Mohammed Haneefa Nizamudeen

Investment thesis

NuVasive (NASDAQ:NUVA) is entering a delicate territory as current headwinds coming from the complex macroeconomic landscape show no signs of fading. Supply chain issues coming from economies reopening around the world after the coronavirus pandemic crisis, together with the current conflict in Europe derived from the war between Russia and Ukraine, as well as a stronger-than-usual dollar, are having a direct impact on the ability of the company to generate cash from operations at a time when the company is in full expansion of its operations.

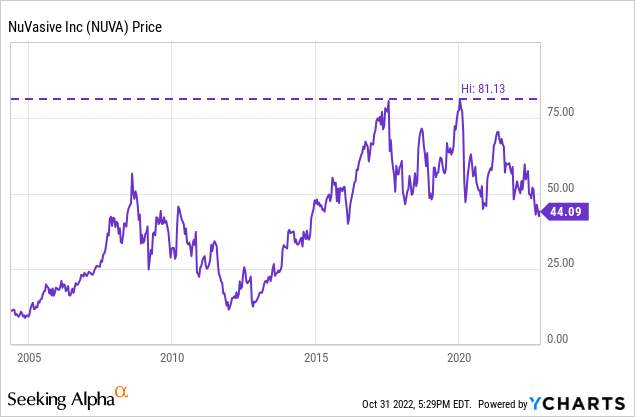

In order to follow the established plans, the management is investing vast amounts of cash to keep NuVasive at the forefront of the minimally invasive surgery industry by launching new products as well as integrating the operations of the acquired businesses in recent years. The problem now is that in recent quarters, said cash is becoming increasingly scarce. This scarcity stemming from depressed profit margins has led the share price to fall by ~46% from all-time highs reached in January 2020, and the large amounts of cash that the company holds, as well as the large inventories and very manageable debt, makes me think that this is a good opportunity for long-term investors, because after all, these headwinds are likely temporary.

A brief overview of the company

NuVasive is a global developer and manufacturer of medical technology for spine surgery. It provides surgical access instruments, spinal implants, fixation systems, biologics, enabling technologies, systems, and services for intraoperative neuromonitoring, magnetically adjustable implant systems for the spine, and specialized orthopedic procedures, such as internal fixators for limb-lengthening procedures under its PRECICE brand.

NuVasive was founded in 1997 and currently operates in over 50 countries, employing around 2,900 workers and enjoying a market cap of ~$2.31 billion. The company owns over 1,700 issued and pending patents worldwide, from which 730 are issued in the United States, and over 400 trademark registrations. It operates in the minimally invasive surgery industry and continually launches new products to stay ahead. It is also a developer of virtual reality training software for its products, which allows the promotion of its products among academics specialized in the sectors in which the company operates.

Currently, shares are trading at $44.09, which represents a 45.66% decline from all-time highs of $81.13 on January 14, 2020, right before the coronavirus pandemic crisis. This drop in the share price is mainly due to a lower capacity of the company to generate cash as a result of the drop in margins caused by current headwinds related to supply chain issues, increased labor costs, higher energy and freight costs, and a stronger-than-usual dollar. Still, these headwinds are likely temporary as they are directly linked to the current macroeconomic landscape, and the company is still generating generous cash amounts quarter after quarter while the balance sheet is robust, so I think it is important to assess the possibility that this may be a good opportunity to acquire shares and make a profit from the turnaround.

Expansion efforts are incessant

The company has been continuously expanding at a fast pace through two main strategies. On the one hand, by acquiring companies to increase their presence in the minimally invasive surgery industry, and on the other hand, by investing large amounts of cash in research initiatives to launch new products on the market and thus increase their reach.

In February 2016, the company acquired Ellipse Technologies, a designer and manufacturer of expandable rod implant systems that can be non-invasively lengthened following implantation via remote controllers using magnetic technology, for ~$410 million, and renamed it to NuVasive Specialized Orthopedics. Later, in June 2016, the company acquired Biotronic NeuroNetwork, a provider of intraoperative neurophysiological monitoring services for surgeons and healthcare facilities across the U.S. to reduce surgical variability and improve clinical outcomes founded in 1982, for $98 million.

In September 2016, the company acquired the LessRay software technology suite, which utilizes an algorithm to drive image registration and help surgeons and hospital staff manage radiation exposure using low-dose image quality enhancement.

Efforts to expand continued and, in January 2018, NuVasive acquired SafePassage, a provider of intraoperative neurophysiological monitoring services. During the same month, the company acquired the remaining 60% of Progentix Orthobiology B.V., a Netherlands-based company focused on developing novel orthobiologics, after a non-controlling interest acquisition of 40% in 2009. And finally, in February 2021, the company acquired Simplify Medical, the developer and marketer of Simplify Cervical Artificial Disc, which is the most clinically effective technology for cervical total disc replacement, for $150 million.

But this is not the end of the story. The company has also invested vast amounts of cash year after year to expand its product catalog, which has allowed it, on the one hand, to increase volumes and, on the other, to achieve surprisingly high profit margins.

As recently as July 2021, the company launched a 3D-printed porous titanium implant for anterior lumbar interbody fusion. Later, in September 2021, it opened the East Coast Experience Center, located in the New York metropolitan area. At this center, the company will train surgeons on the use of their products so that they can offer less invasive procedures to their patients. A month later, in October 2021, the company launched a porous PEEK implant for the transforaminal lumbar interbody fusion procedure with a variety of implant sizes.

In January 2022, the company received FDA clearance for expanded indications of use for Attrax Putty, a synthetic, bioactive, and osteoconductive bone void filler designed to drive bone fusion, with its comprehensive thoracolumbar interbody portfolio for spine surgery. With this, Attrax Putty has become the first synthetic biologic to receive indications for use in interbody fusions of the thoracolumbar spine. This news came six months after the FDA also gave clearance for the Pulse platform, an integrated technology platform designed to increase the safety, efficiency, and procedural reproducibility of spine surgery, with which the company finally launched the product in the market. The Pulse software ecosystem integrates multiple technologies into a single platform, which can be used in all spine surgery cases.

A year later, in September 2022, the company launched Reline Cervical, a new fixation system for posterior cervical fusion in targeted regions.

Revenues continue their growing path

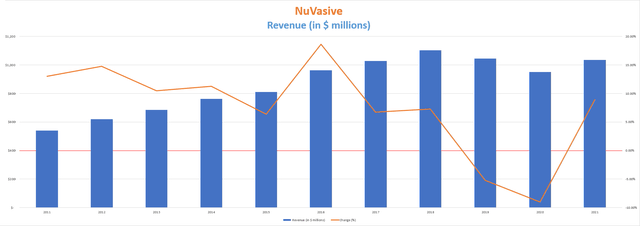

Through acquisitions and new product launches, NuVasive has managed to grow sales over the years until it experienced lower elective procedure volumes as a consequence of the COVID-19 pandemic in 2020, and revenues fell by 10.06% as a consequence. As the world managed to stabilize from the pandemic crisis and restrictions were lifted in different countries around the world, the company achieved an increase of 8.41% in revenues in 2021.

NuVasive revenue (10-K filings)

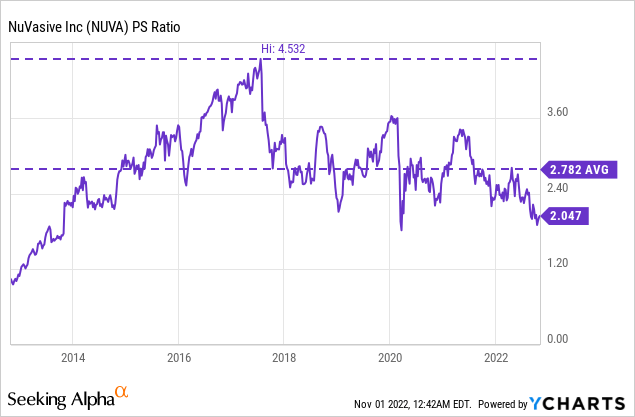

The trend of increased sales has continued throughout 2022 with an increase of 7.19% year over year during the first quarter and an increase of 5.30% year over year in the second quarter, boosted by increasing procedural volumes. Sequentially, revenues declined by 3.74% in the first quarter but increased by 6.77% in the second quarter. Foreign revenues accounted for 23% of the total in 2021 and grew by 10.42% year over year during the second quarter of 2022, so its operations are expanding internationally. The recovery of revenues along with a lower share price has caused the price-to-sales ratio to decline to 2.047.

This means that the company generates revenues of $0.49 annually for each dollar held in shares by investors. Nevertheless, the current ratio is 54.83% lower than the peak of 4.532 reached in 2017, and 26.42% lower than the average of the past decade, which means that investors place less value on the company’s sales than they used to. One of the main reasons is the recent drop in profit margins, which I will evaluate next.

Margins are temporarily depressed

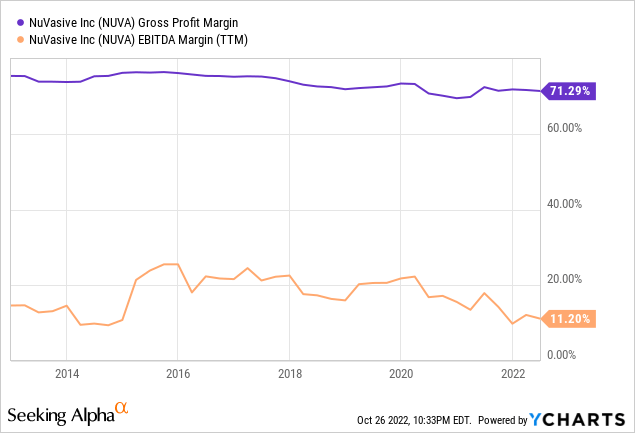

The company reduced discretionary expenses in 2020 as a measure to offset the COVID-19 headwind, and manufacturing capacity was adjusted. While the COVID-19 headwind is easing worldwide, the company’s operations are currently exposed to inflationary pressures, supply chain delays, and negative foreign exchange rates as a result of a stronger dollar, as well as higher freight and labor costs. Currently, the trailing twelve months’ gross profit margin stands at 71.29%, whereas the EBITDA margin stands at 11.20%.

Still, gross profit margins of 72.38% in the second quarter show a slight improvement from the average of the last twelve months, and the same goes for the EBITDA margin of 12.93%, but they are far from the ~75% gross profit margin and ~20% EBITDA margin the company used to enjoy before the coronavirus pandemic crisis and the subsequent headwinds, primarily as a consequence of pricing pressures, and this has narrowed the gap between the cash generated through operations and the cash spent on interest expenses and capital expenditures.

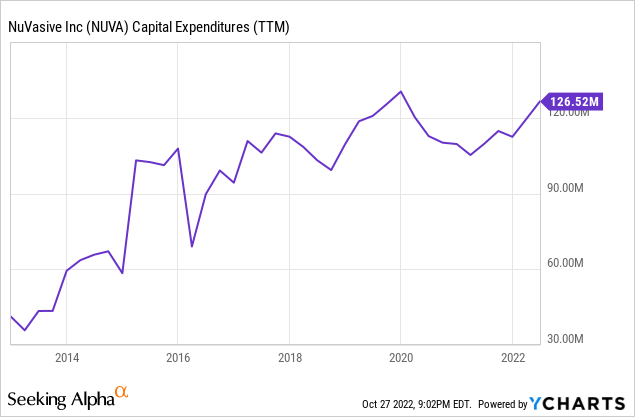

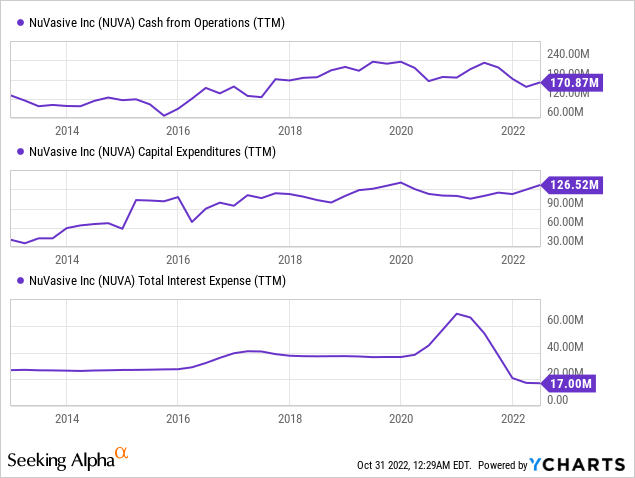

In this sense, the current trailing twelve months’ cash from operations of $170 million represents a significant decrease compared to $235.3 million generated in 2019, $185.9 million in 2020, and $182.2 million in 2021 as variable expenses on higher sales are generating serious pressures. Increased freight costs, a stronger dollar against other currencies, and higher cost of goods sold due to inflation caused a drop in the cash from operations, and higher R&D expenses are taking all the cash generated. The management doesn’t expect these headwinds to ease anytime soon as they are out of their control.

Nevertheless, the company recorded $68.7 million in costs in 2021 related to the acquisition and integration of acquisitions in the past, which is a temporary expense that should be reduced over time.

Debt is overly manageable

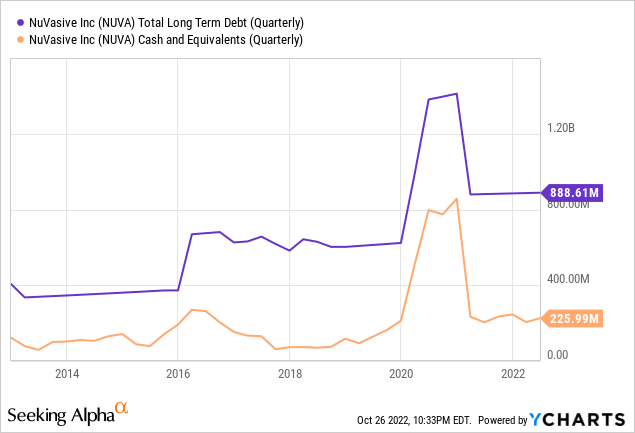

Since 2016, the long-term debt pile has more than doubled from slightly under $400 million to $888 million in the present. The main reason for the increase in debt has been the acquisitions of companies that have taken place in recent years, and the subsequent investments related to the acquisitions.

The company currently holds $225.99 million in cash and equivalents and inventories worth $331.7 million, which are greater than half of the company’s debt. This makes the debt very manageable, especially considering the company’s cash from operations of $170.87 is vastly higher than the annual interest expense of ~$17 million. Furthermore, accounts receivable of $233.6 million are significantly higher than accounts payable of $122.3 million. Still, the company hasn’t been able to raise new cash since the coronavirus pandemic crisis while debt has slightly increased, which means that current headwinds need to relax in order for the company to be able to afford to continue with the current level of R&D expenses in the long run.

Risks worth mentioning

- In the short to medium term, I believe that the most significant risk and the main reason for the current decline in the share price is in the company’s profit margins. Cash from operations has fallen significantly while capital expenditures are at all-time highs, which is causing problems to raise new cash. The company has large cash reserves, inventories, and account receivables, but tensions in profit margins derived from current inflationary and supply chain pressures will need to be relaxed for the situation to improve.

- Also, the company is using cash intensively to maintain its level of sales and increase it over the years through acquisitions and high R&D expenses. If the company doesn’t get the desired results from these investments, it could enter a cash-burning spiral, which could be disastrous for the balance sheet.

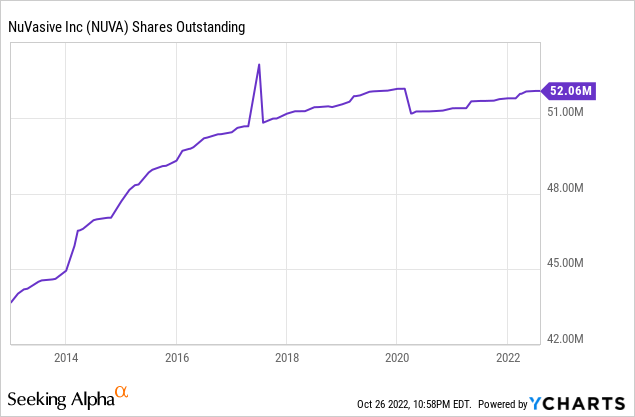

- Another risk that should be considered is share dilution. Over the past decade, the number of shares outstanding has increased by 19.76%, which means that each share represents a smaller portion of the company over time. This is something typical of companies in a period of expansion, so it will be necessary for the company to achieve a certain degree of maturity and stability in its profit margins for share dilution to stop damaging shareholder value.

Conclusion

Everything was going well for NuVasive before the coronavirus pandemic crisis, and since then, the stock price has fallen by 45.66%. Such a significant fall in the share price in such a short period of time may suggest that shareholders have overreacted to current headwinds, but I don’t think this is the case. The company’s cash from operations has been significantly reduced as a result of inflationary and supply chain pressures, which increases the risk that the enormous amounts of cash invested in R&D and acquisitions will not return the expected results in the short and medium term.

Still, the balance sheet is very robust thanks to a large quantity of cash on hand, inventory, and cash receivables, and cash from operations is still more than enough to cover interest expenses and still keep pouring vast amounts of cash into R&D initiatives, and the company constantly launches new products that improve surgeries by making them less invasive, thus increasing the company’s revenue year after year. Current headwinds are related to the current complex macroeconomic landscape, which suggests that these are temporary, or at least much of the tensions generated by it. For this reason, and despite the fact that I consider that it is not an overreaction, I consider that the current decline in the share price represents an opportunity for all those investors who already had the company on their radar and were waiting for the right moment to acquire shares.

Be the first to comment