asbe/iStock via Getty Images

The market downturn has created opportunities in a number of asset classes. This is great for long-term income investors who have plenty of dry powder. It pays, however, to be choosy when selecting the “best of breed” in each asset class, as you would want to have a strong army of dividend payers to defend your castle.

This brings me to the high quality pharmaceutical giant, Novartis (NYSE:NVS). In this article, I highlight what makes the recent dip a good opportunity to layer into this dividend stock, so let’s get started.

Why NVS?

Novartis is a leading Swiss global pharmaceutical giant that employs 110K people from 140 different nationalities. Novartis’s medicines and treatments reach 800 million people worldwide, and in the trailing 12 months, generated $53 billion in total revenue.

Unlike some companies whose fortunes are tied to just one or two blockbuster drugs, NVS carries a well-balanced portfolio of blockbuster specialty drugs that treat immunology, cardiovascular, blood disorders, and oncology. This includes Entresto for heart failure and Cosentyx for psoriasis, which is Novartis’s top-selling drug, and accounts for just 9.2% of its USD $12.5 billion revenue during the first quarter.

Moreover, NVS is seeing solid momentum, as its innovative medicines portfolio grew by 5% YoY on a Swiss currency basis, driven by strong performance of key brands Entresto, Kesimpta (multiple sclerosis), Cosentyx, and Zolgensma (pediatric spinal muscular atrophy).

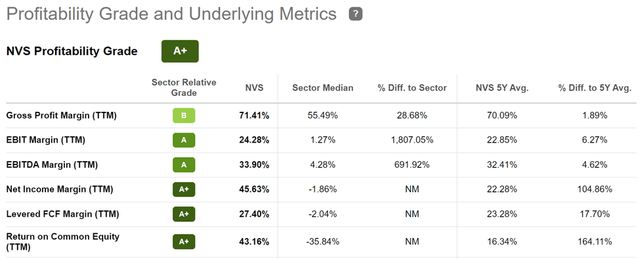

Also encouraging, NVS is seeing an acceleration in core operating income, with 9% YoY growth due to increased productivity and lower impairments. As shown below, NVS scores an A+ grade for profitability, with sector leading EBITDA and Net Income Margins of 34% and 45.6%, respectively.

NVS Profitability (Seeking Alpha)

NVS should be able to maintain its strong margins due to its operating leverage, as noted by Morningstar in its recent analyst report:

While Cosentyx holds patent protection out to 2027 in the U.S., Gilenya could face generic pressures in 2022-23. However, we expect new products will mitigate the generic competition. Novartis’ operating structure allows for cost-cutting following patent losses to reduce the margin pressure from lost high-margin drug sales.

Overall, Novartis’ established product line creates the enormous cash flows needed to fund the average $800 million in development costs per new drug. In addition, the company’s powerful distribution network sets up the company as a strong partner for smaller drug companies that lack Novartis’ resources.

Looking forward, NVS appears to be well positioned with a strong pipeline that includes over 20 potentially significant assets with approval by 2026. Management also appears set to unlock shareholder value with a recent report that it’s leaning towards a potential spinoff of its Sandoz business, with a separate listing of this $25 billion generic drugs unit.

I see this as being a plus for shareholders, as this follows the playbook of other pharmaceutical giants such as Pfizer (PFE), enabling NVS to focus its efforts on higher margin specialty drugs.

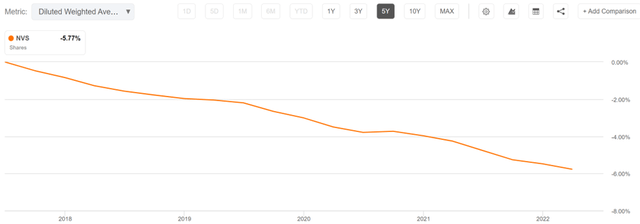

Meanwhile, NVS is returning capital to shareholders, as reflected by the 31.2 million shares that it repurchased during the first quarter alone in the amount of USD $2.7 billion. As shown below, NVS has retired nearly 6% of its outstanding float over the past 5 years.

NVS Shares Outstanding (Seeking Alpha)

NVS also carries a strong AA- rated balance sheet, and pays a 3.9% dividend yield. The dividend is well-protected by a 54% payout ratio and has a 5-year CAGR of 4%. Note that the dividend is paid once per year, and can be lumpy for U.S. investors due to currency translation effects.

Risks to NVS include the potential for pipeline drugs to fail to live up to expectations, along with patent expirations on existing drugs and the estimated $800 million it takes to bring a new drug to market.

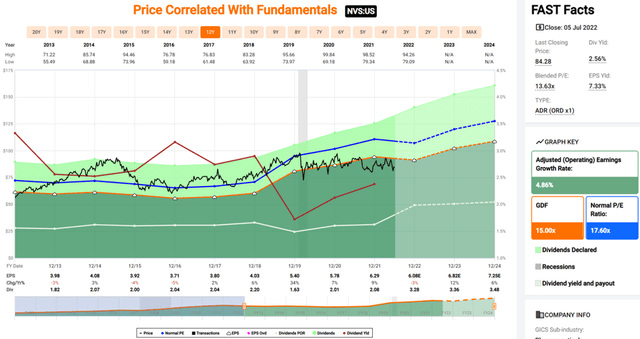

Lastly, I see value in NVS at the current price of $84, which sits below its near-term high of $93.75 reached as recently as April. It also carries a forward PE of just 13.7, sitting well below its normal PE of 17.6 over the past decade. Sell side analysts have a consensus Buy rating with an average price target of $98.17, implying a potential one-year 20% total return including dividends.

NVS Valuation (FAST Graphs)

Investor Takeaway

Novartis is a leading global pharmaceutical company with a solid portfolio of drugs, a strong pipeline, and a focus on shareholder returns. It also maintains strong margins and isn’t heavily reliant on any one drug like some of its peers. The stock appears to be undervalued at the current price, while offering an attractive dividend yield. As such, NVS appears to be a buy for long-term investors who seek safety and yield.

Be the first to comment