Justin Sullivan/Getty Images News

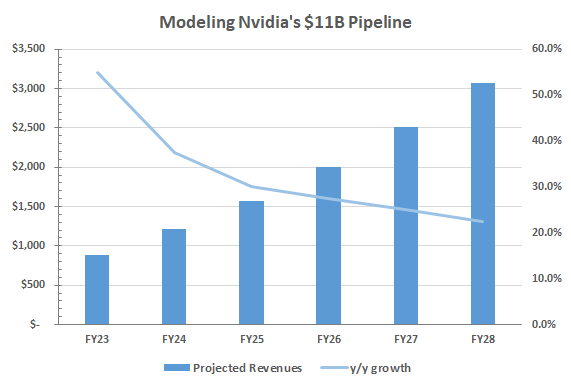

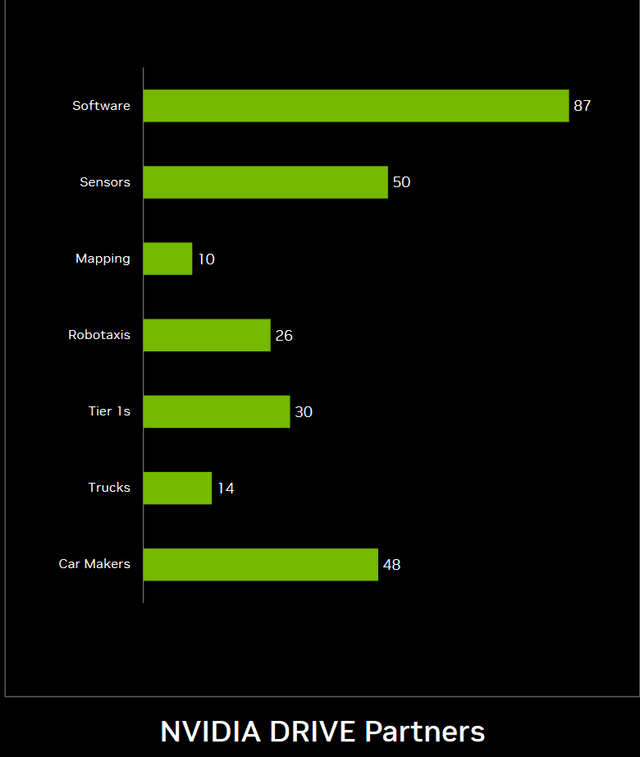

Chip and AI giant Nvidia (NASDAQ:NVDA) is at the helm of the software-defined shift in semi-autonomous to autonomous vehicles, with a range of products and an expanding list of customers and partners supporting long-term growth in the segment. Nvidia has highlighted autonomous driving as one of five “tremendous” forces driving growth — its auto pipeline currently exceeds $11 billion over the next six years. With automotive products first released in 2016, and the adoption of semi-autonomous and fully-autonomous vehicles still in the very early innings, Nvidia’s automotive pipeline looks poised for substantial long-term growth and contribution to revenues over the course of the decade.

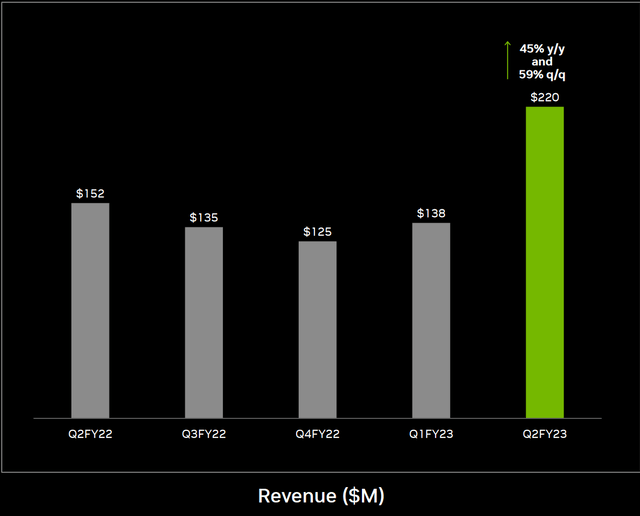

Automotive Shines In A Challenging Q2

Although not yet a significant contributor of revenues at just 2%, Nvidia’s automotive segment showed outstanding growth metrics in an otherwise challenging second quarter.

Nvidia noted that Q2 shaped up as an “inflection point” for Automotive segment revenues, with “strong growth” driven by AI cockpit solutions and self-driving revenues from NEV design wins ramping into volume production. New rollout plans, new vehicles from XPeng (XPEV), NIO (NIO), Li Auto (LI), Baidu (BIDU) and Geely’s (OTCPK:GELYF) JV JiDU, Human Horizons, and others also pave the way for more growth in 2H and beyond. In addition, AV fleet data processing in Data Center ops was among the “key workloads” driving that segment’s revenues +61% y/y.

In terms of revenues, the segment surged 45% y/y and 59% q/q to $220 million, breaking a weaker period of revenues over the trailing twelve months. For 1H, revenues topped $358 million, just about 15% shy of the $412 million generated from Q2 ’22 to Q4 ’22.

Moving forward to Q3 and Q4, growth in the intelligent, connected vehicle industry and scaling of autonomous driving plans from partners such as Pony.ai in China support further sequential growth in revenues. Nvidia believes that the segment can generate sequential growth through the back of the year — but where does that put the segment?

At ~12% sequential growth, a substantial slowdown in pace from Q2’s surge, revenues for Q3 and Q4 would reach $246 million and $276 million. In that scenario, 2H revenues would approach $493 million; for FY23, revenues would approach $880 million, or approximately +55% y/y growth.

As such, Nvidia is on track to record its best year for its automotive business. Revenues approached the $700 million mark in FY20, and are now on track to close in on $1 billion, driven by new vehicle launches, AI cockpit solutions for OEMs such as Hyundai (OTCPK:HYMLF), and growth in intelligent vehicles/EVs equipped with Nvidia tech from leading OEMs including Tesla (TSLA), Mercedes (OTCPK:MBGAF), and others.

Is $1B Possible For FY23?

Given that ~15% q/q growth in both Q3 and Q4 takes revenues in the automotive segment to $900 million, reaching $1 billion in automotive revenues for FY23 is not necessarily impossible, but it would be particularly challenging.

In order to reach $1 billion in revenues for FY23, Nvidia would need ~28% q/q growth in Q3 and Q4 (for revenues of $282 million and $360 million). While ~28% q/q growth seems like a difficult figure to deliver, it’s a lower dollar amount than the sequential growth from Q1 to Q2. In addition, new vehicle ramps from multiple manufacturers, primarily in China, could support growth to this degree — NIO’s ES7 has just launched while the ET7 is still scaling, Human Horizons just partnered to deploy DRIVE Orin on its HiPhi Z for launch in late 2022, while XPeng’s G19 is scheduled for launch this week.

If the segment fails to reach $1 billion for FY23, revenues should easily eclipse $1 billion by FQ2 2024 on a trailing twelve-month basis, given the projection of ~$493 million in segment revenues for 2H. As such, the segment is shaping up to be Nvidia’s next multi-billion opportunity.

Autonomous Driving Opportunity

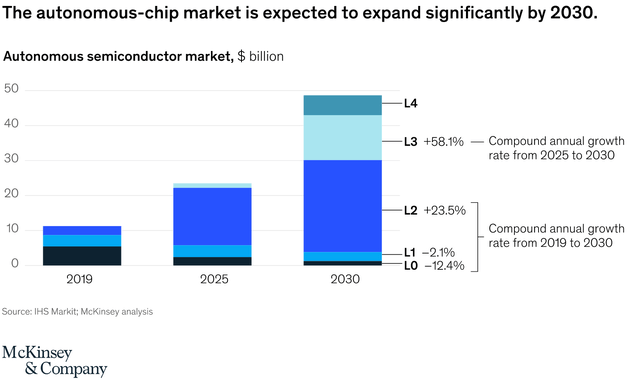

The autonomous driving industry, from semi-autonomous ADAS to fully-autonomous robotaxis and trucks, presents a long-term, multi-billion dollar opportunity up for grabs.

BloombergNEF’s 2022 EV outlook projected that China “will operate the world’s largest robotaxi fleet with about 12 million units by 2040, followed by the US which operates around 7 million autonomous vehicles.” In total, robotaxi fleets are likely to be in excess of 22 million, considering that other nations aside from the US and China are developing AV plans.

Although market reports vary on the outlook for the industry, Allied Market Research projected the autonomous vehicle industry to rise at a ~40% CAGR from $76 billion in 2020 to $2.1T in 2030; Precedence Research forecast a 39% CAGR from $94 billion in 2021 to $1.9T in 2030. Again, the accuracy of these forecasts may vary depending on the pace of autonomous vehicle development, commercialization, and policy support, and may not be realized.

Even so, powerful AI and autonomous driving chips like Nvidia’s are crucial in order to spur the autonomous vehicle market to such strong growth over the course of the decade. For Nvidia’s case, the autonomous chip market is expected to witness substantial growth, from ~$11 billion in 2019 to nearly $50 billion by 2030, with L3-tailored semiconductors witnessing a nearly 60% CAGR to ~$10 billion market size, while L2 remains the largest segment.

Aside from AV developers and OEMs developing chips in-house, such as what previous-Nvidia customer Cruise (GM) recently chose to do, Nvidia faces competition from Qualcomm (QCOM), Mobileye (INTC), and Renesas (OTCPK:RNECY) among others. Qualcomm represents a major threat to Nvidia gaining market share and entrenching itself as a dominant force in the ADAS/AD chip market as Qualcomm’s Snapdragon platform commands a ~$19 billion auto pipeline.

Long-Term Growth Potential: 2027 (FY28) Estimates

Nvidia continues to grow its automotive pipeline, and the $11 billion in design wins over the next six years paves the way for the automotive segment to increase its revenue mix and contribute to Nvidia’s top line. While Q2 showed an inflection in revenues with strong y/y and q/q growth, Nvidia has to translate such growth into a meaningful long-term acceleration.

With ~55% y/y growth projected for FY23 to ~$880 million in a bull case scenario, revenue growth rates are projected to decline slightly moving forward. Continual revenue growth at ~55% y/y moving forward is likely unattainable and unreasonable; forecasting for ~42% y/y growth in FY24 represents an average quarterly revenue of ~$300 million. Growth from leading Chinese EV manufacturers, Polestar (PSNY), and others can drive growth.

By FY26, Nvidia is projected to witness ~32% y/y growth based on multiple new vehicles/platforms coming to market in 2025 from Hyundai, Jaguar (STLA), Mercedes, BMW (OTCPK:BMWYY), JiDU, as well as volume growth from the aforementioned OEMs as well as Polestar and Tesla, among others. Revenues are projected to reach $2 billion for the segment by FY26. Under this projection, Nvidia is forecast to see automotive segment revenues grow by a ~37% CAGR from FY22’s $566 million, taking the segment to Nvidia’s second-fastest-growing behind Data Center.

Author calculations

FY28 would wrap up Nvidia’s current $11 billion pipeline, but it is highly likely that the pipeline will continue to grow — there are already multiple leading OEMs — Hyundai, Mercedes, Jaguar, etc. — adopting Nvidia’s tech and chips in 2024 and 2025, and with the launch of DRIVE Atlan, more lucrative opportunities may arise in the fully-autonomous sphere. As such, long-term projections could see more acceleration and higher growth than projected from intelligent vehicle volume growth, increased OEM adoption, and new product launches. However, stiff competition from Qualcomm and presence in China could serve as long-term headwinds and prevent meaningful revenue acceleration in the long run.

Nvidia has a substantial partner base to build off of to support long-term growth. As ADAS adoption and ADAS-equipped vehicle production increases, sensor partners are likely to increase, given that a majority of leading OEMs rely on a sensor suite including lidar, radar, and cameras for semi-autonomous functions. Mapping is relatively new, and a new mapping platform is scheduled for launch in 2024 to cover over 300,000 miles in Europe, Asia, and North America to aid AV operations and testing. As such, both mapping and robotaxi partners could increase, especially once the >1,000 TOPS DRIVE Atlan comes to market in 2025.

To recap, Nvidia is on the verge of capturing a multi-billion dollar opportunity in the autonomous driving industry, with projected growth rates taking its automotive segment to its second-fastest-growing on a CAGR basis by FY26 at ~37%. By then, Nvidia is projected to reach $2 billion in revenues for the segment. Such acceleration and strength in the segment could see automotive’s revenue mix increase from ~2% to about 5% in just three years.

China AI Chip Ban – Any Effects?

Aside from competitive risks, geopolitical tensions could serve as a headwind in the future.

US officials recently ordered Nvidia and rival AMD (AMD) to halt AI chip sales to China, with Nvidia explaining that the ban concerned risks that chips find a military end-use. Nvidia “said the ban, which affects its A100 and H100 chips designed to speed up machine learning tasks, could interfere with completion of developing the H100, the flagship chip it announced this year.”

China represents a large opportunity for Nvidia’s automotive segment, not just due to its wide range of partnerships and long-term vehicle volumes from NIO, XPeng, Human Horizons, JiDU, and others, but also due to China’s acceleration of autonomous vehicle development. Over the next three to five years, China is aiming to accelerate autonomous vehicle commercialization and operations, with Baidu’s Apollo Go demonstrating the growth potential — it aims to scale from 10 cities to 65 by 2025, adding tens of thousands of AVs to its fleet.

However, Nvidia’s autonomous driving opportunity and sales to Chinese OEMs appears safe for now. Bevin Jacob, a partner at Shanghai consulting firm Automobility, said that there “shouldn’t be any restrictions on Xavier and Orin, and XPeng, NIO and others would continue to ship with those chips.” Yet there is no guarantee that restrictions could change, leaving the Chinese subsegment particularly exposed to the downside.

Outlook

Nvidia’s automotive segment looks to have reached an inflection, finding strength in AI cockpits, self-driving, and semi-autonomous/ADAS offerings. Revenues soared in Q2, and further growth places the segment near $880 million by the end of the year in a bull case. With an $11 billion automotive pipeline over the next six years, with multiple leading OEMs launching new vehicles and platforms incorporating Nvidia’s auto solutions from 2023 to 2025, the long-term growth potential appears substantial. Initial projections based on Nvidia’s current pipeline forecast ~$2 billion in revenues by FY27, bringing the segment up to ~5% of revenues on the backs of a 37% CAGR from FY22. Growth in the autonomous driving, autonomous chip, and ADAS markets are pushing Nvidia’s automotive sector to be its next fast-growing multi-billion dollar opportunity.

Be the first to comment