tiero

Investment Thesis

Universal Technical Institute (NYSE:UTI) provides various education programs in the education sector. They recently announced FY22 and Q4 FY22 results. They saw an increase in the addition of new students in FY22, and management is optimistic about growth in the addition of new students in FY23. In this thesis, I will analyze their financial performance, and after analyzing all the aspects, I will give my opinion on the future of UTI.

About UTI

UTI is a leading workforce that provides transportation, technical training, and health education programs in the United States. They are comprised of two divisions: Concorde career colleges and UTI. Concorde career colleges operates across 17 campuses offering programs in Nursing, Dental, and Allied health. UTI operates 16 campuses and offers degree programs and certificates under various brands like NASCAR Technical Institute, Universal Technical Institute, MIAT college of technology, and Motorcycle Mechanics Institute. It was founded in 1965 and headquartered in Phoenix, Arizona.

Financial Analysis

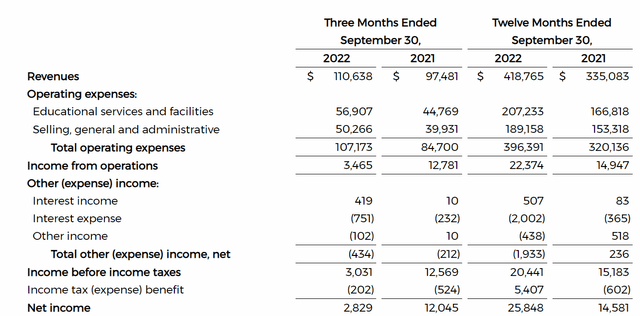

UTI recently announced its FY22 and Q4 FY22 results, and in my view, it’s pretty impressive. The Q4 FY22 revenues were in line with market expectations. They beat the Q4 FY22 EPS estimates by 66.8%. The reported revenues for FY22 were $418.7 million, an increase of 25% compared to FY21. I think the primary reason behind this increase was the increase in the average number of undergraduate students and the increase in the revenue earned per student. The net income for FY22 was $25.8 million, an increase of 77% compared to the net income of FY21. I think this increased net income resulted from proper advertising done by the company, which increased the new students’ addition by 2.7% compared to the FY21. Their diluted EPS for FY22 was $0.38, a significant rise of 125.5% compared to FY21.

Now talking about the quarterly results. The reported revenue for Q4 FY22 was $110.6 million, an increase of 13.5% compared to Q4 FY21. The reported net income for Q4 FY22 was $2.8 million, a decrease of 76.5% compared to Q4 FY21. I believe the primary reasons behind the decline in the net income was the heavy spending by the company on new acquisitions and start-up cost for the new campuses. I believe the fall in the net income is temporary, and in the coming quarters, the company can experience a healthy profit margin.

Technical Analysis

UTI is currently trading at the level of $6.29 and is below its 200 ema, and when a stock trades below its 200 ema, it is considered in a downtrend. In September 2022, it formed a double bottom pattern which is viewed as a reversal pattern; after forming the double bottom pattern, it broke out of the pattern, and after breaking out, it moved up by 32%. Now the stock is returning to retest the breakout level of $6, and I think after the retest, the stock can again move up, reaching the level of $8, giving returns up to 34%. I believe one can enter the stock at $6 for short-term investment by keeping the stop loss at $5.50. This trade can be an excellent risk-to-reward ratio trade where loss is of a minimal 8% and reward up to 34%.

Should One Invest In UTI?

UTI has provided FY23 guidance for expected new student addition, which is in the range of 22000-23500. If we take the midpoint of the range, which is 22750, and compare it to the FY22 new student addition, which was 13374, we can see an increase of 70%, which is quite impressive. They are spending a lot of money on advertising and strategic acquisitions like the purchase of the Lisle, IL campus for $28.7 million and the setup of two new campuses in Austin and Miramar that cost them $28.6 million. I think these acquisitions and advertising will help them increase their revenues and capacity for new student addition, which is a positive sign. These steps taken by them show that they are committed to expanding their business which will ensure an optimistic future for the company.

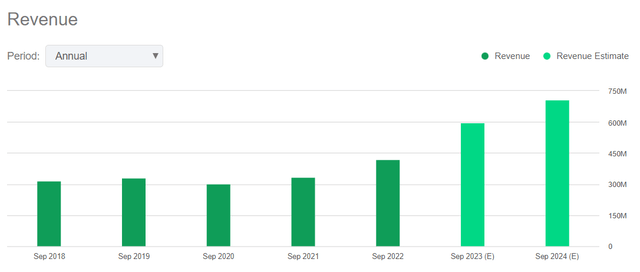

Regarding revenues, they have estimated revenue for FY23 to be around $595.4 million, which is about 42% higher than the FY22 revenue. In my view, they will achieve the revenue targets given the increasing addition of new students and the strategic acquisitions done by them.

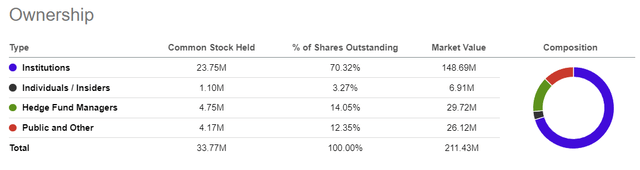

The shareholding pattern of UTI looks decent. Institutions hold 70% of the shares in the company. This shows that owners and institutions trust UTI for the future. When institutions own most of the shares in a company, we see less volatility in price fluctuations, and they are considered safe to invest in, which is a positive sign for investors.

Risk

High Competition

The education market is highly competitive and very dynamic. They compete with public and private colleges and private schools, which can provide tuition low of cost and for free in some cases because of the government subsidies and other financial sources available. Due to this, they might lose students, which can severely impact the company’s revenues. So, to survive in the market, they might have to limit their tuition increases and spend heavily on advertising to attract new students. This could increase their expenses, and it might affect the balance sheet of the company.

Bottom Line

According to my analysis after analyzing all the parameters, I think UTI has a bright future, and it might give decent returns in the future. Their revenues have constantly been increasing for the last three financial years, and they are witnessing an increase in the addition of new students, which is a positive sign. I believe they are on the right track and will continue to do better in the future. Since May 2022, the stock has corrected more than 40%, providing a good buying opportunity. I believe it has significant upside potential, and hence I assign a buy recommendation for UTI.

Be the first to comment