skhoward/iStock via Getty Images

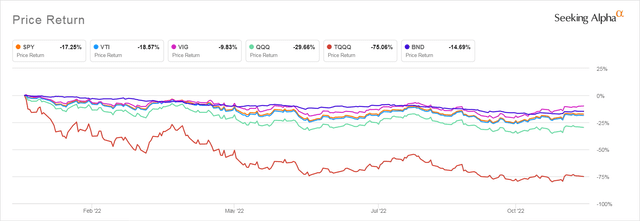

If you hold broad market ETFs like the SPDR S&P 500 ETF (SPY), the Vanguard Total Stock Market ETF (VTI), the Invesco QQQ Trust (QQQ), or the Vanguard Total Bond Market ETF (BND) you are sitting on significant losses for any shares you bought before January of 2022 as well as for those bought during the bear market rallies of the past year. Below are some popular ETFs that have generated significant losses for investors this year.

Losses YTD in Popular Broad Market ETFs

Fortunately, it is possible for investors who pay taxes in the United States to reap some benefit from these otherwise dispiriting losses. They can do this by executing what is called a Tax Loss Harvest.

For those who are new to the concept, I will spell it out here. Then I will suggest some possible tax loss harvest partners for these popular ETFs.

How Tax Loss Harvesting Works

The goal of tax loss harvesting is realize tax losses that you can use to keep from having to pay taxes on capital gains you have received during the past year. This includes the capital gains that can be distributed by mutual funds, even those whose share prices have declined significantly. You can also use tax losses to keep from having to pay taxes on a small amount of your ordinary income. Because tax loss harvesting requires that you buy another security as soon as you sell your losing security, careful tax loss harvesting allows you to take those valuable losses without changing how much you have invested in the market and without changing how you have allocated your stock and bond investments.

How the U.S. Tax Code Treats Capital Losses

The IRS allows you to decrease your taxable capital gains by the amount of any taxable capital losses you have achieved by selling stocks or bonds. Short term losses–those from selling holdings you have held less than a year–are the most valuable because you write them off against short term capital gains which would otherwise be taxed at ordinary income rates. If you are in the 24% or 32% bracket this can save you quite a bit of money.

Your long term capital losses are applied to your long term gains first, but if you have more short term losses than long term gains, you can apply any left-over short term losses to any remaining short term gains. By the same token, if you have more long term losses than long term gains those gains can be applied to your short term gains.

If you don’t have any capital gains to offset you can still benefit from tax loss harvesting. That is because you are allowed to offset $3,000 of taxable ordinary income with taxable capital losses each year. You are then able to save the rest of your taxable losses for use in future years. The current tax code allows you to hold onto these losses indefinitely and use them to offset future capital gains in any amount or $3,000 a year of ordinary income until these capital losses are gone. This is called a Tax Loss Carry Forward. If you use tax software or pay a preparer, that software or preparer should be able to track the carry forward you have saved in previous years and apply it appropriately.

Storing significant tax losses like those you may have experienced this year is extremely useful to those who are investing in a taxable account. By reducing the taxes you pay on a future capital gain, this tax loss harvest allows you to rebalance your taxable portfolio in future years with a minimal tax impact.

A Tax Loss Harvest Is Different From A Regular Sale

Investors are often reluctant to sell a losing investment because they fear that it will shoot back up before they get back in and they will miss out on major gains. This is always a concern, because when the market recovers from a significant drop it often shoots up very quickly indeed.

But you protect yourself from this kind of loss when you tax loss harvest by immediately buying the same dollar amount of another similar, but not identical, investment that you expect to respond to changing market conditions in a way very similar to the security you are selling.

Once you have held your new investment for 31 calendar days, you can sell that new investment and buy back your original investment. So you should end up with almost the identical portfolio you would have had without tax loss harvesting, but with a significant saving on your taxes this year or in future years when the market recovers.

Tax Loss Harvesting Partners

Choosing a proper tax loss harvesting partner is essential. It must be a security that is very similar to, but not identical to, the security you are tax loss harvesting. With stocks this is very easy. You can sell Home Depot (HD) and buy Lowe’s (LOW) and expect to see those stocks behave in a very similar fashion over the next month. Thirty one days later, you can sell your Lowes stock and buy back Home Depot if you wish.

Tax loss harvesting ETFs it slightly more of a challenge, because you must make sure that the tax loss harvest partner you have chosen is truly different enough from the ETF you are selling to be considered a true tax loss. Two ETFs from different companies that follow the same index would probably not be considered to be a legitimate tax loss by the IRS even if they had different tickers. (I put in “probably” because there is some debate in various online forums as to how much attention the IRS actually pays to how closely identical your fund or ETF tax loss harvest partners actually are. )

The Big Gotcha You Want To Avoid

One essential issue you must keep in mind is that a tax loss will be disallowed if you have bought shares of the security you are selling within 30 days of the sale or if you buy back shares of the security you sold for your tax loss harvest within 30 days after the original sale. This includes reinvested dividends, which are treated as a purchase.

So you must check that you have not reinvested a dividend in the security you are going to tax loss harvest within 30 days. You must also turn off dividend reinvestment in that security if you will still hold shares of it after you have sold lots that have tax losses. Turn off dividend reinvestment in the security you buy, too!

I have screwed this one up more than once, so I would urge you to double check when the last time was that you bought shares of any security you are going to tax loss harvest before you sell it. Also check when you received or will receive your dividends before you do your sale.

What Happens If You Do Screw Up?

If you sell a security you bought within the 30 days before your sale or within the 30 days after your sale you have what is called a Wash Sale.

Your brokerage will flag a sale that is not a legitimate tax loss as a disallowed tax loss or wash sale and report it to the IRS as a Wash Sale. All is not lost, as the amount disallowed as a tax loss is either added to the cost basis of your remaining shares if you still hold shares of the security you tax loss harvested or, if you have sold the entire holding, the disallowed loss is added to the cost basis of the security you bought as part of your wash sale.

Some Tax Loss Harvest Partners For Popular ETFs

As mentioned above, you can’t sell SPY and buy VOO or the iShares S&P 500 ETF without the possibility of the sale being flagged as a wash sale, as both ETFs hold the identical holdings.

What you can do is sell SPY and buy a total stock market ETF like VTI or the iShares Core Total Stock Market ETF (ITOT). You could also buy a Large Cap ETF like the Schwab US Large Cap ETF (SCHX) which holds 757 stocks rather than the S&P 500’s 503.

Strictly speaking you should try to keep your tax loss harvest partners very similar so that you don’t change the way your investments are allocated.

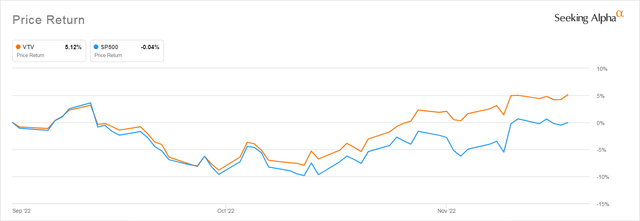

That said, if you wanted to indulge in a bit of market timing, you could tax loss harvest from an S&P 500 ETF into another large cap ETF that has better momentum at the time you are doing your harvest. For example, right now Value ETFs are attracting investors who are worried about Tech, so you might tax loss harvest from an S&P 500 ETF into a Value Index like the Vanguard Value ETF (VTV).

VTV vs SPY Price Return Since September 1, 2022

This market timing tax loss harvest strategy is riskier than the classic form, where you strive to keep your investments close to identical and can lead to losses. But if you choose wisely and only plan to hold your tax loss harvest partner for a month, any losses should not be significant.

Just keep in mind that what you are not doing here is changing your investment strategy. That’s why you should sell whatever security it was that you tax loss harvested into 31 days later and buy back your original investment. This keeps your investments in line with the strategy that made you originally invest the way you were invested before the tax loss harvest. Tax loss harvesting should not become an excuse to fiddle around with the way your portfolio has been designed or to seek better gains.

Suggest Tax Loss Harvest Partners for Popular ETFs Facing Losses

| Current Holding | Same Strategy TLH Partner(s) | Market Timing Partner(s) |

|

SPY VOO iShares Core S&P 500 ETF (IVV) |

VTI iShares Core Total Stock Market ETF (ITOT) Schwab US Large Cap ETF (SCHX) Vanguard Large Cap ETF (VV) |

SPDR S&P 500 Value ETF (SPYV) Vanguard Value ETF (VTV) Schwab Dividend Equity ETF (SCHD) Vanguard High Dividend ETF (VYM) |

|

VTI ITOT |

IVV SPY VOO |

VYM Vanguard Dividend Growth ETF (VIG) |

| Invesco QQQ ETF (QQQ) |

SPDR S&P 500 Growth ETF (SPY) The Vanguard Tech ETF (VGT) |

SPY VOO |

| ProShares UltraPro QQQ ETF (TQQQ) | Direxion Daily Technology Bull (TECL) |

VGT SPY ProShares UltraPro Short QQQ ETF (SQQQ) |

| Vanguard Total Bond Market ETF (BND) |

Vanguard Intermediate Term Bond ETF (BIV) iShares 7-10 Year Treasury Bond ETF (IEF) |

1 Month Treasury Bill (US1M) |

Happy Thanksgiving to all my readers and may your next year have no tax losses at all!

Be the first to comment