Justin Sullivan/Getty Images News

Following the recent announcement by NortonLifeLock of the regulatory approval from the Competition and Markets Authority (‘CMA’) of the deal with Avast (OTCPK:AVASF) which was announced in 2021 for $8.6 bln and expected to be completed by September 2022, we examined the deal and its impact on NortonLifeLock Inc. (NASDAQ:NLOK) in terms of revenue growth, synergies and market share.

Combined Business Increases Revenue and Market Share

Norton provides cyber safety solutions for consumers including the Norton 360 with features such as device security, online threat protection, smart firewall, cloud backup, secure VPN, password manager, parental control, virus protection promise and dark web monitoring. It also has LifeLock which prevents identity theft and ReputationDefender which can control search results. Avast’s antivirus products include Avast Antivirus and Avast One. virus protection and adds web shields, ransomware and firewall modules. Avast also owns AVG which is also a security pioneer offering a wide range of protection, performance and privacy solutions for consumers and businesses.

|

Combined Revenue ($ mln) |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Norton |

2,456 |

2,490 |

2,796 |

2,921 |

3,052 |

3,189 |

3,332 |

3,481 |

|

Growth % |

-4.0% |

1.4% |

9.6% |

4.5% |

4.5% |

4.5% |

4.5% |

4.5% |

|

Avast |

871.1 |

892.9 |

941.1 |

990.3 |

1,042 |

1,096 |

1,154 |

1,214 |

|

Growth % |

7.8% |

2.5% |

5.4% |

5.2% |

5.2% |

5.2% |

5.2% |

5.2% |

|

Combined |

2,456 |

2,490 |

2,796 |

3,169 |

4,094 |

4,285 |

4,485 |

4,695 |

|

Growth % |

-4.0% |

1.4% |

9.6% |

13.3% |

29.2% |

4.7% |

4.7% |

4.7% |

Source: Norton, Avast, Khaveen Investments

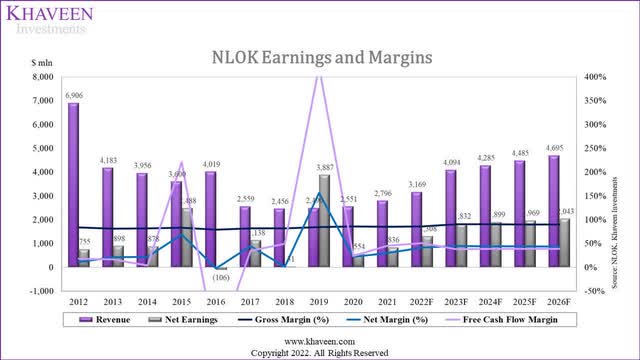

Based on the table above, Norton is more than twice larger than Avast in terms of revenue but had a lower 3-year average growth rate of -0.1% compared to 5.2% for Avast. We forecasted the company’s revenues through 2026 based on its 3-year average as our assumption for its organic growth rate. Assuming the acquisition is completed as planned, we forecasted the company’s total revenue to reach $4 bln in 2023 with Avast representing 25% of total revenues.

|

Market Share |

2021 |

|

Kaspersky |

8.6% |

|

Avast |

10.7% |

|

NortonLifeLock |

31.9% |

|

ESET |

7.2% |

|

McAfee |

21.9% |

|

Trend Micro (OTCPK:TMICF) |

19.8% |

Source: Company Data, Khaveen Investments

Company Data, Khaveen Investments

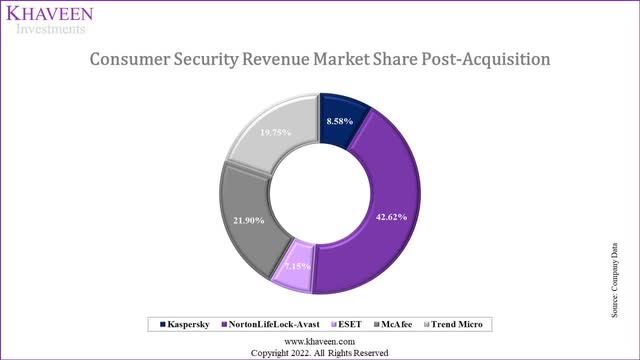

Furthermore, with the combination of Norton and Avast, we expect the company’s market share to increase to 42.62% based on our consumer security software market share calculations. Besides Norton and Avast, other notable competitors include McAfee (22% share), Trend Micro (20%) and Kaspersky (9%). In terms of the barriers to entry of the market, branding is important according to Zelster and G2 ranked these companies as the top in terms of reviews.

Cross-selling Revenue Synergies of $850 mln

Based on the company’s management, Norton highlighted that the combined business would have over 500 mln users with a broad and complementary portfolio (mostly unpaid due to Avast product offerings as Avast’s specialty is in freemium antivirus products and privacy. Norton’s strength is in identity, theft protection and VPN. In the past, Avast bought AVG to merge the two antivirus code bases into a single shared protection engine.

The Avast Board believes the proposed merger of Avast and NortonLifeLock creates a united Cyber Safety business of compelling strategic scale, unlocking value for shareholders today with considerable potential upside. With NortonLifeLock, Avast will be even better positioned to pursue its ambitions and evolve its product portfolio to meet the demand of today’s consumers. – Avast

|

Norton Revenue ($ mln) |

2,551 |

|

Norton Customers (‘mln’) |

23 |

|

Norton ARPU |

109 |

|

Avast Revenue ($ mln) |

941 |

|

Avast Customers (‘mln’) |

16 |

|

Avast ARPU |

58 |

|

Estimated Revenue Synergies ($ mln) |

850 |

Source: Company Data, Khaveen Investments

Based on the table, besides having larger revenues, Norton also has a higher number of customers (23 mln) compared to Avast (16 mln). In addition, Norton’s revenue per user (ARPU) is also higher than Avast at $109 to $58. This indicates Norton’s superior ability to monetize its customer base compared to Avast as explained above with the company’s portfolio of integrated identity protection features. We estimated the company’s revenue synergies by taking the difference between Norton and Avast ARPU and multiplying it with Avast’s customer base. This gives us an estimated revenue synergy opportunity of $850 mln for the company.

Cost Synergies Support Margins

|

Gross Margins |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

NortonLifeLock |

2,097 |

2,189 |

2,388 |

2,487 |

2,599 |

2,715 |

2,837 |

2,964 |

|

Margins |

84.2% |

85.8% |

85.4% |

85.1% |

85.1% |

85.1% |

85.1% |

85.1% |

|

Avast |

660.5 |

702.6 |

791.6 |

787.7 |

828.8 |

872.1 |

917.7 |

965.6 |

|

Margins |

75.8% |

78.7% |

84.1% |

79.5% |

79.5% |

79.5% |

79.5% |

79.5% |

|

Total Combined |

2,097 |

2,189 |

2,388 |

2,719 |

3,708 |

3,867 |

4,034 |

4,209 |

|

Margins |

84.2% |

85.8% |

85.4% |

85.8% |

90.6% |

90.2% |

89.9% |

89.7% |

Source: Company Data, Khaveen Investments

|

Operating Margins |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

NortonLifeLock |

620.0 |

1,058 |

1,221 |

1,244 |

1,299 |

1,358 |

1,418 |

1,482 |

|

Margins |

24.9% |

41.5% |

43.7% |

42.6% |

42.6% |

42.6% |

42.6% |

42.6% |

|

Avast |

345.1 |

343.3 |

405.2 |

426.4 |

448.6 |

472.1 |

496.7 |

522.7 |

|

Margins |

39.6% |

38.4% |

43.1% |

43.1% |

43.1% |

43.1% |

43.1% |

43.1% |

|

Total Combined |

620.0 |

1,058 |

1,221 |

1,385 |

2,028 |

2,110 |

2,195 |

2,285 |

|

Margins |

24.9% |

41.5% |

43.7% |

43.7% |

49.5% |

49.2% |

48.9% |

48.7% |

Source: Company Data, Khaveen Investments

Company Data, Khaveen Investments

Based on the table above, Norton’s gross margins are slightly higher compared to Avast’s at 85.4% in 2021 compared to 84.1%. Similarly, its operating margins are also higher than Avast in 2021. We forecasted the company’s total margins based on its 3-year average through 2026 and calculated its combined margins. For the combined margins in 2022, we prorated it by one quarter as the deal is expected to be completed by September 2022.

Furthermore, in terms of cost synergies, the company announced that it expects approximately $280 mln of annual gross cost synergies by the end of the second year of completion. Norton also announced that the merger would result in a 25% reduction in staff numbers across all geographies and a

broad range of job categories, including management, shared services, product and commercial functions.

All in all, we projected its gross margins to increase to 85.8% with the cost synergies in 2022 compared to 85.4% in the prior year. In terms of operating margins, we forecasted it to reach 43.7% in 2022 and increase to 49.5% in the following year.

NortonLifeLock’s preliminary evaluation work to identify potential synergies arising from the Merger suggests that there will be some duplication between the two businesses’ management, shared services, product, commercial and other functions. – Norton

Risk: Regulatory Hurdles

The deal between both companies is expected to be completed by September 2022 according to Norton. However, the company had previously faced hurdles from regulators including the UK CMA which was concerned that the deal could reduce competition. However, the CMA backtracked and concluded it did not raise competition concerns as security software products were continually developed and improved with different and changing consumer needs. Also, the US FTC and Spain had approved the deal.

Verdict

|

NortonLifeLock Post-Combination ($bln) |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Net Income |

836 |

1,308 |

1,832 |

1,899 |

1,969 |

2,043 |

|

Growth % |

50.9% |

56.4% |

40.1% |

3.7% |

3.7% |

3.7% |

|

Net Income (Analyst Consensus) |

836 |

861 |

916 |

946 |

1,005 |

1,026 |

|

Growth % |

3.05% |

6.35% |

3.29% |

6.23% |

2.02% |

|

|

Difference |

0.0% |

51.8% |

100.0% |

100.7% |

95.9% |

99.2% |

Source: NortonLifeLock, Seeking Alpha, Khaveen Investments

All in all, we believe the deal between NortonLifeLock and Avast could benefit the company with a combined market share of 42.62% and forecasted the company’s total revenue to reach $4 bln in 2023 with Avast representing 25% of total revenues. Moreover, we estimate the company to derive revenue synergies of $850 mln based on the upselling opportunity for the combined company. In terms of margins, we expect its operating margins to increase to 49.5% in 2023 with cost synergies. From the table above, we summarized our net income projections of the company post-acquisition through 2026 and compared it with the analyst consensus.

We believe the increase in revenue has not been accounted for in the analyst revenue consensus. Based on the difference between our projection and analyst consensus, which is a 5-year average of 89.5%, we applied this as a factor of 1.895 to the analyst consensus price target of $26.58 to obtain a price target of $30.49 with an upside of 35.05%.

Be the first to comment