Cn0ra/iStock via Getty Images

Even though almost a year has passed since my last article on Myovant (NYSE:MYOV), I have nonetheless always followed the company closely. My initial interest in Myovant was triggered by the deal with Pfizer (PFE) and my conviction in Myovant’s pipeline. The pipeline conviction has been further strengthened in recent months. Not only has Relugolix been approved in all three indications, but product sales have accelerated in recent months, indicating the huge revenue potential.

Another bonus, but not included in the investment thesis, was the strong interest from Myovant’s majority owner Sumitovant Biopharma. The strong interest has now been confirmed by the offer to acquire all outstanding shares of Myovant for $27 per share. With Sumitovant Biopharma’s buyout offer, I conclude my coverage by addressing recent developments and presenting a valuation approach to evaluate the offer.

Business of Myovant

Logo of Myovant Science (Source: Company Homepage)

I like to start my articles with a brief company overview to give new investors some initial guidance. The company was founded in 2016, is headquartered in Basel, Switzerland, and focuses on the two focus areas of hormone-sensitive cancers and women’s health. Over the past 6 years, the company has successfully completed five Phase 3 clinical trials in these areas, resulting in three regulatory approvals by the FDA in the US. In 2021, Myovant also established itself as a commercial company in the market with its highly differentiated therapies in high-growth categories.

Myovant’s ambition remains to establish its current commercially available brands, together with its top-tier partners, as the new standard of care in the market, and simultaneously maximizing future growth opportunities by expanding its pipeline.

The Pipeline Does Not Reflect the Full Potential

Since my last article, Myovant has continued to advance its pipeline. The clinical development programs were successfully completed and resulted in approvals. As a result, it is increasingly important to question how Myovant can unlock future growth opportunities.

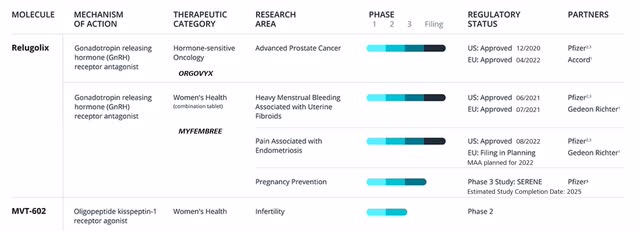

Both products show platform potential (Source: Company Homepage)

The backbone of the company is Relugolix, a product as a pipeline, serving as platform therapy and approved in three indications. In addition to approvals in advanced prostate cancer (APC) and uterine fibroids (UT), the FDA recently approved Relugolix in endometriosis in August of this year.

Additional approvals will follow in the coming months. Along with the submission of the Marketing Authorization Application (MAA) in Europe for endometriosis, the submission of a New Drug Application (NDA) in Canada is also planned across the three indications in 2022.

Enhancing the Label of Relugolix

In addition to the approval processes, Myovant is currently focusing primarily on other life cycle activities and on enhancing the labeling of relugolix.

For example, Myovant has already submitted a supplemental New Drug Application (sNDA) to adjust the current limitation of using Myfembree only for 2 years in UT. The sNDA is based on two-year data from the LIBERTY randomized withdrawal study. The study results show the longer term benefits and demonstrate very strong bone mineral density (BMD) results, which are the main reason for the two year treatment limitation. The FDA will make a decision on the label adjustment by its PDUFA date of January 29, 2023. Following the FDA decision, an sNDA is expected to be submitted for a label adjustment in endometriosis.

In an effort to further differentiate Relugolix from the competition and target a larger patient population, Relugolix is being evaluated for contraceptive efficacy in a Phase 3 study called SERENE. Myovant is confident in the success of the study based on the data to date and expects to unlock significant value and to better serve the women’s needs. For women seeking hormonal treatment for their uterine fibroids or endometriosis, one challenge is having to use barrier method contraception, as simultaneous use of both hormonal therapies increases the risk of serious and severe adverse events, including thromboembolic events.

Additional trials are also being conducted for Relugolix in APC, for example to prove its safety in combination therapies with other agents. Results of this trial may be published as early as the end of 2022.

Indication Expansions for Relugolix and MVT-602

Myovant believes the indication expansion for Relugolix, in both oncology and women’s health, is the second major area providing sustainable growth opportunities. In the further course of the fiscal year, the multiple targets for indication expansions will be defined in close collaboration with partner Pfizer and then communicated to the market.

In my last article, I already mentioned that GnRH modulation has been validated in previous studies, for example in breast cancer. I can also imagine a treatment approach in ovarian cancer or bladder cancer.

In addition to Relugolix, a second product is in the clinical development pipeline, MVT-602. Myovant expects to establish a development pathway for MVT-602 by the end of the fiscal year. MVT-602 is another potential platform therapy that has been investigated in the early stages primarily in the context of fertility. However, due to its multiple sites of action, other exciting potential opportunities are currently being evaluated.

Sales Progress

Originally, I wanted to wait for the publication of the Q2 numbers in order to give an up-to-date assessment. However, given Sumitovant’s offer, the conference call was cancelled, which is why I intend to focus more on the strategic relevance and the outlook.

Especially the sales ramp-up of ORGOVYX is very strong. Not only is the quarterly sequential demand volume growth of 26% impressive, but also the fact that 60% of patients start their androgen deprivation therapy (ADT) therapy with ORGOVYX.

In my opinion, ORGOVYX will be able to maintain that growth rate in the coming months. On the one hand, ADT represents the basic therapy for ADT. On the other hand, 300,000 patients are treated with ADT annually, so the untapped market potential is enormous.

MYFEMBREE sales will really take off in the coming months. With approval in endometriosis, additional synergies can be exploited and Myovant will be able to benefit from several factors.

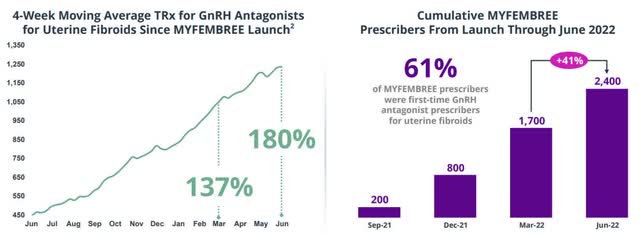

First, Myovant benefits from the large overlap among prescribers. Prescribers have already had a positive experience with MYFEMBREE in UT. Only 6 months after launch, MYFEMBREE has become the market leader in UT and Myovant has increased the GnRH antagonist class by more than 180%.

MYFEMBREE is the main driver of GnRH antagonist growth in UT. (Source: Company Presentation)

Myovant intends to apply this success to the market in endometriosis. Endometriosis represents a patient population twice as large with an even higher unmet medical need. For this reason, competitor AbbVie (ABBV) generates the majority of its annual sales of nearly $150 million with elagolix in endometriosis. If Myovant manages to more than double this market as well within one year and reaches a 50% market share, this would correspond to annualized revenues of about $200 million. Due to the high overlap in prescribers, Myovant will also not need to expand its current sales force of 100 employees.

Financial Assessment

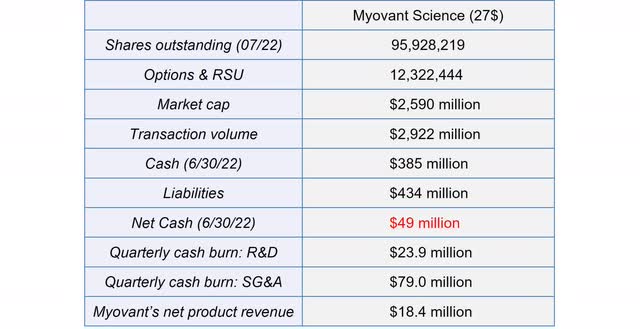

Myovant is in a strong financial position. Due to the milestone payments from the Pfizer deal, its cash position was maintained at a reasonably level over the last years despite the high expenses. The current cash balance of $385 million combined with the committed available financing of $41.3 million will enable Myovant to both further intensify the commercialization of Orgovyx and Myfembree and to advance its pipeline. Cash at the end of Q2 should be slightly higher than at the end of Q1 due to the $100 million milestone payment from Pfizer.

We don’t anticipate any near-term raise of any additional capital. Source: Mehra, Baird Global Healthcare Conference

Financial Overview of Myovant (Source: Author’s Chart)

Due to the loan from Sumitovant of up to $400 million, of which $358.7 million has been drawn to date, liabilities exceed the current cash balance, resulting in a negative net cash balance. While interest is paid quarterly, the terms of the agreement require Myovant to repay the entire loan by the end of 2024. In my opinion, the end of this loan will result in a new financing arrangement.

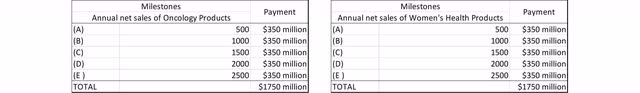

In addition to the net revenues from the commercialization of Relugolix, Myovant is eligible to receive royalties and milestone payments from its partners. Myovant is entitled to receive up to $3.7 billion in regulatory and sales related milestone payments.

The milestone payments show significant potential (Source: Author’s Chart)

While $15 million is due upon approval of Relugolix in endometriosis in the EU, all other milestone payments are not further specified. Consequently, it is difficult to value these milestone payments as no conclusions can be drawn on the likelihood and timing. If all details were known, milestone payments could be calculated using the net present value method. According to management, some milestone payments are considered to be well achievable, while others are more challenging to achieve. Once the milestone has been achieved, the milestone payments are paid out a few days after the end of the calendar quarter.

Tiered sales milestones after hitting specific thresholds up to $2.5 billion in net sales for prostate cancer and also for the combined women’s health indications. Source: Mark Terry, Biospace

I will explicitly point out once again that details on milestone payments have not been disclosed. Nevertheless, I would like to visualize the structure of these milestone payments in an illustration with fictitious numbers.

Exemplary presentation of potential Pfizer sales milestones (Source: Author’s Chart)

The only negative aspect in the quarterly numbers are still the costs, which are far too high compared to the revenues. Expenditures of more than $100 million are offset by product sales of only about $30 million. This calculation already takes into account the royalty payments to Takeda (TAK) and the profit sharing agreement with Pfizer.

For this reason, Myovant remains heavily loss-making, and the threshold to profitability is out of sight. Even if the high quarterly growth rates in net product sales can be maintained, Myovant will not be profitable until mid-2024, according to my calculation.

The road to profitability is still long (Source: Author’s Chart)

Although Myovant will not be profitable in the coming quarters, the current cash balance is still sufficient to fund the company and drive both its commercial strategy and clinical development.

Approach to a Fair Value

In my last article, I already discussed the intense interest of Sumitovant and provided background information on a buy-out speculation. In early October, this intense interest was confirmed by a preliminary, non-binding proposal from Sumitovant to acquire all remaining shares from Myovant. In total, the offer to purchase all remaining shares of Myovant includes a transaction volume of approximately $2.4 billion. However, a committee specially installed for this purpose has rejected the offer as it significantly undervalues the company. For this reason, I will set out an approach to calculate a fair value and summarize the key value drivers.

The cash component is currently negligible. Although the acquirer of Myovant can access the complete cash balance, the debts are also transferred to the acquirer.

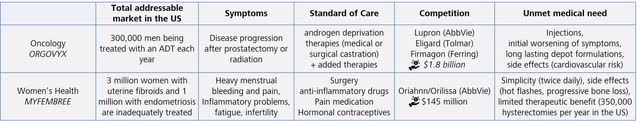

The most relevant value driver at present is the pipeline with the approved product Relugolix. I have summarized the most important facts in the following table:

Summarizing the value of Relugolix (Source: Author’s Chart)

The current therapies available on the market have large shortcomings and do not fully meet the needs of patients. For this reason, Relugolix has an enormous potential to become the new standard-of-care therapy.

Orgovyx can achieve conservative peak sales of over $1 billion. The currently available therapies inferior to Relugolix turn over just under $2 billion annually. It is worth noting that these therapies have been on the market for a long time and no longer have patent protection. Nevertheless, these therapies have tremendous value. For example, Medigene sold a 2% revenue share in Eligard with a remaining patent term of 10 years for about $17.7 million, meaning that Eligard alone was valued at almost $900 million at that time.

With annual therapy costs of about $27,700, a small number of 40,000 patients treated with Orgovyx is enough to achieve blockbuster status and to generate sales beyond $1 billion. If we annualize the steady growing quarterly sales of Orgovyx, Myovant reaches $200 million in annual sales after only 2 years on the market.

The market potential in women’s health is similarly large, although a shift in the treatment paradigm is required and has been the biggest problem to date. The high medical need is reflected in the high number of surgical procedures; approximately 350,00 women have their hysterectomies removed each year due to the severity of symptoms and limited therapeutic benefit. There is a relevant competitor in AbbVie, offering a similar but inferior product in terms of simplicity and tolerability.

Myfembree targets a market of up to 11 million women with symptoms, 4 million of whom are specifically addressed because first-line treatment fails in these women. Even with a limited coverage, this represents an enormous market potential. The fact that Myfembree meets the needs of both prescribers and patients is confirmed by the success that Myfembree has increased the class of GnRH antagonist therapies by more than 180% in UT since its launch in June 2021.

In addition, I have already mentioned that Relugolix could be effective in other indications. As the indications have not yet been disclosed, it is not possible to estimate the future market potential. Even if it takes a few more years until marketing authorization is granted, significant value might be created by due to the long patent term until 2037.

The same applies to the second product candidate in Myovant’s pipeline, MVT-602. The further development strategy has not been disclosed yet.

When valuing Relugolix, it should be taken into account that about half of the value is attributable to Pfizer. Pfizer receives half of the profits in the USA and Canada. In return, however, Myovant is entitled to significant milestone payments. Myovant may receive up to $3.7 billion in total milestone payments. Since no details of these milestone payments are known, it is also not possible to value them. However, it should be noted that the likelihood of receiving the milestone payments also increases with an indication expansion of Relugolix.

Based on the information available, it is difficult for us as investors to narrow down the true value of the company. For this reason, investors should trust in particular the special committee evaluating the offer.

Based on the facts at hand, I believe Myovant should currently be worth at least $4 billion. This is roughly equivalent to discounted future profits including $500 million in milestone payments. I have taken into account that Pfizer has invested more than $850 million in Relugolix to date and still expects a favorable outcome.

As a result, I agree with the committee that Sumitovant’s offer significantly undervalues Myovant. Even at a $4 billion valuation, I think it inadequately takes into account the long-term potential, so a deal would be advantageous to the potential acquirer.

Following the offer, both parties hired external advisors to negotiate a deal and to determine a fair value. This process resulted in an improved proposal from Sumitovant, offering $27 per share. The transaction is expected to close in the first quarter of 2023.

In my opinion, the probability of another adjustment of the offer is very low. On the one hand, there could be a rejection of the offer based on the Investor Rights Agreement (IRA), and on the other hand, Pfizer, as a close partner, could make a counteroffer. However, since Pfizer has rejected the rights to Relugolix for Europe and seems to be comfortable with the existing deal, they are unlikely to enter into a bidding war.

Summary

In recent months, we have seen a strong trajectory for Myovant. Following the successful approvals, sales also accelerated significantly. Based on these developments, I believe Sumitovant is taking the last opportunity to buy out Myovant on the cheap.

While I don’t think the takeover offer reflects the full potential and value of Myovant, Myovant shareholders can enjoy a really nice profit despite the biotech bear market. Nevertheless, I would have liked management to be more open and aggressive in presenting the full potential of the pipeline to investors. Given the opportunity cost, I expect the stock to trade below $27 until beginning of 2023.

The beauty of a buyout is that every investor has an equal opportunity to get the most out of the stock and to sell at the highest possible price, which is the takeover price. Due to the current market situation, there is a wide range of investment opportunities for investors adapted to their individual risk. For me, the buyout also represents an excellent opportunity to end my coverage of Myovant.

Be the first to comment