peakSTOCK/iStock via Getty Images

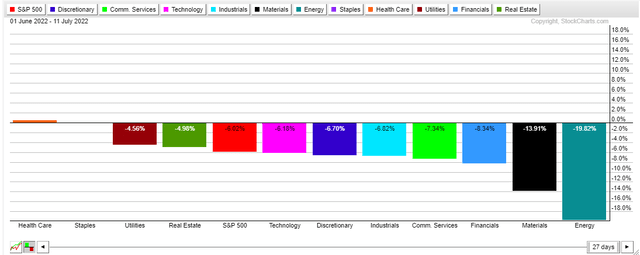

Investors continue to find relative safety in the Health Care sector. While other areas like Tech/Media/Telecom have seen fits and starts of relative strength this year and resources groups like Energy and Materials are increasingly volatile, Health Care emerges as the lone positive sector since early June.

Health Care: The Single Positive Sector

Within the diverse group is one particularly strong stock: Novo Nordisk (NVO). According to Bank of America Global Research, Novo Nordisk is a Denmark-based world leader in insulin and diabetes care. It manufactures and markets a variety of other pharmaceutical products. Key products include Victoza (GLP-1) and long-acting basal insulins Levemir and Tresiba.

Just recently, NVO and Eli Lilly (LLY) began selling or testing drugs to treat both diabetes and obesity. The Wall Street Journal reports that Novo’s anti-obesity drug Wegovy helped the company grow sales in the segment by about $480 million for the first quarter of this year. The company sees revenues hitting $3.5 billion annually by 2025.

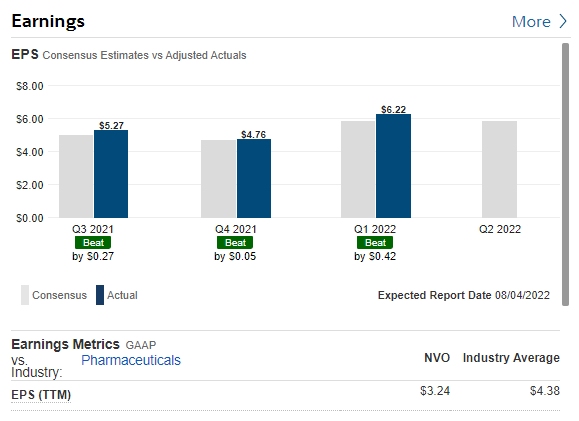

As a result of the success, analysts at BofA are optimistic on NVO shares. Ahead of its August 4 Q2 earnings date, BofA expects another bottom-line beat along with the company increasing its earnings outlook. It’s not just growth from Wegovy either. Strong sales from key drugs such as Ozempic and Rybelsus should help support a roughly 29% YoY climb on its top line, per BofA. Moreover, Novo has beaten on earnings in each of the last three quarters.

Novo’s History Of EPS Beats

Fidelity Investments

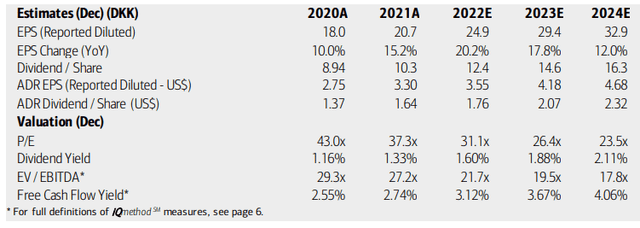

NVO trades at nearly 33x last year’s earnings, according to the WSJ while it pays a scant 1% yield. The $246 billion market cap ADR should grow profits by about 20% this year with gradually slowing growth through 2024 along with an increasing dividend. Free cash flow yield is not overly impressive, and its P/E ratio is high compared to the broad market, but robust growth should support a valuation premium.

Novo Earnings, Dividend, Valuation Forecasts

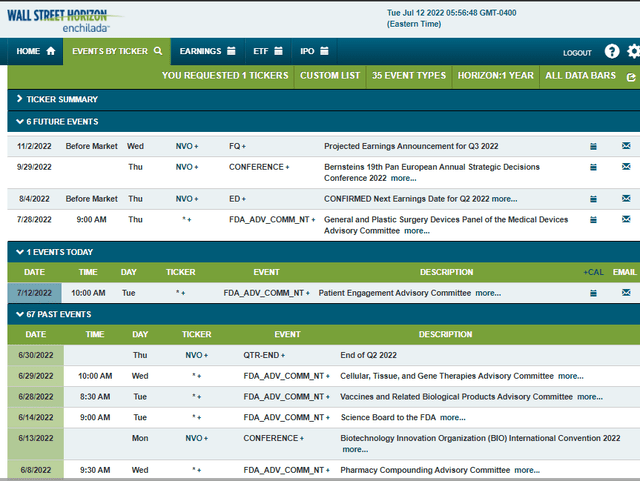

Later this quarter, traders should monitor the August 4 earnings date when Novo reports Q2 results BMO. There’s also a conference held in the UK at which NVO’s management is expected to present, according to Wall Street Horizon.

Upcoming Earnings & September Conference

The Technical Take

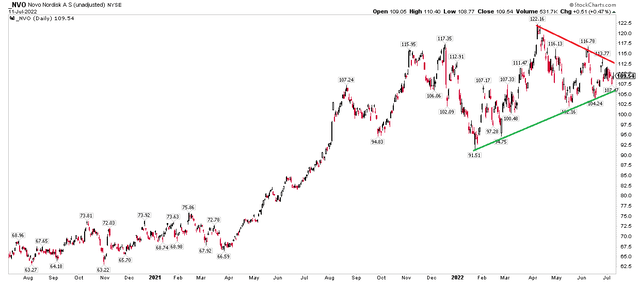

Clearly the business is doing generally well with rising profits and the prospect of an increase in guidance in the coming weeks. But what do the charts say? The stock has been consolidating for much of the last year. That’s actually quite bullish considering the overall market’s weakness. NVO shares have held an uptrend support line since January and are coiling under its all-time high notched in April. Watch for a breakout or breakdown from this pattern.

NVO Is Coiling After Hitting An All-Time High

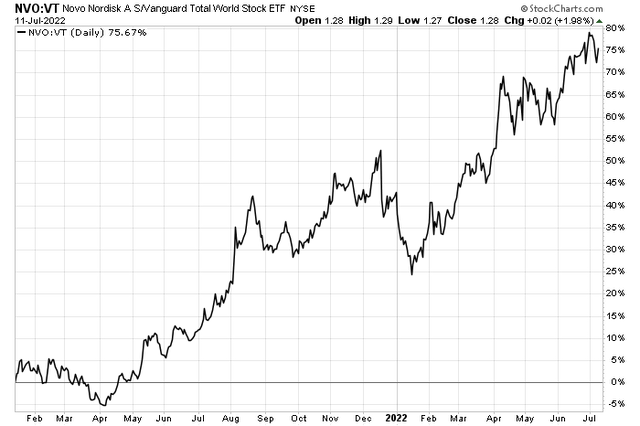

While the chart is important, it’s NVO’s relative strength that is particularly interesting. Notice how when compared to the global stock market (using VT as a proxy), shares are up more than 75% on a relative basis since January last year. Investors seeking strong price-action stocks with good growth fundamentals (a la William O’Neil’s method) might look to NVO.

NVO’s Relative Strength Versus the Global Stock Market

The Bottom Line

I like NVO here based on strong fundamentals and impressive relative strength technically. While its valuation is high, EPS growth from a few key drugs should insulate NVO from broader economic risks. The stock could attract buyers seeking growth as the market continues to struggle.

Be the first to comment