Hobaaa/iStock via Getty Images

I’m in the midst of a new generationally inspired series in which I’m putting together “top 10” lists for investors of all age groups.

I recently commenced the series with the Gen Z and Baby Boomers, and I’ll be working on the following classifications shortly.

- Generation Jones: born 1955 to 1965

- Generation X: born 1965 to 1980

- Xennials: born 1977 to 1983

- Millennials: born 1981 to 1996

It’s important to recognize that all of these lists must have a quality standard in which we’re selecting these constituents. Although the Gen Z crowd is likely to take more risk than the Baby Boomers, there must be guidelines to avoid making careless mistakes in selecting low quality REITs.

Quality is an important part of the investing process, as Warren Buffett explains,

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

So how do you define wonderful?

At iREIT on Alpha, we look for REITs with wide moats, which are companies that generate stable earnings and dividend power, as Benjamin Graham explained,

One of the most persuasive tests of high-quality is an uninterrupted record of dividend payments going back over many years…

Many readers have asked me over the years about my top holdings, and I always confess that my highest conviction holdings are the REITs that have generated reliable and consistent dividend growth.

I’ve learned that it makes no sense to allocate capital to stocks that are not growing their dividend.

I’m proud of my track record here on Seeking Alpha in which I’ve not only generated more followers (than anyone), but also being a trusted voice of reason during volatile times.

And it’s in these unpredictable times that I triple down on quality!

Today I want to provide you with a snapshot of my four top holdings and then compare them to three of the most popular high-yielding names within the REIT sector.

I think it’s important to demonstrate to readers the importance of owning “blue chips”, especially when they can be purchased at a quantifiable margin of safety.

My Top 4 REIT Holdings

My top 4 REIT holdings are as follows:

- Realty Income (O) 5.1% exposure

- American Tower (AMT) 4.7% exposure

- Prologis (PLD) 4.4% exposure

- VICI Properties (VICI) 4.4% exposure

So, as you can see, these top 4 REITs account for 18.6% of exposure and more importantly, these 4 REITs have generated an average return (equal-weighted) of 16.5% since they were purchased.

Let’s take a look at these REITs individually…

Realty Income

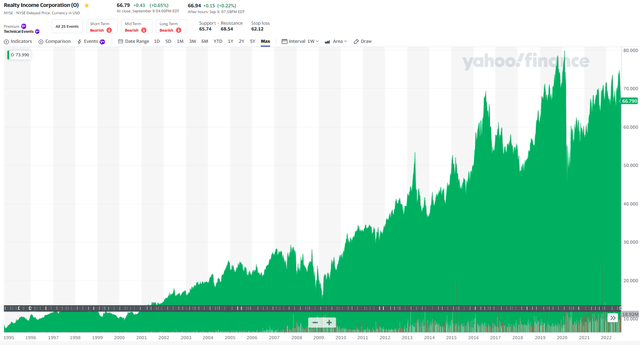

Yahoo Finance: Realty Income

Realty Income is my largest holding, at 5.1% exposure, and shares have returned an average of 13.7% since the first purchase (2014). I have accumulated shares on-and-off, and trim modestly in February 2020 which shares hit $72.89.

Realty Income is considered a “wide moat” REIT and the company has earned its space as my largest holding based upon its scale and cost of capital advantages.

For scale, Realty Income owns over 11,400 real estate properties under long-term net lease agreements, 43% of which are investment grade rated. The REIT’s strategy is to invest in clients with a non-discretionary, low price point, and / or service-oriented component to their business.

It’s only because of this scale advantage that Realty Income was able to grow earnings during the pandemic, and in fact, this blue chip has generated positive earnings growth in 25 of 26 years (as a public company).

In terms of cost of capital, Realty Income is one of only seven S&P 500 REITs with two A3/A- ratings or better. Debt ratios are best in class: 5.2x Net Debt to Adj. EBITDAre, 5.5 Fixed Charge Coverage, and 27% Debt to Total Market Cap. 94% of debt is unsecured and 93% of debt is Fixed Rate.

Just think… Realty Income has just $108 million in secured debt, and $3.3 Billion of liquidity (I mention that because I will make that comparison below).

I’m extremely happy that my #1 holding is also a Dividend Aristocrat (record of 25 years in a row of growing dividends) and in fact, Realty Income has grown its dividend for 27 consecutive years in a row.

Once again, I’m always seeking to own “blue chip” REITs, and it’s important to always purchase shares with a margin of safety.

Currently Realty Income is trading at $66.69, or around 5% below iREIT’s FV target. Typically, when I purchase for my account (or my family) I like to buy at a wider discount; however, I would not say it’s foolish to add more shares at this time.

The P/AFFO multiple is 17.6, compared with the 5-year average of 19.5x. It’s my view that Mr. Market is not valuing this blue chip for its consistency and predictability, and forward growth prospects are extremely reliable. The dividend yield is 4.5% and the payout ratio is solid (82%).

iREIT maintains a BUY with a 12-month total return forecast of 15%.

American Tower

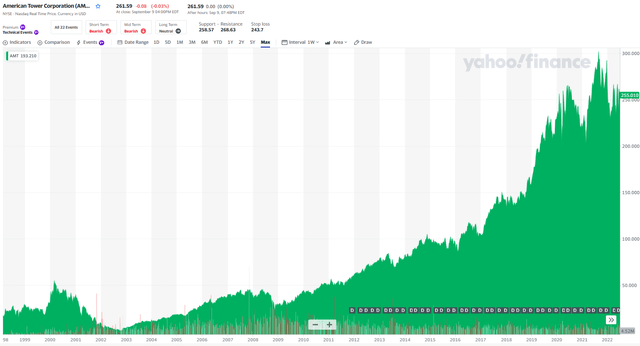

Yahoo Finance: American Tower

American Tower is my second largest holding, at 4.7% exposure, and shares have returned 15.2% since the first purchase (January 2021).

Prior to Covid-19 I’d always wanted to own AMT, but I never found the right time. However, in late 2020 I became fixated on the cell tower REIT and in January 2021 I published an article titled, “It’s Tower Time: We’re Buying American Tower.”

In that article I explained

“…shares are trading at around 23x 2021 estimated AFFO, the lowest of its peers. While some may argue that’s still rich versus the typical REIT, the Street calls for 10% AFFO growth rate over 2020 levels. That’s the highest of the three tower companies, for the record. And it’s 2x-3x the REIT universe average.”

So I pounced, and I have not been disappointed since.

Once again, AMT has scale advantage, with over 222,000 global tower sites in 6 continents and 25 countries. More recently AMT acquired data center REIT, CoreSite, for $10.1 billion, that includes 25 data centers (in 8 US metro areas).

This deal established AMT as a leader across multiple classes of communications real estate as 5G and wireless accelerates globally.

Tower leases are also inflation resistant as they generally include an initial non-cancellable term of 5-10 years with multiple 5-year renewal periods with annual embedded lease escalators of approximately 3% (in the US) and internationally based on based on local inflation indices.

U.S. mobile traffic growth is expected to grow at 23% CAGR through at least 202 and smartphone data usage is projected to increase exponentially on a global basis.

AMT’s balance sheet is also a key ingredient of the overall quality score for the REIT. In Q2 the company increased its percentage of a result of fixed debt to nearly 80%, up from 66% as of the end of Q1-22, and pro forma net leverage dropped to around 5.5x. Now that CoreSite has closed, AMT looks to deleverage back to 3-5x (its target range) over time.

In Q2-22 AMT constructed over 1500 sites representing 12 quarters of over 1000 new builds since the start of 2019, a demonstration of the success of the REIT’s capabilities and expertise, scaled to market positions, and strong customer relationships.

Also, in Q2-22 AMT raised its AFFO per share guidance to $9.74 from $9.72, despite absorbing the negative effects from FX and a continued rise in interest rates. The company said it “expects to dedicate approximately $2.7 billion subject to board approval towards 2022 dividends…represents approximately 12.5% in year-over-year growth on a per share basis.”

AMT has only been paying dividends since 2009, so it’s not in the aristocrat club yet, however, the prospects look promising based upon based on 13.8% AFFO per share growth (‘CAGR’) since 2013.

Shares are now trading at $261.59, +7% above or FV target. The P/AFFO multiple is 25.8x, compared with the 5-year average of 21.5x. We recommend waiting on a pullback, and I’m perfectly content with my skin in the game.

Prologis

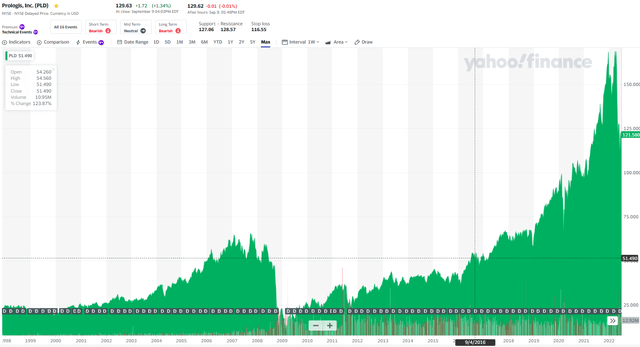

Yahoo Finance: Prologis, Inc.

Prologis Inc. is my third largest holding, at 4.4% exposure, and shares have returned 9.6% since my first purchase (back in May 2022).

Like AMT, PLD is a new holding and I’m happy that I was able to pounce on shares of the global warehouse juggernaut.

Once more, scale has its advantages, and with buildings spread across the US, “Other Americas”, Europe, and Asia, this $180 billion beast (assets under management) has a highly diversified operating platform.

Also, the land portfolio has significant embedded value, with a total buildout of another $30 billion with an overweight in the markets that matter the most. Covered Land Plays (or CLP’s) – acquisitions of income generating assets with the intention to redevelop for higher and better – are targeted at 5% or higher.

In addition to scale advantage, PLD also has a significant “wide moat” cost of capital advantage, which is reflected in iREIT’s perfect “100” quality score and A-ratings from two agencies (Moody’s and S&P).

PLD’s balance sheet remains strong with 4.9x Debt/Adj. EBITDA excluding development gains (+20bps q/q). During Q2-22, PLD and its JVs issued $5.1B of debt at a weighted average interest rate of 1.4% ($4.0B refinancing/$1.1B new issuances) and the company has $5.2B in cash and availability.

PLD generates superior dividend growth (compared with its peers) over the last 1-3- and 5-year periods and the company produces $1.7B of free cash flow after dividends in 2022.

Shares are now trading at $129.63, which is still 13% below iREIT’s FV target.

The P/FFO multiple is 26.9x, in line with the 5-year average. The dividend yield is 2.4% and well-covered by AFFO (60% AFFO). The growth prospects remain solid, with analysts forecasting 11% growth (‘FFO’) in 2023, so we think there’s more room to run.

VICI Properties

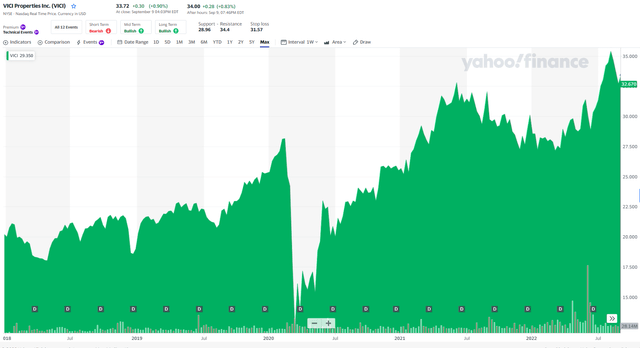

Yahoo Finance: VICI Properties

My fourth highest conviction REIT is VICI, in which I have 4.4% exposure, and shares have returned 27.6% since my first purchase (in July 2019).

As most of my readers know, I have been quite the cheerleader for this gaming REIT, as I explained in my first public article,

VICI has the lowest payout ratio, and while the dividend is lower than the peers, we believe that this REIT has the best potential to grow its dividend.

That is certainly what has happened, and even last week VICI announced it was once again boosting its dividend by another 8%.

In just 5 years (since VICI was formed), the company has grown Adj. EBITDA from $690 million to around $2.6 billion. The train has left the station as VICI’s high-quality portfolio is spread across 43 properties that generate resilient and stable cash flows (100% rent collection to date through the ongoing COVID-19 pandemic).

We consider the gaming properties “Mission Critical” based on the regulatory environment that creates high barriers to entry and limits the tenants’ ability to move locations, contributing to VICI’s 100% occupancy rate. VICI is now the largest triple net lease REIT and one of the top four-wall REITs by LTM Q2’22 Adj. EBITDA.

VICI has generated a whopping $29 billion of capital markets activity since formation and that could not have been accomplished had it not been for the disciplined management team.

The company has an investment grade rated balance sheet that broadens access across capital markets, and we would not be surprised to see the company expand into Europe in the future.

Once more, dividend growth is the mark of quality, and VICI has not disappointed.

Shares are now trading at $33.72, 6% below our FV target. The P/FFO multiple is 20.2x with a dividend yield of 4.6%, Given the success with VICI thus far, I’m excited to be a stakeholder and I will continue to accumulate more shares on a possible pullback.

In Conclusion…

There’s a reason that I recommend owning quality REITs and that really boils down to performance.

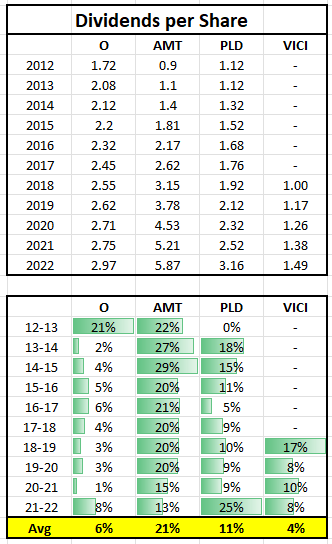

Take a look at this dividend growth chart for my top 4 REIT holdings:

iREIT

As you can see, these four REITs have generated very stable and predictable dividend growth – all four REITs averaged 10% annual growth.

As I mentioned earlier, these four REITs have generated average annualized total return growth (dividends and price appreciation) since purchasing of 16.5%.

Now, I picked three random REITs, that I consider popular because of their yield:

- Gladstone Commercial (GOOD): 7.9% dividend yield

- EPR Properties (EPR): 7.2% dividend yield

- Macerich (MAC): 6.1% dividend yield

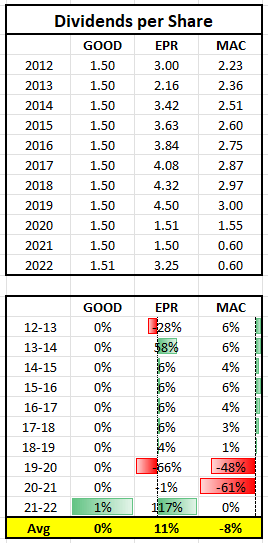

Now take a look at their dividend growth history:

iREIT

GOOD has flat dividend growth, EPR cut the dividend in 2014 and 2020, and MAC cut the dividend during the pandemic. The average dividend growth for all three REITs is 1.0%.

The reason these three REITs are popular is because of their dividend yields – before the pandemic they were boasting these yields:

- GOOD: 10% in 2015

- EPR: 6.4% in 2019

- MAC: 11% in 2019

Even though these REITs were deemed (by us) as unsafe, investors piled in because they were fixated on yield.

The point I want to make here is that it never pays for being too cute, and although my portfolio may be considered boring, by dividend yield standards, the cream always rises to the top!

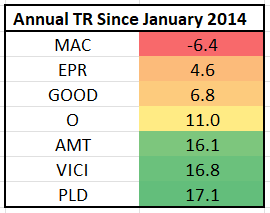

iREIT

Wide Moat Indexes, LLC and MarketVector will be soon launching an Index soon that includes a basket of the highest quality equity REITs, commercial mREITs, and preferreds. We believe that quality is an extremely important reason to own REITs, not just for yield!

Be the first to comment