Hirkophoto/iStock via Getty Images

In The Lead

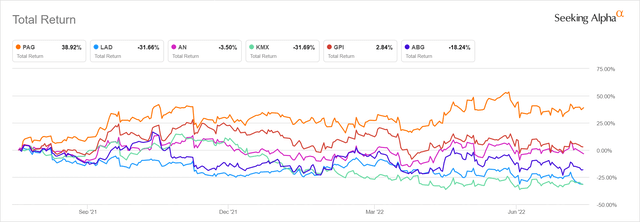

Penske Automotive Group (NYSE:PAG) stock continues to outperform, leading its competitors and delivering a positive total return this year. Since my last review, the stock hit all-time-highs above $120 in June before settling out around the $110 level.

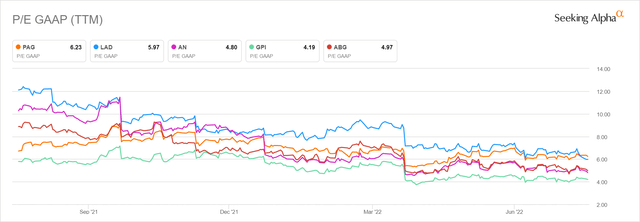

Since I noted Penske’s relative cheapness over a year ago, the market has come to appreciate the company’s diversification with truck sales and leasing, international operations, and plans to grow traditional dealerships and used car superstores. PAG has gone from second cheapest of the group to highest-valued on a P/E basis as it avoided the multiple contraction of its peers.

Penske also leads the group in returning capital to shareholders. In June 2022, the company ended its unusual dividend policy of increasing the payout by $0.01 per share each quarter only to instead raise it $0.03 each quarter. With a $0.53 payout scheduled for 9/1/22, PAG would have a forward yield of 2.1% if it keeps following the same policy. On top of that, Penske has reduced share count by 6% in the past year through buybacks and still has $330 million of buybacks outstanding. This would reduce share count by another 4% when completed.

Despite all this good news, hazardous conditions have been spotted on the racetrack in the form of a coming economic slowdown. In racing terms, that means a yellow flag is in effect and the cars have to slow down and stay in line until the track is cleared. Penske is in a great spot as the lead car but won’t resume making substantial progress until a green flag is present.

To put it more directly, Penske has benefitted from strong demand, delivering high margins despite supply constraints. The entire industry could now see weakening demand from an economic slowdown even as some of the supply constraints are relieved. This would be a double whammy to profits, putting an end to the rapid growth of 2020-21. Penske remains in good shape to make it through a recession, but the stock will likely get hit along with the rest of its peers. PAG is a good long-term hold, but better prices will be available further into a downturn for those who want to buy.

Slowing Down

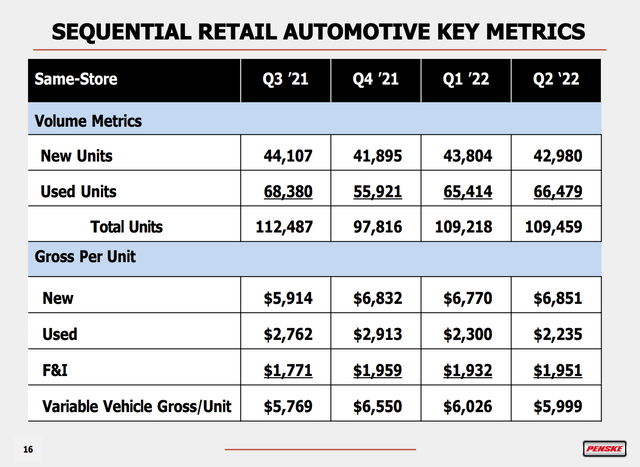

Penske sold 132,000 cars in their auto dealerships in 2Q 2021. Since then, volumes have come off considerably on a same-store basis as a result of supply issues. Even adding in about 6,000 cars sold from new dealerships only gets total sales up to 115,000 which is still lower than a year ago. Fortunately, high demand for new cars allowed the company to achieve higher gross margin per unit on new car sales as well as financing and insurance.

Penske Automotive 2Q 2022 Earnings Slides

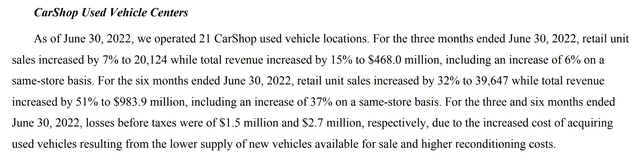

Used car gross margins have been declining however, also due to low supply as fewer new car sales means fewer used car trade-ins. In fact, the CarShop used car superstores, which were supposed to be a growth engine for the company, have produced slight pre-tax losses so far this year.

Penske Automotive 2Q 2022 Earnings Release

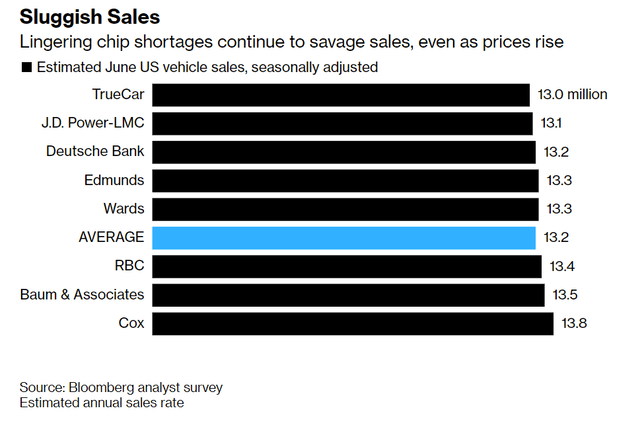

Supply chain issues continue to drive down the forecast for industry sales in 2022. Annualized US new car sales estimates based on June results averaged 13.2 million, compared to over 17 million in the 2015-2019 period.

For the full year, Cox Automotive forecasts slight improvement to 14.4 million, but that was reduced from an earlier estimate of 15.3 million. Many supply problems are expected to be resolved by 2023, but a demand decline lurks on the horizon. Higher prices and higher interest rates will impact affordability while a recession would limit discretionary spending.

Diversification And Other Advantages

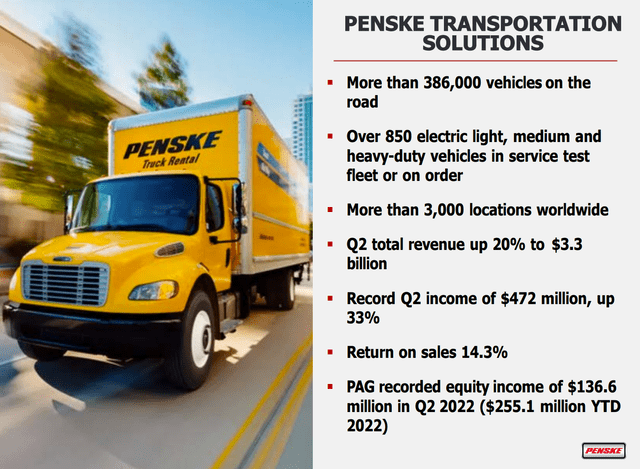

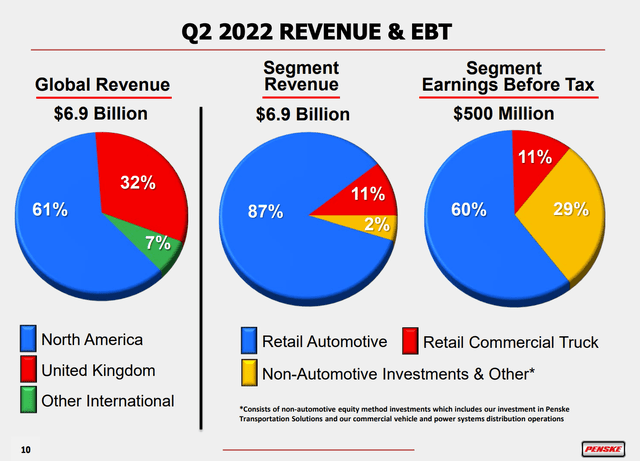

While Penske faces the same industry headwinds as its car sales peers, the company is unique with its diversification into other businesses. The company’s commercial truck dealerships contribute only about 11% of Penske’s pretax earnings but have been growing better than the auto business lately. Gross profit of the truck dealerships is up 18.9% on a same-store basis and 32.4% overall with the biggest contributor being the service and parts business.

The truck leasing business (PTS) is another business unique to Penske, PAG owns 28.9% of PTS and accounts for its share of PTS income by the equity method. This income now is up 33% from last year and makes up over a quarter of PAG’s pretax earnings.

Penske Automotive 2Q 2022 Earnings Slides

In addition to the business diversity, Penske has geographical diversity with 32% of revenue coming from the UK and 7% from other non-US locations including a truck and engine distribution business in Australia. Foreign currency effects happened to be a drag on earnings this quarter but can become a tailwind when the dollar weakens, or national economies recover at different rates.

Penske Automotive 2Q 2022 Earnings Slides

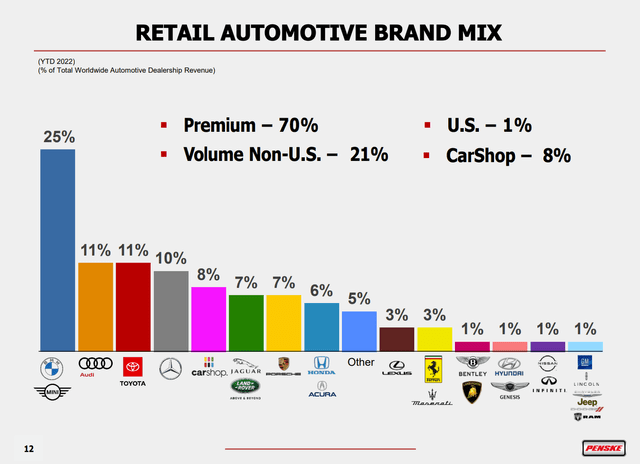

Another advantage Penske has is its luxury brand mix. This could prove advantageous in a recession, where high-income consumers are least affected.

Penske Automotive 2Q 2022 Earnings Slides

Capital Management

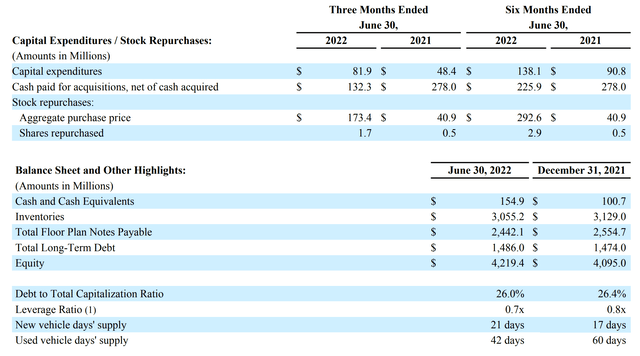

The cash flow statement is not available as the 10-Q is not out yet, but Penske managed to build its cash balance in the first half of 2022 from $101 million to $155 million. Capex plus acquisitions were similar in value in the first half of 2022 as last year. Buybacks increased by more than $250 million. The company would probably like to increase its inventory of autos, but supply constraints have kept these low at only 21 days of new car sales (12 days in the US and 32 in the UK) and 42 days of used car sales. As a result, total inventory in dollars is slightly lower than at the start of the year despite the higher car prices. Long-term debt is little changed this year and leverage is low at 0.7x EBITDA. Floor plan debt is down $113 million.

Penske Automotive 2Q 2022 Earnings Release

Looking forward, Penske should be able to maintain its best in class growing dividend but increasing inventory levels back to normal would cause a draw on cash or an increase in floor plan debt. Higher floor plan debt combined with higher interest rates would increase total interest expense. Nevertheless, with leverage currently about the lowest of its peer group, Penske has room to increase debt if needed without hurting its credit rating.

Conclusion

The relative valuation of Penske Automotive stock has increased over the past year to reflect the company’s growth, diversification and balance sheet strength compared to peers. This has showed up in the share price as well, with PAG the only one of its peers showing a significant gain over the past year. The valuation still looks cheap at a trailing P/E of 6 but this reflects concerns about peaking sales and margins as a recession appears to be on the way just as supply constraints could be ending.

Penske is in the lead as the yellow flag is about to come out. Its strengths should allow it to keep this lead but the debris on the track from an economic downturn will slow everyone down. While Penske is a well-run company, the stock could take a hit in a recession allowing new buyers to get in at better prices.

Be the first to comment