shutter_m

Main Thesis/Background

The purpose of this article is to evaluate the Nuveen Municipal High Income Opportunity Fund (NYSE:NMZ) as an investment option at its current market price. It is a closed-end fund with an objective “to provide high current income exempt from regular federal income tax. Its secondary investment objective is to seek attractive total return consistent with its primary objective.”

This is an option I have suggested before, but readers should consider that over the past year performance has been abysmal. I will get to the reasons why later in this review – but a lookback at 2022 doesn’t inspire confidence:

YTD Fund Performance (Seeking Alpha)

This reality should explain in some ways why I am not going to come across as wildly bullish in this article. Personally, I do see some reasons for buying or holding NMZ at these levels. But there are plenty of risks too, as holders in 2022 surely recognize. This backdrop suggests a “hold” or neutral outlook is appropriate as we move in to the new year, and I will explain why below.

Munis As A Whole Pique My Interest

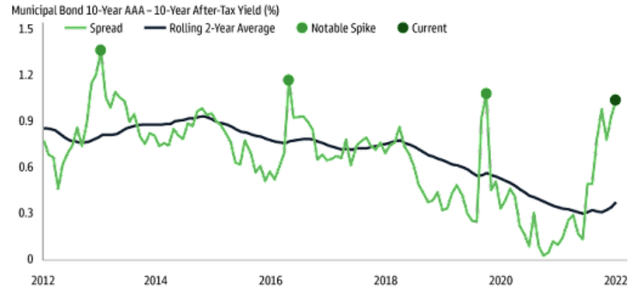

To begin, I want to recap why I am even interested in munis at all right now. This includes NMZ or any of the many ETFs or CEFs out there in the market today. Simply put, there sell-off in 2022 has been steep enough that yields have reached levels not seen in a long time. Not only have absolute yields risen, but so has the spread between munis and treasuries. This is true across the board – so the entire sector should be resonating with income investors:

Current Yield Spread (St. Louis Fed)

Of course, with rising interest rates and high inflation, absolute yields need to be taken with a grain of salt. Yes, income streams are high, but so is the impact of inflation. The point here is more on relative value in that investors are being compensated for munis at a rate above treasuries that we rarely see. This tells me that a rebound in the sector is very likely (since investors will buy in and normalize the yield spread).

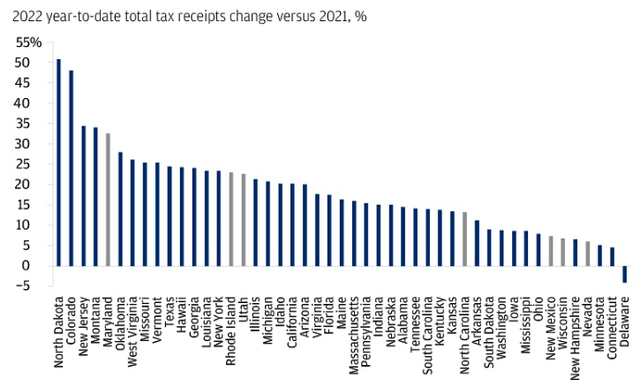

In addition to the relative yields, I like munis because I see a strong credit backdrop. Despite pandemic pressures and recession worries, state and local governments have seen strong tax receipts this calendar year. This has been due to rising property values (increasing property tax collections), resilient retail sales (sustaining sales tax collections), a strong labor market, and federal support to both households and state governments. Some states have fared better than others to be fair – but the positive tax receipt trend is almost universally consistent across U.S. states:

Tax Receipts (By State) (JPMorgan Wealth Management)

What I takeaway from this is that states are in a better position now than they were in a year ago. While this doesn’t mean 2023 won’t have a host of new challenges, I think the financial footing that many states are on will limit defaults in the muni realm. This is especially true for GO (general obligation) bonds that are backed by tax receipts. It is hard not to like this sector for those two key reasons.

How Does NMZ Fit In?

My readers know I am a muni bull for 2023. But as I stated at the onset, this “bullish” outlook doesn’t necessarily extend to NMZ. The obvious question that needs to be answered then is – why?

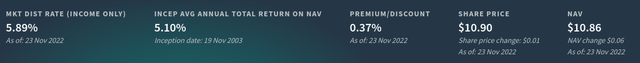

One reason is that “value” is hard to define here. NMZ often trades at a premium price, so NMZ’s modest premium now may seem like a reasonable option. At just over par, the price isn’t that bad:

In isolation this may not seem like a problem. But I would remind readers that the muni CEF space has a plethora of options. Most (if not all) of these funds have been beaten down this year. The result is there are plenty of options to find similarly-rated or superiorly-rated bond funds that trade at discount prices to NAV. While NMZ’s premium is very small, it looks expensive when I consider other options from Nuveen that have near double-digit discounts. That makes me wonder how many investors will see relative value here and bid up the price. In my view, this limits the short-term opportunity.

The Income Story Is Mixed

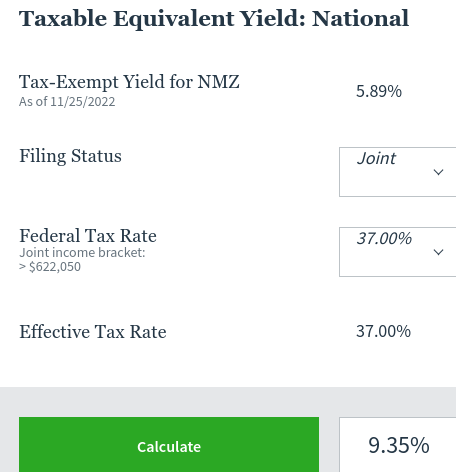

Looking deeper in to NMZ requires a look at the income stream. On the surface the “high” yield focus of the fund should draw in some buyers. The fund does not limit itself to investment-grade quality bonds like many CEF options, so naturally the yield is higher. When we factor in tax savings, it is worth noting that NMZ has a tax-equivalent yield in excess of 9% for those in the top income tax brackets:

Tax-Equivalent Yield – NMZ (Nuveen)

This is certainly very attractive. But, again, NMZ is not the only fund out there to offer a strong after-tax income stream.

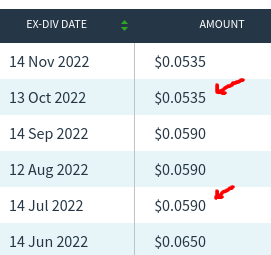

Still, 9% is 9%, so why not choose NMZ? To answer this I will look-back at the distribution story of 2022. As owners of NMZ are surely aware, the fund has seen two distribution cuts this calendar year alone:

Income Cuts (2022) (Nuveen)

This is a bit of a good news / bad news situation here. The bad news is that nobody wants a lower income stream. Seeing two income cuts in such a short time period is unlikely to spark a lot of confidence. It no doubt explains some of the reason behind NMZ’s massive sell-off this year and will likely remain top of mind for many investors (or potential investors) in the fund.

However, the good news is that this means the worst could be behind us. The potential for income cuts makes for a difficult hurdle to overcome. But once that income cut materializes, investors will often rotate back in after the initial pain of the cut and any immediate corresponding sell-off. With NMZ seeing two cuts in rapid succession, it is possible the fund managers have limited any further damage going forward. If true, and the fund is now paying a distribution more in-line with what it is actually earning on its holdings, than that is good news for current owners.

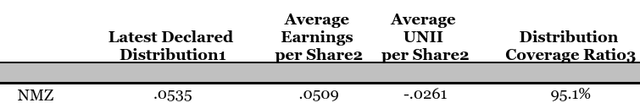

So – is this the case? For now, it appears so. NMZ’s negative UNII balance is manageable and its coverage ratio is above the 95% level. This is more in tune with actual earnings per share and hopefully prevents another distribution cut over the next few quarters:

The conclusion I draw here is that the income picture is mixed and therefore supports my more cautious take. The yield looks high and enticing. The fact that two cuts have already occurred does limit the potential for another one. But we also have to consider that investors have many options, some of which have coverage ratios that are stronger and backed by more quality assets. It makes NMZ more of a gamble, and explains why I find it hard to be too bullish at current levels.

The Fed & Recession Risks Are Making Things Difficult

Now for some risks. This is critical because NMZ has hard a very poor return this year. This means readers should examine the why behind this reality in order to determine the likelihood of early 2023 bringing more of the same.

The fact is that bonds and bond funds in general have been in rough shape primarily due to inflation and the Fed’s attempts to stymie it. With high inflation and interest rate hikes from the central bank, bonds have been dropping in value. NMZ has been his disproportionately because of its use of leverage, clocking in at almost 43% at time of writing:

Leverage (Nuveen)

This is not to suggest that if NMZ didn’t use leverage everything would be fine. The underlying bonds would likely still be in the red this year. But the point is that leverage amplifies gains and losses – and 2022 has been a year of losses. This leverage metric continues to be a concern in the short-term because not a lot has change. Inflation may have peaked, but it is still high, and the Fed is still continuing on a rate-hiking path because of it.

The other factor of contention is the yield curve inversion. This is occurring because the Fed is hiking short-term rates aggressively while at the same time the market is anticipating a recession on the horizon. This dynamic means that short-term rates are rising at a faster clip than longer term rates (when the market anticipates a recession it also anticipates lower rates resulting from it).

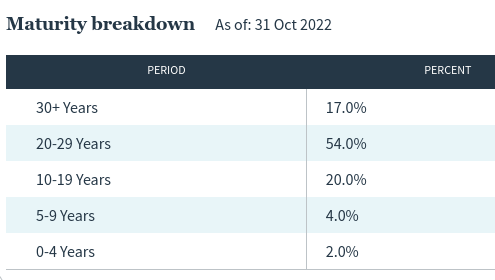

This hurts NMZ in particular because of its use of leverage. NMZ will borrow at short-term rates to invest those proceeds in longer-dated maturities. The idea is the yield pick-up from this action will benefit the fund. And this is precisely the strategy NMZ employs, with the vast majority of its assets having maturities at 10 years or longer:

Maturity List (Nuveen)

I have discussed this in other reviews but it is especially relevant here so it bears repeating. NMZ has very long-dated assets and is therefore very interest rate sensitive:

Duration (Nuveen)

This means if the Fed keeps on hiking rates, NMZ has much further to fall.

Also important is understanding how this impacts income. While NMZ’s decline this year is partially driven by the distribution cuts, the root cause of those cuts is the excessive use of leverage and long-dated assets during this challenging environment. The pressure on fund costs without an attractive yield pick-up on the backend means that NMZ is struggling to earn what it needs to. With two cuts already in the books, something has to change to ensure a third one does not come soon.

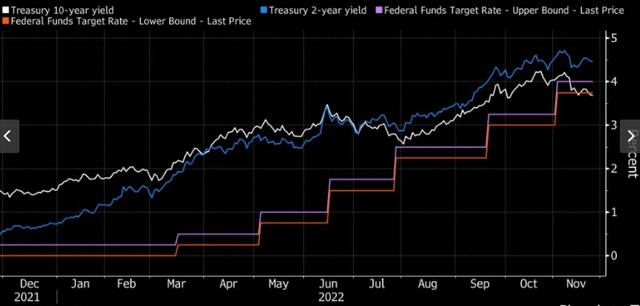

The concern I have is that the yield curve remains inverted and while the market is hoping the Fed will pump the brakes in 2023, we don’t know if that will be the eventual outcome. Right now the 10-year yield is below the 2-year yield and the Fed’s benchmark rate:

Yield Curve Dynamic (Bloomberg)

The obstacle here for NMZ is that as long as this scenario is real, the fund is going to have a difficult time improving its income metrics and overall value for investors. That said, there is opportunity at the moment. The share price has been beaten down and the income level has been slashed. If conditions improve in the sense that the Fed begins to lean more dovish and a recession is avoided, plenty of upside could be ahead. This is fundamental to why I am not “bearish” on this option – or most leveraged muni CEFs for that matter.

But we also have to understand this backdrop has been widely responsible for NMZ’s pain and that backdrop could persist. If it does, further losses could be ahead, and investors need to manage their expectations as long as recession fears and Fed rate-hiking are dominating minds and headlines.

Bottom-line

I like the idea of adding to my muni positions now, and as 2023 gets underway. I like the sector and I like the valuations across the space. Unfortunately, this rosy outlook doesn’t extend to NMZ. The fund is short of relative value since it trades at a slight premium while many other options have discounts to NAV. The distribution has been under pressure this year and that won’t subside until either the Fed takes a step back or recession risks fade and longer-term rates can rise. Finally, the extensive use of leverage has backfired this year, and the yield curve inversion has persisted, meaning the fund’s strategy could continue to backfire going forward. Therefore, I believe a “hold” rating here is appropriate, and I would caution readers to approach this fund very selectively at this time.

Be the first to comment