halbergman

DNOW Has Many Positives

NOW Inc. (NYSE:DNOW) provides maintenance, repair, and operating supplies (MRO products), pipes, valves, artificial lifts, pumping solutions, and others. Because of increasing PVF sales and its strong balance sheet, I already discussed the stock as a good “buy” in my previous article.

Following the stock’s strong run over the past month, I expect its operating profit to increase significantly because of increased demand for the core service of supplying packaged units in MRO products, PVF, and safety services. On top of that, it will benefit from increased demand for fiberglass solutions in turnkey solutions. Currently, it focuses on optimizing inventory and cost control. Recently, it made an acquisition that strengthened its pump strategy and expanded the flex-flow horizontal rental pumps solution.

However, during Q2, higher working capital requirements pushed its cash flows into negative territory. Nonetheless, armed with a robust balance sheet, the share repurchase program reflects the board’s confidence in its improved financial performance. The stock is relatively undervalued compared to its peers. So, I would suggest investors buy the stock.

Strategic Focus

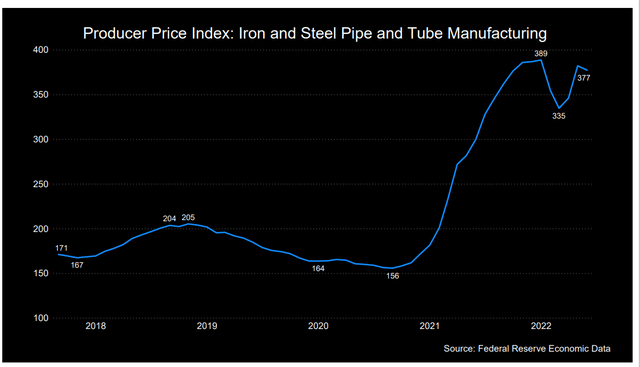

I discussed NOW’s PVF (pipe, valves, and fittings) sales and other key strategies in my previous article. In the past year until June, the producer price index for iron and steel mills increased by 26%, indicating a rise in input cost. In the current scenario, DNOW’s management is optimizing inventory to control costs by forward-positioning its supercenters to capture a margin-accretive share. So, US Process Solutions could reduce customers’ long lead times and address inventory shortness. In the Permian, it has worked out of its new location for a quarter, which helped it maintain customer proximity and deliver value to the last mile. Among other opportunities, it sees increased demand for its fiberglass solutions in turnkey solutions. Overall, its core service of supplying packaged units in MRO products, PVF, and safety services are in higher demand.

In international business, the company has considerably reduced its footprint after ceasing operations in Russia. It also exited a few countries in Latin America and the Middle East. Although it may result in a $4 million to $5 million quarterly revenue loss, it transitions from an export model to a regionalized service model to reduce costs.

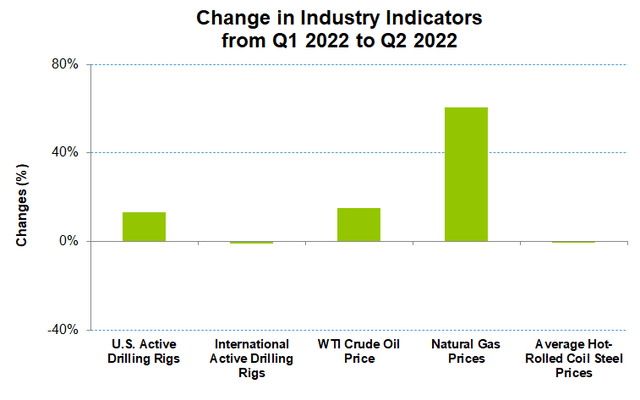

Market Outlook And Forecast

Over the past year, the crude oil price spiked by 40%, while rig count and completion activity increased by 56% and 35%, respectively. The upswing has favored a recovery for the company’s US Drilling Services segment. In Q3 2022, DNOW expects its US revenues to increase by “mid-single-digits.” EBITDA can expand by “low single digits” in Q3. Gross margin, however, would remain unchanged compared to the 1H 2022-level (~23%).

Its FY2022 guidance, at the middle of the year, is among the highest in many years. In FY2022, the management expects revenue to grow by ~30% compared to FY2021. EBITDA can increase by $100 million in FY2022, which translates into a 420-basis point improvement compared to FY2021.

Digitization And Pumping Strategy

The company’s DigitalNOW platform slightly underperformed the overall company. This operation’s revenues increased by 9% quarter-over-quarter versus the company’s 14% topline growth. However, with increased automation, it achieved higher percentages of the bill and material accuracy. During Q2, through the application of the Mercury Asset Management solution, it secured a multi-year integration services contract. Its shop.dnow.com platform and eSpec digital product configurator and dryer equipment packages help workflow solutions and reduce greenhouse gas emissions.

The company also strengthened its pump strategy during Q2. It made an acquisition that expanded the flex-flow horizontal rental pumps solution. Its rental H-pump solutions would reduce lead times and address the criticality of equipment uptime in high demand.

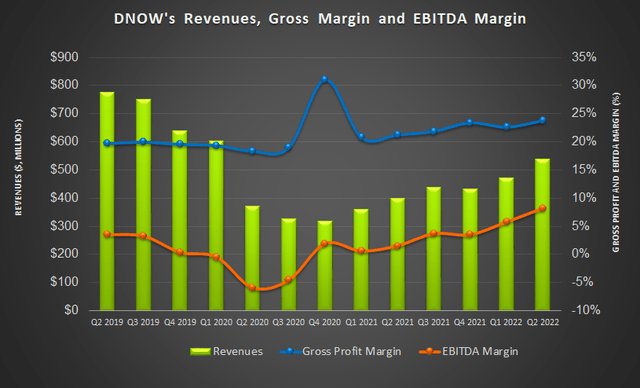

Q2 Drivers And Margin Analysis

The company’s U.S. revenues increased by 22% in Q2 2022 compared to Q1 as the upstream activity increased in the U.S. The U.S. energy centers contributed ~76% of total U.S. revenues. The company executes a new regionalized fulfillment model that selectively targets opportunities in this region.

Its revenues from international markets (excluding Canada) increased moderately (4% up) quarter-over-quarter in Q2. The offshore investments in subsea tie-back projects have begun to trickle, and the FPSO projects materialize in Europe, leading to the topline growth in Q2. In Q2, the offshore drilling rig utilization improved, and day rates increased. In the Middle East, drilling and production investments expanded. Jackup rig activations in Southeast Asia also saw an increase. In Latin America, the nationalized oil companies have started investing again as offshore activity from drilling contractors increased.

The company’s gross margin expanded by 110 basis points in Q2. The margin expansion reflects increased project product margins, lower inventory costs, and pricing benefits. The warehousing, selling, and administrative expense (or WSA) also decreased during Q2, leading to a 250 basis point hike in the EBITDA margin in Q2 compared to Q1.

Cash Flows And Balance Sheet

In 1H 2022, growing market activity led to higher working capital requirements, which pushed DNOW’s cash flow from operations (or CFO) to the negative territory from a mildly positive CFO a year ago. Although free cash flow (or FCF) remained negative in 1H 2022, it improved due to lower capex plus acquisition spending in 2022. The management expects to generate positive FCF in 2022 as the effect of supply chain disruption reduces by Q4.

DNOW’s liquidity was $574 million as of June 30, 2022. Because DNOW is nearly free of any debt, it gives it a definitive advantage over its peers (FAST, MSM, and MRC). During Q2, it embarked on a share repurchase program amounting to $80 million. The decision reflects the board’s confidence in its improved financial performance and robust balance sheet.

Linear Regression Based Forecast

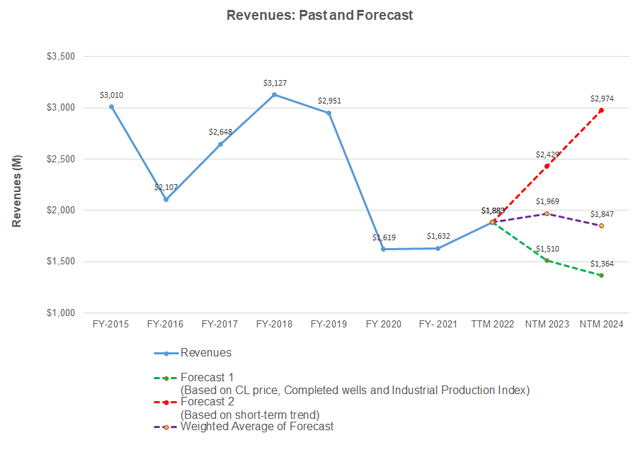

Author created, Seeking Alpha, and EIA

A regression equation (based on the completed well count, crude oil price, Industrial Production Index, and DNOW’s reported revenues) for the past seven years and the previous four-quarters suggests that its revenues can increase in the next 12 months (or NTM) 2023. However, it can decline in NTM 2024.

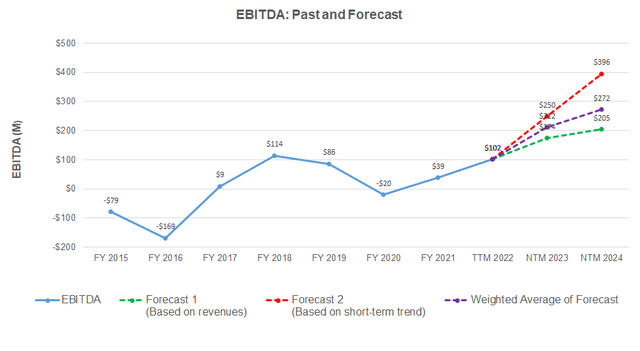

Author created and Seeking Alpha

Based on a regression model, I expect the company’s EBITDA to increase significantly in NTM 2023 and at a decelerated pace in NTM 2024.

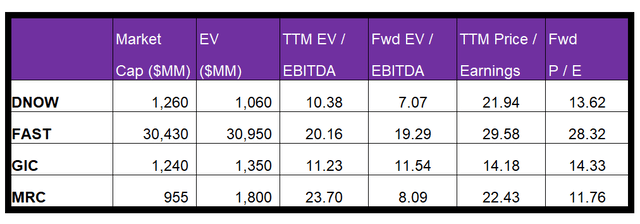

Target Price And Relative Valuation

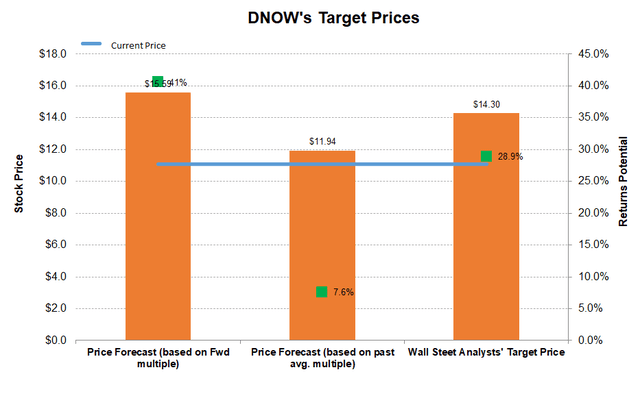

Author Created and Seeking Alpha

DNOW’s returns potential (41% upside) using the forward EV/EBITDA multiple (7.0x) is higher than Wall Street’s sell-side analyst expectations (29% upside) and the returns potential (7.6% downside) based on the past EV/EBITDA multiple.

DNOW’s forward EV/EBITDA multiple contraction is steeper than its peers’ EV/EBITDA contraction. The company’s EV/EBITDA multiple (10.4x) is lower than its peers’ (FAST, MSM, and MRC) average. This typically results in a higher EV/EBITDA multiple compared to peers. So, the stock is relatively undervalued.

Why I Remain Bullish?

In my previous article, I stressed DNOW’s PVF and value-added service growth propelling DNOW’s sales. I wrote,

In early 2022, DNOW’s strategies will hinge on the interplay between PVF (pipe, valves, and fittings) price hike and the cost rise in line-pipe and high steel content products. As the drilling activities rise, the company looks to grow its share of pipe valves and fittings for the wellhead hookups and tank battery facilities. Along with value-added services, their lifting costs will also be lower.

In the middle of the year, its stance somewhat shifted to more innovative inventory management, cost control, and margin expansion. As a result, its quarter-over-quarter EBITDA growth (63% up) surpassed the revenue growth (14%). I think it will continue to focus on margin unless the economy steps out of the shadow of the recession.

What’s The Take On DNOW?

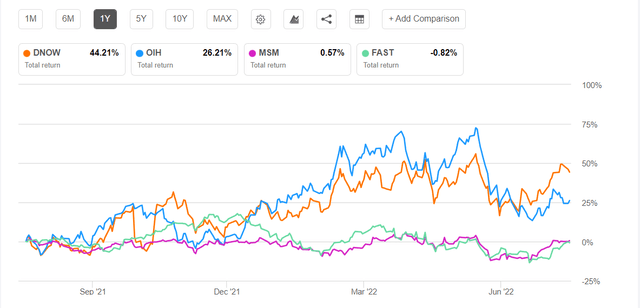

By mid-2022, DNOW’s strategies have changed from price hikes of PVF products to optimizing inventory to control costs. It maintained customer proximity and delivered value to the last mile. By the end of 2022, its revenues can significantly increase because its core service of supplying packaged units in MRO products, PVF, and safety services are in higher demand. Also, the DigitalNOW platform pushed the topline growth higher. The stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

The company holds a robust balance sheet with no debt and ample liquidity. However, during Q2, DNOW reduced its footprint in many international operations and ceased operations in Russia, impacting its sales volume in the short term. Plus, higher working capital requirements pushed its cash flows to the negative territory. The stock’s relative undervaluation should prompt investors to buy it at this level.

Be the first to comment