assistantua/iStock via Getty Images

Introduction

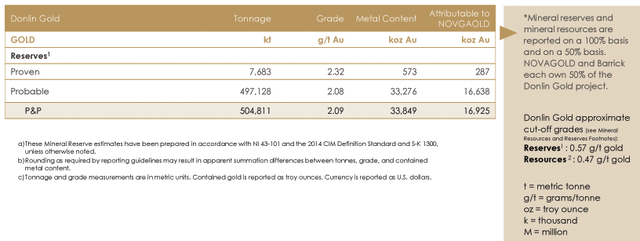

NovaGold Resources (NYSE: NYSE:NG) owns 50% of a gold project in Western Alaska called the Donlin Gold Project. The joint venture is shared with Barrick Gold. Here is an excerpt of the last 10-Q filing.

The Donlin Gold project is owned and operated by Donlin Gold LLC (“Donlin Gold”), a limited liability company that is owned equally by wholly-owned subsidiaries of NOVAGOLD and Barrick Gold Corporation (“Barrick”).

The company released its second-quarter results on June 29, 2022, ending 02/28/2022.

Note: This article is an update of my article published on May 3, 2022. I have followed NovaGold Resources since 2019.

1 – Presentation and 2Q22 Results Snapshot

Reminder: NovaGold Resources and Barrick Gold USA – a subsidiary of Barrick Gold (GOLD) – are developing the Donlin Creek open-pit gold project in Alaska under a 50-50 joint-venture (“JV”) partnership called Donlin Gold (2007).

The company filed its 10-Q for the second quarter of 2022 on June 29, 2022.

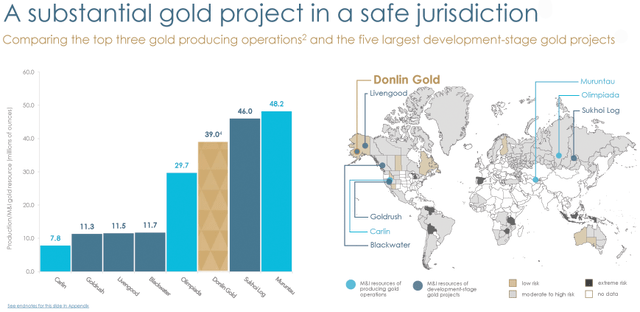

With 39 Moz of gold resource, it is an impressive project. Furthermore, it is located in Alaska, offering extra safety, which is extremely important now. We have a project with a cut-off grade of 0.58 G/T on the not-so-remarkable side.

The only issue is the cost necessary to bring this project to production. Inflationary pressure is here to stay and will considerably inflate an already ballooning CapEx, which threatens the feasibility of the project, one of the biggest in the world.

NG Donlin Map (NovaGold Resources)

2 – Stock Performance and commentary

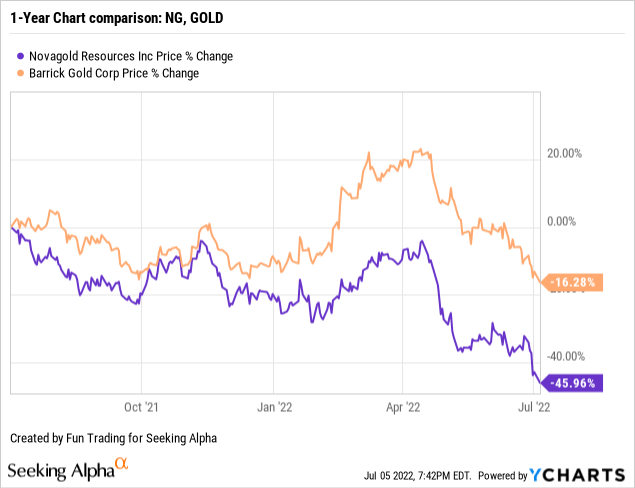

NG has dropped 46% on a one-year basis, from nearly $8.45 to $4.62. If we compare NG to GOLD, we can see that NG has significantly underperformed GOLD.

3 – Investment Thesis

I see Donlin Project as an opportunity to invest long-term at a fair price considering the mineral reserve. But it is crucial to be cautious and prudent with gold projects that are getting more expensive to build and could become too expensive. The Donlin Project is an exceptional prospect, and the fact that Barrick Gold owns 50% makes it more valuable.

However, we are years away from a final investment decision, and inflationary pressure and a weakening gold price due to the Fed’s action erode feasibility.

Therefore, as I regularly recommend to my subscribers in my marketplace, “The Gold and Oil Corner,” I strongly recommend trading short-term LIFO by using about 70% of your NG position. I also recommend building a core long-term investment that you keep and grow until the project’s final investment decision.

Note: Trading LIFO is only allowed in the USA but not Europe or Canada. However, it is possible to trade NG and keep a long-term position while trading the short-term using two separate accounts. Please read my final note about it at the end of my article.

NovaGold Resources 2Q22 (November 31, 2021) – The Raw Numbers:

Note: The company is not generating revenues and is in development.

| NovaGold Resources | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 |

| Net Income in $ Million | -10.52 | -11.79 | -10.27 | -10.00 | -14.97 |

| EBITDA $ Million | -9.04 | -10.17 | -8.74 | -8.48 | -13.29 |

| EPS diluted in $/share | -0.03 | -0.04 | -0.03 | -0.03 | -0.04 |

| Operating Cash Flow in $ Million | -1.98 | -1.88 | -1.72 | -6,00 | -2.32 |

| Total Cash $ Million | 107.6 | 173.34 | 169.12 | 155.13 | 142.29 |

| Long-term Debt in $ Million | 107.59 | 114.22 | 115.72 | 117.24 | 118.92 |

| Shares outstanding (diluted) in Million | 332.50 | 331.64 | 331.86 | 332.94 | 333.23 |

Source: NovaGold Resources 10-Q

* In the 10-Q: As of June 29, 2022, the Company had 333,337,307 Common Shares, no par value, outstanding.

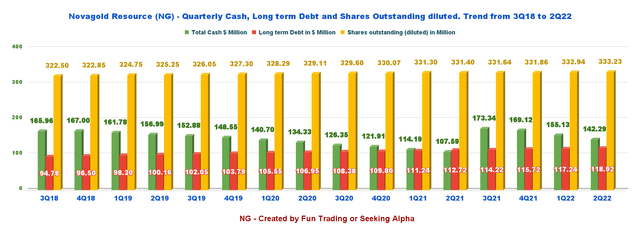

As shown in the table above, the outstanding diluted and the long-term debt are kept at the same level, and the total cash is $142.29 million at the end of 2Q22.

An additional payment from Newmont Corporation (NEM) of $25 million comes due in 2023 related to the sale of NovaGold’s 50% interest in the Galore Creek project in 2018.

NG Quarterly Balance sheet selected data History (Fun Trading)

The financial position is solid, supporting the 2022 CapEx estimated at $60 million. Furthermore, on an optimistic note, the company expects that the cash position is sufficient to cover the expected funding of the Donlin Gold Project.

At present, we believe we have sufficient working capital available to cover anticipated funding of the Donlin Gold project and corporate general and administrative costs until a decision to commence engineering and construction is reached by the Donlin Gold board for the Donlin Gold project, at which point substantial additional capital will be required.

Donlin Gold – An Impressive Open-pit Project

1 – Mineral reserves and mineral resources are indicated in the table below. Unchanged from the preceding quarter.

NovaGold Resources’ share of the mineral reserve proven and probable is 16.925 Moz, with an additional 2.997 Moz in M&I and inferred. The basics have not changed since the preceding article.

NG Reserves attributable to NovaGold Presentation (NovaGold Resources)

- The mineral reserves, P1 and P2, are 33,849K Au Oz with a cut-off grade of 0.57g/t gold related to reserves, and the total grade is 2.09 g/t with a LOM of 27+ years. The company expects to produce 1.5 M Au Oz per year in the first five years.

- The initial CapEx for Donlin Gold is $7,402 million. Because of the location, barging will be used as the main transport for goods.

- 2022 proposed overall CapEx is expected to be $60 million, equally shared with Barrick. 2022 Donlin Gold Drill Program is the largest in more than a Decade, Focused on Advancing Preparation for Feasibility Work.

- Long-term debt represents a promissory note payable to Barrick Gold of $118.92 million.

2 – Donlin Gold: The 2022 budget is still $60 million.

NovaGold Resources expects to spend about $46 million in 2022, including $13 million for corporate general and administrative costs; $3 million for withholding taxes on PSUs and other working capital; and $30 million to fund our share of expenditures at the Donlin Gold project.

About $17 million of the $30 million CapEx at the Donlin Project will be going to the 2022 drilling program. Also, $9 million will be spent on external affairs, permitting, environmental, land, and legal activities, and finally, $4 million is earmarked for project planning and fieldwork.

The main objective for NovaGold is to advance the Donlin Project toward a construction decision. However, NovaGold Resources is nowhere near the delivery of project milestones, including achieving various technical, environmental, sustainable development, economic and legal objectives, getting necessary permits, starting feasibility studies, preparing engineering designs, and financing to fund these objectives.

Technical Analysis and Commentary

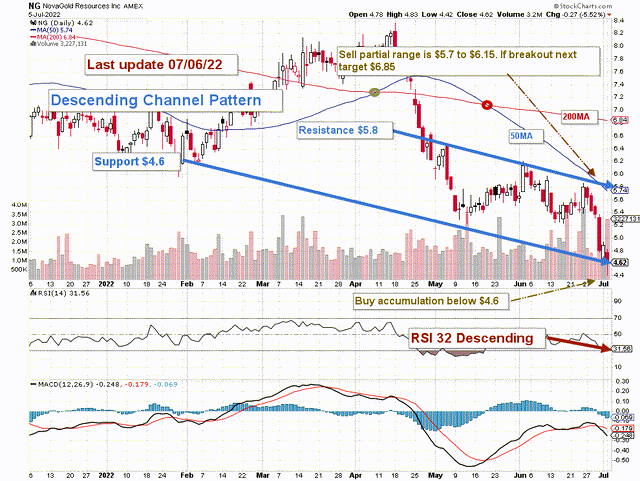

NG TA Chart short-term (Fun Trading)

NG forms a descending channel pattern with resistance at $5.8 and support at $4.6. Descending channel patterns are generally short-term bearish but often initiate within longer-term uptrends.

As I have recommended in my preceding article, the trading strategy I suggest is selling LIFO 50% between $5.7 and $6.15 and waiting for a retracement to buy back at or below support at $4.60 with potential lower support at $3.85.

I consider this buy range as a good opportunity for the long-term.

Note: RSI is now considered oversold at 32, and any downside from here is a definite buy signal.

The stock experienced a steep selloff the past few days due to weakening gold prices and high inflation, causing the Fed to turn increasingly hawkish, which may drive the global economy into a damaging recession.

The gold price is now trading below $1,800 per ounce, and NG is dropping to a multi-year low as the project’s feasibility turns uncertain due to inflationary pressure. Thus, investing only a tiny part of your available cash is crucial until the company can reach a construction decision.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS). However, it is allowed in the United States to generally accepted accounting principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stocks, one for the long-term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Be the first to comment