martin-dm/E+ via Getty Images

Investment Thesis

Nu Holdings (NYSE:NU) is the parent company of Nubank, a leading digital bank in LATAM. The Brazil-based company was founded back in 2013 by David Vélez. As a digital bank, all customers’ banking activities are done online. The company has taken Brazil by storm and grown substantially over the past few years with over 40 million active customers currently, making it one of the largest digital banking platforms in the world.

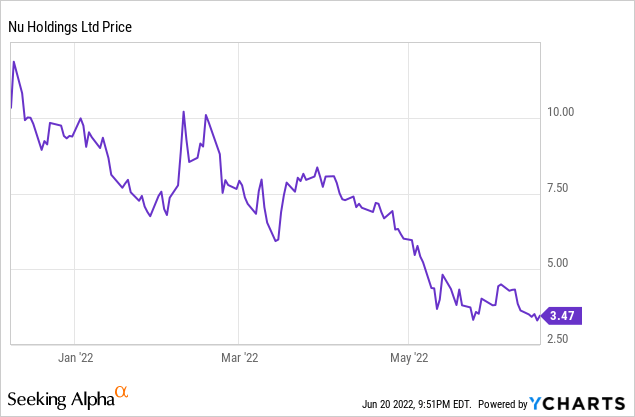

Nu Holdings is the blockbuster IPO of 2021. The Buffett-backed fintech company went public with a whopping valuation of nearly $50 billion. However, the stock quickly got caught in the broad market selloff, with the share price down almost 70% from its all-time high. The company has a huge TAM (total addressable market) and is growing revenue quickly. It is also expanding its offerings to capture a larger wallet share from existing customers. After the selloff, I believe the company is now trading at an attractive level given its growth and the opportunities that lie ahead. Therefore, I rate Nu Holdings a buy at the current price.

Market Opportunity

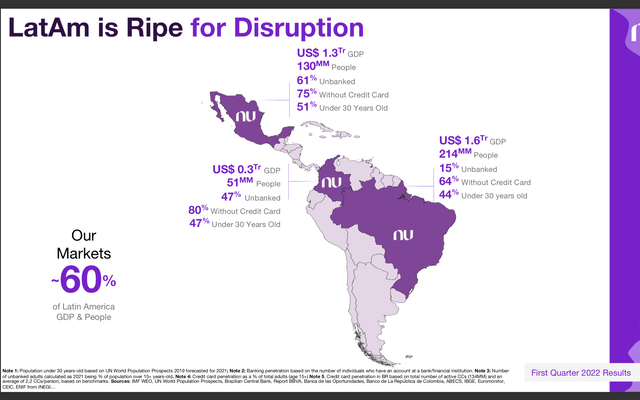

Nu Holdings aims to make banking easy and accessible to everyone in the LATAM (Latin America) region. Nu Holdings operates mainly in Brazil, Mexico, and Colombia, where a large amount of the population remains unbanked. According to PagBrazil, there are currently around 16.3 million adults in Brazil without a bank account (10% of the adult population). While another 17.7 million adults have not used their bank account for at least a month. These unbanked adults combined transact over $67 billion USD annually. In Mexico, the number is even worse with over 50% of the population being unbanked, according to S&P Global (SPGI).

Besides just banking, the company also offers products like credit cards, insurance, loans, investments, and business accounts. These offerings further increase its TAM and customer engagement rate. Despite having over 40 million customers, Nu Holdings’ penetration rate is still low in LATAM. Currently, around 33% of adults in Brazil are Nu Holdings customers, while the percentage is much lower in Mexico and Colombia at 2.2% and 0.5% respectively. Nu Holdings is trying to disrupt the outdated banking industry in LATAM, and it has a TAM to capitalize on.

Expanding Offerings

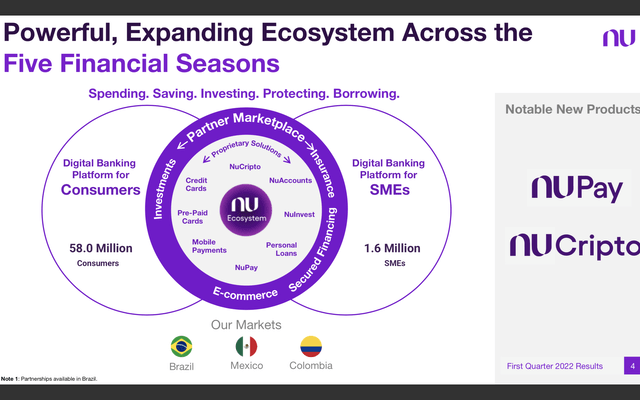

Nu Holdings is trying to build a full banking ecosystem by expanding its product and service offerings. The company’s core product is its digital banking account. It is a savings account with a higher interest rate compared to traditional banks. It allows users to make free instant transfers and payments 24/7, and withdraw money from over 25k ATMs all over the country. Customers can also apply for a debit or credit card for contactless purchases in-store and online. As the company established a strong client base, it is now starting to offer more new products and services to further monetize customers. Nu Holdings is now also providing life insurance, mobile insurance, personal loans, and investment services. The power of Nu Holdings is that all these services can be done in-app, without having to go to different places for different services. Everything is also integrated, which provides a seamless and exceptional experience for customers.

Besides the consumer end, Nu Holdings is also expanding to business banking that targets SMEs (small and medium-sized enterprises). The company now offers business accounts and business credit cards for companies. Businesses can now conveniently transfer money and receive payments in a variety of ways. It allows them to easily send and track bills made in the app. The business credit card also allows companies to track employees’ spending easily. The company also recently launched NuTap, a feature that allows businesses to use their phone as a POS (point of sale) device to accept contactless payment from credit and debit cards. The continuous product expansion is crucial to its ecosystem as it is able to increase customer engagement rate, which then drives up the monthly average revenue per customer.

Financials And Valuation

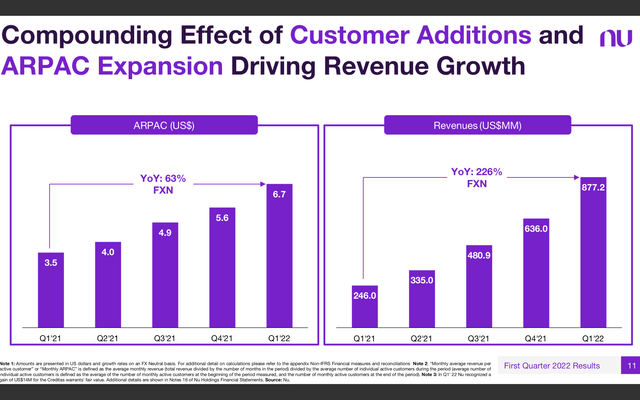

Nu Holdings recently announced its first-quarter earnings for FY22 and the results are very impressive with strong growth across all metrics. The company reported a revenue of $877.2 million, up 258% YoY (year over year) from $245 million. Interest income and financial instruments generated $619.4 million, or 70.6% of total revenue. While fee and commission income generated $257.8 million, or 29.4% of total revenue. Gross profit was $294.1 million, up 154% YoY from $115.7 million. The gross profit margin for the quarter was 34%. Operating cash flow increased modestly from $131.4 million to $163.6 million. Adjusted net income was $10.1 million, compared to an adjusted net loss of $(11.9) million a year ago.

The company ended the quarter with 59.6 total customers, up 61% YoY. Purchase volume was up 112% from $7.5 billion to $15.9 billion. The monthly average revenue per active customer went from $3.5 to $6.7, representing a successful monetization of new products and services. Deposits were $12.6 billion compared to $5.5 billion a year ago, representing a 129% increase. The company’s balance sheet is very healthy with $4 billion in cash and only $370 million in debt, giving it enough capital to navigate through the weakening economic cycle.

David Vélez, CEO, on Q1 results

This is the strongest quarter in Nu’s history. We reached nearly 60 million customers and a record-high activity rate of 78%. Our earnings-generating formula helped drive a record high quarterly revenue of US$887 million (226% increase YoY on an FXN), with a low customer acquisition cost, increasing revenue per customer, and decreasing cost to serve.

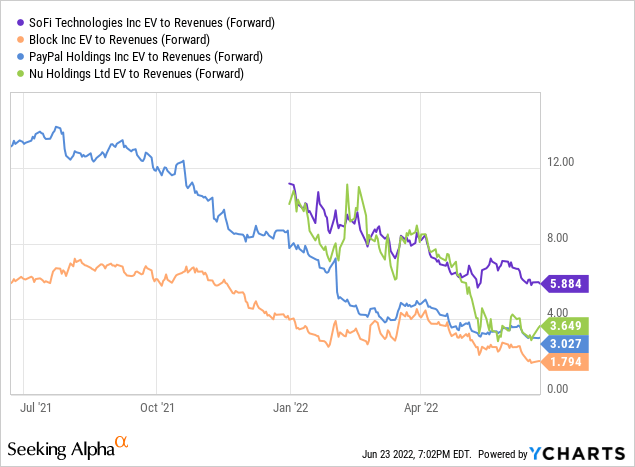

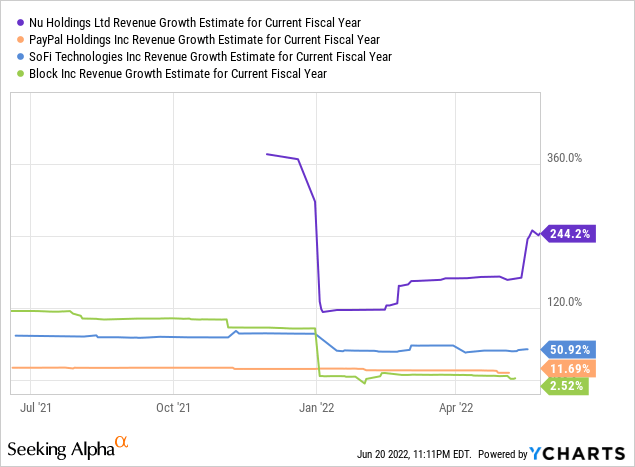

After the massive drop since its IPO, Nu Holdings is now trading at a compelling valuation. It is currently valued at a fwd. EV/sales ratio of 3.65 (I am using EV/sales rather than price to sales, as it takes the cash and debt balance into account). Current valuation is elevated compared to its fintech peers such as Block (SQ), and PayPal (PYPL), while cheaper than SoFi (SOFI), as shown in the first chart below. However, it is important to keep in mind that the growth rate of Nu Holdings is much higher at over 200%, while Block and PayPal are struggling to grow, as shown in the second chart below.

Nu Holdings is also projected to continue its strong growth. According to Seeking Alpha’s analyst estimate, the company is estimated to further grow revenue by 47% in 2023, while Block and PayPal are estimated to grow by 20% and 17% respectively. The increase in revenue will put the company’s FY23 EV/sales ratio at 2.47, much more in line with peer’s multiples. It is also worthy to note that Block is trading at a low EV/sales ratio due to its low gross profit margin, which is currently standing at 28.7%, 630 basis points lower than Nu Holdings’. As the company continues to grow, the sales multiple will drop quickly to even lower levels. I believe the current valuation is more than justified as it is still in its early hyper-growth stage with a huge market expansion opportunity.

Macro Risks

The current high inflation rate may pose significant risks to Nu Holdings. The company generates a lot of its revenue fees from loans and credit card purchase volume. However, with inflation being persistent and central banks being forced to raise rates, consumer purchasing power will decrease, and the delinquency rate may go up. This will increase the number of NPL (non-performing loans) and also reduce purchase volume. This problem is further magnified as the company operates mainly in the LATAM region, where the economy is much more volatile and vulnerable. For example, the current inflation rate in Brazil is 12.1%. While the unemployment rate is also much higher at 7% compared to 3.6% in the US. These underlying risks are definitely something investors need to keep in mind when investing in Nu Holdings.

Conclusion

In conclusion, I believe Nu Holdings has a massive potential going forward. The TAM for the company is huge, and fintech is still in its early innings. A large percentage of the population in countries like Brazil, Mexico, and Colombia remains unbanked, which provides a huge opportunity for Nu Holdings to further expand. I expect the penetration rate of fintech to accelerate quickly as more and more of the LATAM population have access to mobile and the internet. The company is also actively launching new offerings to expand its ecosystem and improve monetization. The recent quarterly report demonstrated that this strategy is working, with revenue up over 258% and revenue per customer almost doubled. The current valuation is in line with peers, yet Nu Holding is growing significantly faster. I believe a higher valuation should be warranted due to its strong growth and huge TAM, therefore, I rate the company as a buy.

Be the first to comment