Sergio Yoneda/iStock Editorial via Getty Images

Investment thesis

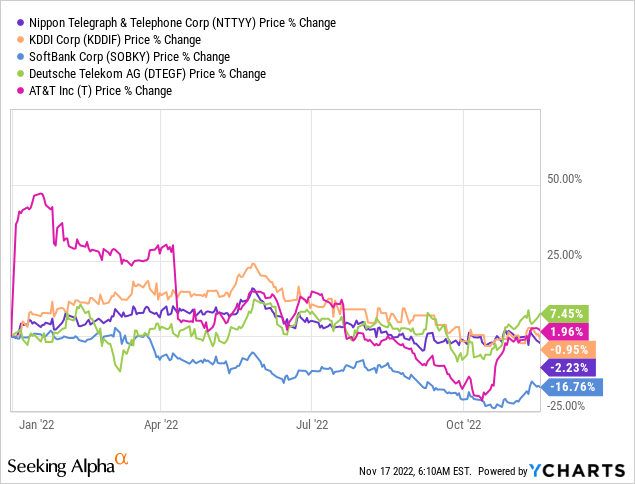

Nippon Telegraph and Telephone Corp.’s (OTCPK:NTTYY) shares have outperformed the market year-to-date, and are in line with its key domestic peer KDDI. Q1-2 FY3/2023 results demonstrated stable performance despite macro headwinds, and the company continues to increase shareholder returns. The shares could be an attractive proposition during turbulent economic times with a steady 3.5% dividend yield. However, with limited scope for sustainable earnings growth, we maintain our neutral rating.

Quick primer

Nippon Telegraph and Telephone Corp. (better known as NTT) is Japan’s largest integrated telecommunications company and is 34.8% owned by the Ministry of Finance of the Government of Japan. Its core earnings driver is the mobile business operated by subsidiary NTT DoCoMo, which was wholly consolidated in FY3/2021 (stake raised from 66.2% to 100%) at a cost of JPY4.3 trillion/$39.4 billion in September 2020 – the largest ever tender offer in Japan.

The group has a total workforce of 339,050, with over 50% employed in the Global Solutions business which provides IT services and data center operations in 80 countries.

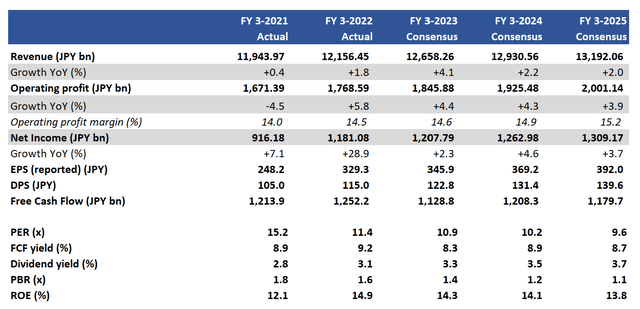

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

NTT shares have performed relatively in line with its key domestic peer KDDI (OTCPK:KDDIF), and have lagged slightly versus global peers Deutsche Telekom (OTCQX:DTEGF) and AT&T (T).

We revisit our previous view from May 2021 where we rated the shares as neutral, with concerns over the company’s ability to balance its deleveraging strategy and catering to shareholder returns.

Steady performance in Q1-2 FY3/2023

Despite challenges from rising electricity rates and price reductions for the mobile business, NTT’s Q1-2 FY3/2023 results demonstrated stability with revenues growing 6.8% YoY, and operating income falling slightly at -1.3% YoY. FY3/2023 company guidance remains unchanged, with the implied operating growth of 8.5% YoY which to us look slightly optimistic. Nevertheless, spending looks well managed with FY capex expected to rise 3.7% YoY, and personnel expenses at core group companies NRR East and NTT West to decline 1.6% YoY.

What is more difficult to manage in the shorter term is debt, with the debt-to-equity ratio reaching 99% in FY3/2022 (page 71) after the NTT DoCoMo transaction. With debt levels expected to remain relatively flat YoY for FY3/2023, the company appears happy to let gearing remain historically high. With current financing costs being offset by financing income, this may be a practical approach.

On a negative footing, there is little evidence to date of synergies with the DoCoMo business integration. The Global Solutions business (principally IT services) is trading behind guidance, due to the shortage in semiconductors affecting customer project rollouts – but the pipeline is said to be relatively firm although there is a risk of project slippages in H2 FY3/2023.

Overall, no major surprises were underlying NTT’s ability to operate sustainably despite some macro headwinds.

A steady growth pace of shareholder returns

NTT has maintained a gradual growth profile for its dividends, increasing for 10 consecutive years since FY3/12 (page 63). While the prospective dividend payout for FY3/2023 remains on the lower side of the spectrum at 35%, this emphasizes management’s aim of maintaining a steady track record of increases over time. The company also announced a new JPY150 billion/USD1.0 billion share buyback program running to March 2022 – this is on top of a hefty JPY360 billion/USD 2.5 billion share repurchase from the Japanese government conducted in September 2022. In total, the total shareholder payout ratio is set to reach 75% for FY3/2023 which is very high but likely to be a one-off.

With an asset-heavy balance sheet, there is always scope for NTT to allocate greater capital to shareholders. There are assets already earmarked for sale worth JPY211 billion/USD 1.5 billion, and other financial assets worth JPY1.52 trillion/USD10.5 billion (page 4). However, management takes a conservative stance and the likelihood of large one-off gains is low. A “slowly but surely” approach may not be to everyone’s tastes, but if investors are looking for a low-risk coupon of around 3.5% or so, NTT could certainly fit the bill.

Valuation

On consensus forecasts (see Key financials table above), the shares are trading on PER FY3/2024 10.2x on a free cash flow yield of 8.9%. These valuations are not high despite the ex-growth profile and a rising yearly dividend looks highly probable.

Risks

Upside risk stems from accelerated progress over cost reductions via the DoCoMo integration as well as personnel costs at the key retail operations NTT East and NTT West. Dividend payouts could increase, with the historic high being 42.3% in FY3/2021.

Downside risk comes from future dividend hikes being lower than market expectations. The Global Solutions business has overseas exposure where the company is not highly competitive and profitability could decline as wage and other cost inflation takes hold.

Conclusion

NTT is a relatively stable operation with a solid asset-rich balance sheet, and a cash cow business with a progressive shareholder returns policy. These are positive characteristics, yet the shares do not look particularly exceptional. During turbulent economic times, NTT may look like a decent place to park some capital, but from a longer-term perspective, it does lack dynamism and upside risk. If you are an investor looking for a conservative business with a steady 3.5% yield, then NTT is for you. As we look for investments that display sustainable growth, we maintain our neutral rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment