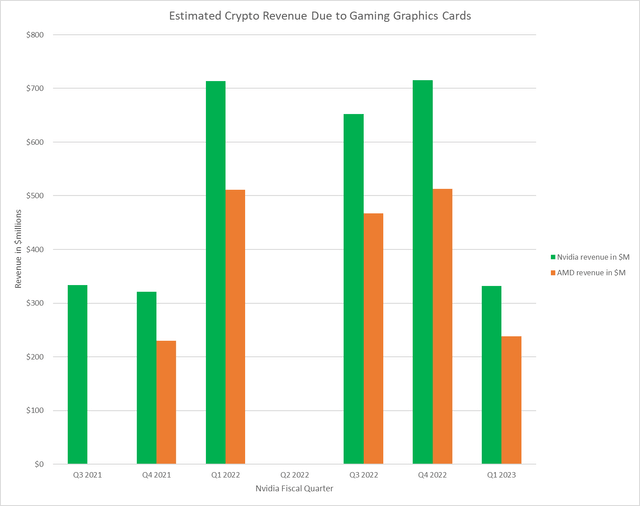

The chart below summarizes the quarterly revenue for Nvidia and AMD due to crypto:

One question that I can’t resolve is what happened to the GPUs that were taken out of the pool due to the influx of the CMP cards in the Nvidia fiscal 2022 Q2 quarter. Were they subsequently put back into the pool or were they replaced with newer cards? For this analysis, I just assume they were replaced with newer cards.

Investor Takeaways

There appears to be a segment of the investor community that believes that Nvidia’s enormous success with the RTX 30 series is somehow a fluke and an artifact of crypto mining demand. The above analysis shows that this is highly implausible, if not impossible.

Even in Nvidia’s fiscal 2022 Q2, when we would expect crypto demand to be minimal based on hash rate growth and sales of CMP chips, Nvidia’s gaming segment revenue grew by a phenomenal 85% y/y.

The crypto dependency thesis is also undermined by the Steam Hardware Survey. The top 20 of the most modern DirectX 12 GPUs by Steam usage share is dominated by Nvidia graphics cards, many of which are RTX 20 and 30 series:

Source: SteamPowered.

Even as crypto GPU demand has dropped off in fiscal 2023 Q1, Gaming segment revenue growth has continued to be strong, at 31% y/y. The removal of crypto demand hasn’t gutted the market for Nvidia graphics cards. It has simply allowed gamers and other PC users to finally buy RTX 30 cards at the list price.

Future demand is certainly clouded by the impending switch of Ethereum to a different approach to processing transactions and securing the block chain. Current Ethereum miners will be left out in the cold, and the roughly 15 million mining cards will be flushed into the used market.

This switch, referred to as “the merge” could happen as soon as August, although this is very much in doubt. If and when it does, there will certainly be a glut in the used graphics card market, and this can be expected to depress new card sales as well.

However, these cards will not be considered very desirable. Mining graphics cards are flogged to within an inch of their lives, and sometimes beyond. Used mining cards are not a good value.

Furthermore, Nvidia is about to unleash its RTX 40 series, and these will likely be more attractive than used cards one or two generations old. Keep in mind that while 15 million mining cards seems like a lot, it’s only about what Nvidia sells in a couple of quarters. So, any glut that occurs will likely only last a few quarters.

While Nvidia’s Gaming segment is still very important in terms of revenue, investors should keep in mind that last quarter Data Center revenue exceeded Gaming revenue for the first time ever. Nvidia’s multiple growth opportunities include high performance computing, AI, and autonomous vehicles.

Rather than fearing the end of Ethereum fueled demand, Nvidia investors should look forward to the time when things get back to “normal” and Nvidia can better serve its loyal gaming customers. I remain long Nvidia and rate it a Hold.

Be the first to comment