monzenmachi/E+ via Getty Images

Investment thesis

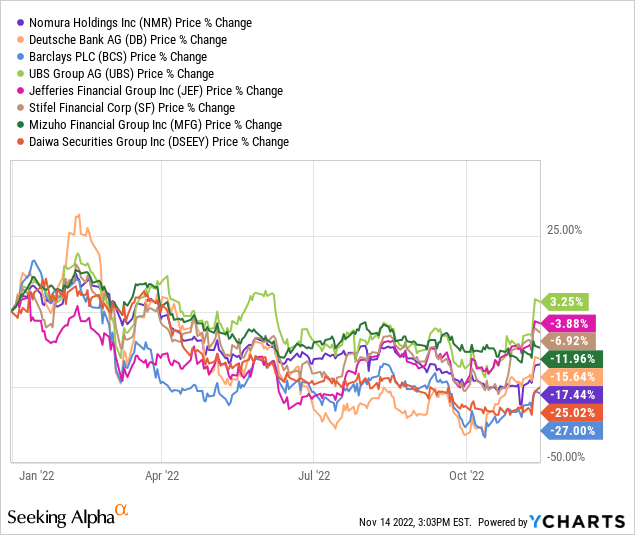

Nomura’s (NYSE:NMR) shares have underperformed its mid-tier investment bank peers, highlighting its heightened cost base and operating leverage. With the macro outlook showing no sign of a sustained recovery, we believe a flat to falling dividend into FY3/2024 is likely, and rate the shares a sell.

Quick primer

Nomura Holdings is the largest Japanese securities brokerage and asset management business headquartered in Tokyo. The Wholesale business which includes investment banking, equities, and fixed income made up 65% of Q1-2 FY3/2023 sales, followed by Retail brokerage at 23% and Investment Management at 5%. The business is aiming to shift its business model towards generating sustainable earnings by growing its asset management and capital-light origination activities.

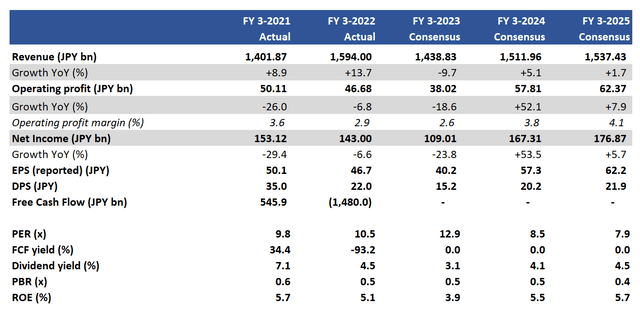

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

Nomura’s shares have relatively underperformed YTD compared to the mid-tier investment banks. It has managed to outperform its direct domestic peer Daiwa Securities (OTCPK:DSEEY), although Mizuho Financial Group (OTCPK:MZHOF) has fared marginally better.

We previously raised concerns about volatile shareholder returns in March 2022. In this piece we want to assess the outlook for the business given the challenging macro conditions, and whether cost structure improvements can be made with Q2 FY3/2023 staff compensation and benefits reaching a historic high (although partially impacted by a weak Japanese yen) (page 14).

Depending on the Wholesale division

Trading conditions during Q1-2 FY3/2023 were difficult, with sales dropping 8% YoY and income before taxes decreasing 55% YoY (page 5), highlighting very high gearing. Activity by its Retail customers slowed and Investment Management saw the value of its portfolios drop and performance fees declined. However, the Wholesale division saw robust activity in fixed-income products, driven by demand for macro products (with its strongest quarterly revenue in six and a half years) which more than offset the slowdown in equities. Investment banking remained subdued as corporates limited capital markets activity.

Rapid monetary tightening in the US and UK and major FX volatility boosted demand for macro products, but we have some concerns that these are not sustainable trends. A global recession now appears probable which may deliver some trading opportunities but overall, we expect to see a slowdown in capital markets activity and market participants taking a more ‘wait-and-see’ approach. There does not appear to be a major driver to allocate risk capital, which would be negative for all intermediaries. However, the extreme is also true where major volatility and exogenous factors drive trading activity – although this will temporary and usually result in weakened market participants.

Nomura’s strategy of scaling its recurring revenue base with Retail sales of discretionary investments as well as loans and insurance, together with targeting inflows for Investment management is making some headway. However, Q1-2 FY3/2023 results show a major dependency on the Wholesale division which contributed 95% of total income before taxes (page 5). With this backdrop, we believe it will be difficult for the business to perform a major earnings recovery YoY into FY3/2024, as currently being forecast by consensus (please see the Key financials table above) with net income growth of 53% YoY.

Cost structure implications

Management has been talking about the importance of cost control for the last two years, yet it is a perennial point of discussion. To be fair, the compensation ratio of 48% in Q2 FY3/2023 looks high, but there has been pressure on the top line. Despite two poor quarters of trading, management is not being particularly vocal about cost reductions.

There appears to be a need to invest in updating infrastructure in the Wholesale business, particularly in IT. The Retail business has traditionally been staff-heavy, but we cannot see any major cuts here as this division wants to maintain top market share, it can be a high-return operation in bull markets, and is important in supporting investment banking mandates.

Focus on gaining global market share and M&A activity appear more of a priority for management than cost cutting. Areas highlighted include private markets and digital products, and inorganic growth opportunities are likely to arise with better pricing under current market conditions.

The implication here for investors is that management is aiming for topline growth, which perhaps is easier to conduct than focusing on cost reductions which may place the business at a disadvantage once the market tide turns. However, our view is that if negative macro conditions continue YoY into FY3/2024, investors will have limited upside risk and significant downside risk with no recovery of dividends to normalized levels, with further valuation markdowns YoY.

Valuation

On consensus forecasts which appear too bullish, the shares are trading on PER FY3/2024 8.5x on a 4.1% dividend yield. We believe these valuations are misleading, given the implied robustness of a recovery YoY despite the continued lack of a recovery profile in the global economy.

Risks

Upside risk comes from temporary jolts of market activity, particularly in November 2022 given the uplift in equities as well as bonds. Q3 FY3/2023 results may see a significant upswing QoQ. The company may also unveil a major cost reduction program, shedding staff but more likely limited compensation.

Downside risk comes from continued low levels of capital markets activity, lowering demand for the Wholesale business. Major dividend cuts YoY for FY3/2023 is already on the cards, but a lack of recovery YoY may push investors away to alternative names in the sector.

Conclusion

Nomura’s relative share underperformance appears to stem from its highly geared business model, and a lack of earnings visibility with limited color on the future business backlog. While expectations over shareholder returns are not high, we believe a flat to falling dividend YoY into FY3/2024 is realistic and would be a negative catalyst. We rate the shares as a sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment