Wipada Wipawin/iStock via Getty Images

What Is The Goal Of This Article?

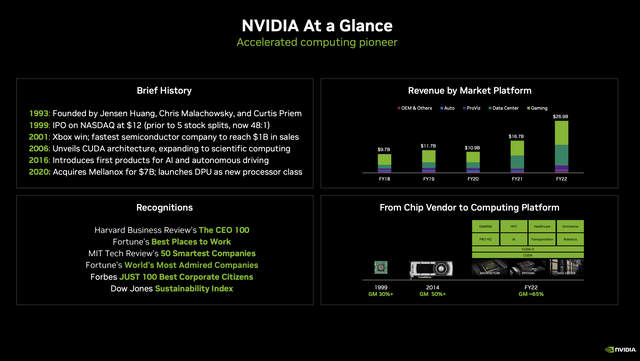

The goal of this article is to introduce readers to my 5P Stock Scoring System, as I will be using this in future articles to provide a summary of if a stock is investable at the moment. This scoring system has helped me factor in both qualitative and quantitative metrics in my thesis for stocks. I can’t think of a better way to deep-dive into this scoring system than for me to use it on Nvidia Corporation (NASDAQ:NVDA) and see where it ranks.

Nvidia is one of the most successful mega-cap stocks of our time. Let’s find out if the 5P Scoring System can help tell us why and if we would want to take a position. As a reminder, this scoring system is subjective and meant to invoke thought and research by the investor. There are so many things that are personalized that go into investment decisions, such as time horizon, risk tolerance, area of expertise, time desired to follow a stock, etc., and this is not financial advice, just an opinion.

People – Leadership, Company Culture, And Insider Ownership

The most important P in my 5P scoring system is around people at the company. When we invest in companies we really are investing our money in the capabilities of people that create and grow businesses. The first thing I look for is a founder CEO or a CEO that has been there for 10 years or longer at the company. The reason for this is because a leader who has been with the company that long or founded it has a specific vision in mind and commitment level to the business. The next thing that supports further confidence in the leadership team at a company is if the team has its employees and shareholders’ best interests in mind.

CEO Founder Jensen Huang (Nvidia Corporate Presentation)

So how do you measure if a CEO and leadership team are aligned with their shareholders? The first place I look to, is to see if the CEO and leadership team have significant shares of ownership in their company. Now, the bigger the company, the less percentage of stock they may hold, but it still could amount to a large amount of money. I want the CEO and leadership team to be incentivized and focused on growing their company and beating their competition.

Another aspect of this is if the CEO takes a smaller salary and more stock for compensation, which shows confidence in their company’s future success. The leadership team is essentially betting on themselves and their capabilities, which also can drive them to work harder.

The other two things I focus on to see if leadership is aligned with shareholders are:

- How transparent is the leadership team with company updates and results being made with shareholders, partners, and employees?

- Does the CEO or the company itself buy back shares when they have severely declined? this can be another indicator in their confidence in the business.

Now let’s talk about how you measure if the CEO is aligned with the best interest of their employees. I want to understand the company culture and what do employees say about working at the company, and would they recommend a friend to work there? I also want to know what is the average tenure of the leadership team, which can tell me a lot about their commitment to the business and the greater vision of the company. Another thing to look for, is has the company been awarded for being a great place to work at locally and within its industry overall? I believe it is difficult and rare to maintain healthy and sustainable company cultures the bigger a company gets, but those who can tend to provide exponential returns.

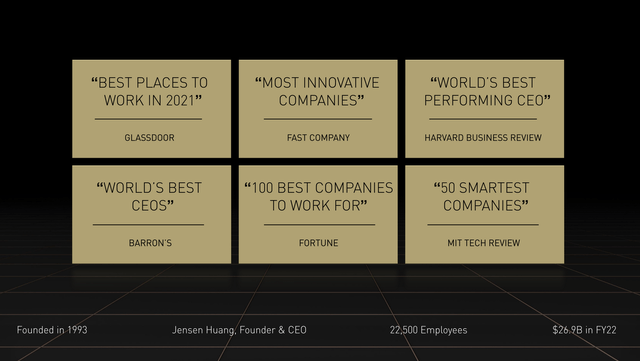

Nvidia Forbes and Glassdoor Ranking (Nvidia Corporate Presentation)

So now, let’s review if Nvidia gets a full point for the first and most important P (People) in my scoring system. The answer is a 200% Yes! and here is why:

- Nvidia is led by Founder and CEO Jensen Huang who has significant share ownership of 3.45% of the entire company, totaling $9.6 billion.

- Jensen is compensated primarily by stock and is only paid out with a salary of right under $1 million a year. That is a lot of money to most, but in the world of CEOs that amount is not much compared to the majority.

- The company has chosen to expand their stock buybacks to over $15 billion through 2023.

- Nvidia has also paid a small dividend to its shareholders since 2013, and I would expect to make the status of dividend aristocrat one day in the future, which could lead to a whole another investing audience in the stock.

- The company’s executive leadership team’s average tenure of nearly 14 years is one of the longest I have seen in the tech industry. This company is continuing to transform itself rapidly toward Jensen’s company vision.

- Jensen has been named One of the Top CEOs by Glassdoor in 5 of the last 9 years and has been named a Top Place to Work at for the last 8 out of 10 years!

- Nvidia keeps investors, partners, and employees up-to-date on all of its newest innovations via their two GTC conferences they have annually.

I could go on and on, but I believe the facts laid out above demonstrate Nvidia earns the full point for people in my 5P Stock Scoring System.

Problem Solving – Delivering Successful Business Outcomes To A Large TAM

The next thing I look for is still mostly qualitative in review, but has some quantifiable measures as well. I want to invest in companies that are solving critical problems for its customer base and delivering these successful business outcomes to a large total addressable market (“TAM”). If a company is solving problems and delivering successful business outcomes to its customers, but the customer TAM is small, then long-term growth may be more difficult to achieve and sustain. So let’s examine what problems Nvidia is trying to solve, are they delivering successful business outcomes, and is their customer TAM large and diverse?

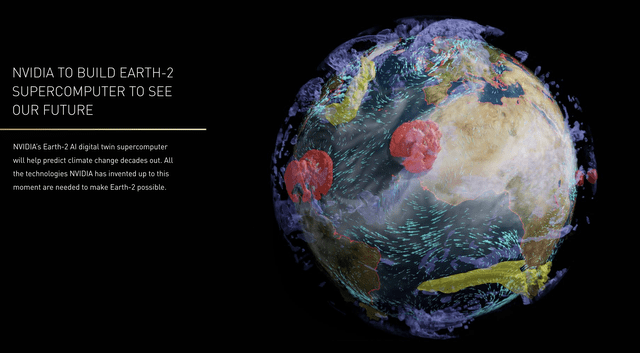

Earth 2.0 Nvidia Digital Twin (Nvidia Corporate Presentation)

Nvidia is trying to solve the largest and most complex problems of our time that impact businesses, consumers, and essentially the entire globe. The company has created such an impactful and superior ecosystem that over 3 million developers are using either their GPUs or Computer AI Platform. Here are some examples from Nvidia’s corporate presentation on the challenging and meaning problems Nvidia is helping solve:

- NVIDIA’s Earth-2 Al digital twin supercomputer will help predict climate change decades out. All the technologies NVIDIA has invented up to this moment are needed to make Earth-2 possible.

- Researchers using NVIDIA accelerated computing won the Guinness World Record for the fastest DNA sequencing technique, achieved in five hours and two minutes. The DNA sequencing record can allow clinicians to take a blood draw from a critical-care patient and reach a genetic disorder diagnosis the same day.

- Nvidia AI is delivering conversational AI solutions, AI avatars for restaurants, and powering autonomous vehicles.

- Nvidia Clara Holoscan helps visualize microscopy images of living cells in real time to help detect rare biological events instantly.

- Announced a broad initiative to evolve Universal Scene Description (“USD”), the open-source and extensible language of 3D worlds, to become a foundation of the open metaverse and 3D internet.

Platform – Product That Is Superior, Breeds Expansion, And High Switching Costs

For a company to create an effective platform or ecosystem of solutions it has to be great at innovation and delivering superior products. The company must also have a well thought-out vision from an R&D perspective that creates additional value for customers when they adopt more of a platform or ecosystem.

If the company is in software and does this effectively, they should have high net revenue retention rates. If the company is in hardware, then their customer base will progressively add more hardware devices to deliver better performance and a connected experience. This is not an easy feat to accomplish, so companies that do this typically have the best engineering talent in their industry.

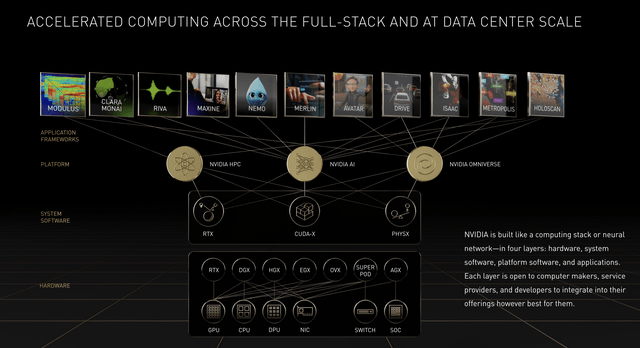

Nvidia Accelerated Computing Platform ( Nvidia Corporate Presentation)

Nvidia transformed massively from being a graphics card company in 1993 to now being the first ever full acceleration computing company with CPUs, GPUs, DPUs, and AI software. They are now delivering such performance increases in their new chipsets that come out every 18 months that is pushes customers to have to upgrade, because they do not want to fall behind their competition in this space.

The Nvidia ecosystem is best described by the company as a:

“computing stack or neural network-in four layers: hardware, system software, platform software, and applications. Each layer is open to computer makers, service providers, and developers to integrate into their offerings however best for them.”

The Nvidia ecosystem is an open one, meaning it works with many other partners and competitors solutions for their customer base. The customer has free choice as to what inside the Nvidia ecosystem they will utilize or build upon, but Nvidia has created this platform in such a way that the software runs best on Nvidia hardware. This is beneficial to customers but also Nvidia itself, as this drives more revenue, expansion in to the Nvidia ecosystem, and ultimately creates higher switching costs for customers.

In my opinion, Nvidia easily checks this second P of the stock scoring system.

Positive Free Cash Flow Or Profitable

Companies that are generating profits or free cash flow or both, are able to continue to reinvest in their innovation and growth with that cash. This can accelerate the lead they have against competitors in their industry. Also, when the macroeconomic scene is faced with inflation and other turbulent situations like we are experiencing now, the market leans closer to stocks that are profitable. Now currently the market is shying away from all growth stocks due to continued rate hikes and inflation globally. The semiconductor industry has been hit the hardest, and one of the reasons is all the tensions between China and Taiwan, and the Russia and Ukraine war.

So you may be saying right now, “Why would I ever buy Nvidia stock in this market as it has been declining 63% YTD and continuing to currently decline?” The reason I have purchased Nvidia stock in this environment is because it is times like this for long-term investors that you make your greatest returns on high quality growth stocks that are financially healthy. A financially healthy company does not have to slow down on their R&D spend if they are generating free cashflows and profits.

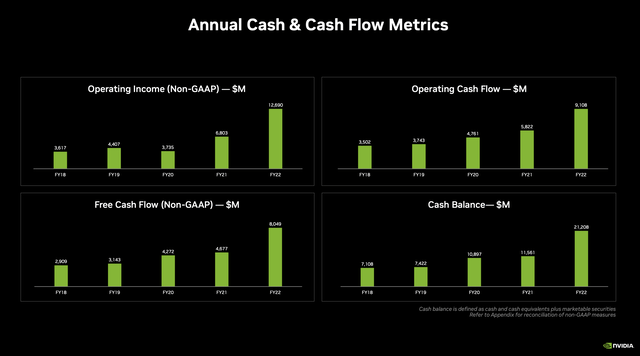

The below image says enough for me on Nvidia getting the fourth P checked in my stock scoring system. If you want more financial proof that Nvidia is generating positive free cash flows and is profitable, you can check out the stock page on Seeking Alpha.

Nvidia Corporate Investor Presentation

Proven Financial Sustainability And Strength

If a company is checking the first four P’s in the scoring system, then they most likely will check the 5th and final P (Proven Financial Sustainability and Strength). The longer a company can compound free cash flows, profits, and high revenue growth, the easier it is for them to build a financial durability for the long-term. The larger the cash pile the company has the more flexibility they gain on how they want to grow the business and defend it against the competition. Some companies choose to eventually pay out a dividend to reward shareholders for holding their stock and demonstrates they are healthy enough to do so consistently. This may be the case for stocks that pay a dividend but depending on the company it may also signal they don’t have any innovation left to reinvest in the business.

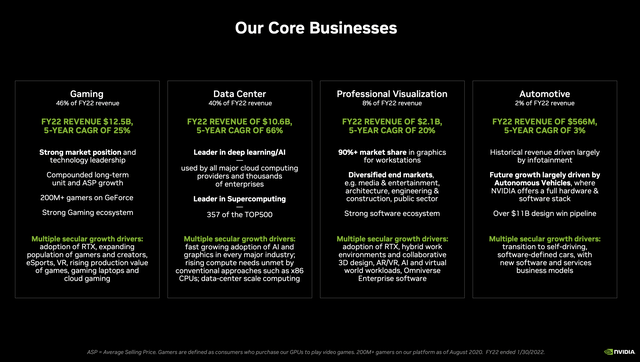

The image below illustrates the exception long-term performance of their four core businesses. Nvidia’s balance sheet and stock returning performance over the last 10 years has proven financial sustainability and strength of this stock and company.

The Final Score For Nvidia And What We Can Learn From The Results

I will begin by reminding you this scoring system is subjective and not full-proof by any means, but it should help investors understand their potential stocks more thoroughly.

Nvidia is one of the elite companies that earn a perfect score on my “5P Stock Scoring System,” and my money is where my mouth is, as this is my number one portfolio holding at 20% weight. In the short term, it has been volatile but in the long term I believe it will continue to compound and reward myself and other shareholders.

A company doesn’t have to check all 5Ps to be a successful investment, but if they do check all five, you should have earned some conviction in the stock after all that qualitative and quantitative research. You also may have found a successful and compounding machine that will be around for many years in the market. For me if a stock checks all five Ps, I will invest in it, especially if it is a tech stock.

Please let me know what you think about Nvidia and my 5P Stock Scoring System. If this article was helpful in any way, please share it with others on your social media platforms. My goal is to continue to provide educational, helpful, and entertaining content on investing to help others realize they too can create wealth by investing in the stock market.

Be the first to comment