alacatr/iStock via Getty Images

Readers of this space know that in valuing gaming companies, we always look at the numbers in terms of how investors should view management’s successes and failures. Because of my career background as a c-suite gaming executive, I have observed up close how the dynamics of management skills trickle down through the system from that c-suite to the front line employee. When that system works, it becomes a certain candidate in our view for a closer look. And after that look, we always find performance of the company reflecting that above average skill set in ongoing operations. What often does not happen is that Mr. Market, drowned as he is under a daily avalanche of numbers, metrics and quick ratios tied to shrinking attention spans, doesn’t see all opportunities.

The one final judgment I try to arrive at is a question: Would I want to be in business with this management? And is there an identifiable dynamic between how the business is run and the earnings and sales growth it achieves over time.

What we saw in Monarch (NASDAQ:MCRI) from 2016 on

MCRI archives

One of the best signposts of gaming companies that produce superior returns over time lies in its origins. Of course, nearly all gaming operators that have thrived over the past 60 years or more have sprung from the singular vision of a founding owner or early successor who brought more than money to the table. The list goes on and on. The names are legendary: Steve Wynn, Sam Boyd, Sheldon Adelson, Kirk Kerkorian, Barron Hilton, Bill Harrah— Benny Binion, and many others. Among the many others lie gaming founders best left for their appearance on archival wanted lists of the FBI in those wild and wooly days of Vegas from the 50s to the 70s.

The bacillus of mediocracy that inevitably invades corporations as they grow over time has to be periodically checked and often harsh steps taken to stick with the vision of the founder. These then are the companies that have gone on to become industry leaders with revenue streams in the billions and the geography of their properties spread across the nation and indeed the entire globe. The speed of growth of course has an indispensable hand maiden: Governments willing to legalize casino gambling. But it’s to be remembered that when a market opens up, it’s open to all for bidding. And the best performing management—more often than not, winds up with the prize of a license.

Among all companies in the sector, those I worked for, those I sent colleagues to, those I consulted for, those I watched transform from little more than mom and pop locals casinos to international giants was the common thread of an ever broader vision of a larger entity achieved with all deliberate speed.

Monarch Casinos was one of those companies lodged in the small-cap sector. But it had a distinction from its peers both large and small: It has never been in a hurry to grow by any means other than organic expansion of its existing asset base. It’s classically, the tortoise that wins with cool deliberation. It’s a company with no illusions or delusions to carry it forward.

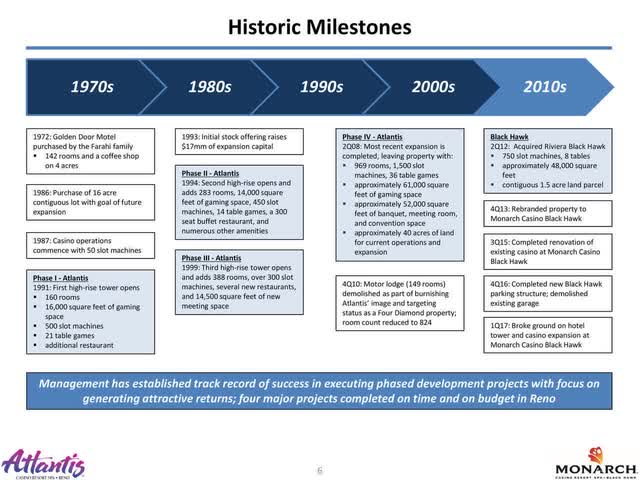

MCRI

The company began in the 1970s by a family of emigre Iranians who migrated into the motel business in Northern Nevada. A classic father and son legacy, it grew into a small gaming operator. Then step by careful step it morphed into Monarch carrying the management mantra of the founding Farahi family: Attention to customer needs, location, finance expansion with as little debt as possible and be on the lookout for opportunities outside home base that make sense.

Monarch owns and operates the Atlantis Hotel Casino in the Reno-Sparks market. The property has grown in size over the years and now commands a 16.5% share of the Reno-Sparks market located in one of the higher income areas there. It’s a market that simultaneously is rooted in Reno’s past with traditional feeder markets from Northern California. However, since 2010, the area has become a booming center of technology industries and refugees from California taxes and deteriorating life style. It numbers 500,000 now. Its population growth since 2010 has hit 17.5% against a 7.5% national average. Arriving new residents have brought the family income above the national average.

Among its many relatively new tech residents is the Tesla (TSLA) battery factory and all the multiplier economics that delivers.

As the company grew it began searching for an expansion outside Nevada. It wound up in Black Hawk, Colorado, where it laid plans for its second major casinos resort. It began by acquiring one of the market’s store front casinos, added a garage, 514 rooms, a casino floor holding 1,100 slots and 40 table games. It owns its own sports book. It has benefited by a move by Colorado gaming regulators to remove betting limits from its casinos.

MCRI

Above: The Atlantis in Reno, located in an upscale area in a hot growth market in Northern Nevada.

So on the surface, MCRI is a small, solid, two property casino operator. One can understand how for many years Mr. Market may have looked at its stock, shrugged, thought it seemed kind of nice, but where was it going?

Let’s take a look

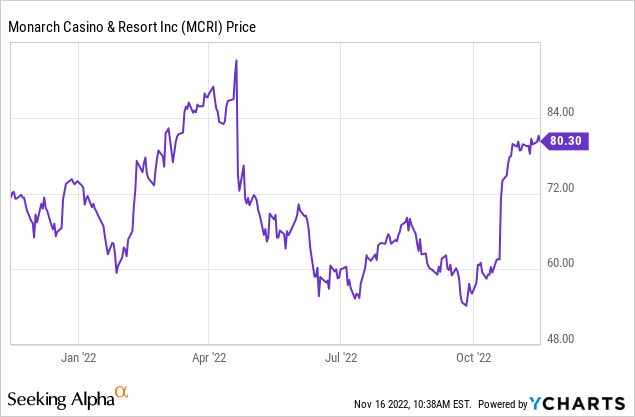

Price at writing: $81.50

52 week range: $54.01–$94.26

1 – year analyst target: $78.50

Our target based on what we believe is a rapidly-accelerating level of pent-up demand as pandemic headwinds beginning to diminish. We also believe now that the Black Hawk Monarch property has been completed, and the company’s balance sheet is strong, that MCRI may be ready for its next step.

Market cap: $1.539b

Revenue (ttm) $468m.

EBITDA: $160M.

3Q22 margin: 35% indicative evidence of a tight ship management focus on cost controls, service quality and debt service that isn’t choking growth.

Cash on hand: $33m

LT debt: $27m

Net leverage: 0.0 as of 3Q22.

MCRI has not withdrawn anything from its established $70m revolver line. We believe that will remain the case until management has spotted its next market opportunity.

A quick look at 3Q22 key results:

MCRI

Above: The expansion in Black Hawk: Slow and steady wins the race.

Net revenue: $133m up 19.8% y/y.

Net income: $27, 493m up 23%

Adj. EBITDA: $51.6b up 28.3%

Diluted EPS: $1.44 UP 22.6%

Projected earnings (Analyst consensus: Average)

2022E: $4.51

2023E: $4.85

Sales growth (estimate): 20.50% for 2022 2023: 3.50% 2023.

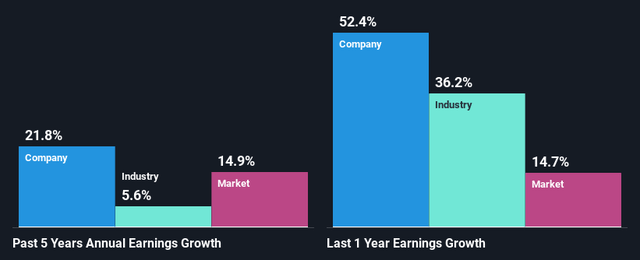

It’s here we part company with analysts. First it’s fair to state that this stock has been and continues to be thinly covered, and to an extent, thinly traded. Those are among the reasons we believe the stock sneaked up on Mr. Market. Our coverage on MCRI has been sustained since 2016 for reasons we stated at the beginning of this article.

For 2023 we’re forecasting revenues to reach over $518m against analyst estimates of $493m.

We have mixed sets of estimates from our on the ground industry colleagues active both in Reno/Sparks and Black Hawk. We have set that against what we believe is the accelerating pent-up demand factor for both markets assuming we do not experience a major surge in covid over the next year. We do factor in a residual COVID bump here and there. Monarch enjoys a 16.5% share of market now for metro Reno.

We projected total gaming win for both Northern Nevada and Black Hawk against a modest rise in market share for both properties between now and next June.

On that basis we make the case based on our past forecasts for Monarch that it will earn $5.35 for 2023.

Conclusion

The move of MCRI from our original look at $26 to over $80 does indeed prove that the stock has its fans, yet still appears to evade the attention of many investors in the space. We think it’s a matter of scale. A small-cap gaming company with properties in two markets clearly did not have the charm that hot stocks of 2021 did in the space.

Example: In March of 2021 Draft Kings (DKNG) traded at $71.48.

And its price at writing today is ~$14. In that same 30-day period, MCRI traded at $72.36 and now trades at $81. Trading on price is not a stand- alone strategy. Investors bought the DKNG story because of its high visibility and wild projections of what the sports betting business would become. MCRI had been inching it up since our 2016—not because of our take, but because investors who really understood the dynamics of a solid gaming business acted.

MCRI could be a transaction stock in a merger of close to equals with a company with a similar range of revenue and a smart geography based on growth. What MCRI would bring to the table is a clean balance sheet, a strong sales and earnings growth record and a management that understands how all the gears in this business mesh.

Be the first to comment