ThitareeSarmkasat

When we last covered NuStar Energy LP. (NYSE:NS), we gave a balanced assessment of risks and rewards and came away with a neutral/hold rating. While we were bulls on energy in general and the Permian in particular, we did not think NS was the best way to play this. Specifically we said:

Going forward though it remains to be seen how the volumes story offsets the storage woes. Weakness in storage can get far worse as contracts roll over and customers suddenly find that they have far more storage space competing for their dollars. On the other hand, while pipeline volumes can increase, we are not going to see significant pricing power as even there, capacity is more than sufficient. We remain neutral on the name and see better places to make money.

Source: A Mixed Bag

A lot has changed since then and while crude oil and natural gas prices averaged higher than what we had expected, we also have seen interest rates and credit risk move up meaningfully. Let’s examine where NS stands today and what might be interesting plays for the company.

Q2-2022

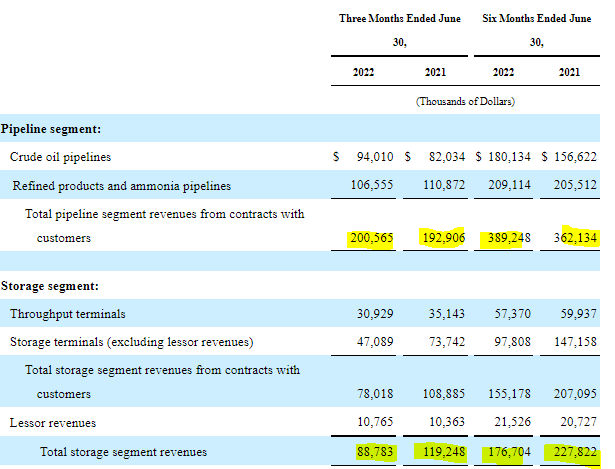

The story here played out in a similar manner to what we had suggested a year ago. Pipeline segment volumes and revenues were robust. The company’s Permian volumes grew to 522,000 barrels per day in the second quarter of 2022, an increase of 16 percent over the previous year. This was offset by storage segment as volumes handled and revenues continued to fall off.

NuStar 10-Q

The ultra steep backwardation on the futures curve for crude oil has not helped the storage area one bit and the next quarter should be headed in the same direction. Buried in there though, is the impact of the asset sales and it is difficult to prune out exactly how much revenue drop came from those.

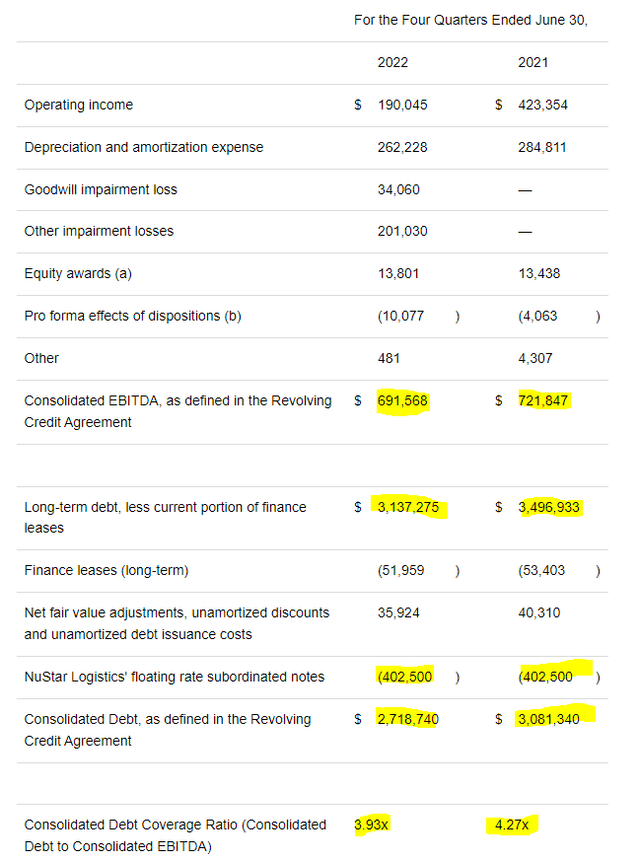

From a credit perspective, the asset sales at decent multiples (see here and here), offset the falling EBITDA and leverage dropped vs last year.

The sub 4.0X debt to EBITDA is a welcome number to look at, but we stress here that this is a very fluffed up look at where things stand for the equity holder. The 3.93X comes after removing the NuStar Logistics Floating Rate subordinated notes (NSS) and also does not look at the mountain of preferred shares (par value $1.364 billion) ahead of the common. It continues to be our belief that this situation of overexposure to storage volume declines combined with heavy leverage, make the common shares poor prospects.

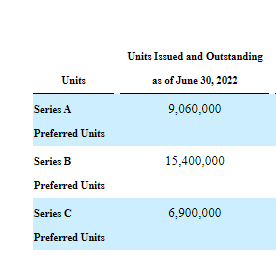

Preferred Shares

NS offers three preferred shares that trade publicly and a fourth one that had a private placement. All are par value of $25 per share, cumulative, and fixed-to-floating rate securities.

NuStar Energy L.P., 8.50% Series A Fixed to Float Cumulative Redeemable Perpetual Preferred Units (NYSE:NS.PA)

This one was callable on 12/15/2021. Yield is floating at LIBOR plus 6.766%. Based on Fed Fund Futures, NS might have to pay as high 11.266% on this. At a price of $22.82, the yield could go as high as 12.34%.

NuStar Energy L.P., 7.625% Series B Fixed to Float Cumulative Redeemable Perpetual Preferred Units (NYSE:NS.PB).

This one was callable on 6/15/2022. Yield is floating at LIBOR plus 5.643%. Based on Fed Fund Futures, NS might have to pay as high 10.143% on this. At a price of $20.60, the yield could go as high as 12.30%.

NuStar Energy L.P., 9.00% Series C Fixed to Float Cumulative Redeemable Perpetual Preferred Units (NYSE:NS.PC).

NS.PC is callable on 12/15/2022. After 12/15/2022, yield floats at LIBOR plus 6.88%. Based on Fed Fund Futures, NS might have to pay as high 11.38% on this. At a price of $23.41, the yield could go as high as 12.15%.

The three publicly traded ones are all hurtling towards a 12.00% plus yield and this is going to weigh on NS.

Interestingly, even at the high end, of currently projected Fed Fund Futures, all of these are below what the privately traded D units will cost.

The purchasers will acquire 23,246,650 Preferred Units at a price of $25.38 per Preferred Unit. At the initial closing, scheduled to occur on June 29, 2018, the purchasers will purchase $400 million of Preferred Units. The purchasers have agreed to purchase the balance of the Preferred Units at a second closing, scheduled to occur on July 13, 2018. Each closing of the sale of the Preferred Units is subject to the satisfaction of customary closing conditions.

The terms of the Preferred Units include: Distributions of 9.75% per annum for the first two years, 10.75% per annum for years three through five, and the greater of 13.75% per annum or the common unit distribution rate thereafter.

Source: Business Wire (emphasis by author)

Year 5 is about to end in about one full-term pregnancy and NS will have to pay 13.75% on those. One final point here is that series D is huge compared to the rest.

NuStar 10-Q

So the cost impact will be rather brutal with $12 million annually extra going just to service these. If we add the impact of the rate hikes on the other series, we are looking at $35-$40 million annualized additional expense, from June 2023. Let’s not forget the NSS notes which are also floating currently at LIBOR plus 6.734%. Fed Hikes should increase the cost of those significantly in 2023.

Verdict

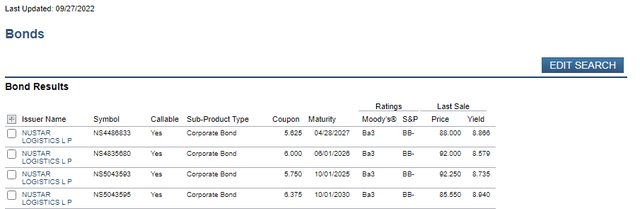

2022 was still the honeymoon year and NS did not have to deal with hostile credit markets. 2023 will likely prove far more challenging. As floating rate costs increase, NS will have to weigh how to continue to deleverage and also prepare for refinancing its large bond maturities in the coming years. All these notes below were issued under very benign credit conditions and their yields to maturity should give investors some pause.

We think NS will use a combination of asset sales, bank credit line and internally generated excess cash flow to redeem the series D in June 2023. That will likely max out its redemption capacity and the three publicly traded floating rate preferred shares will remain unredeemed. The three offer safer prospects relative to the common shares but their value could fall significantly in the next rate cut cycle. We don’t have a position here, but if we did have to choose, we would go with the October 2025 bonds with an 8.735% yield to maturity.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment