M-Production/iStock Editorial via Getty Images

Norwegian Air Shuttle (OTCPK:NWARF) most likely is one of the companies that many expected to fail due to the pandemic. I have been following the company for several years and what became clear is that the company engaged an unhealthy growth path without growth translating into value for the company. This brought the company into a bad financial position and the airline started cannibalizing itself selling assets to keep the business flowing. Luckily, Norwegian Air Shuttle has reorganized itself at the cost of shareholders and is now following a healthier path forward. In this report, I will analyze the Q3 2022 results.

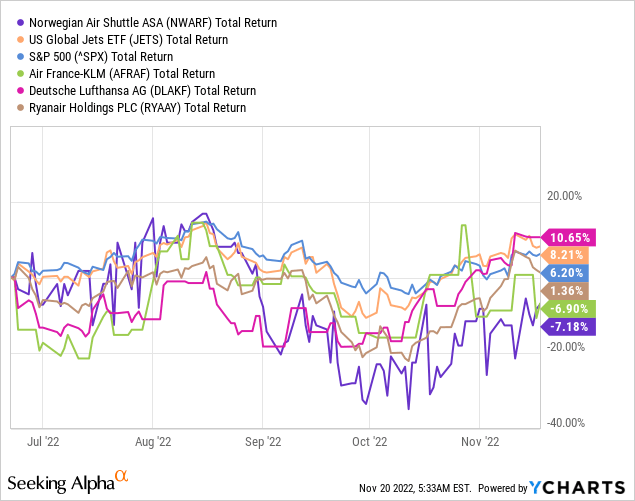

Norwegian Air Shuttle: Underperforming the Market and Peers

While I previously marked shares of Norwegian Air Shuttle a speculative buy, the performance has been underwhelming compared to the broader markets as well as industry peers. The reason for that are the concerns on inflation and doubts on continued strength in consumer spending. In a risk-on mode on the markets that puts pressure on turnaround companies such as Norwegian Air Shuttle as investors look for safer investment opportunities. All with all, I do believe that the share price performance does not reflect any discontent with the execution of the strategy at Norwegian Air Shuttle, but merely reflects investors shifting their focus towards safer investments leaving the names with higher risk and potentially higher rewards sidelined.

Significant Improvement For Norwegian Air Shuttle

Norwegian Boeing 737-800 (Norwegian Air Shuttle)

For most airlines, I usually look at the financial performance compared to pre-pandemic levels. That is not the case for Norwegian Air Shuttle. The sole reason for that is that Norwegian Air Travel as we know it today is significantly different in approach, size and business than it was pre-pandemic. The company went from unbridled growth without regard for financial performance. The pre-pandemic Norwegian had 156 aircraft including long-haul operations. Norwegian as we know it today has 70 aircraft and is not expected to grow its fleet beyond 100 units until 2030. So, there is no realistic or meaningful base to adopt the year-over-three comparison for Norwegian Air Shuttle.

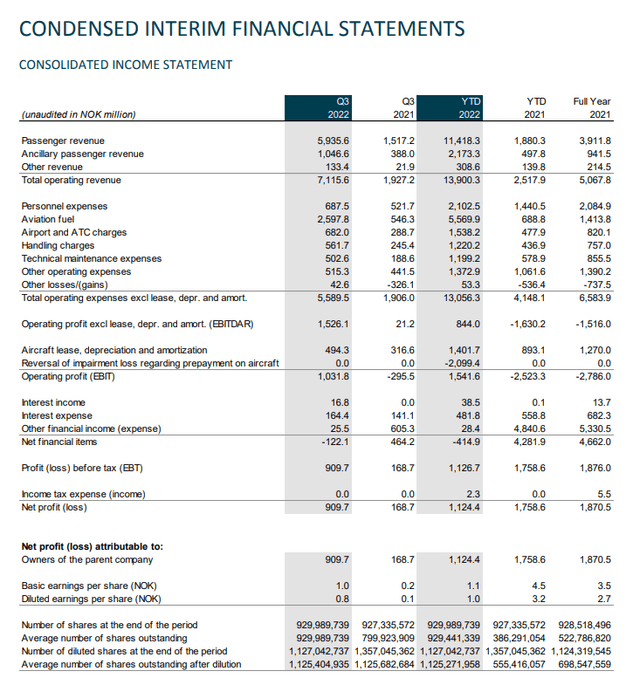

Q3 2022 year-over-year earnings Norwegian Air Shuttle (Norwegian Air Shuttle)

For Norwegian, even the year-over-year results are not quite as meaningful as one would think as we are comparing results of an airline with 70 aircraft now with results of an airline with 51 aircraft last year. Operating revenue increased from 1.9 NOK billion to 7.1 NOK billion. This reflects strong demand for air travel and a 128% capacity increase. Roughly 2.5 NOK billion of the 5.2 NOK billion increase is driven by higher capacity and the remainder is driven by an increase in unit revenues. Operating costs increased due to a combination of high fuel prices, higher flight activity and unfavorable forex effects. Nevertheless, operating profit improved significantly from a 295.5 NOK million loss to a 1 NOK billion profit.

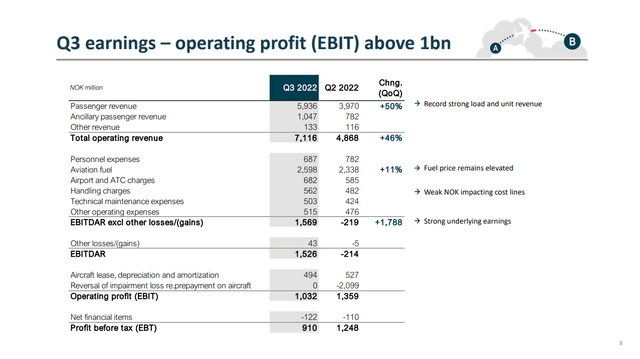

Q3 2022 earnings Norwegian Air Shuttle (Norwegian Air Shuttle)

More meaningful are the quarter-over-quarter comparisons and those show revenues increase by almost 50% significantly aided by record high unit revenues and capacity expansion. On the cost side, fuel costs are higher quarter-over-quarter due to the high fuel prices, but results were good as is also visible in the EBITDAR which improved from a 214 million NOK loss to a 1.569 billion NOK profit despite having some elevated costs due to wet leases, which are more expensive than flying with own aircraft or long-term leases. EBIT shows a decline of roughly 300 million NOK but that was mostly driven by a reversal of impairment and not really reflective of underlying performance.

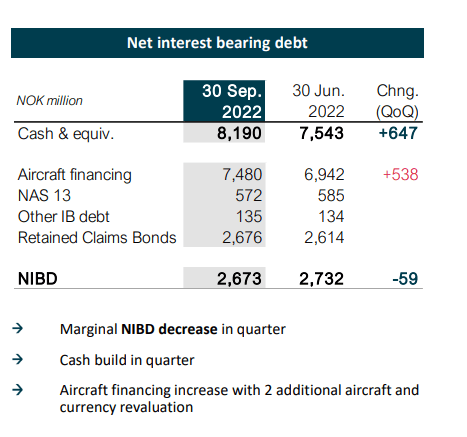

Net debt Norwegian Air Shuttle (Norwegian Air Shuttle)

During the quarter we saw the net interest bearing debt improve by 59 million NOK and this is really a metric that will be a watch item going forward. Ideally, we would like to see that debt go down but as Norwegian is aiming to grow again it might as well go up. However, Norwegian should be cautious on how it manages its debt because unbridled growth is what brought the company into significant problems in the first place.

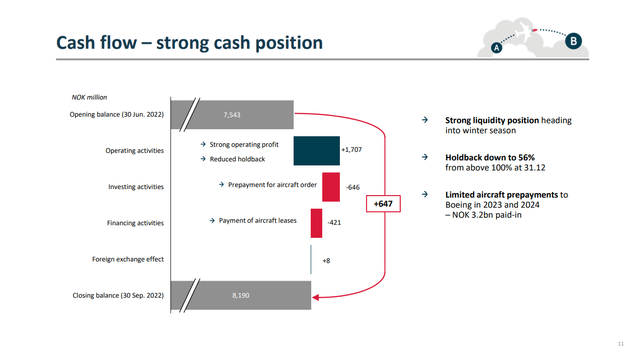

Cash position Norwegian Air Shuttle (Norwegian Air Shuttle)

Diving a bit deeper into the cash position, we see that there was a strong operating cash flow of 1.7 billion NOK and even after lease payment as well as 646 million NOK in pre-payments to Boeing, the cash position significantly improved which will help the provides more than just a cushion to go through the low winter season.

Risks and Opportunities For Norwegian Air Shuttle Shares

The risks for Norwegian Air Shuttle are actually the same as those witnessed by other airlines and those are high inflation that could ultimately lead to softening in demand for air travel and high fuel prices which increase the fuel bill. Furthermore, as an investment opportunity the aforementioned risks as well as general sentiment on the markets could make Norwegian Air Shuttle less desirable in the case risk appetite further decreases. This reduced risk appetite in combination with Norwegian cutting capacity by 25% in the low season are likely the main reasons for the underperformance on the stock markets.

Norwegian also has some opportunities or cushions going forward. The company has a comfortable cash position with smaller pre-delivery payments to Boeing in the coming years as well as flexibility to take out capacity during the winter while also eliminating the associated costs to some extent via power-by-the-hour lease contracts. The airline likes to maintain this flexibility going forward, though reduced appetite from lessors to accommodate such contracts put some question marks on how that flexibility can be achieved. Furthermore, the airline has a cautious growth aspiration adding MAX aircraft to the fleet which bring down the fuel bill by up to 18% in some cases when compared to the Boeing 737 NG. Those MAX aircraft should be coming in at a faster rate in the coming two years and beyond that the airline has purchase orders with Boeing, which require cash pre-payments but do not require monthly lease payments. So, the airline will grow without having monthly cost overhangs and simultaneously unlock scales of economy which should further boost performance.

Additionally, as the credit rating improves Norwegian Air Shuttle will see cash from ticket sales come in earlier from the acquirers. For the quarter, the holdback rate was 56% down from 65% and as performance further improves, so will the credit rating and the holdback rate will decline further.

Ticker Risk: Low Price, Low Volume

Investors who are interested investing should pay close attention to the combination of low price and low volume. Due to the low volume there’s a lack of liquidity, which makes quick buying and selling and constant prices more challenging. The price being extremely low on a per share basis seemingly makes it more attractive to take speculative positions, but the lack of volume in combination with low stock prices also significantly increase risks for investors without an easy way to sell shares when volatility increases. Investors should be aware of these additional risks when making investment decisions.

Conclusion: Norwegian Air Shuttle Stock Remains A Speculative Buy

For all the aforementioned reasons, I do believe that Norwegian Air Shuttle remains a speculative buy where the business strategy does warrant a speculative buy position but it should also be pointed out that in a risk-off market, Norwegian Air Shuttle might not be the airline that investors want to bet on despite its improving metrics and that could introduce underperformance as we have seen over the past months.

Be the first to comment