Doucefleur/iStock via Getty Images

Investment Thesis

I last updated on Novavax (NASDAQ:NVAX) – the vaccine developer – back in early December 2021, when the company’s stock traded at a value of $169, and its market cap was ~$13bn. I was bullish – the company’s share price was trading at a 60% discount to recent highs of $270, and I discussed my grounds for optimism as follows:

If we imagine that the 850m COVID vaccine doses ordered from Novavax are delivered next year, at let’s say $21 per dose (based on a recent small sale to Denmark at that price) then Novavax could earn as much as $18bn, which would put the company on a par with the major players – Moderna (MRNA), for example, which is forecasting for $15 – $18bn of revenues this year, or Pfizer (PFE), which is forecasting for ~$29bn of revenues from Comirnaty next year – with profits split equally with BioNTech (BNTX).

If we compare the market caps of Novavax, at $12.8bn, Moderna, at $105bn, and BioNTech, at $69bn, it’s pretty clear why investors are getting excited about Novavax’s prospects for the next two years.

But can a company that continually flatters to deceive actually deliver sales volumes to match investors sky-high expectations? In reality, management does not even have to do that – with Moderna trading at a price to sales ratio of ~9x, and BioNTech at ~5x, let’s say Novavax only earns $5bn of vaccine revenues next year, and take the midpoint of the 2 P/S ratios – 7x – and multiply $5bn by 7 to get $35bn.

Since that post, Novavax has provided 2022 guidance for $4 – $5bn of revenues – right in the sweet spot I mention above – and yet its share price has fallen to $54, down 69% since my last update, and at its lowest ebb since May 2020 – before the company was selected to participate in Operation Warp Speed (“OWS”), the Trump administration’s COVID vaccine accelerator, which has provided Novavax with >$1.7bn of funding to date.

The valuations of both Moderna and BioNTech have fallen too, to respectively $60.5bn, and $37.3bn, meaning their forward price to sales ratios are currently, based on forecast 2022 earnings of ~$19bn each, 3x and 2x.

It’s easy to understand why this has happened when we consider that demand for COVID vaccines is not as widespread or urgent as it was 12 months ago, and the two messenger-RNA vaccine developers are therefore likely to earn significantly less from vaccine sales in 2023 than they will this year.

But even at 2.5x 2022 sales, Novavax’ valuation ought to be at least as high as December’s $13bn market cap, surely? The market does not seem to see it that way, and there’s perhaps a simple explanation.

While Moderna and Pfizer / BioNTech successfully completed pivotal trials of their vaccines in the US allowing them to win an Emergency Use Authorization (“EUA”) in December 2020, and go on to manufacture and distribute billions of doses, Novavax’ path to approval has been beset by a variety of issues – some external, and some self-inflicted – and the company has still not secured approval of any kind in the US for Nuvaxovid, its sub unit protein COVID vaccine.

In other words, we can be fairly sure that Moderna and BioNTech / Pfizer will deliver the doses they have pledged to deliver in 2022, and be paid accordingly, just as in 2021, while Novavax continually frustrated the market last year, failing to earn a solitary cent from vaccine sales, so what guarantee can there be that 2022 will be any different?

In a nutshell this seems to be the reason why Novavax is currently valued at significantly less than 2022 forecast sales at the midpoint. The valuation would seem absurdly low – and a major investment opportunity – were it not for the fact that Novavax has a tendency not to deliver when it matters.

Its subunit protein vaccine approach has proven to be effective and safe, and its manufacturing capacity is 2bn doses per annum, management says, which, even after all this time, ought to make for a compelling investment opportunity.

In this post I will cover Novavax’s most recent presentation, released with its Q4 and FY21 earnings, and management’s latest earnings call, to try to establish if Novavax is now a well and truly busted flush, or whether patient shareholders, or those acquiring stock at the current lower price could still realize some upside in the next couple of years.

The Bull Case – Management’s Struggles Are Understandable – Novavax Is Now Ready To Make A Major Contribution To Longer Term COVID Vaccination

Although it seems fanciful to say it now, prior to Moderna and Pfzer / BioNTech’s outstanding November ’20 pivotal US trial results, Novavax was thought by many to be as likely as these other two to be first to market with an effective COVID vaccination.

The frustration with Novavax is that its vaccine’s effectiveness and safety has never really been in question. Had Novavax been able to arrange a 30,000 patient US trial, it’s tempting to wonder if it could have beaten e.g. Johnson & Johnson’s (JNJ) adenovirus COVID vaccine to market, but instead the company conducted its trials in the UK, South Africa, and South America.

The positive data – 89.3% efficacy in its UK trial – arrived at the end of January 2021, but then Novavax began to have manufacturing issues related to a shortage of raw materials, such as the 2k liter plastic bags used to grow cells required for vaccine production, and consistency of Chemistry, Manufacturing and Controls (“CMC”) at its different plants, and was forced to postpone its follow-up PROTECT-19 trial in Mexico and the US.

That pretty much ruled Novavax out of the race to supply mass vaccines to the US (other than the 100m pre-bought as part of OWS), and at the time of my last note, Novavax had only managed to secure an approval in Indonesia, with its vaccine manufactured by the Serum Institute of India, with whom Novavax has an agreement in place, under the name Covovax. It’s not hard to see why investors opted to sell.

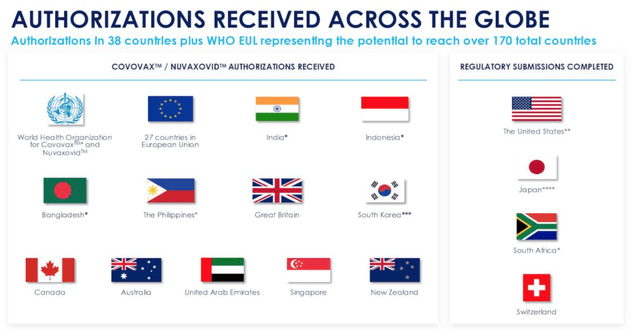

Fast forward a few months and today the situation looks quite different, approval wise, however, as we can see below:

Authorisations received by Novavax for Nuvaxovid / Covovax as of end of Feb 2022. (earnings presentation)

Authorisations received by Novavax for Nuvaxovid / Covovax as of end of Feb 2022. Source: Novavax FY21 earnings presentation.

The list of countries in which Novavax’ vaccine is approved now numbers 12, and includes major territories such as South Korea, the United Kingdom, and Canada, and has also been added to the World Health Organisation’s Emergency Use Listing (“EUL”), the 10th vaccine to be added overall.

Novavax CEO Stanley Erck told analysts on the company’s Q421 earnings call that the “vast majority” of forecast revenues for 2022 would be derived from product sales, and primarily product sold under the Nuvaxovid name and produced by the company, rather than the Covovax doses manufactured by the Serum Institute of India (“SII”).

Erck did stop short of providing quarterly guidance, which probably set investors nerves jangling, but was able to provide reassurance that 27m doses had already been shipped to Europe, and another 42m were scheduled to be delivered in Q221.

What’s more, the guidance does not necessarily include additional sales were Nuvaxovid eventually to be approved in the US – a Biologics License Application (“BLA”) requesting full approval will be sent sometime in H222, management has promised, and the EUA also remains in play.

As I mentioned in my last post, in the space of 12 months, Novavax grew its employee count from ~150, to ~800, which must have been a huge challenge operationally and perhaps explains why Novavax had so many issues hitting its targets – targets which were likely forced upon the company externally, rather than being a realistic internal assessment of what was possible, and when.

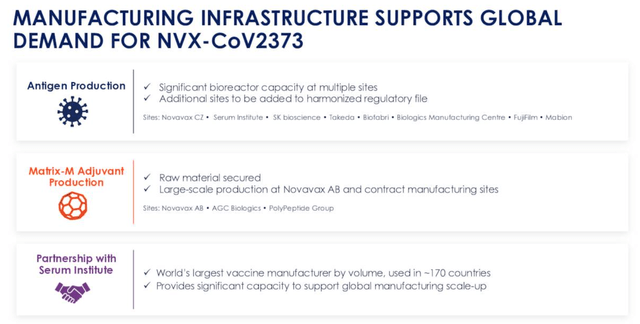

Novavax has plugged away, and now it appears it has the manufacturing infrastructure it needs, and the raw materials also, which management says has helped Novavax finally reach its manufacturing capability target of up to 2bn doses per annum.

Novavax updates on manufacturing capabilities: (earnings presentation)

Novavax updates on manufacturing capabilities: Source: Novavax FY21 earnings presentation.

Of course, this has all come too late for Novavax to grab a significant share of the mass vaccination market that will generate >$100bn of sales for Moderna, Pfizer and BioNTech, but in its presentation, Novavax lists 4 global market opportunities that are substantial in themselves: Primary Vaccination, Booster Vaccination, Pediatric Vaccination, and Equitable Access.

Although Nuvaxovid’s late development means it missed out on the revenues bonanza being enjoyed by approved COVID vaccines in 2021, and this year, CEO Erck pointed out on the Q421 earnings call the global vaccination rate is currently at ~56%, still significantly short of the WHO’s target of 70%.

The majority of the unvaccinated may be in developing rather than developed countries, likely making the WHO Novavax’s most important buyer, but there may be pockets of unvaccinated in developed countries, who may prefer Novavax’ approach over an mRNA vaccine.

Nuvaxovid may represent a good option for a booster shot, also having shown in trials that it can increase naturalization titers for all variants of COVID in a single booster, and as a pediatric vaccine, where it has shown 82% clinical efficacy against the Delta variant with a strong safety profile.

Novavax has even started work on an Omicron specific vaccine, which is admittedly at the preclinical stage (investors know not hold their breath where Novavax is concerned), and a COVID / Influenza bivalent vaccine is in a Phase 1 trial, with Influenza / RSV and Influenza / COVID / RSV combos also in development, albeit preclinical.

To summarize why Novavax can still be considered an important player in the COVID vaccination field, we can say with some confidence that Nuvaxovid is, according to all trials and studies, a safe and effective vaccine, that is capable of being manufactured at a rate of ~2bn doses per annum, along with its Matrix M adjuvant (see my previous article for a brief discussion of the science, and manufacturing process).

To this day, only Moderna and Pfizer / BioNTech’s vaccines can be said to be a preferred choice over Nuvaxovid, and that’s really more to do with their first mover advantage than efficacy, safety, or convenience – Nuvaxovid can be stored at room temperature.

As such, perhaps we can believe Novavax management when it guides for $4 – $5bn of revenues in FY22, and if that target is hit, it seems almost inconceivable that Novavax shares will be priced as low as $169 come the end of the year. It’s extremely rare to find a company trading at a Price to Sales ratio of <1x, and if Novavax does generate that volume of revenues, it will almost certainly be strongly profitable also – Moderna and BioNTech enjoyed profit margins well above 50%.

To my mind, that is as close to a guarantee of upside as an investor is likely to get, and when we add in catalysts such as a potential approval in the US, Q1 and Q2 earnings which ought to confirm management’s claims about delivery of 50-100m vaccines, and perhaps progress in the clinic with its bivalent or trivalent vaccines, Novavax, with arguably the third best COVID vaccination option on the market, really ought to deserve a much higher valuation. I cannot necessarily foresee the upside I promised in my last note in December, but there are powerful reasons to believe Novavax can at least recoup the value lost across the past four months.

A Brief Guide To The Bear Case

The bear case in relation to Novavax is not – thanks to the company’s well publicized struggles – difficult to make, and I will summarize it as follows.

First of all, in its 35-year history, Novavax has never had a product approved. The company has had near misses with both RSV and Influenza (see some of my previous articles on the company) but it could not get over the line, just as it been unable to do this far with Nuvaxovid.

Many people are skeptical about Novavax’s technology which synthesises the spike protein gene required for expression through the Sf9/BV baculovirus, and via its insect (moth) cell platform, which produces complex antigens able to fold into their native secondary and tertiary structures. There’s no question that messenger-RNA vaccines proved to be the most reliable and safe option for mass vaccination programs, so why rely on Novavax for protection against future outbreaks? Novavax has failed to move with the times.

Novavax management has consistently fumbled its trials, manufacturing, logistics, and approval applications, and that has destroyed investor faith in the company. Given >$1.7bn by OWS, Novavax demonstrated that it could not respond to the pandemic as effectively as two other companies that began developing vaccines at around the same time, and who had also not had a product approved before – Moderna, and BioNTech.

Conclusion – Timing Has Been Novavax’ Achilles Heel – But It’s Time May Still Come

During the pandemic – perhaps we should not yet be overly confident that the days of lockdowns and over-burdened hospitals are behind us – the crisis management capabilities displayed by the like of Moderna, BioNTech, Johnson & Johnson and even AstraZeneca (AZN) – were clearly superior to Novavax, although nobody knew exactly what progress was being made by who, which is why valuations fluctuated substantially.

That may not reflect well on Novavax, but the company should not necessarily be judged on what it was able to do in the period March 2020 – December 2021, when it was a relative minnow, but what it may be able to do over the longer term with its COVID vaccine and vaccine sin development.

Nuvaxovid did not ultimately gain authorization in the US, or indeed in any other country, in time to play a role in the mass vaccination process, which must have come as a major disappointment to investors picking up the company’s stock based on that opportunity, but there appears to be a solid product here, one that can be manufactured, distributed, used or stockpiled by up to 170 countries worldwide, at a rate of ~2bn per annum.

This same product may be developed into new bivalent or trivalent vaccines, and taken together, Novavax’ body of work across the Respiratory Synctial Virus, Influenza, and COVID is arguably as impressive as any of its rivals, although Novavax doesn’t have the approvals to show for it.

Ultimately, however, whether you are a Novavax bull or a Novavax bear, you must concede that if the company hits $4.5bn in revenues in 2023, that feat alone ought to drag the market cap valuation and share price upward – perhaps, as I have argued, by >100%. And let’s also not forget that Novavax reported a cash position of >$1.5bn as of Q421.

What’s more, these revenues are not so large as to be unrepeatable in subsequent years, as is the case with e.g. Moderna or BioNTech’s current revenue streams.

These two companies may have further to fall valuation wise, although they have masses of cash available to fund further R&D – but Novavax at least has a shot at its first highly profitable year as a commercial company, and unless management finds yet another way to disappoint investors, the share price is likely to be rewarded for this progress.

Be the first to comment