Spencer Platt/Getty Images News

Elevator Pitch

I raise my investment rating for Robinhood Markets, Inc.’s (NASDAQ:HOOD) shares from a Sell to a Hold. HOOD’s shares have fallen by -84.7% since my earlier article for the company was published on August 10, 2021. I had previously assigned a Sell rating to Robinhood Markets in view of its demanding valuations and regulatory risks.

I upgrade HOOD from a Sell to a Hold now. I think that positive news with respect to potential collaborations or M&A transactions with FTX and an improvement in the company’s future financial performance could lead to a recovery in Robinhood Markets’ share price. But HOOD is not a Buy, as the company has yet to prove that it can diversify its revenue in the long run.

Why Has Robinhood Stock Dropped Below $10?

HOOD’s shares first dropped below the $10 price point on April 27, 2022 closing at $9.51 at the end of that trading day. While Robinhood Markets’ stock price has rebounded above $10 subsequently, its shares have remained below the $10 mark since the beginning of June 2022 as per the chart below.

Robinhood Markets’ Share Price Performance In The Past Six Months

Seeking Alpha

The main reason for HOOD’s poor stock price performance is weak investor sentiment which has led to a lower appetite for risk-taking and lower trading volumes. The CNN Business Fear & Greed Index, which is arguably the most well-known measure of investor sentiment, suggests that investors have gone from “Fear” to “Extreme Fear” in the past month.

In the next section, I highlight how Robinhood Markets’ financial and operating performance have been affected by this change in investor sentiment.

HOOD Stock Key Metrics

HOOD’s operating and financial metrics are a good reflection of the weak market environment and its impact on the company.

According to the company’s Q1 2022 financial results media release issued on April 28, 2022, Robinhood Markets’ monthly active users or MAUs contracted by -10% QoQ to 15.9 million in the first quarter of this year. More significantly, this represents a -25% decline from HOOD’s peak quarterly MAUs of 21.3 million recorded in the second quarter of 2021.

Another key operating metric is Net Cumulative Funded Accounts which hasn’t seen much growth on a QoQ basis in the past few quarters. HOOD’s Net Cumulative Funded Accounts were 22.8 million, 22.7 million, 22.4 million and 22.5 million, for Q1 2022, Q4 2021, Q3 2021, and Q2 2021, respectively.

Robinhood Markets’ Definition Of Net Cumulative Funded Accounts

HOOD’s Q1 2022 Results Press Release

Robinhood Markets’ key financial metrics for Q1 2022 weren’t good as well.

HOOD’s top line decreased by -43% YoY and -18% QoQ to $299 million in Q1 2022, and this turned out to be -16% lower than what Wall Street analysts were initially anticipating. The company’s net loss per share of -$0.45 for the most recent quarter was also much wider than the market’s consensus bottom line forecast of -$0.36 per share.

I discuss in the subsequent section whether there are any catalysts that could help to re-rate HOOD’s shares in the short term.

Can Robinhood Stock Go Up Again?

I think Robinhood’s stock has a good chance of going up again in the near term, assuming that two key catalysts materialize.

The first catalyst is the improvement in HOOD’s financial performance in subsequent quarters.

Robinhood Markets is in a good position to earn higher net interest revenues and benefit from a slower rate of increase for the company’s expenses going forward.

In its FY 2021 10-K filing, HOOD highlighted that it generates interest revenue from “securities lending transactions”, “margin loans to users”, and “cash, cash and cash equivalents, and deposits with clearing organizations.” Net interest revenues contributed 14% of Robinhood Markets’ top line for fiscal 2021. In a rising rate environment, the increase in HOOD’s net interest revenues could help to partially offset the expected decline in transaction-based revenues.

Separately, Robinhood Markets lowered its full-year FY 2022 operating cost growth guidance from +15%-20% previously to +2%-5% when it announced its Q1 2022 financial results in late-April. This is largely driven by HOOD’s recent plans to cut its staff strength by approximately -9%.

In summary, a larger-than-expected increase in net interest revenues and a slower-than-expected rate of increase in its operating expenses might help Robinhood Markets to deliver above-expectations results in the financial quarters ahead.

The second catalyst relates to the potential synergies or corporate actions that could arise as a result of a new substantial shareholder.

Seeking Alpha News reported earlier on May 12, 2022 that “Emergent Fidelity Technologies Ltd, a company whose sole owner is FTX founder Samuel Bankman-Fried, reported owning 56 million shares (or 7.6% equity interest) in” HOOD. A recent July 7, 2022 Reuters article referred to FTX as “one of the largest cryptocurrency exchanges”, and quoted FTX founder Samuel Bankman-Fried saying that “he and his company still have a ‘few billion’ on hand to shore up struggling firms.”

According to a Bloomberg report cited in a June 27, 2022 Seeking Alpha News article, FTX is considering the acquisition of Robinhood Markets. Previously, analysts from Citigroup (C) have estimated that HOOD could be valued at $15 in a M&A scenario as compared to its last traded share price of $8.63 as of July 6, 2022. Even if a potential acquisition of HOOD doesn’t materialize, it is possible that Robinhood Markets and FTX could collaborate on various projects and initiatives in the future. FTX has recently ventured into equity trading in the US; while cryptocurrencies accounted for about a quarter of HOOD’s Q1 2022 transaction-based revenues.

In a nutshell, I see Robinhood Markets’ share price rising again in the near future, driven by better-than-expected financial performance in the next few quarters, and positive news flow relating to either partnerships or M&A with FTX.

Is Robinhood A Good Long-Term Stock?

I don’t view Robinhood Markets as a good long-term stock yet.

In my prior August 10, 2021 update for HOOD, I noted that Robinhood Markets’ “revenue model, which relies heavily on Payment For Order Flow or PFOF, is a problem because this raises its regulatory risk profile and does not create value for its users despite being commission-free.” I still have the same concerns.

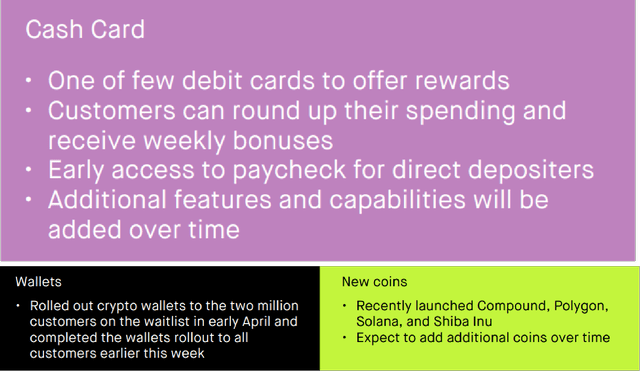

On the positive side of things, HOOD is putting in the effort to diversify its revenue streams. These include the introduction of new products such as the Robinhood Cash Card, crypto wallets and new coins in March and April 2022 as detailed below.

New Products And Services Launched By HOOD

HOOD’s Q1 2022 Results Presentation

Revenue diversification is both about new products and new customers. HOOD has traditionally been associated with risk-taking traders, but this could change in the future. According to a June 13, 2022 Piper Sandler sell-side research report (not publicly available), Robinhood Markets participated in Piper Sandler’s recent 2022 Global Exchange and FinTech Conference and revealed that it is “working in areas like retirement accounts and other products” as part of plans “servicing passive and long term investors.”

Transaction-based revenues accounted for as much as 77% of HOOD’s top line in FY 2021 as per its 10-K filing. While Robinhood Markets is moving in the right direction with its plans to generate new revenue streams, it is far too early to conclude whether HOOD will be successful.

Is HOOD Stock A Buy, Sell, or Hold?

I rate HOOD stock as a Hold. There is a high probability that Robinhood Market’s shares might see a rebound in the short term, but HOOD isn’t a good long-term investment candidate because it is still very reliant on transaction-based revenues now. As such, a Hold rating for Robinhood Markets is fair.

Be the first to comment