Drazen_/E+ via Getty Images

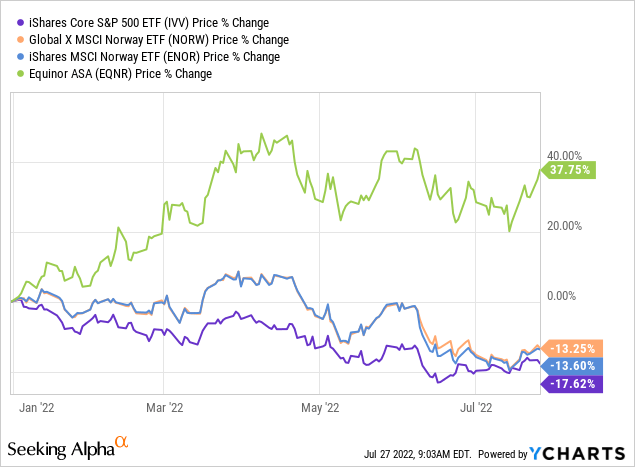

Dwarfing coronavirus-torn 2020, 2022 has been a markedly tough year for global equities, Nordic stocks being no exception. For instance, the negative ~13% price return the Global X MSCI Norway ETF (NYSEARCA:NORW) has delivered this year perfectly encapsulates how betting on the strong oil price rally and its tailwinds for commodities-correlated currencies (and ETFs) and relying on what is at times deemed ‘Nordic stability’ could result in sheer disappointment. Another way of saying, this is a textbook example of how a macro-centered thesis can flop.

Surprisingly, the Norway ETF is in the red even despite Equinor (EQNR), its precious holding from the energy sector, appreciating by close to 38% in New York and over 55% in Oslo.

This supermajor delivered a beautiful story of multiples expansion and a solid improvement in underlying fundamentals (growth rates included). Just for better context, its Enterprise Value/2021 Proved reserves ratio now stands at ~19.8x vs. ~17.2x on January 1. This is not the consequence of the proved oil and gas reserves increase (they are updated once a year) or higher net debt. Contrarily, the latter has even gone sharply down, as the company is literally printing cash this year thanks to the Brent price teetering near the decade highs, with a phenomenal trailing twelve months FCF margin of 28%, and a whopping $44.6 billion in cash & cash equivalents on the balance sheet, 1.46x higher than the total debt. Consequently, the multiple expansion was driven solely by capital appreciation undergirded by the energy crisis and the historic crude price rally. Surprisingly, EQNR even remains underappreciated from a comparative valuation standpoint.

We see a completely similar story in the case of Aker BP (OTCPK:DETNF), another Norwegian Continental Shelf oil & gas major, previously absent in the NORW portfolio but now the third-largest holding (~5.9%). However, it should be noted that other mostly non-energy NORW investments have not been that successful, even those stocks from the financial sector that are supposed to benefit from higher interest rates, like DNB ASA (OTCPK:DNBHF), the country’s largest financial services group, which is down ~7.4% in Oslo YTD.

Anyway, why 2022 has been so sluggish for NORW despite its main investment (close to 20% of the net assets) EQNR performing excellently, and oil being so expensive and supportive of the stronger krone? This is not because the Norwegian economy is headed into a recession. This is a moment when contrasts of monetary policy across the globe meet energy demand in the FX market. And energy bulls lose.

Delving deeper: NORW essentials recap

NORW is a top-heavy passively managed exchange-traded fund tracking the MSCI Norway IMI 25/50 Index. In the current iteration, NORW is long 68 stocks, with the top ten accounting for more than 63%.

In November 2021 when I covered this fund for the first time, the portfolio also contained 68 stocks, implying it has remained homogeneous this year, but upon deeper inspection, a few differences still could be observed. For example, it added Aker BP mentioned above as the oil price rally catapulted its float-adjusted market value. Meanwhile, Sbanken ASA (~0.5% weight as of November 11) is no longer among the holdings as it was acquired by DNB ASA earlier this year.

Soaring oil prices boost government cash flow but do little to prop up the ailing krone

In my previous article on the ETF published in November 2021, I flagged that two factors should be watched closely to understand what returns NORW could be capable of delivering. They are Norges Bank’s policy and the oil price. Both could heavily impact the NOK/USD rate and push the ETF’s NAV south even if the prices of its underlying holdings creep higher. And though acknowledging that the policy rate increases were in the cards, I opted for a neutral opinion, partly owing to my conservative outlook for the crude price (which as we all know appeared to be way too conservative).

But what now? Norges Bank sounds decidedly hawkish. In June, it acknowledged that faster rate increases are necessary to address the emerged economic headwinds bolstering inflationary pressures. Higher rates denting consumer spending and inflicting pain on overleveraged households is a concern. But inflation becoming untamable is a much greater danger, and thus I have little doubt the central bank will be walking the walk. Most importantly, the recession is barely in the cards, so the central bank has the luxury of gradually pushing borrowing costs higher without the risk of breaking the economy.

The most recent data from Statistics Norway presented earlier this July show inflation at a 33-year high, with consumer prices increasing by 6.3% from a year earlier; something similar was seen only in October 1988. And this is materially above the 2% target. Delving deeper into the all-item CPI, we see a few even higher rates as Transport delivered the fastest increase of 11.7%, followed by Restaurants and Hotels at 9.2%.

Norges Bank started raising interest rates already in 2021, when most developed players, the U.S. included, were still figuring out whether too-early hikes would hamper economic growth; this was a factor implicitly bullish for the krone.

Additionally, geopolitics pushed the oil price to the stratosphere. As a consequence, not only exploration & production companies are literally printing cash (I see a 30% increase in Aker BP’s 2022 FCF as likely; Equinor might deliver a 43% growth rate), but also the Norwegian government is reaping benefits. The net government cash flow from petroleum activities (taxes, net cash flow from the SGFI, etc.) is forecast to surge to an all-time high of a whopping NOK 933 billion this year (as of May 12 estimates), around 3.2x the 2021 level.

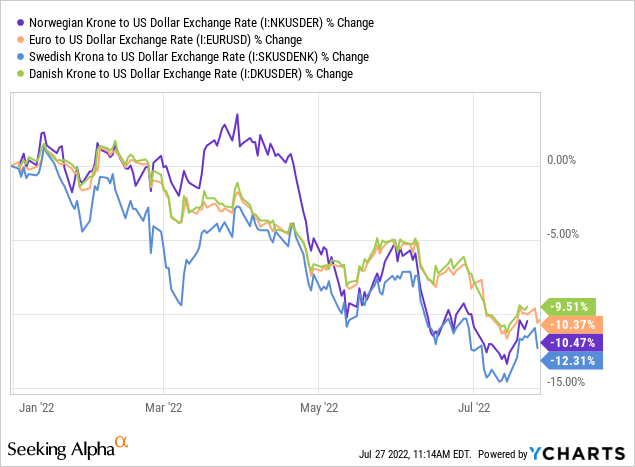

A seemingly unambiguously bullish backdrop for the krone? Alas. With the Fed even more hawkish assuming the entrenched inflation issue in the U.S., and with the terminal rate probably going to as high as 4%, arguments of the krone bulls look somewhat bleak. As a result, the NOK depreciated by around 10.5%, together with other Nordic currencies that are much less oil-dependent and the euro, grossly contributing to NORW’s and ENOR’s negative returns this year.

Final thoughts

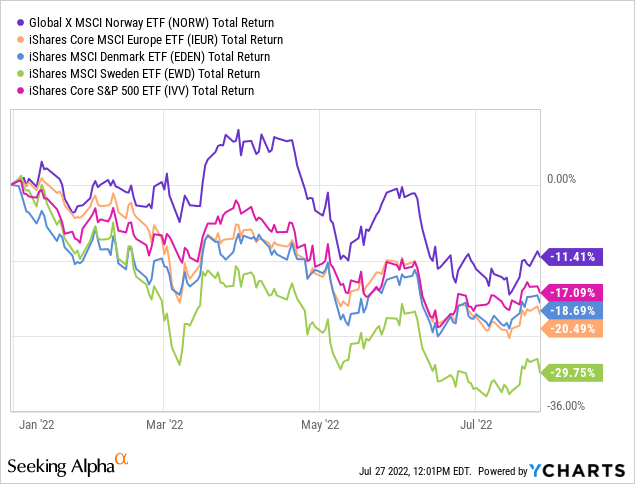

In sum, the silver lining is that even though its 2022 to-date return is negative, the Norway ETF has performed well better compared to its Nordic peers, the basket of European stocks (IEUR), and the U.S. bellwether fund iShares Core S&P 500 ETF (IVV) this year.

For context, the iShares MSCI Denmark ETF (EDEN) was battered by the historic euro slump (the Danish krone is pegged to the euro) together with an investor exodus from high-multiple stocks that disproportionately affected renewable energy, while the iShares MSCI Sweden ETF (EWD) suffered from the weaker Swedish krona, the issue I addressed in my May article, while it has no meaningful exposure to oil producers to prop it up amid soaring crude prices.

Admittedly, NORW’s comparatively better performance was secured by the vertiginous rally in oil & gas equities, which still was not enough to keep the krone from falling, and an even measly positive return was not achieved by the fund.

Looking into the Norway thesis once again, further policy rate increases look almost certain, (at least) until it reaches 3% in the summer of 2023 as mentioned in the June monetary policy assessment. This should be supportive of the krone’s appreciation vs. the USD or at least save it from a steeper decline. However, I believe this is insufficient for a bullish opinion on NORW. There will be no upgrade, it remains a Hold.

Be the first to comment