Justin Sullivan

Alphabet (GOOG) and Apple (AAPL) are two of the biggest technology companies in the world. Both companies have built strong brands and moats, generate billions of dollars in revenues and buy back a ton of stock every quarter. Although both companies don’t operate in the exact same industry, they are comparable based on their enormous size and large amount of profits their businesses generate. While both companies also have their unique issues and strengths, I believe there is a clear winner for investors that want to prepare for a recession!

Google vs. Apple: strengths and weaknesses

The truth is, a recession is already here: the US economy shrank at an annual rate of 0.6% in the second-quarter, after GDP fell at an annual rate of 1.6% in the first-quarter. The only question at this point is how deep the current recession will be and how long inflation will weigh on consumer spending.

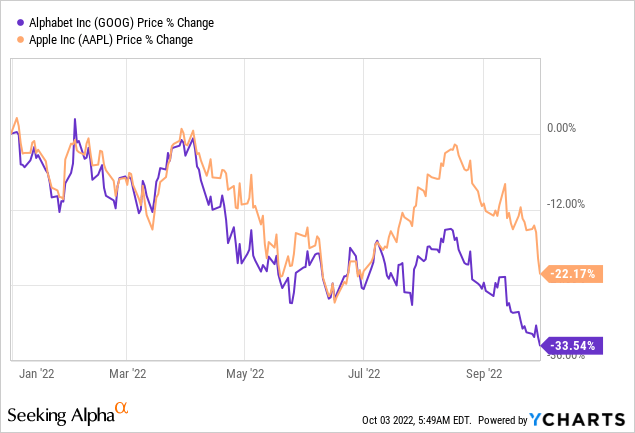

Because of the change in macroeconomic outlook, both Google’s and Apple’s shares have lost a significant amount of value this year. Year to date, Google has lost 34% of its value while Apple’s shares have seen a decline of 22%.

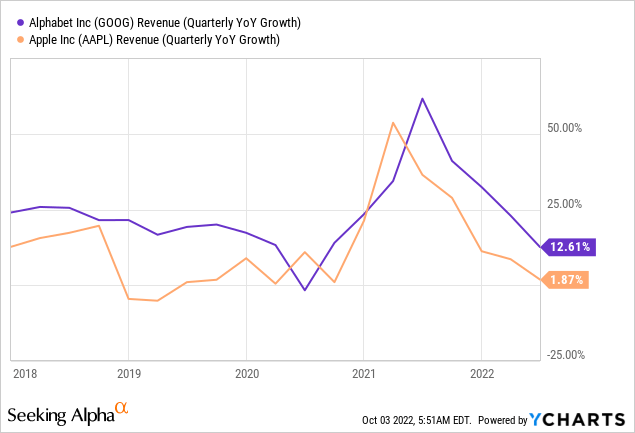

Both companies have had their fair share of issues this year. Google’s unique problem in 2022 has been the down-turn in the digital advertising industry which has started to affect the firm’s Search and Advertising business. Google’s Search business — which is still Alphabet’s bread and butter — grew only 14% in Q2’22 due chiefly to a rapid deceleration in the ad market. Google suffers from the exact same problems as Meta Platforms (META) which is also seeing advertisers reduce their spending due to heightened macroeconomic headwinds such as slowing economic growth and inflation. Because of these headwinds, Google saw only 13% growth in its top line in the second-quarter.

Apple’s unique problems are of a different nature, but are possibly much more severe than Google’s core business advertising slowdown. Apple’s total revenues increased at only a fraction of Google’s top line in the last quarter: 2% year over year. Apple’s growth was largely due to the company’s Services business which saw its revenues grow 12% year over year to $19.6B in the three months ended June 25, 2022. Apple’s hardware revenues actually declined 1% year over year in FQ3’22 to $83.0B, indicating that market weakness has begun to take a toll on the company’s growth.

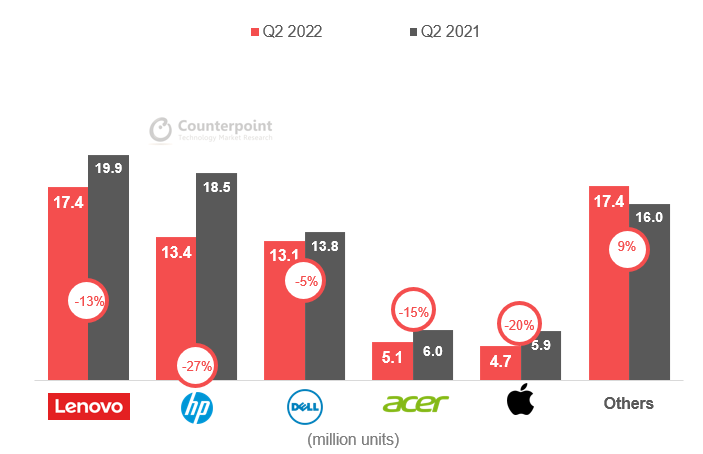

Additionally, as a company selling consumer electronics, Apple has been affected by a severe down-turn in the device market which has led to major declines in volume shipments for most OEMs. Apple and other device manufacturers have seen steep drops in PC, tablet and mobile phone shipments in the second-quarter… and it may get worse before it gets better.

Counterpoint Research

As a result, Google, based off of Q2’22 results, grew its top line seven times faster than Apple.

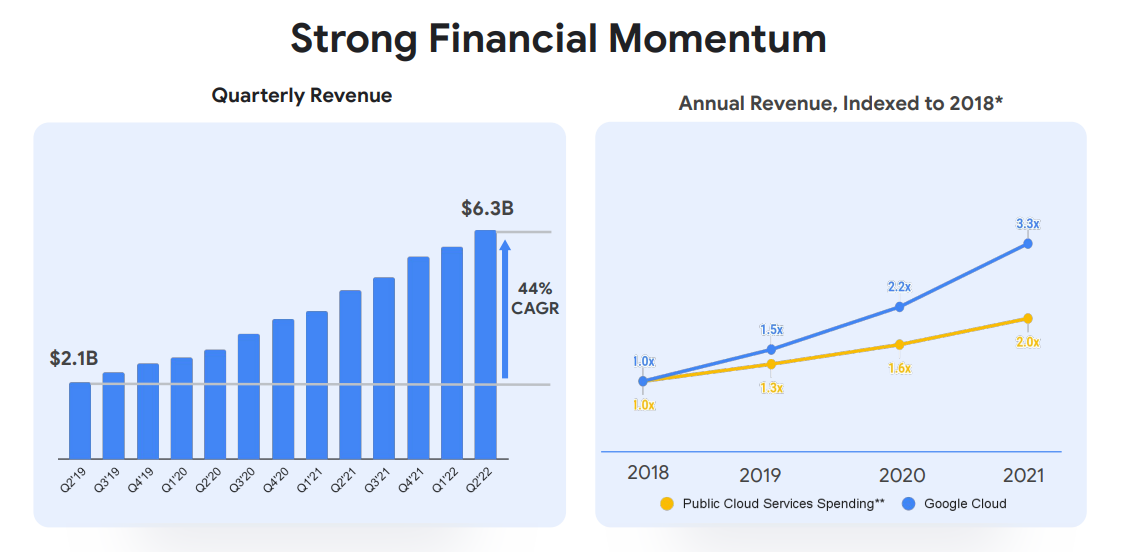

Google’s growth is largely due to the increasingly important — and recession-resistant — Cloud business which is in a prolonged upswing due to accelerating enterprise adoption. Google’s Cloud business generated revenues of $6.3B in the last quarter and grew at an annual average rate of 44% since Q2’19.

Google Cloud Growth

Apple’s growth engine — Services — increased its revenues during the same time period from $11.5B to $19.6B, showing an average annual revenue growth rate of only 20%. Google’s fastest growing business — Cloud — is therefore growing twice as fast as Apple’s own growth engine.

Market expectations: Google vs. Apple

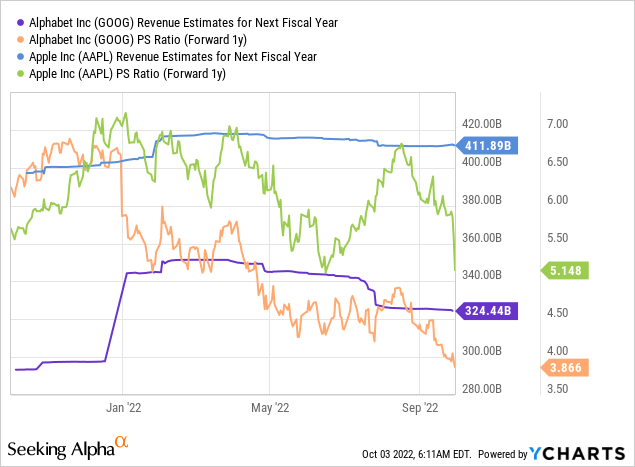

The market expectation is for Google to grow its revenues 12% in FY 2022 and also 12% in FY 2023. At the same time, growth expectations for Apple are more muted and the market expects 7% top line growth in FY 2022 and 5% in the year thereafter. Based off of expected revenues, Google represents the better value with a P-S ratio of 3.9 X compared to Apple’s 5.1 X.

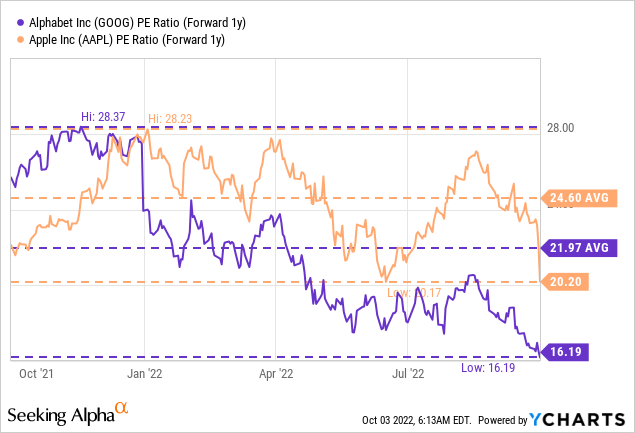

Google also has a more attractive valuation based off of earnings. Google has a P-E ratio of 16.2 X vs. Apple’s 20.2 X. Google is trading at the lowest P-E ratio in a year as well…

Stock buybacks

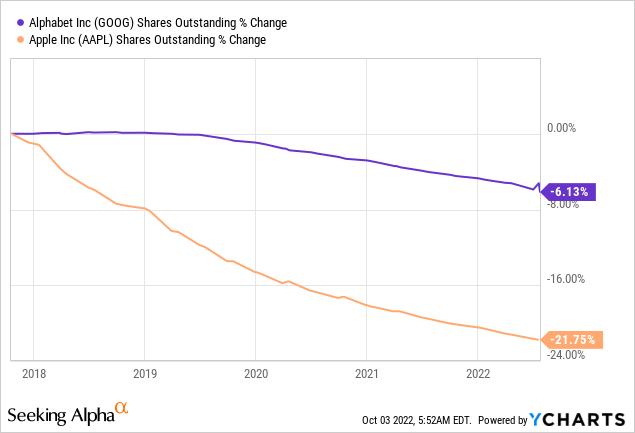

Both companies use a lot of their free cash flow and cash resources to buy back shares in the market. Earlier this year, Apple announced a $90B stock buyback authorization while Google announced a $70B buyback program. Apple does not only have a larger buyback, but is also more aggressive in its execution than Google.

Risks with Google and Apple

Both companies have top line risks, but these risks are of a different nature. While I see bigger risks for Google related to inflation and the state of the advertising market, Apple is more exposed to market saturation as well as weakness in PC/device shipments and in consumer spending. Apple’s hardware sales actually dipped into negative territory in FQ3’22 and the down-turn may get worse before it gets better if volume shipments continue to decline in the fourth-quarter.

Final thoughts

I believe Google has stronger recession value than Apple, in part because Google is more diversified and Cloud is a real growth engine for the software company. Google’s Search business is unrivaled in size and reach which creates a cash flow positive, stabilizing business while Cloud is the growth engine within Alphabet… which is growing at twice the rate than Apple’s Services business. During recessions and periods of high inflation, consumers may continue to cut back spending which I believe will affect Apple’s top line more severely than Google’s. Google also has an advantage regarding valuation and the company is expected to grow at a much faster rate than Apple.

Be the first to comment