CloudVisual

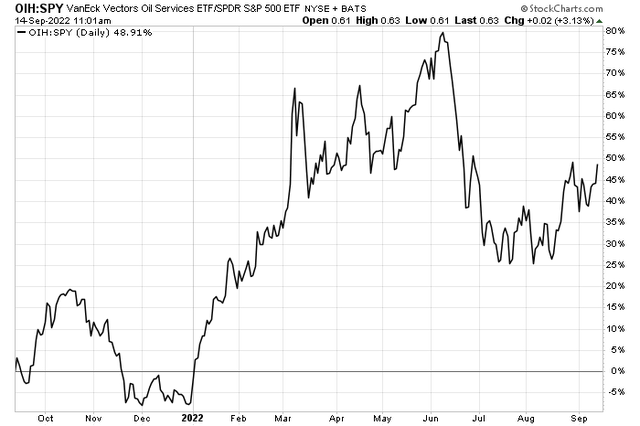

Oil services stocks continue to rebound versus the broader market. An ETF I track is the VanEck Vectors Oil Services ETF (OIH). Compared to the S&P 500 Trust ETF (SPY), OIH is on the verge of printing fresh highs dating back to late June. The summer swoon in energy equities has reversed itself despite WTI oil prices cratering into the 80s.

On Tuesday, President Biden appeared to ‘put’ a floor under the market when the White House said it would begin refilling the national Strategic Petroleum Reserve should domestic oil prices dip to $80. Amid a world of uncertainty in the stock market, oil seems to have more positive headline risks than negative currently. One turnaround oil services name has done all the right things technically and looks attractive on valuation.

Oil Services Equities On The Mend vs SPY

According to CFRA Research, Noble Corporation (NYSE:NYSE:NE), together with its subsidiaries, operates as an offshore drilling contractor for the oil and gas industry worldwide. The company provides contract drilling services to the oil and gas industry through its fleet of mobile offshore drilling units. As of February 16, 2022, it operated a fleet of 20 offshore drilling units, which included 12 floaters and 8 jackups.

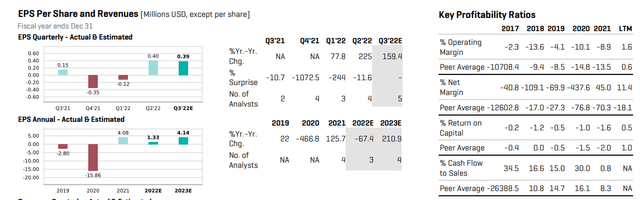

The Texas-based $2.3 billion market cap Energy Equipment & Services industry company within the Energy sector trades at a high trailing 12-month GAAP price-to-earnings ratio of 27.1 and does not pay a dividend, according to The Wall Street Journal.

While Noble’s valuation looking back suggests investors should take a cautious stance, the forward earnings outlook is more sanguine. Using next year’s $4.14 EPS estimate, the stock trades at just 8.2 times 2023 operating earnings, per CFRA.

The company also has strong operating leverage as seen in a big profit jump, more than tripling from 2022 to 2023, with just a 50% rise in forecast revenues in that time. If we assign a below-average 14 earnings multiple to the stock using next year’s EPS figure, that yields a share price near $60.

NE: Earnings & Valuation Forecasts

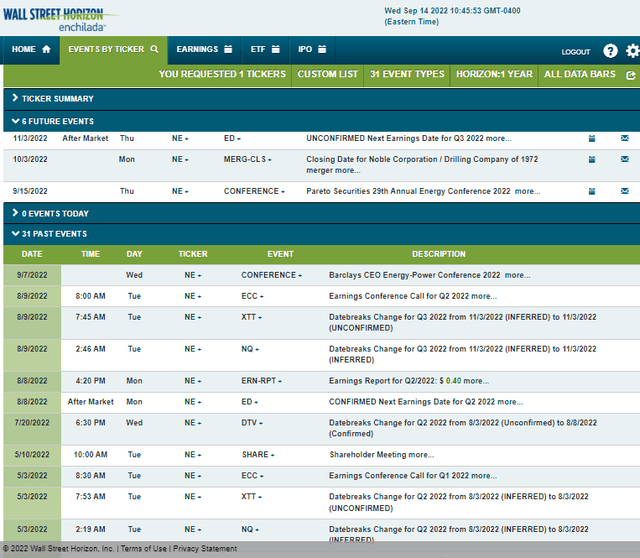

Noble Energy’s corporate event calendar by Wall Street Horizon shows that its management team is slated to present at the Pareto Securities’ 29th annual Energy Conference.

Specifically, Robert W. Eifler, President and CEO is scheduled to speak at the event today and tomorrow. Industry news and key company-specific information are sometimes shared at conferences like this. On October 3, the company is scheduled to close on its merger with Maersk.

Corporate Event Calendar

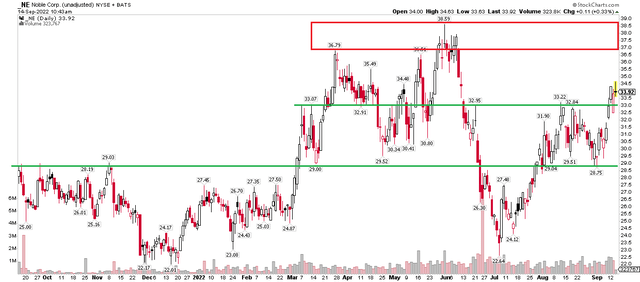

The Technical Take

Noble shares have done all the right things lately. The stock successfully defended the $28 to $29 area on a test earlier this month. And in just the last few days, NE rose above its August peak in the $32 to $34 range. Up next could be a test of its highs in the upper $30s. Being long here with a stop under the turn-of-the-month lows makes sense – perhaps $27.90.

We can even suggest a bullish measured move price objective of $37.50 based on the range breakout that has taken place last week through this week.

NE: Breaks Out Above Resistance – All-Time Highs In Play?

The Bottom Line

Noble Energy shares are cheap using 2023 earnings while its technical chart also looks ideal. I like the general tailwinds in the industry right now. Going long NE with a stop under the lows notched a few weeks ago is a good play.

Be the first to comment