nielubieklonu

Note: Noble Corporation (NYSE:NE) has been covered by me previously, so investors should view this as an update to my earlier articles on the company.

Last week, leading offshore driller Noble Corporation (“Noble”) announced Q3 results ahead of consensus expectations with decent profitability and strong free cash flow generation.

Even better, following the recent merger with Maersk Drilling, the company announced an up to $400 million share repurchase program:

We anticipate that the combination of our robust financial profile and high-quality backlog will position Noble very well going forward, and we are pleased to deliver on a key transaction rationale with today’s announcement of a $400 million share repurchase authorization.”

While the merger has resulted in the company’s net debt position to increase to approximately $190 million, backlog almost doubled to approximately $3.9 billion.

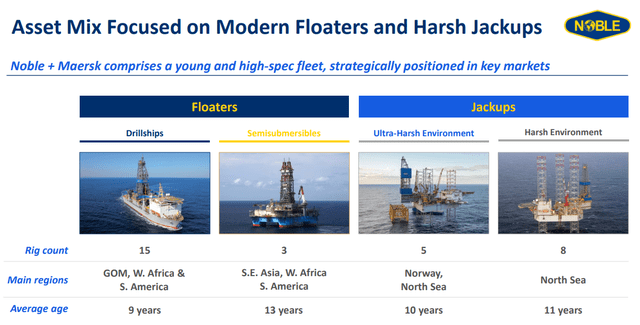

The combined company commands a fleet of 31 rigs (18 floaters and 13 jackup rigs) of which 28 are currently contracted:

While prospects for the company’s modern ultra-deepwater drillships remain decent, the Maersk Drilling-inherited heavy exposure to the North Sea jackup markets represents a short-term headache due to recovery lagging behind the deepwater markets and other shallow-water regions in the world as outlined by management on the conference call:

On the jack-up side, we currently have over 50% of our available days contracted for 2023, and we are also encouraged by the current level of customer dialogue. With the delayed recovery and day rates for jack-ups versus what we have experienced for floaters as well as the expected softness in the Norwegian jack-up market for 2023. We do not expect to realize the true earnings power our jack-up fleet until beyond 2023.

For Q4, the combined company expects Adjusted EBITDA of between $155 million and $175 million as well as capital expenditures of between $65 million and $85 million.

Liquidity is likely to take a slight hit this quarter as the company expects to utilize approximately $70 million in cash to squeeze out legacy Maersk Drilling shareholders.

With less than 60% of available days contracted for 2023 at this point, I will leave it to management to make initial projections for the combined company on the upcoming fourth quarter conference call.

Bottom Line

Noble Corporation’s shares ascended to new 52-week highs as market participants cheered decent third quarter results and particularly news of an up to $400 million share repurchase program.

Going into 2023, the company’s modern ultra-deepwater floater fleet should benefit from ongoing, strong industry conditions partially offset by some weakness in the harsh environment jackup markets.

After the 60%+ rally from recent lows, shares might be ripe for a breather in the short-term but with the offshore drilling industry likely in the early innings of a multi-year growth cycle, investors should consider adding on any major pullbacks.

Be the first to comment