Spencer Platt/Getty Images News

Thesis

NN (NASDAQ:NNBR) stock performance has been poor over the past year, despite the recent improvements in financial performance in the latest quarter, as sales grew by almost 9% and EBITDA grew by 30%, leading to the company being undervalued compared to peers on a multiples basis. However, the upside is limited, given costs are expected to increase, and therefore we recommend holding until we see further improvements.

Intro

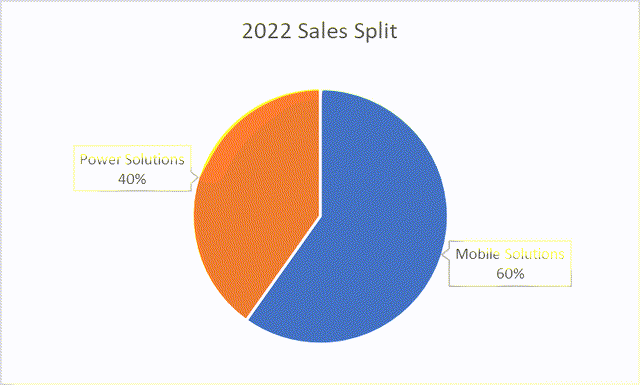

NNBR is an industrial company focused on designing, manufacturing, and distributing high-precision components across the US, and is based in Charlotte North Carolina. The company operates via two segments: Mobile Solutions and Power Solutions. Mobile Solutions focus on automotive end markets, whereas Power Solutions focus on military, aerospace, and medical end markets, among others.

The sales split for the two segments (as of September 2022) are as follows, with Mobile Solutions accounting for approximately 60% of sales, and Power Solutions contributing 40%.

Seeking Alpha

(Source: Seeking Alpha)

The company’s share price performance has been dire over the past year, down by more than 60%, significantly underperforming compared with the broader market, with no sign of resurgence. The stock currently sits at around $1.65, at the far lower end of its 52 week range.

Seeking Alpha

Financial Analysis

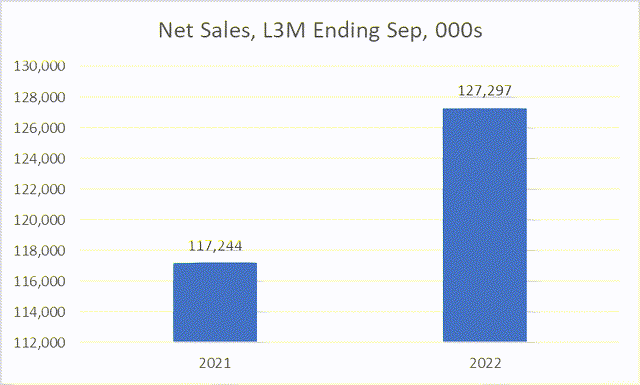

In the last 3 months ended September 30, NNBR has performed well, with net sales up by almost 9% ($10m increase) for the period compared to the same period a year prior, which was driven by increased pricing as well as higher demand for the Mobile Solutions segment.

Seeking Alpha

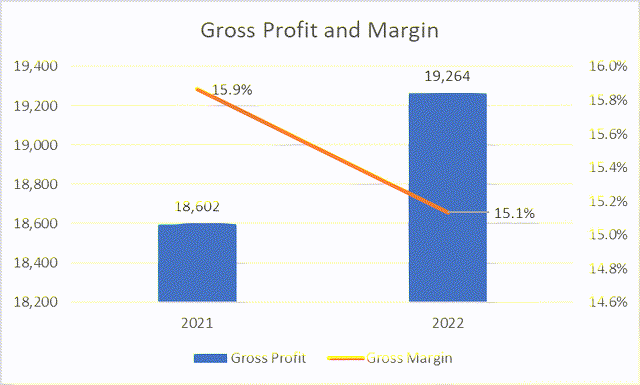

However, unfortunately, the cost of sales growth outpaced the growth in net sales, as the cost of sales for the period grew by almost 10%, which was driven by inflationary pressures, as expected.

As sales growth was robust, gross profit also increased, growing by almost 4% for the period. However, due to the higher cost growth, the gross margin dipped for the period, dropping from around 16% in 2021 to almost 15% in 2022.

Seeking Alpha

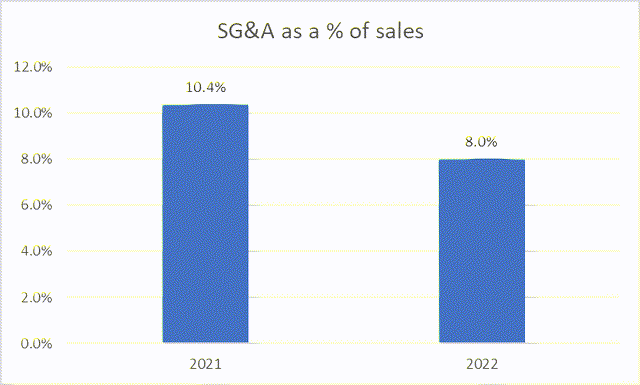

When looking at operating expenses, we can see that NNBR successfully improved their position and lowered its cost base. SG&A for 2022 dropped by around 16% compared to 2021, decreasing by almost $2m for the period. The reason for this decrease was due to lower incentives and stock compensation expenses, given the dropping share price. Therefore one could make the case that these costs would return if a successful turnaround took place.

But given that SG&A decreased for the period, coupled with the fact the sales also grew at a solid pace, SG&A as a % of sales dropped by more than 2 points, declining from 10.4% in 2021, to 8% today.

Seeking Alpha

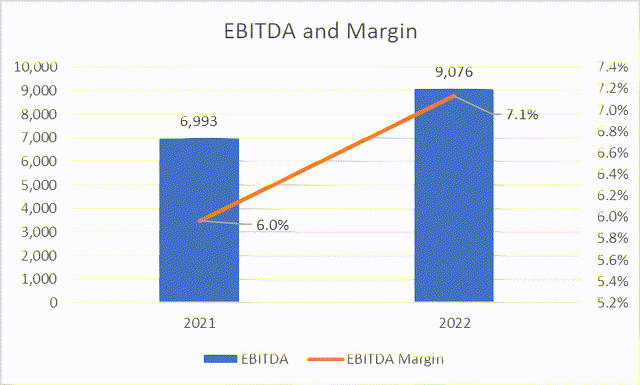

If we take into account D&A, we can see operating profit/loss (or EBIT) for the period improved, where the loss was halved (from around -$4.5m in 2021 to around -$2.1m today). But if we adjust for D&A (which was practically static for the period compared to the year prior), we can see a solid improvement, where EBITDA grew from around $7m in 2021 to above $9m in 2022, growing by a massive 30% increase over the period, and leading to an improvement in the EBITDA margin by more than a point, from 6% in 2021 to 7.1% today.

Seeking Alpha

Valuation

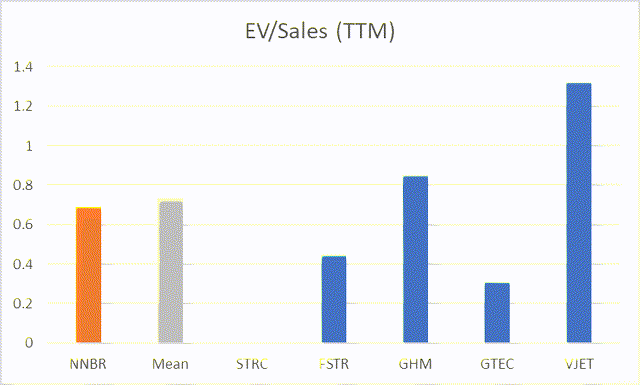

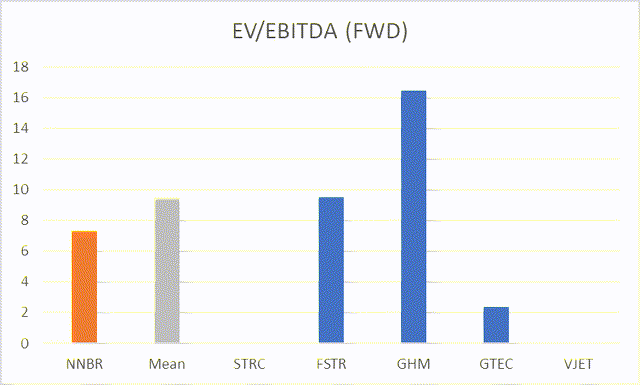

If we collate a set of peer companies that operate in the same industry with similar market cap, we could potentially understand if NNBR is undervalued, overvalued, or even fair valued, if we compare multiples.

First, if we take a look at EV/Revenue, we can see that peers, on average, are trading at around 0.73x sales, whereas NNBR is trading at around 0.69x to 0.7x sales currently, indicating that there is a marginal upside of around 5-6%, which is fairly limited.

Seeking Alpha

However, if we take a look at EV/EBITDA (where unfortunately 2 data points are missing due to a lack of available data, and forward numbers were taken to remove outliers), we can see that on average peers are trading at around 9.5x earnings, whereas NNBR is trading at around 7.4x, again, indicating that there is potential upside, this time showing a more attractive upside of around 25-30%.

Seeking Alpha

Risks

- One risk to the thesis is, as we mentioned before, a return of high SG&A costs. Given that the improvement in earnings was entirely driven by the lowered SG&A costs, this risk is quite high. The improvement in SG&A was due to a lower stock compensation expense, which can be attributed to the lowered share price, so lower comp was paid out. However, if we see a rebound in the share price (given it is currently undervalued compared to peers), then we will no down see the SG&A costs figure rise back up due to the higher stock compensation expense, and lead to a lower bottom line (not only wiping out current gains but lead to a lower figure compared to the same period in 2021 as cost of sales growth seems to be outpacing revenue growth).

- Secondly, as mentioned above, the cost of sales growth is quite high, at almost 10%, which is driven by inflationary pressures and is outpacing the growth in revenue. If this were to continue (a likely scenario), then we could see gross profit being tapered, followed by a lower earnings figure, and thus the share price will no longer be undervalued (and potentially be overvalued)

Conclusion

NNBR’s financial performance has been positive in the latest quarter compared to the same period a year prior, as there has been both top line growth (of around 9%) and bottom-line growth (of around 30%) given the improvements in operating expenses. This has led to the company being slightly undervalued compared to peers on a multiple basis but given that costs are expected to rise in the future, as discussed above, and the limited upside from the valuation, we don’t necessarily recommend a buy unless we see further improvements in the financial. Therefore, we recommend holding for the moment.

Be the first to comment