halbergman

Investment Thesis

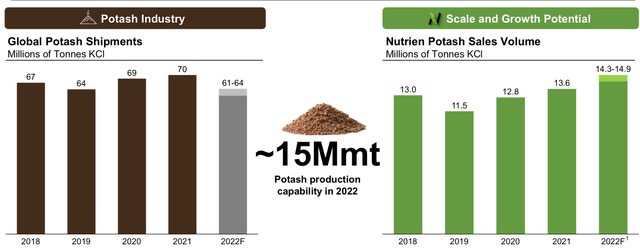

Due to the surge in natural gas prices, Europe has to import agrichemical products such as Ammonia from North America. As the world’s largest fertilizer supplier, Nutrien (NYSE:NTR) is well-positioned to leverage its production capacity to increase its presence in Europe. In Q2 2022, Nutrien announced its expansion plan to reach 18 million tonnes of potash production capacity by 2025, up from 13.6 million tonnes in FY21. With the global potash supply tightening and Nutrien expanding, Nutrien will likely to further dominate the fertilizer market.

Through acquisitions, Nutrien consolidated the scattered global agricultural retail distribution channels. Especially in Brazil, the third largest corn producer, and the largest soybean producer, Nutrien is establishing its network to accelerate the deliveries of seed, chemicals, and fertilizer. Brazil will plant soybeans from September to November and corn in late December. Brazil had a record planting crops in 2021, and I only see this year breaking the previous record due to the supply constraints from Eastern Europe. This trend will increase demand for Nutrien products in Brazil.

With the catalysts from Europe and Brazil, I believe there is more upside for NRT.

European Market

In retaliation for NATO sanctions on the Russian invasion of Ukraine, Russia began cutting down the natural gas supply through Nord Stream 1 to Europe in July. On August 19th, Russia shut down the supply from the Gazprom pipeline for three days. Nord Stream 1 and Gazprom supplied around 26% of the German natural gas, and Russia’s unilateral action surged the price of European natural gas futures by 300%.

European Natural Gas Futures (Trading Economics)

40% of the total natural gas supply from Europe comes from Russia. Russia has the mighty power to shut down entirely as it opened a new sales channel to China through the “Power of Siberia.” On the other hand, Europe suffered energy dependency triggered by the decades-long O&G underinvestment. There is no practical way for Europe to overcome the energy shortage in the near term; renewable energy infrastructure and other alternative energy pipelines require ample building time, and LNG is not a sustainable solution. Thus, Europe entered an energy-saving mode, such as European Commission’s Gas Demand Reduction Plan, German public building energy-saving mandates, and market-driven price surge in retail energy usage.

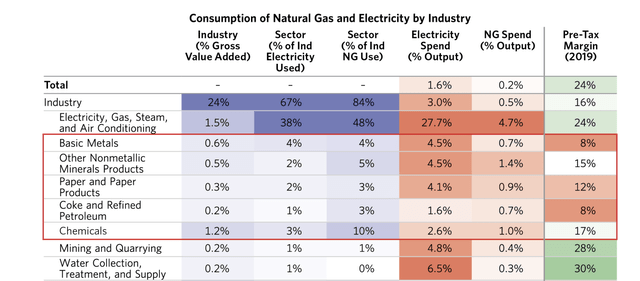

The priority of natural gas usage in Europe is in the residential sector, and other chemicals/products with high natural gas as a component will be sourced offshore. Chemicals ranked as the second highest NG use sector with 10% of total NG usage. Agrochemicals such as fertilizer require the elements of Ammonia, urea (liquid Nitrogen), and diammonium phosphate (DAP). Moreover, those elements need the input of NG.

Usage of Natural Gas by Sector (Bridgewater Associates)

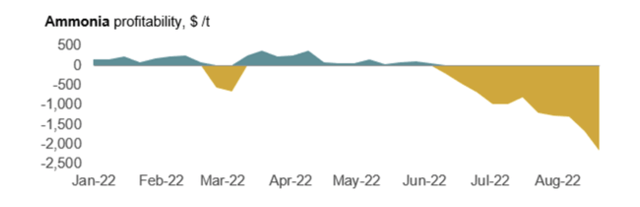

The European natural gas price forced the major Norwegian agrochemical company Yara International (OTCPK:YARIY) to cut 65% of its ammonia production. Moreover, Yara is not the only one; even the largest chemical producer in the world, BASF, is sharply cutting Ammonia production and trying to obtain Ammonia oversea from North America. These were not strategic decisions; European chemical companies were forced to get out as they lost $2000 per ton of Ammonia produced.

European Ammonia Profitability (CRU Group)

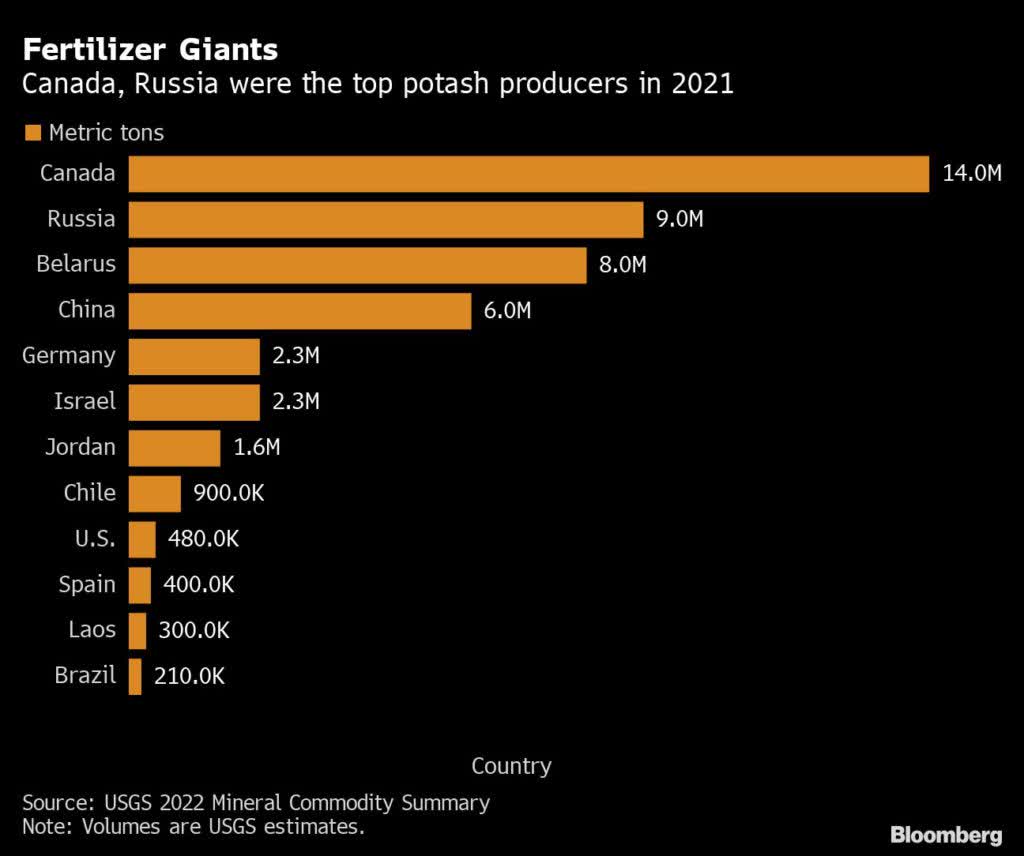

The conflict between Belarus and Lithuania cuts off the Belaruskali Potash supply, accounting for 11.4% of the global supply. Belarus and Russia together count for 24% of the total supply. The conflict marks a tremendous market share opportunity for Nutrien. NRT had 20% of the global Potash production in 2021. The sanctions on Belarus and Russia make the pie smaller, but it allows Nutrien to become more monopolistic in the Potash market. Furthermore, China has been closing borders since the beginning of 2021 to emphasize the zero-covid policy or autarky in some opinions. The Chinese supply of Potash will be consumed domestically in the near term.

Fertilizer Market Share (Bloomberg Terminal, Mining.com)

According to Nutrien’s Q2 Earnings, global potash shipments are estimated at 62.5 MMT midpoint, and NRT’s potash sales are estimated at 14.6 MMT midpoint. It indicates that NRT will take 23.4% of the market share in FY22. I think the estimate is conservative; it does not entirely factor in the impact of Eastern Europe supply constrain and the trend of importation from major European chemical companies.

Potash Market Size (NRT Investor Relation)

In Q2 FY22, Potash alone contributed $2 billion of adjusted EBITDA, which increased 309% YoY. In the same period, the cost of goods sold only increased by 22%. It indicates the leverage Nutrien has in the potash market. As the supply constraint worsens in Europe, the recent potash price pull-back will see a new high soon. This average unit price sold in the second half of FY22 will likely surpass its first half at $669 per MT. The $7.6 to $8.2 billion FY22 EBITDA guidance range seems quite conservative.

Brazilian Market

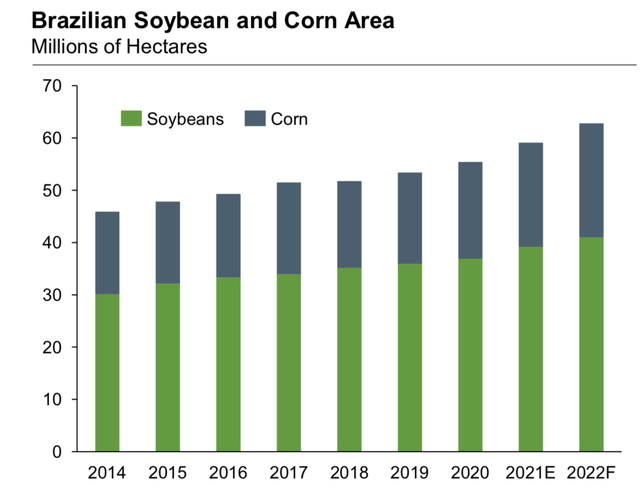

Brazilian agricultural export totals $120 billion in 2021, an increase of 19.7% from 2020. The Brazilian trade surplus is expected to expand over the following years, caused by the sanctions in Eastern Europe and the severe drought crisis across Iowa, China, and India. Corn and Soybean are the top produced crops and are expected to generate 60 million hectares of outputs in FY22. The plan to expand the agricultural outputs requires additional demand for fertilizer.

Brazilian Soybean and Corn Production (Nutrien Investor Relation)

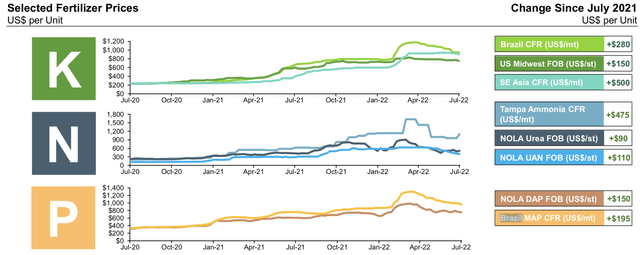

In 2021, Brazil was already the second largest consumer of Potassium and Phosphorus, and the current global dynamics will further drive up the demand for fertilizer domestically. Since July 2021, Potassium, Nitrogen, and Phosphorus fertilizer prices have increased at different rates across Asia, US, and Brazil. Brazil CFR and Brazil MAP CFR are currently trading at $800 per unit, which are the most expensive across all products; in addition, in Q2 FY22, retail has 23% of crop nutrient gross margin and 27% crop protection products gross margin. It shows the value-add nature of retail products, which can leverage even more on the surge in fertilizer price. As the spring planting season is coming in September, we shall see another price surge in Brazil’s CFR.

Fertilizer Price Surge (Nutrien Investor Relation)

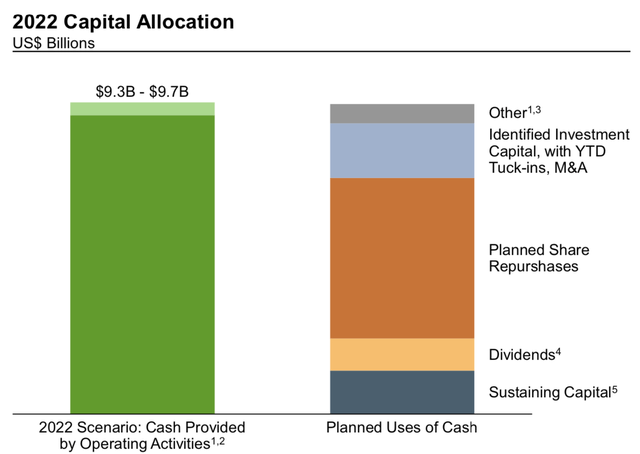

Interestingly, the Brazilian agricultural market is scattered, with no big players in the retail channel. Nutrien is well-prepared for this expansion opportunity. From 2020 to 2021, Nutrien spent $300 million consolidating the Brazilian retail channels. The outcome of those horizontal mergers was proven effective; now, more than 35% of the retail revenue is generated outside the United States. NTR has completed 14 strategic acquisitions, mainly in Brazil, this year, including the acquisition of casa do adubo. Casa do adubo is an exemplary acquisition, which added 39 more retail shops and ten distribution centers. Completing this deal in the coming months will significantly increase sales in the LATAM region. Compared to FY21, Nutrien plans to invest $1.7 billion in growth capital, M&A in retail channels, and project investments. The sufficient capital budget will enable Nutrient to fully take advantage of the global shortage situation and establish a global fertilizer network. The global shipment challenges will not be a quick fix; producing local and supplying local becomes the most feasible solution. I believe the growing local influence of Nutrien in Brazil will be a long-term moat for its market leader status.

FY22 Capital Allocation (Nutrien Investor Relation)

Financials

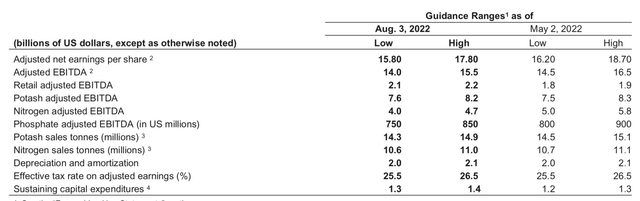

In Q2 FY22 earnings, the management team raised the midpoint guidance of retail adjusted EBITDA from $1.85 billion to $2.15 billion. The rise is mainly due to the promising outlook in Brazil, and the past acquisitions yield more returns than previously estimated. However, the management also lowered the midpoint guidance for Potash, Nitrogen, and phosphate due to crude oil’s rise and the drop in nitrogen prices. However, as mentioned above, the recent European curtailment of fertilizer raw materials might suggest a different direction from the guidance.

NTR Guidance (Nutrien Investor Relation)

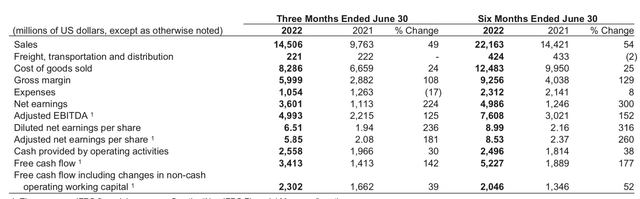

The first half result highlights significant growth in both the top line and bottom line. The revenue increased by 54% YoY, while the COGS only increased by 25%. The net earnings end up south of $5 billion, which tripled from a year ago. The strong performance brought the diluted net earnings per share to $8.99, which increased 316% YoY. In addition, NTR’s free cash flow reached $5.2 billion, which leaves space for a capital budget increase in the next fiscal year.

NTR Consolidated Results (Nutrien Investor Relation)

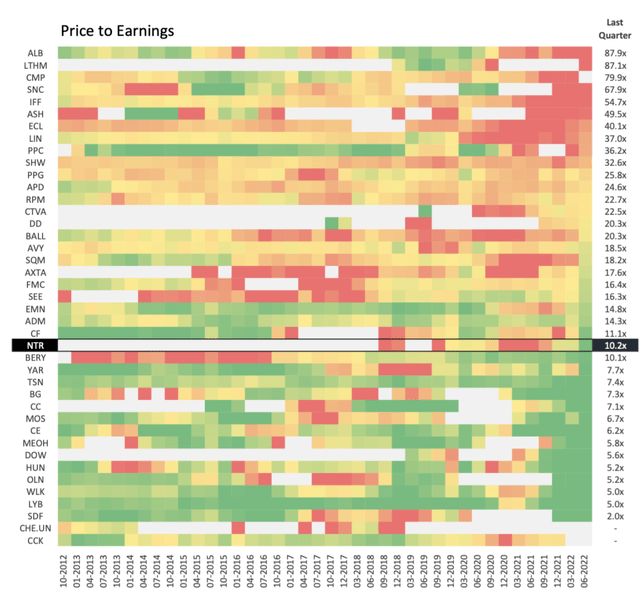

Despite the stock rally in the past year, NTR’s LTM P/E ratio is now at 8.13, which seems undervalued compared to the industry median. Chemical companies may have different business models and growth rates, and the comps may not tell the entire story. However, NTR’s industry leadership, near-term catalysts, and long-term sustainable growth plan should award itself higher multiples.

NTR Comps (Marktfeld Analysis, Refinitiv)

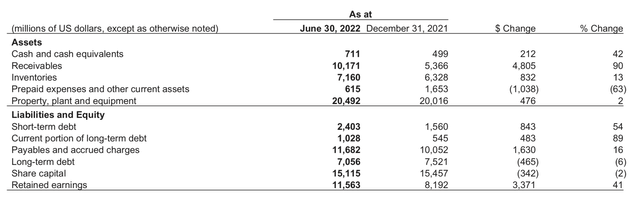

Nutrien has a healthy balance sheet. Nutrien has $711 million cash on hand on the asset, a significant improvement from year-end FY21. As a result of the drastic sales volume spark this year, the account receivables doubled from FY21. This needs attention as investors should closely monitor the receivables turnover ratio. NTR does not have significant outstanding debt; its coverage ratio is healthy.

NTR Balance Sheet (Nutrien Investor Relation)

Valuation

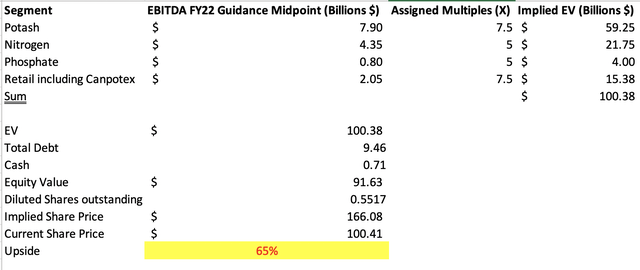

Since Nutrien has different segments with different market positions, I used a sum-of-the-parts valuation. The potash and retail segment has market leadership and supply constraints from the competitors, so I assigned 7.5x EV/FY22 Guidance Midpoint EBITDA multiples. For Nitrogen, we saw a price reduction trend recently; as a result, it was assigned a low multiple of 5x. Nutrien is a minor player in the Phosphate space and has no plan to expand aggressively in the future. Thus, I assigned a 5x EBITDA multiple to it. The sum of implied enterprise value totals $100 billion. It implied an EV/FY22 Guidance Midpoint EBITDA of 6.8x. According to Marktfeld’s data, NTR’s peer group EBITDA multiple medians is 12x. Thus, I believe a 6.8x EBITDA multiple is a fair valuation. I subtract debt and add cash which results from the implied equity value of $91.6 billion. The implied share price is $166.08, which suggests a 65% upside opportunity.

Valuation (Made by Author, Information from Company Guidance)

Risks

Investors need to monitor the situation between Russia and Ukraine closely. If the armistice was reached and the Eastern European supply constraint was relieved, then the price of Potash could see a significant downside. Furthermore, if Russia decides to increase the supply of natural gas to Europe, the European chemical companies will again produce fertilizer domestically. The increase in supply will impact the competitiveness of Nutrien.

Brazil’s presidential election is coming in October. Historically speaking, election results usually brought volatility to the market. Worker’s party candidate Lula da Silva stated, “family farming can feed our country,” which was viewed as a relatively unfriendly signal to foreign corporations trying to consolidate the retail business in Brazil. If Lula wins the election, there can be a potential obstruction for NTR to expand in Brazil.

As shown in the financials, NTR has a spike in receivables this year. As the global economy cools down, the AR collection can become a challenge for Nutrien. The investor should pay attention to the AR number in the upcoming quarters to validate if there are any improvements.

Conclusion

As the leader in the fertilizer industry, Nutrien can provide solutions for global fertilizer shortage. NTR’s four segments across Retail, Potash, Nitrogen, and Phosphate allow it to serve as a one-stop shop for large corporations and small-to-middle customers. As the curtailments in Europe continue, we shall see Nutrien gain more market share. The upcoming spring in the southern hemisphere provides another expansion opportunity for NTR on the Brazilian retail channel. From the sum-of-the-parts valuation, I believe Nutrien is currently undervalued, with a 65% upside coming.

Be the first to comment