Arthit Pornpikanet/iStock via Getty Images

It’s been a little over 4 months since I wrote my latest “avoid” piece on nVent Electric plc, (NYSE:NVT) and in that time, the shares have returned a loss of ~6.7% against a loss of about 10.7% for the S&P 500. This drop in price has me intrigued, because the shares may now represent great value. The company’s released financial statements since, so I’ll review those, and I’ll also look at the stock as a thing distinct from the underlying business. I’m also absolutely champing at the bit to write about my latest options trade here, so get ready for some industrial grade bragging. I’ll offer a trade idea for new people to consider here.

Welcome to the “thesis statement” portion of the article. This is for people who want a little bit more than a title and a few bullet points, but may want far less of my writing. I can understand that, because even I feel a bit put off after I revisit it. So, for the people who want much more, and much less, I present my thoughts in a summary paragraph. I think the latest financial performance has been underwhelming. The fact that ongoing costs like cost of goods sold, SG&A etc. are well above trend is concerning, and I don’t like the fact that the capital structure has deteriorated significantly. In spite of this, the shares are even more expensive now than they were when I last reviewed this name. That said, I determined before that the dividend is reasonably secure, and nothing’s happened to change my views on that front. For that reason, I’d be willing to buy, but not at current prices. Enter put options. I wrote August puts with a strike of $25 already, so I won’t enter a short put trade until these expire worthless or are exercised. For people just joining us, though, I think February 2023 puts with a strike of $25 offer a great yield at the moment. After all, we may as well get paid to wait for the price to come into our buy zone.

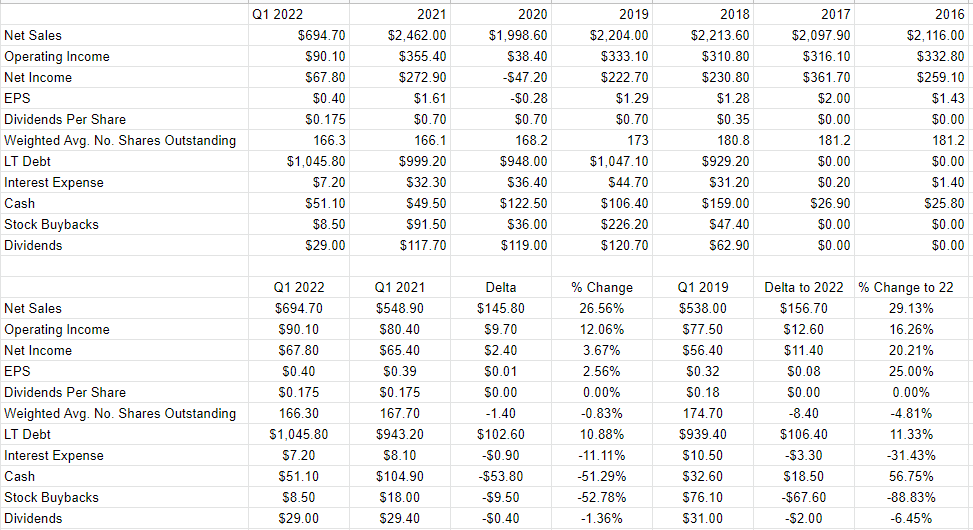

nVent Electric Financial Snapshot

I’ve written at length previously about the longer term financial performance, and why I think the dividend is reasonably secure here, so if you’re interested in that, please see my earlier work on this name. I’m not overly impressed by the most recent financial performance here. Although revenue during the first quarter of the year was about 27% higher than it was the same period last year, net income was up by only 3.7%. Net income didn’t manage to keep pace with revenue growth because COGS, SG&A, R&D, and provision for tax were up 31.6%, 21%, 33.3%, and 130% respectively. In other words, the relatively sclerotic net income growth is largely a function of the growth of ongoing costs like selling and administrative expenses.

In addition, the capital structure is worse today than it was a year ago. Long term debt is about $102 million higher, and cash is down about 51%. In the face of this, the company, probably wisely, kept the dividend constant.

In order to work out whether or not 2022 is anomalous, I looked at the costs for each year of this company’s short financial history. It seems that the elevated cost structure of 2022 is a standout. For instance, COGS, in 2022 were 35% higher than they were in 2018, 36% higher than they were in 2019, and, as I wrote above, they’re 31.6% higher than they were in 2021. This indicates to me that the company may have shifted into a permanently higher cost structure. It’s not certainly the case, but it’s something we should keep an eye on as time progresses.

In spite of all of this, I think there’s value here, and I’d certainly be willing to buy the stock at the right price.

nVent Electric Financials (nVent Electric investor relations)

The Stock

I’m fascinated by the glitch in human memory that creates the feeling of deja vu. I’m so into this phenomenon that I try whenever possible to create a cheap simulacrum of that feeling by being repetitive. My tendency to repeat myself, and “drone on” about things has less of a positive impact on friends and family than you might expect. Anyway, I mention that as a bit of a warning-preamble because I’m about to indulge in this tendency again. If you’re one of my regular readers, you know that I consider the “business” and the “stock” to be very different things. If you’re new to my stuff, I’ll let you know now. I consider the “business” and the “stock” to be quite different things. Here’s what I mean. Every business buys a number of inputs, performs value-adding activities on them and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. It’s also possible that the stock’s movements relate to the crowd’s view about “the market” in general, and have very little to do with what’s going on at the company. So, in some sense, the stock is “doubly buffeted” by the crowds’ rapidly changing views about a given company, and the crowd’s rapidly changing views about the overall stock market, the overall economy etc.

In some ways this is tiresome, because if the stock’s price is really the present value of all future cash flows (it is), then it shouldn’t bounce around in price so much. While this is tiresome, it’s also potentially profitable, because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations.

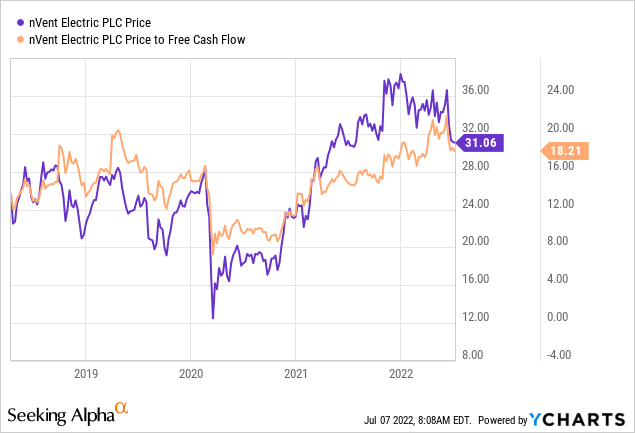

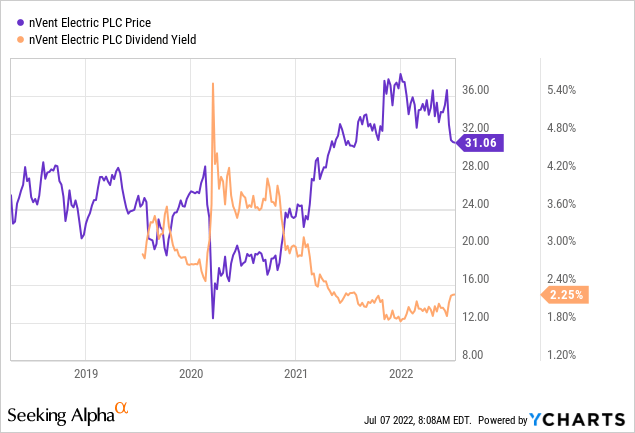

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. Previously, I decided to eschew these shares because they were trading at a price to free cash flow of ~17.2 times, and sported a near record low dividend yield of about 2%. Fast forward to the present, and we see that, although the dividend yield is a bit higher, the shares are actually about 6% more expensive, per the following:

Thus, to repeat myself as I often do, the shares are “cheaper, but not cheap enough.” For that reason, I must recommend continuing to avoid this name.

Options Update

I’d like to take this opportunity to brag a little bit. Although I didn’t want to buy the shares at the then price of $33.40, I was quite comfortable buying at $25, so I wrote 10 August puts at that strike price for $.45 each. Though the stock has dropped in price, these last traded hands at $.30, so I think this trade’s worked out well so far. I think the chances are fairly good that these will expire worthless, so I’ll add this $.45 to the $1.45 per contract premia that I’ve already earned selling puts on this name. Now that the shares have come down a bit in price, it’s time to think about new trades for people just joining this party. While I won’t sell any puts until my current crop expires (or doesn’t), I think people who are just joining us have the opportunity to earn some decent premia for taking on the obligation to buy this company at a very decent price. Before continuing, I want to comment on the language used by options traders. It’s true that if the short put writer would be “obligated” to buy a given stock at a given strike price that they pre-selected. I think the word “obligated” is a bit weighted in this context, because I think being exercised in this way would result in a positive outcome. We can use “obligated” in this context, in the same way that in very different circumstances we might be “obligated” to go to dinner with a charming Hollywood starlet or similar. Obligations can also be pleasant.

With all that in mind, if I were just coming to this trade today, I’d sell the February 2023 puts with a strike of $25. These are currently bid at $.90. So, if the shares remain above $25 over the next several months, the investor will simply pocket this premium, which is a “win” in my estimation. If the shares fall in price, the investor will be obliged to buy, but will do so at a price that locks in a current dividend yield of ~2.8%, which I would also characterize as a “win”. This is why I describe these trades as “win-win.”

Now that you’re hopefully excited by the prospect of a “win-win” trade, we come to the portion of the article where I get to indulge in my semi-sadistic tendency to pour ice water all over this dinner party by writing about risk. This trade, like all others, comes with risk. I consider the risks associated with put options the way I trade them to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts because they sport a high premium. This strategy leads to disastrous results. Take my word on this one, as it’s informed by some painful experience.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that nVent’s stock price closes out the year at $40 per share. Obviously, puts will expire worthless, which is a great outcome in some ways, but put writers don’t catch any upside in the stock price. So, short put returns are capped by the premium received. This hints at the “low risk, low return” nature of put options.

Secondly, it can be emotionally painful when the shares crash below your strike price. As of this writing, whenever this has happened to me, things have worked out well over the long term, because I insist on only ever writing puts at “screaming buy” strike prices. That said, it has been emotionally stressful in the short term on occasion. If you’re going to sell puts, please be aware of the way that they can play with your emotions.

If you understand these risks and can tolerate them, I would recommend that you sell the puts described above. Whatever happens, you’ll collect a decent risk adjusted return, and in my experience, “risk adjusted returns” are what this investing business is all about.

Conclusion

In spite of the negative trends appearing all over the financial statements recently, I still think there’s value here, as long as the investor can buy at the right price. The problem is that we’re nowhere near the right price yet, and so I must continue to avoid the name. This puts investors on the horns of a dilemma: they can sit around and wait for shares to drop in price (BORING!) or they can generate some income by selling people the right to “oblige” them to buy at a price they find attractive. If I were not already “on the hook” to buy 1,000 shares at $25 between now and August, this is what I’d do. Further, if and when my options expire in August, this is exactly what I’ll do again if circumstances warrant. For people just joining this party, I think this is the most sensible approach. Rather than earn nothing, you may as well pocket some money for taking on the obligation to buy this business at an attractive price.

Be the first to comment