Young777/E+ via Getty Images

Investment Thesis

Nucor (NYSE:NUE) manufactures and sells steel products. Since I wrote about Nucor last month, evidence has continued to strengthen that steel prices are going to remain strong for a while, yet Nucor’s share price has barely moved.

Investors right now are trying to rotate into and out of commodities. The market is undecided on where to best position itself.

On the one hand, commodities are seriously cheap right now. While on the other hand, tech has taken a beating in the past 12 months, which leads many investors to inevitably clamor for ”buy the dip” strategies. The thesis there? XYZ stock now ”only” trades at 10x forward sales. Yes, all the free cash flow is stock-based compensation, but that’s a ”non-cash expense”.

On yet the other hand, over the past decade commodities have been a terrible place to invest. Why should investors believe that this time it’s different?

Typically buying into commodities at low multiples to free cash flow has been the absolute worst time to buy into commodities. Yet, I nevertheless argue that this time it’s different.

Steel Prices Are Moving Higher

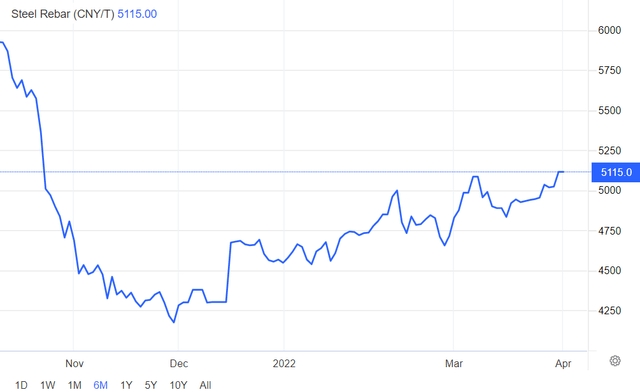

Trading Economics, steel prices

Here’s the fact, since December still prices have been trending higher. What does this tell you? It tells you that it has absolutely nothing to do with the Russian sanctions. The underlying dynamics were already in place prior to the sanctions coming into place.

What this means is that the steel prices trading at near the 5-year high marker had nothing to do with Russian sanctions that only came into place around the middle of March.

Said another way, Russian sanctions put accelerant into what was already a very tight steel market.

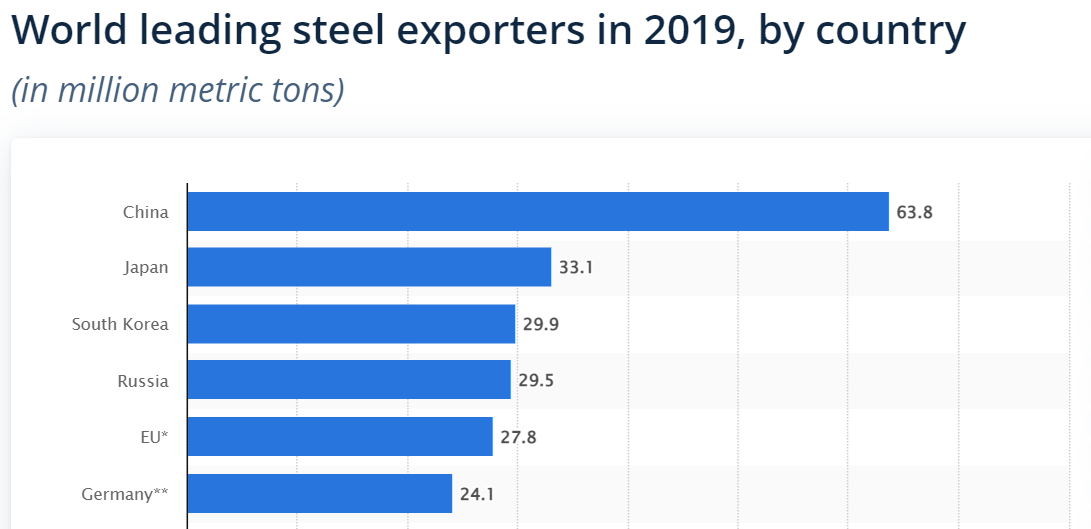

Statista

Russia is the top 4 producer of steel in the world. Thus, the sanctions make it difficult for Russia to export steel. Then, you have China being the biggest exporter in the world, but you have to keep in mind the following.

Steel production is very carbon-intensive. China’s intent on being greener has made it eager to cap steel production. Thus restricting supply.

That leaves European players as well-positioned to produce more steel. The problem though is that to make steel you need natural gas, as the fuel source. But as you know, Europe is going through an energy crisis.

Trading Economics, gas prices in Europe

Natural gas in Europe is now up more than 500% y/y. For steel producers in Europe, it becomes practically uneconomical to mass-produce steel, asides from what is already contracted out.

Finally, you have analysts that follow this sector running surveys that highlight market participants nearly unanimously agree that steel prices in April are going to continue to move higher.

This begs the question, how will heavy industry, the housing industry, infrastructure, bridges, and EVs get built? Steel is used in countless end markets. You simply can’t move an economy forward without steel!

NUE Stock Valuation — Still Cheaply Valued

Before discussing its valuation, keep in mind that Nucor carries $2.5 billion of net debt. Moreover, Nucor has $600 million of debt maturity coming up in Q3 2022, which I fully expect Nucor to pay down.

What’s more, we already know that just a few weeks ago, Nucor announced its intention to early redeem its 2023 notes.

This shows that not only Nucor is generating very strong cash flows, but that Nucor believes it has strong-enough near-term prospects that it can chip away at its debt stack early.

For a business that’s highly free cash flow generative, this makes sense.

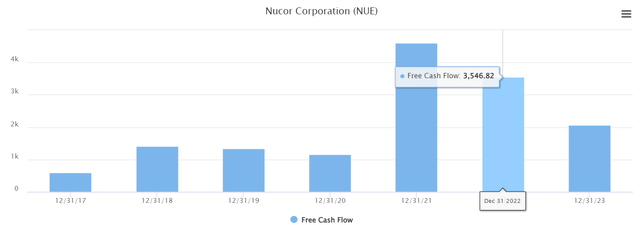

TIKR

On the other hand, analysts following the company largely predict that Nucor’s free cash flow will dip lower in 2022 compared to 2021.

However, for all the reasons noted above, I don’t believe that to be the case. In fact, I strongly contend that over the next several weeks, once Nucor announces its full Q1 2022 results, analysts will be busy upwards revising their guidance.

Indeed, I continue to assert that given where steel prices are now, the likelihood of Nucor reporting $5.5 billion of free cash flow in 2022, as I argued in my previous article, strengthens further.

This puts NUE priced at approximately 7x this year’s free cash flow.

And as I’ve been making the argument for some time now, getting new steel supplies online could take at least another 2-3 years.

What company is going to get funding for additional steel production in this environment?

Businesses simply don’t know if these elevated steel prices are going to stick or slide away? Consequently, it’s very difficult to project a net present value for a project with such volatile inputs.

The Bottom Line

Investors are now facing a terrific setup. You have a really tight steel market, where getting meaningful further supply online is going to take a few years. Meanwhile, for now, NUE’s share price is very low compared to the company’s total free cash flow potential over the next year or two, at roughly 7x this year’s free cash flow.

To me, this strikes me as an asymmetrical bet, where the upside is meaningfully higher than the downside.

I don’t own shares in NUE but I do own shares in X. Whatever you decide, good luck and happy investing.

Be the first to comment